The UK, US & Singapore – A Spotlight on the Crypto Regulations

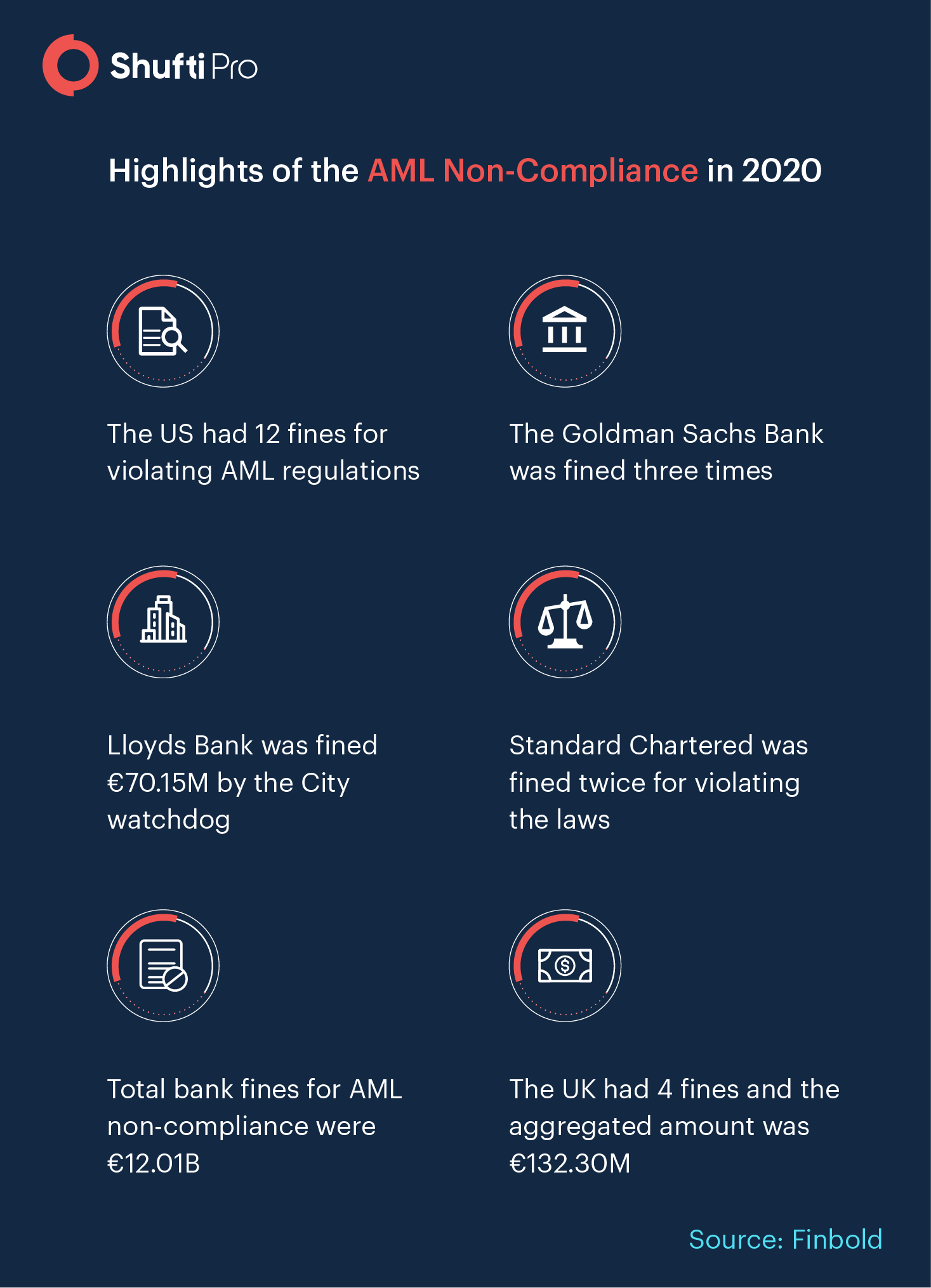

Non-compliance with anti-money laundering regulations has been an issue for the finance and crypto sector for a long time. The year 2020 was life-threatening but it became an opportunity for fraudsters to execute their malicious plans. Amid the Covid-19 pandemic, money laundering and terrorist financing significantly increased. Different reports have revealed staggering numbers and AML law violation has led to hefty penalties on banks, crypto exchanges, and other financial institutions. The UK and the US had the highest numbers of money laundering and AML non-compliance fines. On the other hand, Singapore made sure 2021 will keep penalties away from all the finance and crypto companies. These three states have taken necessary steps to prevent financial crimes, especially through cryptocurrencies. So, there have been certain amendments and some new laws have been enforced as well.

