AUSTRAC’s ML/TF Risk Assessment Report on Major Banks [Part 1]

Back in September 2018, the Australian Government provided AUD 5.175 million funding to AUSTRAC for undertaking a 3-year-long program, focused on delivering risk assessments on Australia’s largest industry sectors – banking, gambling and remittance services. With reports of financial misconduct increasing by more than 200% compared to 2020, updated regulatory guidance became a need of the hour.

Fast-forward to today, AUSTRAC has released four money laundering and terrorism financing (ML/TF) risk assessment reports centred on the banking sector. The report seeks to assist the industry in understanding, detecting, and combating serious financial crime threats. The assessments examine four key subsectors of the banking industry, namely Australia’s four major banks, twelve other domestic banks, seven foreign subsidiary banks, and 48 foreign bank branches that operate from the country.

This blog makes up the first chapter of our four-part series on AUSTRAC’s report and discusses the key ML/TF risks related to the big four banks in Australia.

Which are the Big Four Banks of Australia?

The major banks by assets in Australia are ANZ, the Commonwealth Bank, National Australia Bank, and Westpac. Collectively known as the “Big Four”, ANZ, Commonwealth Bank, NAB and Westpac manage the nation’s finances and hold approximately three-quarters of the banking sector’s total assets.

Australia’s Big Four Banks Under Attack

According to AUSTRAC, the overall money laundering and terrorism financing (ML/TF) risk associated with Australia’s major banks is marked as high. The high rating has been assigned after a careful review of intelligence documents and Suspicious Matter Reports (SMRs). In particular, the big four banks reported 174,507 SMRs to AUSTRAC between 1 April 2018 and 31 March 2019 and two-thirds of all money laundering-related intelligence reports were linked to these financial institutions.

Listed below are the three prevalent ML/TF threats targeted at the big four according to AUSTRAC’s report.

1. Money Laundering

The nature and extent of money laundering threats facing Australia’s major banks are assessed as high. Suspicious cash transactions were identified in 79% of money laundering-related SMRs and nearly all money laundering-related intelligence reports (93%). The SMRs also highlighted that money launderers combined various fraud techniques to hide the illicit source of funds. This involved the use of money mules, shell companies, electronic transfers to other bank accounts, fraudulent cash deposits from ATMs, multiple transactions to dummy accounts, and the purchase of luxury assets to layer the illegally earned funds.

Interestingly, the percentage of suspicious cash deposits made from ATMs was lower compared to face-to-face transactions from the big fours. AUSTRAC assessed that this was likely due to transaction limits set at ATMs, whereas large cash deposits enabled in-person are more likely to trigger transaction monitoring procedures. Apart from this, less than 1% of SMRs detected trade-based money laundering, however, AUSTRAC states this is likely due to challenges relating to detection.

Suggested Read: FATF Publishes 35 New Indicators Against Trade-based Money Laundering

2. Terrorism Financing

The nature and extent of terrorism financing threats facing major banks are assessed as medium. The big four banks submitted 74% of all terrorism financing-related SMRs in the reporting period and were linked with 46% of all intelligence reports regarding suspected terrorism financing. Identifying terrorism financing is a tricky task as typically the funding for such activity is raised through legitimate means, such as through wages, government-based benefits, loans, family support and business earnings. AUSTRAC identified that funds for terrorism financing were also acquired through fraudulent means, such as through loan fraud, credit card fraud and charity fundraising under a false pretence.

The report further points out common indicators of terrorism financing, which are as follows:

- International transfers being made to banks located in high-risk jurisdictions

- Large cash withdrawals made from a bank after it refuses to conduct business with an institution located in a high-risk jurisdiction

- Parties linked to a transaction have known affiliations with terrorist entities or activities

