KYC Isn’t Enough: Get Ready for the Future of Verification

- 01 Why is KYC Not Enough?

- 02 Know Your Transaction (KYT) vs. Know Your Customer (KYC)

- 03 Why Should Financial Organisations Use KYT?

- 04 Which Industries Need KYT?

- 05 Challenges and Opportunities for KYT Implementation

- 06 KYT Is The Future: The Importance of New Technologies in Business

- 07 How Can Shufti Help

Over the past few years, companies have been looking for more sophisticated identity verification (IDV) solutions, and 91% of businesses in the financial services and telecom industries intend to boost spending on IDV. According to industry forecasts, the IDV market will double by 2027, reaching $18.6 billion.

Financial institutions like banks now have more in-depth customer data than ever. But how well do they understand customer habits? Naturally, Know Your Customer (KYC) helps risk-based due diligence by permitting a closer examination of clients and their payments. But firms should also be looking at transaction behaviour more closely.

Especially now, when cryptocurrency use is so widespread, the ability to scrutinise crypto transactions for signs of financial wrongdoing is crucial. The emphasis is not on a specific person but on the entity, transaction, associated history, and connections.

Why is KYC Not Enough?

In recent years, KYC verification solutions alone have proven insufficient to combat increasing financial crimes. The customer life cycle extends far beyond the onboarding phase, where KYC comes into play.

Recent research indicates that identity fraud in the cryptocurrency and banking sectors nearly doubled in 2022, whilst payment fraud surged by 40%. Money laundering is a common consequence of fraud.

Today’s compliance and risk teams must monitor the full user path, so know your customer checks won’t cut it. This entails a variety of measures, including the verification of user transactions and the timely detection of odd patterns. Companies can’t do this without trustworthy transaction monitoring and fraud prevention solutions.

These measures are essential because not all black marketeers immediately raise red flags. For instance, criminal organisations frequently employ “money mules” to clean their money. These covert identities, such as an elderly retiree with no criminal history, are utilised to launder money without raising red flags during onboarding.

That’s why it’s crucial to do more than just verify identities and move on to analysing things like login times, locations, and transaction histories. The same holds for finding legitimate accounts that criminals have hacked.

Concurrently, the Know Your Transaction (KYT) approach is a powerful tool for uncovering money laundering transactions that contain unlawful or questionable behaviour. The KYT verification discloses the clients’ business operations and provides data-driven conclusions by constantly monitoring real-time transactions. Red-flag indicators on location, originating bank, timing, payment velocity, etc., are developed based on patterns and attributes determined from the raw transaction data and related to the nature of the business.

Know Your Transaction (KYT) vs. Know Your Customer (KYC)

Due to KYC, businesses will completely understand their customers’ risk profiles and financial situations. Understanding the customer’s identity, transaction history, and risk profiles is crucial for successful KYC transactions. Some of the steps involved in KYC are:

- Verifying the customer’s identification

- Knowing the customer’s business

- Identifying the customer’s potential for money laundering

The idea is to check that patrons aren’t doing anything illegal. The main distinction between KYC and KYT verification procedures is that KYC examines the customer as an individual, and KYT examines the customer’s financial dealings or transactions.

However, more than know your customer procedures are needed to help businesses learn more about their clients and the deals they conduct. This is where Know Your Transaction (KYT) checks come in, allowing businesses to keep tabs on their customers’ financial dealings and learn more about them.

Why Should Financial Organisations Use KYT?

Adherence to Laws and Rules

Compliance with anti-money laundering and counter-terrorism financing rules is mandatory for financial institutions. For institutions to fulfill these duties and avoid non-compliance fines, KYT is necessary.

Identifying and Preventing Monetary Crime

Money laundering, terrorism financing, and other forms of financial crime can all be uncovered and prevented using KYT verification in financial institutions. This safeguards the financial institution and its clients from potential monetary and reputational losses.

Risk Management

Financial organisations can use KYT to better manage the risks connected with their customers, transactions, and counterparties.

Greater Focus on Customer Verification

Financial institutions can benefit from KYT because it enhances their client due diligence process by giving them access to more comprehensive data on their customers’ transaction histories and related risks.

Increased Productivity

By eliminating the need for time-consuming and error-prone manual processes and boosting data collection reliability, KYT verification may help financial institutions streamline operations and save time and money.

Which Industries Need KYT?

Know Your Transaction (KYT) is essential in any field that regularly processes significant transactions. Know Your Customer (KYC) programs are modified to meet specific business needs in this setting. One factor is the payment method (cash, card, third-party payment processor, wire transfer, etc.).

KYT in Cryptocurrency

The crypto industry has strongly emphasised the concept of KYT. This is because transactions are prioritised over individual identities in cryptocurrency and blockchain. In this case, transaction history tied to patterns rather than blockchain users is used to determine authenticity.

Banks and other financial organisations dealing with digital assets or blockchain clients increasingly prioritise KYT. Now that the FATF has introduced and adopted its travel rule, crypto exchanges, and VASPs must supplement their existing KYC due diligence with KYT efforts to comply with relevant regulations fully.

KYT in Real Estate

To prevent money laundering and other fraudulent actions, Know Your Transaction is crucial in the real estate sector. By adopting Know Your Customer (KYC) procedures, real estate agents and brokers may confirm the legality of their client’s funds and conduct thorough due diligence on all transactions, all while staying in line with anti-money laundering laws. There is less of a chance that illegal funds will enter the market thanks to KYT, and the real estate ecosystem will be safer and more reliable.

