How Age Verification Protects the E-commerce Industry From Potential Risks

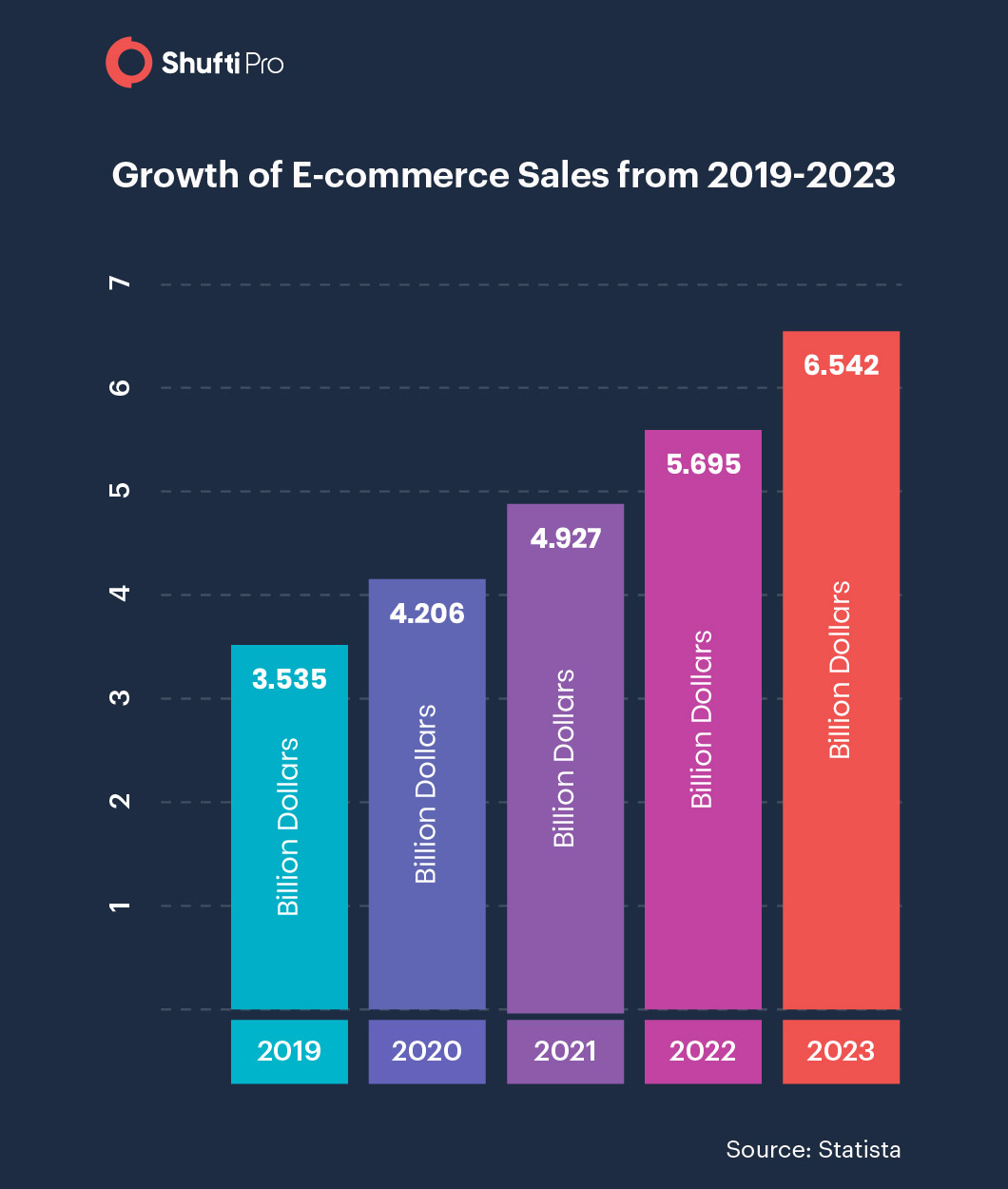

Online shopping has become the new normal since the COVID-19 pandemic struck. With digital products and services being in popular demand, online businesses need to adapt to the constantly evolving customer needs to survive market competition. According to a study, almost 2.14 billion consumers will buy goods and services from online platforms by 2021. Where the surge in e-commerce stores has brought innovation to the table, it also creates challenges for businesses and customers alike.

E-commerce Growth and Age Verification

E-commerce platforms sell various products and services to a wide range of audiences. Where healthcare, electronics, and clothing stores are all over the internet, purchasing these items are not harmful in common. Today, e-commerce vendors can sell items like alcohol and tobacco, which in an offline setting, requires the buyer to be an adult or accompanied by a grown-up.

Merchants providing age-exclusive services have the social and ethical responsibility to safeguard children from consuming age-restricted products and take precautions when selling them to online customers, just like at a physical store. Age verification helps online vendors to deliver age-appropriate services to consumers.

