How Multi-Factor Authentication Is Playing An Important Role In Combating Rising Online Business Fraud

The advent of online businesses has brought a lot of convenience for customers using modern technologies. Especially after the COVID-19 pandemic, the trend of buying and selling using digital platforms has increased to a large extent, altogether changing traditional business models. This digital conversion is not only limited to standard everyday shopping but the whole technology sector, which has shifted towards online transactions ultimately leading to increased revenue and business.

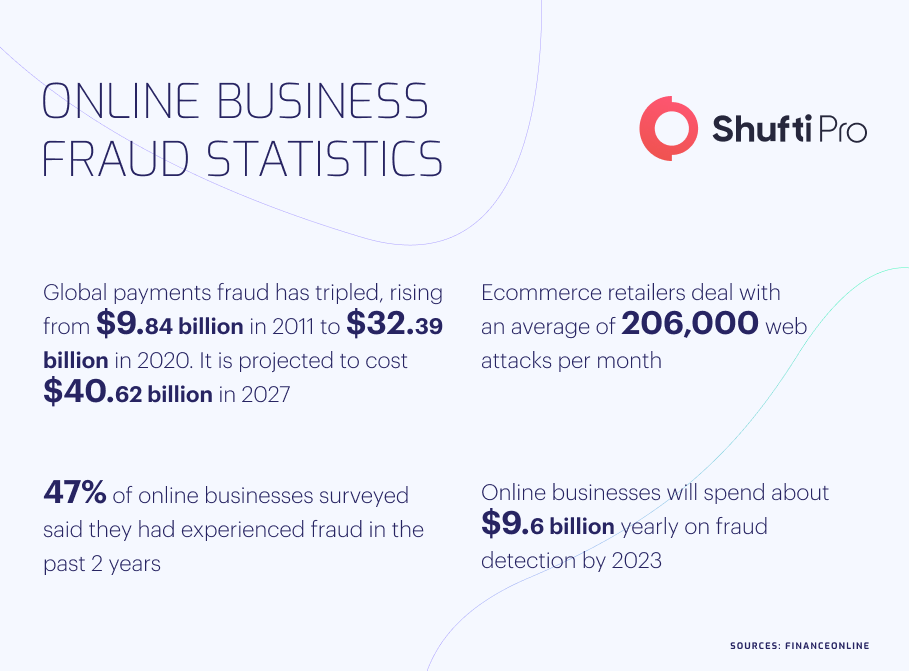

With the ever-increasing growth of online businesses globally, the percentage of cybercrime has also increased, exposing users to multiple threats of identity theft and other financial loss. Most companies are working tirelessly to eradicate crime, and it is expected that by 2023, businesses worldwide will be spending $9.6 billion annually on anti-fraud measures. The overall system is in dire need of effective solutions that can help mitigate the risks of monetary crimes and ensure the security of users. Multi-factor authentication is an advanced option that has all the capacities to halt criminal activities by putting an extra layer of security over the users’ and companies’ accounts.

Online Businesses – A Highly Vulnerable Industry

Within a decade, the online selling and purchasing trend has skyrocketed, resulting in a huge influx of money in the digital industry. This is the primary reason that criminals have engaged in illicit activities inflicting a myriad of losses on sophisticated users. Online banks and financial institutions, the majority of typical online businesses, and eCommerce stores do not have effective identity verification measures which prevent scammers from opening accounts and abusing them for multiple crimes. It’s not just fraud, bad actors are also involved in money laundering and terrorist financing through online businesses by investing their black money in the sector and covering it under different layers.

Fraud is generally carried out by hackers who use multiple hacking techniques to steal user credentials and take over their accounts, further performing illicit transactions. Authorities globally have also raised their concerns in the wake of rising scams in this sector and instructed their respective countries to implement stringent regulations preventing criminal activities. Multi-factor authentication could be an ideal solution for online businesses as it will help businesses and users, add an extra security layer to their accounts, restricting the illicit onboarding of scammers.