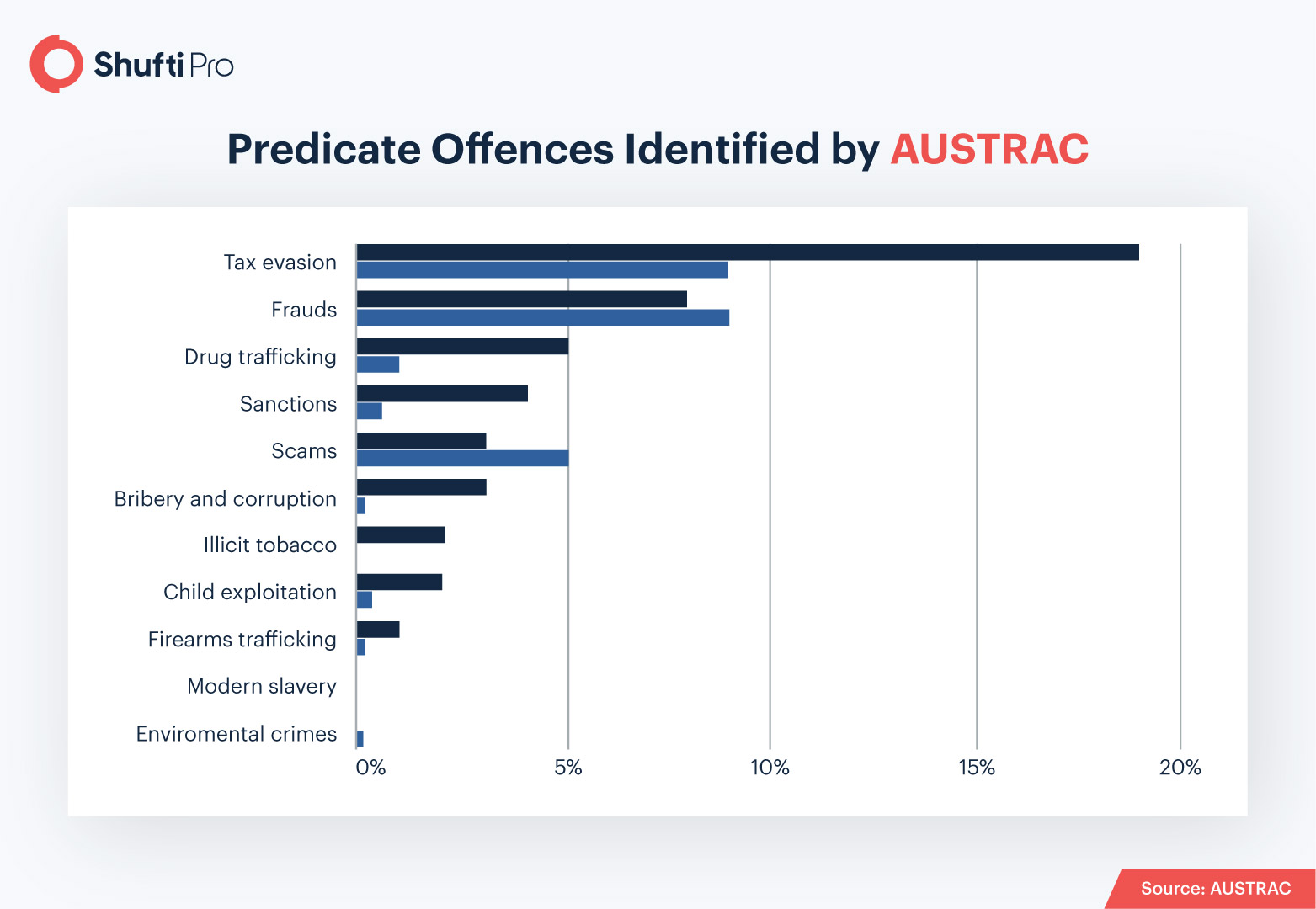

3. Predicate Offences

AUSTRAC assesses the nature and extent of the threat posed by predicate offending involving major banks as high. This assessment by AUSTRAC is based on close consultations made with partner agencies, and a thorough review of intelligence reports and SMRs. The leading predicate offence was found to be tax evasion, where 73% of intelligence reports involved one of the big four banks. Other offences included drug trafficking (illicit tobacco trades), fraud, and scams.

“The ACIC estimates Australians spent more than $11 billion on illicit drugs in 2018-19. AUSTRAC assesses a sizeable portion of these funds are laundered through the banking system,” states the report.

In particular, identity fraud was most commonly reported, followed by loan application fraud and cheque fraud. ID fraud was found to be the driver behind the latter two, especially as criminals used stolen or forged ID documents, fake addresses, and fraudulent IP addresses, to open multiple fraud accounts. AUSTRAC’s report also gave the big four banks a stark warning to stay vigilant against mortgage brokers that assist known criminals in acquiring home loans.

Suggested Read: AUSTRAC New Risk Assessment Report on Banking Sector Warns Brokers of High ML/TF Risk

Drivers Behind Big Four’s ML/TF Vulnerability

AUSTRAC identified the following main areas of concern that have put the big four banks in the highest category of risk:

- A very large customer base of approximately 47 million clients

- A significant number of customers in higher-risk categories, including PEP lists, known criminal entities, Designated Non-Financial Businesses and Professions (DNFBPs), among others

- Numerous products and services that can be used to store and move funds

AUSTRAC identified transaction accounts, credit card accounts, bank cheques, trust accounts, and correspondent banking services as the most vulnerable products, stating that “these channels can offer criminals anonymity, facilitate identity fraud and other financial crimes, and complicate detection of unusual or suspicious transactions,”. Increasing customer and institutional shift towards online banking and high exposure to foreign jurisdictions were also cited as areas of concern for ML/TF risks.

Consequences of Emerging ML/TF Threats

AUSTRAC divides the consequences of money laundering and terrorist financing threats into four broad categories. For customers, the consequences are labelled as major, since becoming a victim causes financial loss and emotional distress on top of reputational damage. For Australia’s big four banks, the consequences are pronounced as moderate, as they have the tendency to absorb the financial impacts of criminal activities.

In terms of the Australian financial system, the community, and national security, the consequences are cited as major and quite detrimental. This is because money laundering is often the enabling force behind other financial crimes and identity frauds, leading to disastrous consequences on the economy as well as national and international security interests.

Do Australia’s Major Banks Have Sufficient Risk Mitigation Strategies?

AUSTRAC assessed that it had mixed reviews on the risk mitigation strategies adopted by ANZ, Commonwealth Bank, NAB and Westpac. On one hand, significant investments were made by these financial institutions to enhance AML policies and procedures. On the other, significant and systematic deficiencies were identified. The report clearly states that all four banks lack governance and assurance around AML/CTF compliance, and the risk mitigation strategies are inconsistently implemented across the reporting entities.

In the End, It All Comes Down to Automated AML Solutions

Any organization that needs to devise an effective AML compliance strategy must deploy an AI-powered AML screening solution. AML screening is the key method used for conducting a risk assessment of any company’s existing or potential customers while staying in compliance with global AML guidelines.

With AML screening, businesses ensure that their customer base is not included in any of the sanctions list, PEP list, criminal watch list, or adverse media news.

Need to safeguard your organization against money laundering threats? Contact us right away!

Explore Now

Explore Now