What is Age Verification?

Digital age verification is a process which ensures customers engaging with online businesses are above the legal age limit. Age verification helps determine customers of age-oriented products which are suitable only for an appropriate set of audiences. It is significant in protecting underage minors from products not suitable for their age.

Why is Age Verification Significant?

Consumption of age-limited products which are sold over online platforms could have a bad impact on the mental and physical health of minors. What happens if an underage gets their hands on illegal drugs or a subscription of an adult-themed magazine or online platform? It has a bad influence on their personality and could have adverse effects on their health condition. This is when verifying age over e-commerce platforms becomes increasingly important to ensure minor protection.

Age verification checks at these particular e-commerce stores can prevent inappropriate products and services reaching children below the suitable age limit. A secure age verification software integrated with an e-business website not only helps enterprises to be compliant with modern online safety regulations, but also provides better opportunities for parental control.

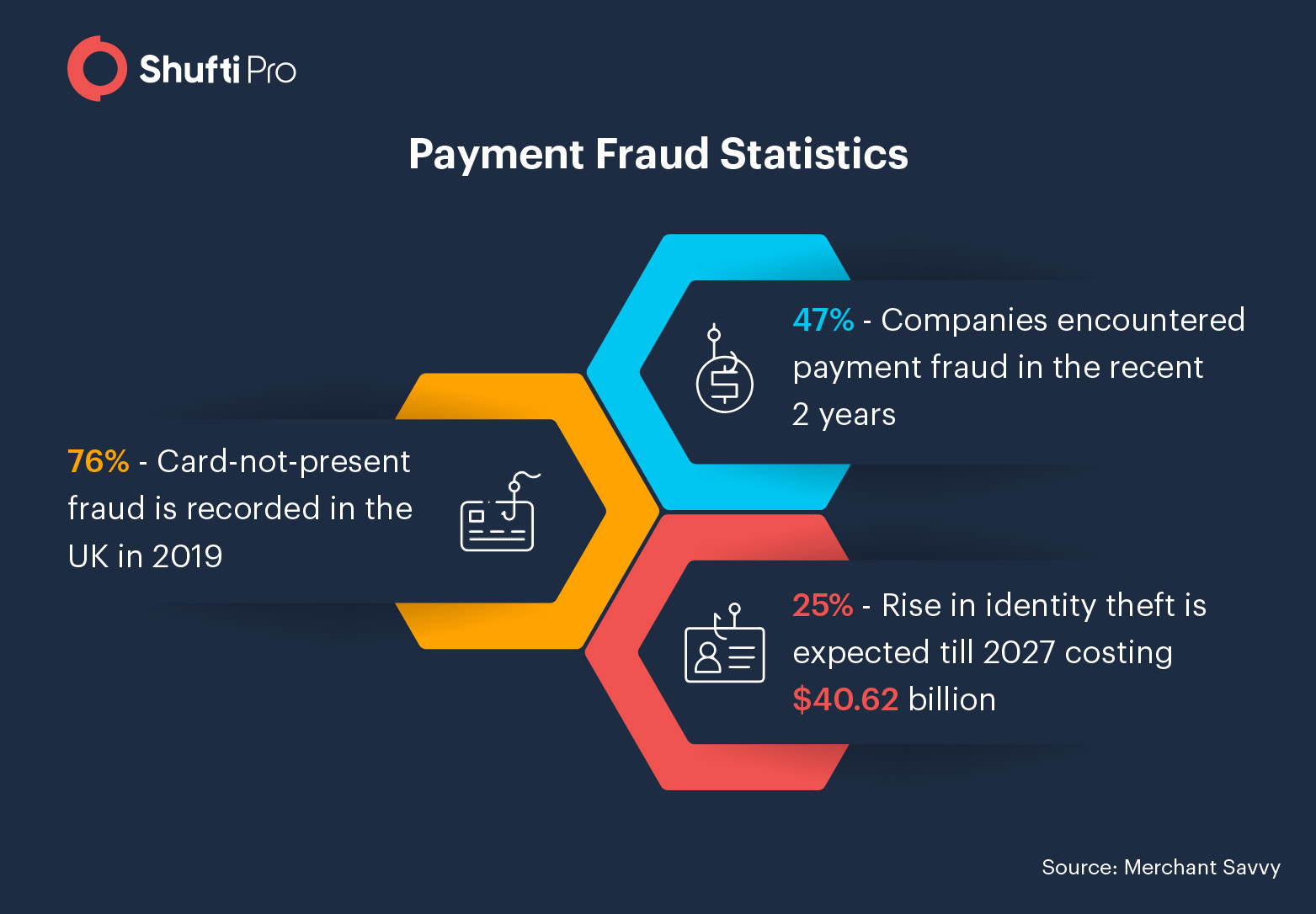

Risks in the E-commerce Sector

Online scammers employ different ways and means to steal the identity of genuine users to commit payment fraud. From compromised credit card credentials to imposter websites and synthetic identities, fraudsters get the better of consumers. Apart from this, children themselves are not capable of deciding if a platform is secure and often end up giving their information to a potential scammer. The identity of minors is comprised the moment they open an imitation website intended to trick people and submit their payment details including credit card pins, address and other personally identifiable information like name, bank account number, etc.

