KYC/AML Compliance – A Safeguard Against Money Laundering in the NFT Market

The instability in the non-fungible token (NFT) sector can be seen in the record sales of $25 billion in 2021 and the surge in financial crimes involving NFTs in 2022. NFTs are the digital version of artworks that are constantly part of the news due to their high value and online sales to wealthy collectors from around the world.

Art has been bought by wealthy business tycoons and corrupt politicians long before NFTs were introduced in 2014. Just like the art and antiquities market, NFTs provide money launderers with the perfect medium to spend larger portions of their illegally-obtained funds without any questions about the source of money.

The Art Market and NFTs

Discretion and anonymity in the world of art have contributed to making it a safe haven for money launderers. Unlike stock exchanges or gold trade, art or NFTs have a value that is highly dependent on collectors. Many famous artworks before NFTs were valued in the multi-million dollar bracket, including the Salvator Mundi by Leonardo da Vinci, which was sold for over 450 million USD.

The price tags of non-fungible tokens representing digital art in the form of images or videos, and those of crypto assets have skyrocketed in the last year. For those who speculated and guessed the incoming spikes, investing in these digital assets has been quite profitable. Not only investors, but auction houses also made millions of dollars by selling NFTs representing simple cartoons. Even the world’s biggest brand names like Gucci and Coca-Cola have sold NFTs in the past year.

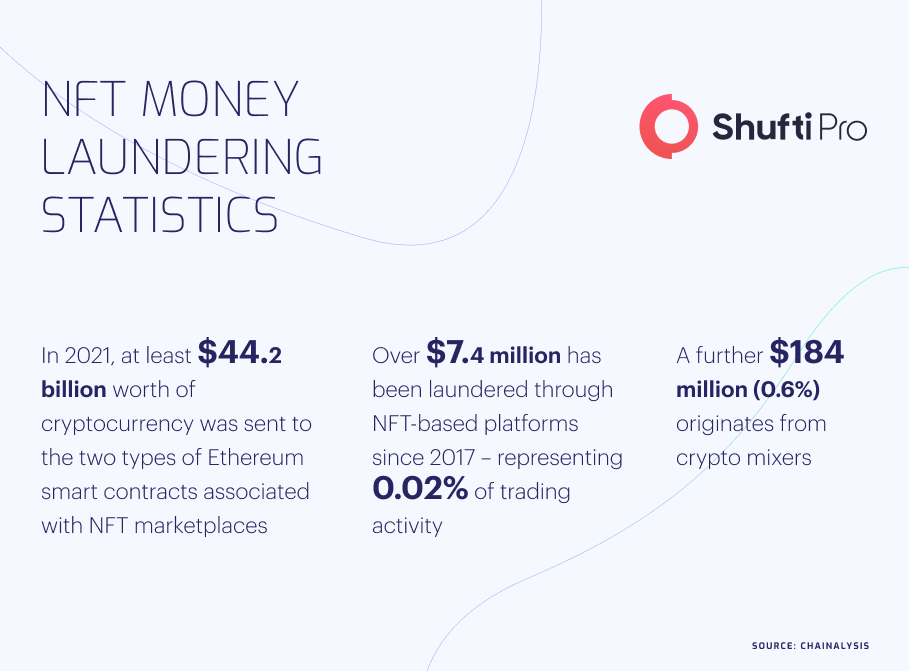

The Concern of Money Laundering

As the NFT and art market is still not regulated like banks and other financial institutions, there are numerous opportunities for financial criminals to launder illicit funds. In light of the rising money laundering cases in the sector, regulatory bodies and financial authorities around the world are exploring possibilities of introducing regulations for NFTs. The widespread adoption of NFTs itself has become a concern for regulators, as the sale and purchase of these digital representations mostly involve the use of cryptocurrencies. The use of digital assets to buy NFTs makes it more difficult for authorities to track down those who try to evade the broadening scope of Anti-Money Laundering (AML) regulations for the art market.

Regulations for the Art Market

As per the EU’s AMLD5 (5th Anti-Money Laundering Directive), the sale and purchase of artworks worth more than €10,000 must involve the process of Customer Due Diligence (CDD). The art gallery, or auction house that is selling the artwork must comply with AML regulations and report suspicious activities to the relevant authorities. That being said, the confusion remains as to whether the 5AMLD applies to NFTs because there is no given definition for a ‘work of art’. One opinion is that NFTs can be taken as digital works of art and therefore fall under the scope of KYC (Know Your Customer) and AML/CFT regulations.

Another EU regulation that can be applied to NFTs is the 2020 Markets in Crypto-assets Regulation (MiCA). The MiCA defines NFTs as “a digital representation of value and rights which may be transferred electronically, using distributed ledger technology or similar technology”. The ‘other crypto assets’ category of the MiCA can bring NFTs under its scope, which will mean that NFT distributors will not be obliged to get licenses, but will still be required to operate as a legal entity. This also applies to the businesses dealing with NFTs that are based outside the EU. NFT issuers must comply with the requirements stated in the MiCA and implement AML screening checks. Similarly, the US does not have a specific regulation for NFTs, but some states have formulated their own laws to keep NFTs under check.

How NFTs are Used for Money Laundering

Even though the ways to clean dirty money are always evolving, money laundering through NFTs also works with the same basic methodology. According to the Paris-based global financial watchdog FATF (Financial Action Task Force) guidelines, the risks of money laundering and the regulations to be implemented to counter those risks are heavily dependent on the nature of the digital asset and the way they are traded.

This year, the US Treasury issued a warning regarding the risk of money laundering through NFTs in the art sector. “The ability to transfer some NFTs via the internet without concern for geographic distance and across borders nearly instantaneously makes digital art susceptible to exploitation by those seeking to launder illicit proceeds of crime because the movement of value can be accomplished without incurring potential financial, regulatory, or investigative costs of physical shipment.”

In addition to that, the Treasury Department also stated that financial criminals can self-launder money through the purchase of NFT and the transfer of digital assets to different e-wallets or accounts. The Treasury Department also stated that criminals can create a sales record of their NFT before selling to a legitimate entity and receiving real money. The majority of the financial regulators around the world have recently started taking steps to regulate cryptocurrencies such as Bitcoin (BTC) or Ether (ETH). For instance, the EU extended the scope of AML regulations by including cryptocurrencies in the 5AMLD. In September 2020, the European Commission proposed regulation for cryptocurrencies in the form of the MiCA (Markets in Cryptoassets Regulations).

In this proposal, the EU for the first time defined a criteria for classifying a crypto asset as a “digital representation of value or rights which may be transferred and stored electronically, using distributed ledger technology or similar technology”.

Considering this definition, at least half of the regulation extends to cover NFTs. Although the MiCA proposal is still in progress, it is aimed at combating money laundering through NFTs at a time when the trading volumes are at their highest.

What Shufti Offers

Shufti’s state-of-the-art identity verification and AML screening solutions are ideal for NFT service providers to combat rising financial crimes. These solutions allow NFT providers to determine the real identities of the customers along with the ownership records of the digital assets. Shufti’s robust AML solution is powered by thousands of AI models and screens customers against 1700+ global watchlists.

Apart from incorporating a robust AML background screening solution, the FATF urges businesses to comply with KYC regulations. Shufti’s all-in-all identity verification solution allows businesses to keep a check on their customers and stay compliant at all times.

Want to know more about KYC/AML solutions for the NFT market?

Explore Now

Explore Now