Expanding and Securing Financial Services with Shufti’s Video KYC Solution

In recent years, Know Your Customer (KYC) has gone through significant digital transformations. Banks and other financial organizations were among the first to shift towards the digital landscape, as is customary. When video verification became available as a KYC option, however, many financial institutions were no longer as forward-thinking as they had been. Many banks remained resistant to video KYC verification even after Covid-19 pushed video-based KYC to the forefront.

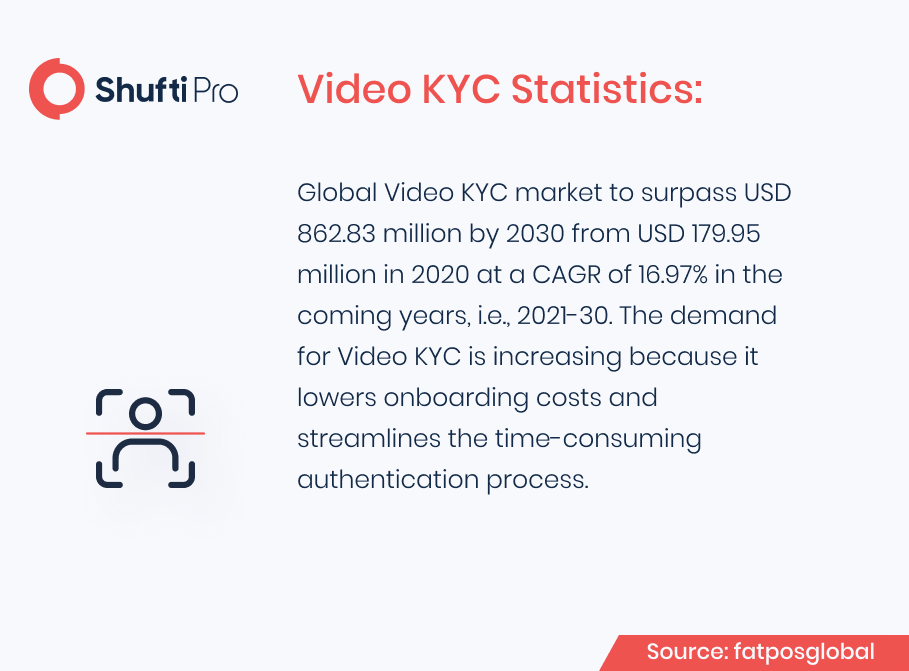

Despite this, consumer demand for video KYC verification solutions also grew, forcing banks, Fintech startups, and large enterprises to create alternate digital customer onboarding solutions. However, many banks have limited their use of e-KYC verification and/or video chat to a small number of existing customers. Moreover, the lack of video-based KYC adaptation was blamed on a lack of personnel training and system needs. For this reason, the situation becomes favorable for cybercriminals. By using sophisticated technologies they came up with rigid methods to scam individuals and financial firms.

Financial Industry and Prevailing Crimes

For banks, financial service providers, and individuals, the increasing number of criminal activities including money laundering is becoming a global concern. Criminals are using more complex tactics to dodge legal scrutiny and carryout crimes, such as money laundering, and terrorism funding. Therefore, financial regulatory authorities are developing new strategies as well as laws to detect and prevent financial crime.

Financial institutions are also obliged to play their role in fighting the battle against money launderers and other organized crime organizations by ensuring that the restrictions set in place by authorities are followed – or face severe fines. Financial compliance is a major global concern, thus, the global cost of financial compliance is estimated to reach over $180.9 billion each year.

As a result, every financial organization should be aware of the criminal threats they face, as well as the precautionary measures they must implement to both protect themselves and comply with regulatory requirements.

Rigid Regulatory framework – The Only Way of Halting Financial Crimes

Criminals who launder money and fund terrorist organizations typically employ sophisticated strategies, making it hard for financial firms as well as law enforcement authorities to detect and apprehend. Money launderers and terrorist financiers both need to move funds across borders to clean their illicit gains, therefore both of these crimes are becoming global concern.

The US Bank Secrecy Act (BSA), the UK Proceeds of Crime Act (POCA), and the EU’s anti-money laundering directives all require banks, financial institutions, and other obligated entities to comply with jurisdictional AML/CFT rules. The Financial Action Task Force (FATF), an intergovernmental organization established to set worldwide AML/CFT standards, provides recommendations to most jurisdictions when developing anti-financial crimes laws.

AML standards are intended to prohibit financial institutions from assisting money laundering and terrorism financing, whether deliberately or unknowingly. While legislation varies jurisdiction-wise. They generally impose financial reporting and record-keeping duties, as well as the development and implementation of in-house AML/CFT compliance solutions in accordance with the FATF’s risk-based approach.

In reality, this implies that businesses must create and implement an internal anti-money laundering/counter-terrorist financing compliance solution based on an evaluation of the specific risks they face. Risk-based AML is based on the effective application of Know Your Customer (KYC) measures, which necessitate the collection and analysis of a variety of data in order to precisely identify customers, understand their behavior, and assess the legality of their transactions. When unusual patterns of bogus transactions or money laundering activities are discovered, businesses must notify the appropriate authorities as soon as possible by filling out a suspicious activity report (SAR).

Sixth Anti-Money Laundering Directive (6AMLD)

The EU’s Sixth Anti-Money Laundering Directive (6AMLD) went into force for member states on December 3, 2020, and financial institutions must comply by June 3, 2021. Following the 5AMLD, which broadened existing AML/CFT provisions, the sixth anti-money laundering directive aims to empower financial institutions and authorities to do more in the fight against money laundering and terrorism financing by broadening the scope of existing legislation, clarifying regulatory details, and toughening criminal penalties across the EU.

6AMLD broadens the definition of money laundering to include a broader range of offenses. When the regulation takes effect, “aiding and abetting” will be considered money laundering as well, and will carry the same criminal consequences. Prior to 6AMLD, EU money laundering regulations mainly targeted individuals who profited directly from money laundering; now, under the new rules, so-called “enablers” will be held legally liable as well.

Bank Secrecy Act (BSA)

The Bank Secrecy Act (BSA) is the most essential anti-money laundering regulation in the United States that obligates banks and other financial institutions to comply with its requirements. The Bank Secrecy Act, enacted in 1970, requires financial firms to cooperate with the US government in the fight against financial crime.

The BSA is designed to not only assist in the battle against money laundering but also to ensure that banks and financial institutions are not utilized as facilitators of the crime. Under the BSA, financial institutions must try to detect and monitor possible money laundering activities, as well as report them to authorities so that enforcement action can be done.

The Financial Crimes Enforcement Network (FinCEN) is in charge of enforcing the Bank Secrecy Act, which places a range of compliance requirements on financial institutions. Senior management should ensure that they have a thorough understanding of the legislation in order to meet those requirements.

Final Thoughts

Performing identity verification and screening customers while onboarding is a requirement every bank and financial institution has to fulfill. With the development of new digital services that are being offered to the customers, these institutions must employ digitally advanced verification solutions to overcome the growing risk of fraud and money laundering.

Shufti’s video KYC solution enables a robust and rigid identity verification solution for onboarding remote customers. Both banking and financial institutions can acquire video KYC services from Shufti to onboard clients seamlessly. Shufti’s video KYC services utilize facial recognition and liveness detection for effective customer face authentication and to ensure the live presence of customers during the interview. Here Shufti can help them keep their operations secure and their customers happy. Our video KYC solution offers enhanced security with a quick verification system compatible with their onboarding operations.

Want to know more about video KYC for financial firms?

Explore Now

Explore Now