The reason child identity theft is so common on the internet is the lack of age authentication frameworks. As a result, these websites and organizations have to face serious consequences in the form of non-compliance penalties which ultimately lead to compromised brand image. A few of the challenges and risks associated with e-commerce platforms are discussed below:

Chargeback Costs

On average, from the total number of chargebacks filed, 86% of them are cases of friendly fraud. Usually, fraudsters order a product or buy a service online, use it for one or two months, and then claim that they didn’t make the purchase, which is in fact a chargeback fraud. The merchant or service provider receives the requests and has to return the amount in most cases. This way, cybercriminals defraud e-commerce businesses at a slow but steady pace.

Although chargebacks are not practically illegal, fraudulent claims can result in severe penalties to the cardholder requesting the reversal. In the case of minors, when purchasing online goods without the consent of their parents, the scenario is different. Minors can easily buy their favourite video game on the web, which has a decent amount of violence and R-rated content, using their parent’s credit card. Since payment card authentication is only limited to details provided on the card, they are not a great means of validating user age. Credit card authentication with age verification offers added protection for minors and helps businesses cut on chargeback costs.

Identity Theft

The most common type of fraud over the internet is performed through stolen identities, and e-commerce platforms are no exception. As of July 2020, almost 4807 identity theft cases have been reported, according to the Federal Trade Commission. The compromised details are then used to either take over existing accounts or make up synthetic identities by using the stolen information and combining it with made-up credentials. Identity theft fraud is usually carried out through phishing emails containing suspicious links, data breaches, or misplaced social security cards and driving licences.

E-commerce platforms are a sweet spot for criminals to pursue their illicit motives by claiming personally identifiable information of other users and buying products and services with them. Lack of proper age verification mechanisms make e-stores a potentially harmful platform for minors.

Child identity theft is a growing problem since stolen Social Security Numbers (SSN) of children are used to create synthetic identities, which are then used to get credit credits, and avail other illegal benefits. Fake payment gateways at malicious e-commerce websites result in compromised SSNs.

Fake Affiliate Programs

Many online vendors are unaware of affiliate fraud in which dubious actors make up false customer acquisition by manipulating their e-store traffic. These platforms often end up as places for performing illicit criminal activities since they are infiltrated by fabricated identities. Affiliate fraud can take the form of spam emails, multiple refreshing of web pages, and integrated pop ups appearing on e-commerce websites. Age verification systems provide a solution to verify and protect minors from these false platforms and being a target of child identity theft.

Obligations for Online Sellers

Online sellers of any type of products should provide services which are suitable and appropriate for their audience. E-commerce companies operating in the sector have certain financial obligations imposed by regulatory authorities which they have to follow.

The level of risk associated with the product usually determines the age verification law which is applicable to it. For instance, the GDPR allows the minimum age of consent to be between 13-16 in the European Union States and imposes a penalty of $22.5 million in case of non-compliance.

Similarly, the minor protection law in the US known as COPPA has a penalty of $43,280 against the offender. Having proper age authentication gateways at online shopping stores could help businesses avoid hefty sums paid in fines.

Brand and Business Credibility

As a result of not following global age verification laws, a business could get in serious trouble. Not having proper means to restrict age-limited content and products to children can notoriously defame an organization, and become a cause of e-commerce fraud. A drop in the brand credibility hurts its market reputation in terms of both customer loyalty and acquisition which can affect business operations in the long run.

Just like other online enterprises, e-commerce platforms have the corporate social responsibility of taking adequate age verification measures to restrict buying and selling of age-exclusive products by minors.

How Shufti’s Age Verification Helps

Online age verification is of prime importance when it comes to minors using online services. Shufti Pro’s solution for age verification assists e-commerce platforms to verify the age of their customers in light of international guidelines issued by regulatory departments like the EU, FDA, and FATF. Our age verification solution provides a foolproof mechanism to determine the exact age of an individual by taking into account authentic ID documents and a facial proof of identity.

Using Artificial intelligence, Shufti checks for potential manipulations in documents to take down identity theft which is a common issue for e-commerce stores. Merchants selling age exclusive products online can comply with online child safety guidelines using Shufti’s age verification services with a single API integration with their e-commerce platform.

Check out our age verification services here.

Explore Now

Explore Now