Recent Crime Cases In Online Businesses

Online businesses have become quite crucial for the global economy, and countries are generating huge exports through them. Prevailing scams in the sector are posing huge threats to the overall system which has urged law enforcement to take decisive action against the culprits. By looking at recent crime cases, it becomes clear that global regulatory authorities and different countries are working tirelessly to fight scams and make digital platforms secure for users.

Four Jailed for £13.7 Million Scam in the UK

Law enforcement authorities in the UK conducted a raid and arrested four criminals who were involved in an online scam of £13.7 million. The investigations have found that scammers were using advanced hacking techniques to control different users’ and companies’ accounts carrying out fraudulent activities. They were further laundering the black money to other countries through different channels using banks and financial institutions. The whole gang has been penalized with 15 years of imprisonment.

60 Arrested in Connection with eCommerce Fraud

European police, along with law enforcement officials from 19 different countries, conducted a giant raid arresting 60 criminals of different backgrounds involved in eCommerce fraud. It was discovered during the investigation that scammers were using stolen identities and illicit credit card details to make purchases over different online shopping platforms. Police have stated that in a span of a few years, criminals performed more than 6500 fake transactions inflicting losses of 5 million euros to businesses.

Global Regulations to Curb Financial Crimes

The Financial Action Task Force (FATF), European Union (EU), and Interpol have raised concerns about rising money laundering and terrorist financing through online businesses. FATF has issued detailed guidelines for all member states, which are binding for all countries to implement strict checks to counter criminals. Let’s have a look at some of the laws prevailing in different countries:

US

The United States has adopted quite a tough approach towards prevalent cybercrimes in the eCommerce and online business sector. Although all the states have different laws, the Federal Trade Commission (FTC) is also overlooking the whole space ensuring that businesses are implementing strict measures against criminals. All B2B businesses and eCommerce stores have been guided to report to FTC in case any violation or suspicious activity is observed.

UK

The United Kingdom’s Fraud Act regulates all types of criminal activities involved in digital platforms. As per this act, it is mandatory for all online businesses to keep strict scrutiny over their users and monitor all types of financial transactions. It has also been instructed to digital platforms to implement Know Your Customer (KYC) checks while maintaining detailed transaction history and records, which can be used in case of any crime.

Canada

Section 342 of the Canadian Criminal Code clearly states that stealing any online information and abusing it further is a criminal offense that could result in imprisonment along with hefty fines. Law enforcement authorities have conducted several raids in the recent past, arresting criminal gangs and penalizing them through court by following this section.

How Multi-Factor Authentication Can Help Ensure Compliance

Multi-Factor Authentication (MFA) is a technique that requires individuals or companies to produce two or more pieces of evidence to gain access to their digital assets. Generally, the users are sent a One Time Password (OTP), SMS, secret question, or biometric check to pass this phase of verification. Multi-factor authentication is just like a door with two locks; the first is the username and password, and the other is in the form of OTP. This way, the whole verification process becomes much more complicated for criminals to bypass, and most hacking attempts on the system result in failure.

Implementing MFA in online businesses can really help secure their platforms from hacking attempts and protect their customers’ valuable assets. Not only individuals, but companies must also use this effective technique to increase the security layer over their business and official accounts. MFA techniques have remained very successful in securing users’ confidential details, and almost all technology giants like Facebook and Twitter are using them to secure user accounts.

How Shufti Can Help

Online businesses are playing a huge role in shaping the world’s digital future, and it is crucial to secure this sector by implementing stringent security measures. All companies that make this investment will enable them to run their operations smoothly and keep their customer’s assets safe.

Shufti’s state-of-the-art multi-factor authentication services are the most optimum option for online businesses to ensure compliance with global standards. Through Shufti’s KYC services, online businesses can verify the true identities of their users, keep vital records, and further authenticate them using multi-factor technology. It is efficient enough to provide results in mere seconds with ~99% accuracy.

Would you like to get more information about multi-factor authentication solutions for online businesses and how Shufti solutions can help?

Explore Now

Explore Now