ID Verification for High-Potential Digital Fraud Cases

Instances of digital frauds and payment scams are highly damaging for banks and financial institutions. Not only first-party fraud which includes an individual or group of people that provide false identity information to become part of a legitimate system but also third-party fraud such as data obtained from data breaches used to make online user accounts.

A banking industry exposed over 13 billion records containing user and organizational data that has been stolen or lost since 2013. Financial institutions (FIs) all over the world are striving hard to mitigate high-risk criminal activities. It is estimated that by 2020, the U.S. will be spending USD 599 million to combat loss by account application fraud. In the bank account application fraud, fraudsters use synthetic ID documents and stolen Personally Identifiable Information (PII) to open a bank account.

Fraud Prevention Strategy

The most successful fraud prevention mechanism is ID verification. In the digital environment, the chances of criminal activities and fraudulent attempts are high. Banks and financial institutions are under the regulatory obligations of verifying each onboarding identity to curb the high potential financial crimes such as money laundering and funding of terrorist activities.

Chargeback fraud

Among all chargeback frauds, 86% are of friendly fraud which is increasing at a rate of 41%. All totaled digital frauds cost online retailers an average of 1.47% of their overall revenue. In chargeback fraud, a user calls his banks or credit card company to request a chargeback over some product which he has not ordered. The online merchant would have to transfer the money without even suspecting the fraud. As a result, the fraudster who made the purchase gets money as well.

Unprotected bank transfers

The digital payment services are under the threat of suspicious transactions. Unauthorized access over user accounts can be responsible for transferring funds to some suspicious destination. Money laundering and illicit funds transfer activities are performed through digital channels.

