The FATF Travel Rule: What Business Owners Must Know

The rapidly evolving landscape of technology and cryptocurrency has made the regulation of digital assets absolutely necessary. This was when one of the most critical regulatory initiatives was taken, the FATF Travel Rule, imposing stringent restrictions on Virtual Asset Service Providers (VASPs) to combat terrorist financing and money laundering.

Understanding the FATF Travel Rules in Detail

The “Travel Rule”, also known as “Financial Action Task Force (FATF) Recommendation 16”, mandates VASPs to provide exact information regarding the sender and recipient of a virtual asset transfer to corresponding VASPs or financial institutions before or during the transaction.

The FATF recommends that countries impose a minimum limit of 1,000 USD or EUR for virtual assets transfers. VASPs must gather the name of the originator and beneficiary, along with the virtual asset wallet address or particular transaction reference number, for transfers below this limit. For transfers exceeding the limit, VASPs must gather additional data such as the originator’s account number, customer identification number, date of birth, national identity number, and physical address.

The Travel Rule applies to VASPs during traditional wire transfers, virtual asset transfers to other VASPs, or with another obligated entity, such as banks and financial firms. Although the FATF does not mandate that VASPs reveal transaction information to people who are not bound entities under some circumstances, VASPs can carry out virtual asset transfers with any non-obligated entity.

Although the exchange of personal information between financial companies has been a long-standing practice, the Travel Rule is an emerging regulation for the cryptocurrency sector. Creating an unparalleled communication network between crypto platforms is necessary to assure compliance and prevent money laundering.

The Latest Updates in Travel Regulations

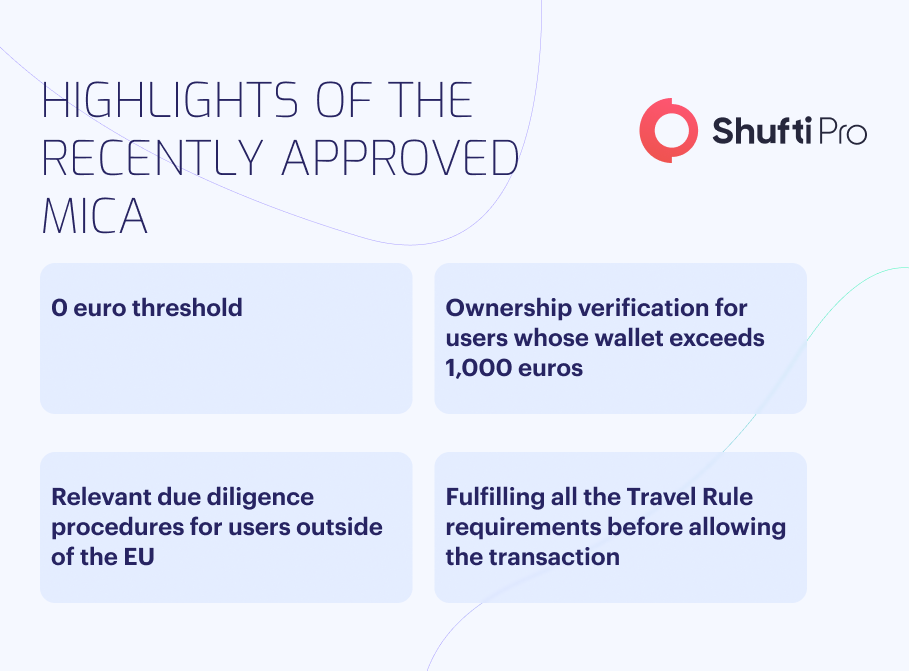

The EU approved the Revised Transfer of Funds Regulation and Crypto-Assets (MiCA) on April 20, 2023. The new document will significantly impact all VASPs in the Union once it goes into effect in January 2025. The latest paper aims to standardise the Travel Rule throughout the EU.

The structure of VASPs’ enterprises will change due to the new regulation. Therefore, cryptocurrency businesses must keep up with the Travel Rule updates.

According to the FATF update on implementing FATF Standards on VASPs, 29 out of 98 responding jurisdictions stated that they had passed Travel Rule legislation as of March 2022, but only 11 jurisdictions had started enacting enforcement and monitoring processes. Japan declared that by May 2023, it would include cryptocurrency transactions within its Travel Rule. “Regulation 5 of the Money Laundering and Terrorist Financing Regulations” will be effective in the UK as of September 1, 2023 and Lithuania is expected to follow in 2025.

How Will Travel Rule Benefit AML and CTF Efforts?

Money launderers and terrorists now have more options to perpetrate financial crimes due to the rapid use of cryptocurrency and the resulting legal inconsistencies in jurisdictions worldwide. Blockchain technology’s anonymity is especially handy for money launderers since it allows the beneficiary to stay anonymous, but the sender of cryptocurrency transfers must provide verifiable information, such as a name and address.

The FATF Travel Rule will facilitate AML and Countering Terrorism Financing (CTF) activities by improving the audit trail as virtual assets are moved between companies. The new data-collecting regulations mean financial authorities will be better equipped to identify and stop cryptocurrency-related money laundering activities. The laws will deter financial fraud by limiting the number of VASPs criminals can use to transfer money.

Challenges with the Implementation of the Travel Rule

The FATF Travel Rule’s core principle is information exchange, however, many VASPs find it a significant compliance burden due to the industry’s lack of regulations. Insufficient identifying ownership data required to facilitate cryptocurrency transfers means VASPs and financial firms must create AML solutions which enable them to share the essential data and that adhere to current privacy laws. Along with meeting these regulatory requirements, VASPs must consider the costs and administrative tasks the FATF Travel Rule solutions entail. Not only this, but they also figure out how to maintain cryptocurrency transactions efficiently and affordable for customers.

How Can Firms Adhere to the FATF Travel Rule?

An optimal Travel Rule solution must meet legal requirements without interfering with client service needs. As a result, the FATF has recommended criteria that a Travel Rule solution should have to fulfil the intended objectives of Recommendation 16:

- The solution should be simple to incorporate with a current AML and CTF programme and have little regulatory impact and adoption hurdles.

- It should be economical and open source for innovative start-ups and smaller VASPs.

- It should help establish a global regulatory framework for the transfer of virtual assets.

- It should be flexible to consider upcoming technological improvements and advancements.

- It should support law enforcement’s efforts to punish terrorists and money launderers by proactively spotting suspicious activity.

- It must be scalable, easy to operate, and capable of gaining widespread industry support.

Though the FATF Travel Rule is tech-neutral, it makes several recommendations that could assist VASPs in implementing a Travel Rule solution by leveraging current infrastructure and technology. These consist of the following:

- Keys are made in pairs for every participant in digital communication, and they only encrypt and decrypt data for the originators and beneficiaries.

- Public and private keys are also used by Secure Sockets Layer (SSL) and Transport Layer Security (TLS) connections to encrypt data transmitted through the internet.

- Authorities manage digital certificates with the X.509 Public Key Infrastructure (PKI) standard. Public keys are verified further by X.509 certificates used in the private and public sectors.

- Providing procedures and protocols for developing programmes and outlining how various solutions should connect with one another.

How Can Shufti Help?

Shufti’s AML transaction monitoring solution checks the anonymity of crypto transactions to prevent money laundering. The AI-powered AML solution allows you to abide by the FATF Travel Ruke, avoid heavy fines from regulators, and keep your reputation flawless.

Still confused about how an AML transaction monitoring solution works?

Explore Now

Explore Now