KYT in Insurance

KYT principle is critical in bolstering safeguards against fraudulent actions and unusual financial habits in the insurance industry. The insurance industry may better monitor and track transactions, verify the integrity of claims and policyholder contacts, and maintain strict compliance with anti-fraud legislation if it adopts KYT methods. By facilitating the rapid identification and prevention of fraudulent activity, KYT helps the insurance business maintain the integrity of payouts, protect legitimate policyholders, and strengthen its credibility and financial stability.

Challenges and Opportunities for KYT Implementation

Financial institutions may face several difficulties when implementing KYT, including:

Cost: Especially for less established banks, implementing KYT can be prohibitive. Costs can be reduced by employing open-source software or contracting out KYT to a third party.

Data Quality: Qualified data is necessary for KYT, but it can be challenging to collect and retain. The problem can be solved by collaborating with other organisations and investing in data management systems and processes.

False Positives: False positives from KYT systems are a waste of effort and a potential security risk. Improving the quality of investigations and reducing the number of false positives are two approaches to addressing this problem.

Limited Resources: Some banks, especially smaller ones, may need more workforce or funds to devote to KYT. Investing in automation can help prioritise KYT tasks based on risk.

Emerging Technologies: New technologies like blockchain and cryptocurrencies complicate the KYT process. Investing in R&D to keep up with evolving technologies and forming partnerships with KYT service providers are two ways to overcome this obstacle.

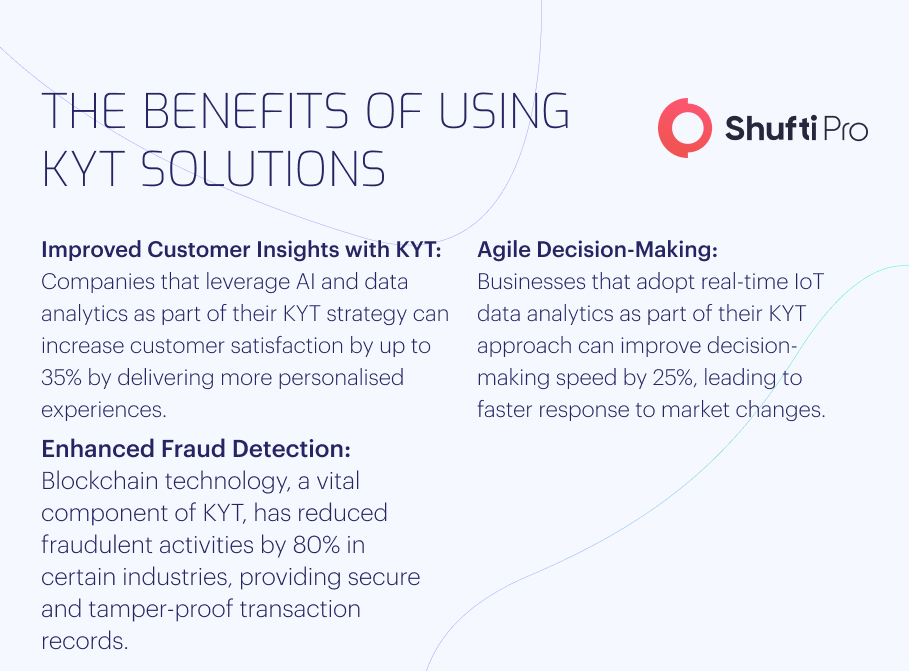

KYT Is The Future: The Importance of New Technologies in Business

The development of KYT is intrinsically linked to the effects of new technology on the financial sector.

Machine learning and artificial intelligence

AI and machine learning are anticipated to be pivotal in KYT, allowing for more precise and efficient financial fraud detection. These tools help firms keep ahead of new risks by analysing massive amounts of real-time transaction data and spotting questionable behaviour patterns.

Blockchain

There are advantages and disadvantages to using blockchain technology for KYT. One potential benefit of blockchain technology is that it may generate an immutable record of transactions, making it more straightforward to track the whereabouts of any given sum of money. However, due to the anonymous nature of blockchain transactions, new KYT procedures are needed to ensure that all parties are correctly identified.

Cryptocurrencies

The rising acceptance of cryptocurrency has created new difficulties in knowing your transaction procedures. Due to the anonymity and decentralisation of cryptocurrency transactions, innovative KYT solutions are needed to identify instances of possible financial wrongdoing.

IoT (Internet of Things)

The IoT produces massive volumes of data, opening up new possibilities for KYT. For instance, insurance fraud might be uncovered by analysing sensor and device data.

How Can Shufti Help

Shufti’s Real-Time Transaction Monitoring Solution is comprehensive since it employs multiple technologies.

By equipping compliance professionals in AML, Shufti works toward the goal of regulatory AML compliance. We employ technology to assist them in getting their work done more quickly and at a lower cost, so they can focus on the business while we handle the technological details.

Artificial intelligence (AI) and other AML technologies enable efficient and sophisticated AML services to detect the data needed for Know Your Transaction. This allows for better transaction monitoring and automatic data gathering during financial transactions.

Want to learn more about Know Your Transaction?