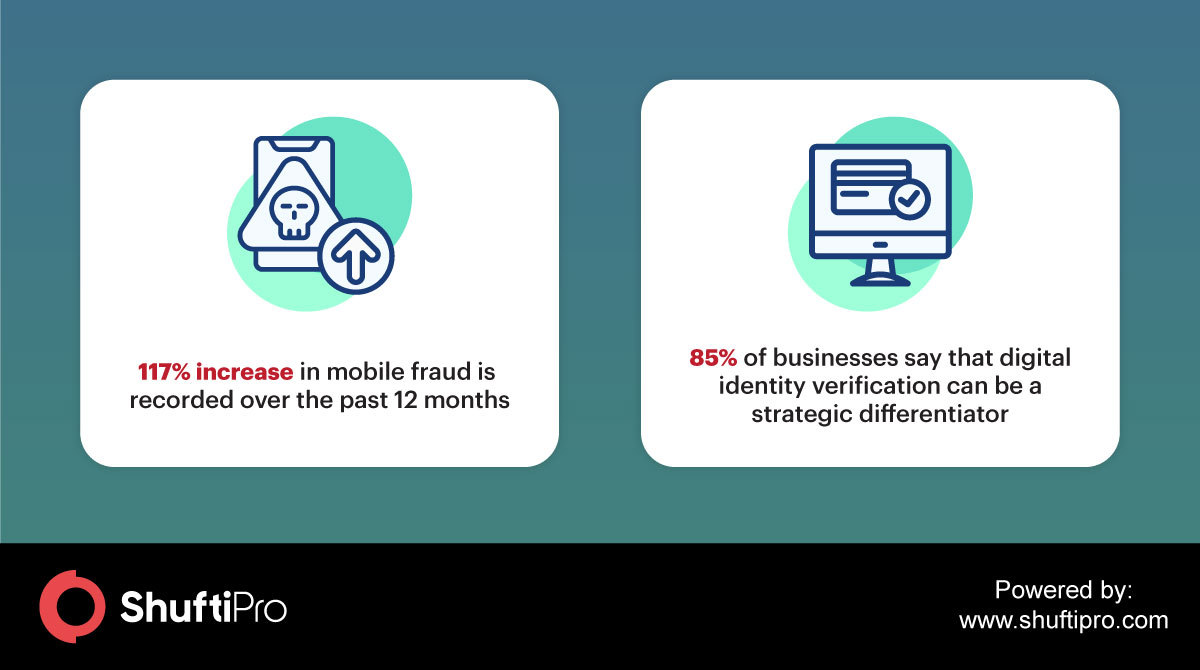

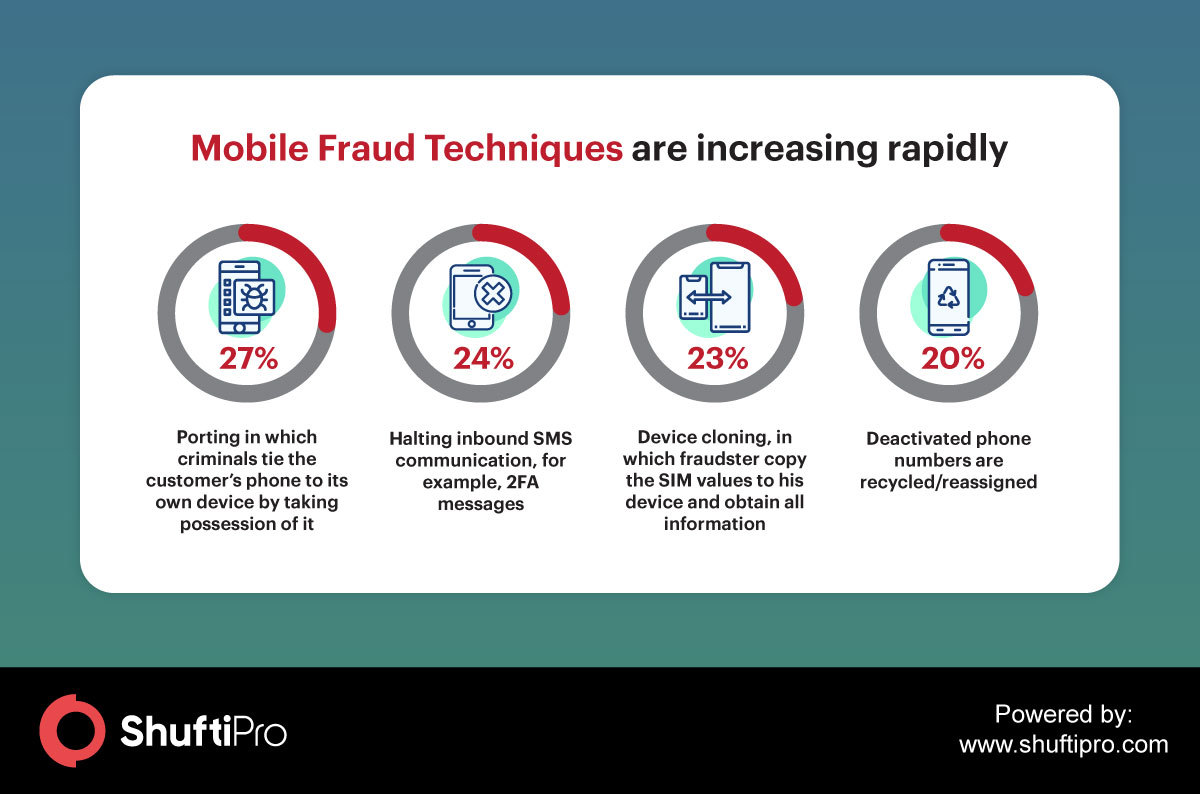

Mobile fraud

Mobile fraud is the leading fraud today in which fraudsters are able to access the confidential data and impersonate as if a legitimate customer is making a request. ID verification for customers helps mitigate the risks of fraud that occur through mobile devices. There are some common mobile frauds that are increasing rapidly with the penetration of the Internet and mobile devices. With varying but almost similar occurrence percentages, these mobile frauds are becoming part of daily mobile users. However, the need is to combat the crimes by ensuring a strict ID verification.