What are the New Crypto Rules in the US?

The United States has embraced crypto-based transactions. On January 4, 2021, the Interpretive Letter 1174 by the US Office of Comptroller of the Currency officially confirmed that the US banks are now allowed to use cryptocurrencies to make bank payment processes easier for the customers.

The letter specifically states that banks can use stable coins and Independent Node Verification Networks (INVNs) for conducting payments. Stablecoins are a specific type of cryptocurrency that is tethered to other assets for reducing their price volatility. Banks in the US can now issue and exchange stablecoins. Storing, validating, and recording can be done through distributed ledger systems or INVNs (an electronic database where information is stored on several computers rather than one).

Brian Brooks, the Acting Comptroller of Currency, has issued three letters ever since he took the reigns. He is emphasizing on making money transactions as convenient as possible with the use of technology. However, his third letter has warned banks about the additional risk that comes with crypto-based transactions. Financial institutions must make sure that incorporating such technologies for increasing the efficacy of transactions must not be at the cost of violating AML/CFT regulations.

Tightened Sanctions by the Trump Administration

In the last two months, the outgoing Trump administration has kept a high pace of designating sanctions against plenty of targets. One of them is the relisting of Cuba as a sponsor of terrorism on January 11. According to Mike Pompeo, the Secretary of State, Cuba has been repeatedly providing support to international terrorism acts. As a result, the ban on Cuba has been renewed for US economic aid, opposition to the World Bank and IMF, and arms and dual-use exports. After Cuba, the US has also banned the use of certain Chinese payment software along with increasing sanctions on Iran.

The UK – FCA Bans Crypto-Based Transactions

In October 2020, the Financial Conduct Authority (FCA) banned transactions in cryptocurrency. The efforts have come into effect in January 2021. The authority says that there will no longer be any crypto-related investments for retail consumers. Sales, marketing and distributions of any investments related to cryptocurrency have been banned. According to FCA, retail investors can save up to USD 70 million because this rule will ban all illegal crypto products.

On the contrary, cryptocurrency exchanges are against this and they claim that FCA’s bans will result in the destruction of the crypto sector. Investors can move to different states to continue transactions in crypto where regulators cannot reach them. The explicit regulatory system is still a draft and regulatory authorities have announced rigid KYC law for cryptocurrency.

HSBC’s Bans for Any Crypto Transactions

HSBC is the largest high street bank in the United Kingdom and one of the first banks to ban cryptocurrency transactions. All processes that involve cryptocurrencies like Bitcoin have been completely banned. An article in The Times newspaper revealed that HSBC has taken the initiative to mitigate the risk of money laundering and terrorist financing through cryptocurrencies. This means that consumers cannot use their credit or debit cards or any other bank facilities to deposit fiat funds in crypto wallets. Similarly, cryptos cannot be converted into fiat money and deposited in bank accounts.

Singapore – Updates in the Payment Services Act

The Parliament of Singapore has planned to update the Payment Services Act and make the AML controls on cryptocurrencies more rigid. Followed by the amendment passed on January 4, 2021, every cryptocurrency service provider must obtain a license from the Monetary Authority of Singapore (MAS). Previously, only the service providers that possessed cryptocurrency or money were regulated. However, all cryptocurrency exchanges that facilitate transmission, exchange or storage have to acquire a license from the MAS. All entities must devise customer due diligence and transaction monitoring protocols for effective compliance with these amendments.

The law-making bodies of Singapore are hoping that these new regulations will mitigate the risk of money laundering and terrorist financing with cryptocurrencies in the country. This will assist them in monitoring cross-border transactions where Singapore’s service provider is only the facilitator and not a sender or recipient.

It All Narrows Down To…

Cryptocurrencies have been used for financial crimes, and their anonymous nature is one of the main reasons behind the unbelievable ML/TF numbers. Every year, two to five per cent of the global GDP is laundered as revealed by UNODC and Europol. Given the rise in fincrime, regulatory authorities around the world are in action to mitigate the risk in the future. In 2020, criminal activities significantly increased and led to the enforcement of new rules. The UK has banned all crypto-related transactions. On the contrary, the United States has accepted payments in cryptocurrencies. Similarly, Singapore has amended the Payment Services Act and every crypto exchange has to acquire a license from the MSA before facilitating any activities in cryptocurrency. An effective way of complying with the regulations has been suggested as well. Crypto exchanges must add more rigid customer due diligence and transaction monitoring protocols to ensure compliance.

Get more information on transaction monitoring and AML compliance from our experts.

Explore Now

Explore Now