The Role of KYC Protocols in Safeguarding the Future of Cryptocurrency

Despite volatility in the crypto sector, millions of individuals access their services worldwide. Thus, governments are considering regulating the crypto market and are updating verification requirements for enterprises to onboard clients and establish trustworthy relationships with financial institutions.

However, transactions amongst cryptocurrency users are generally conducted anonymously and are completed within seconds due to the cryptographic security provided by blockchains. The rapidity and anonymity of these transactions help criminals conduct illicit activities, as they can bypass traditional security checks. The total value of illicit cryptocurrency transactions reached approximately $20.1 billion in 2022, representing an increase from $18 billion in the previous year.

Intensified scrutiny of cryptocurrency transactions has made it more crucial for crypto exchanges to fulfil Anti-money Laundering (AML) and Countering Terrorism Financing (CTF) regulations. These exchanges must tackle any concerns about anonymity in cryptocurrency transactions by implementing appropriate Know Your Customer (KYC) protocols.

What is KYC Crypto?

KYC regulations ensure businesses gather and authenticate crucial customer information, combating identity theft and fraud. Financial Institutions (FIs) usually implement KYC crypto measures when customers open new accounts, apply for loans, make investments, and do other significant transactions. These measures typically involve submitting personal information such as driver’s licences, Social Security Numbers (SSNs) and secure data storage to ensure compliance during an audit.

Although cryptocurrency exchanges are now subject to the same regulatory standards as traditional financial institutions, some are concerned about these regulations, arguing that collecting such data undermines the fundamental anonymity of cryptocurrencies. Certain exchanges may require clients to provide identification information during the account opening process. However, they immediately grant trading access before verifying this data—access is only revoked if the subsequent KYC checks uncover any concerning issues. On the other hand, some exchanges have chosen to bypass US KYC regulations by suspending access for users based in America.

Despite attempts to bypass or evade KYC regulations in the realm of cryptocurrencies, the expanding cryptocurrency market and its increasing popularity guarantee that KYC rules will expand for exchanges.

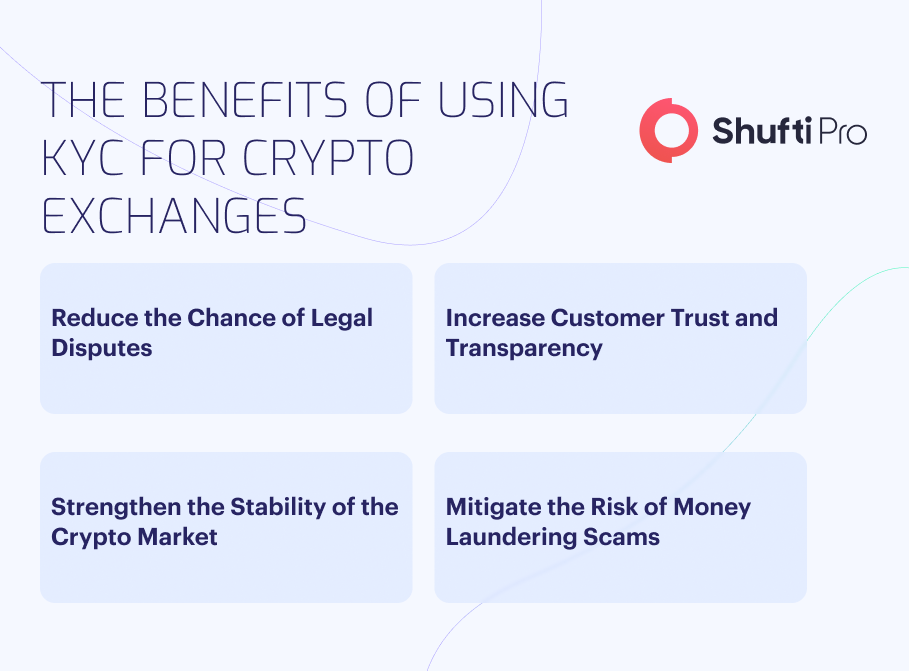

Benefits of Using KYC Solution for Crypto Exchanges

Like other regulated entities operating in the financial industry, cryptocurrency firms must conduct identity verification checks and adhere to KYC procedures. This is to ensure that the clients are who they claim to be. Apart from fulfilling compliance obligations and mitigating the risk of noncompliance penalties, what advantages can be derived from implementing strong KYC measures in cryptocurrency exchanges?

Minimise the Likelihood of Legal Disputes

Firms have to meet changing legal requirements in the continuously evolving crypto landscape. Crypto exchanges may decrease legal risks and demonstrate their commitment to compliance as international regulations evolve with a strong KYC solution.

Enhance Customer Trust and Transparency

A proactive and comprehensive approach to establishing and verifying customer identities in a crypto exchange builds trust among customers and banking partners. It shows the exchange’s dedication to knowing the individuals it conducts business with. Lacking strong KYC protocols can make customers hesitant to utilise the service, damaging the business’s reputation.

Strengthen the Stability of the Crypto Market

Anonymity, market volatility, heavy media attention, and supply and demand dynamics contribute to the crypto industry’s fundamental instability. Incorporating stringent identity verification measures as part of the exchange’s KYC checks helps stabilise the market and boost confidence among investors.

Mitigate the Risk of Money Laundering Schemes

Stronger KYC measures minimise the risk of using the exchange for illicitly-obtained crypto or engaging in layering schemes. KYC checks combat money laundering and fraud and boosts security for customers and crypto exchanges.

KYC Risks in the Crypto Exchange

The evolving regulatory landscape and the tactics used by criminals challenge KYC compliance in the crypto industry. The following weaknesses and hazards should be taken into account by cryptocurrency exchanges when developing and executing their KYC solutions:

- Anonymous Transactions: Money launderers are drawn to cryptocurrencies because of their anonymity when performing online transactions. Thus, exchanges should integrate digital controls into their identity verification process, including collecting biometric customer information.

- Transaction Speed: Cryptocurrency funds can be transferred between accounts within seconds, often bypassing AML and CTF controls. Exchanges should conduct security checks before transferring funds to user wallets to ensure compliance.

- Structured Transactions: Criminals who seek to avoid reporting requirements may spread their money through other accounts in smaller quantities. To detect and avoid structuring methods, crypto exchanges should have to Know Your Customer (KYC) rules that limit account signups to a single user.

- Money Muling: By encouraging “money mules” to use Bitcoin exchange services on their behalf, money launderers can take advantage of the system’s inefficiencies. Trading platforms should use due diligence to find money mules whose profiles don’t match their wealth or financial behaviour.

- Negative Customer Experiences: Besides regulatory risks, crypto exchanges with inadequate or unsuitable KYC procedures risk negatively impacting customer experiences. Crypto compliance enables exchanges to create comprehensive risk profiles and adjust their AML and CTF controls accordingly. By doing so, exchanges can optimise experiences for lower-risk customers, ensuring swift and efficient services where burdensome AML and CTF scrutiny is unnecessary.

How Can Shufti Help?

Shufti offers an AI-powered KYC solution to crypto exchanges operating in 230+ countries and territories. Our robust KYC solution verifies identities within seconds to mitigate the risk of identity theft and fraud. Not only this, but our KYC solution helps crypto exchanges stay compliant with global regulations and avoid heavy fines.

Still, confused about how KYC solutions help crypto exchanges keep scammers at bay?

Explore Now

Explore Now