Identity Verification – Do’s and Don’ts for Compliance

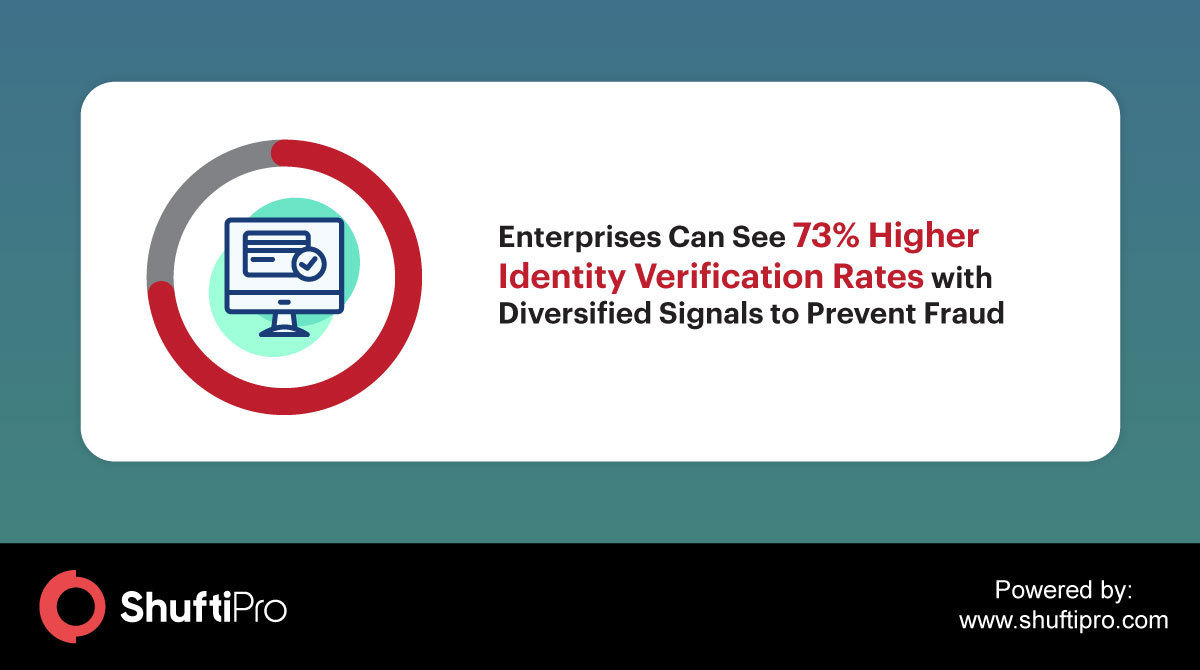

Digital identity verification is the only solution that aligns well as per the regulatory requirements of ensuring KYC compliance. Also, to fight back against the high-scale financial crimes and digital frauds, digital identity verification is the most praised solution by business entities.

ID verification involves various methods of verifying the identity of customers in which document verification is the one most adopted by businesses. In digital document verification, a user’s government-issued ID card is scanned to ensure that it has not been digitally manipulated or involved in some criminal activity. ID verification provides a strong trust for online businesses. It is crucial to assure that the online user who is holding the ID is actually the one who they say they are.

The different digital fraud cases can be solved with mere identity verification that verifies each onboarding identity. ID verification involves an ID scan with a selfie to verify the identity of individuals. In this way, it serves many benefits to businesses that seek to build trust in their digital channels, get higher levels of assurance, and meet KYC/AML compliance obligations.

Common documents for verification purposes

The following are some common documents that can be used for ID verification purposes:

- Household utility bills such as water, gas, electricity, TV, and landline, etc.

- Lease or rent agreement

- Bank account statements

- Official photographic ID

Less common documents

Some documents are not commonly used for verification purposes because they are not considered as much authentic when it comes to verifying the identity of an individual.

- Mortgage statement

- Housing insurance documents

- Voter registration certificate

- Municipal tax statement

Non-acceptable documents

For ID verification, some documents cannot be accepted when it comes to compliance requirements. These include;

- Envelopes and postcards

- Internet and mobile phone bills

- Invoices for privately rendered services

- Self-completed applications

- Informal letters

- Tax-related documents

For ID verification, generally, PII is verified which must feature the full name and address of an individual. The following are some other requirements:

- The name and address should be clearly visible in the document.

- It must be recent

- There should be a residential address given

- It must be issued by an official authority

ID verification services also maintain a balance between mitigating fraud and customer experience. The AI-powered ID verification provides an optimized customer experience that leaves no stone unturned when it comes to secure business, regulatory compliance, or a smooth onboarding process for end-users.

Explore Now

Explore Now