Understanding False Positives in AML Transaction Monitoring

- 01 What is Transaction Monitoring?

- 02 What is a False Positive?

- 03 False Transaction Monitoring: A Compliance Challenge

- 04 Causes of False Positive Alarms in AML Transaction Monitoring

- 05 Differentiating False Positives and False Negatives

- 06 Balancing False Positive and False Negative

- 07 Detect False Transaction Monitoring With Shufti

Financial institutions such as banks, neo-banks, insurance companies, investment companies, fintech, etc., must develop and implement risk-based anti-money laundering (AML) programs to fight money laundering and terrorist financing in the digital sphere and in accordance with regulatory compliance requirements. Financial institutions should make sure that proper monitoring and screening processes are in place after performing risk assessments on their clients to alert them when those clients exhibit unusual activity that could be a sign of terrorist funding, money laundering, or any other financial criminal activity.

An AML warning does not, however, inevitably signify the existence of a financial crime. In an attempt to identify actual illegal behavior, financial institutions frequently have to cope with a large number of false-positive AML alerts due to the response of transaction monitoring and transaction screening procedures. However, the startlingly high rate of AML false positive fatigue may be a factor in the industry’s personnel shortage.

The Financial Times reports that AML fines increased by 50% in 2022 over 2021. Over $6 billion in fines were imposed on brokerage and trading firms, while over $2 billion was levied against the banking industry. Financial institutions must improve their workflows even if there could be a lot of unintended consequences. Advanced technologies can differentiate businesses in this way. Financial institutions can assist compliance teams in preventing fatigue caused by AML false positives, as AML false transaction monitoring can be quite burdensome.

What is Transaction Monitoring?

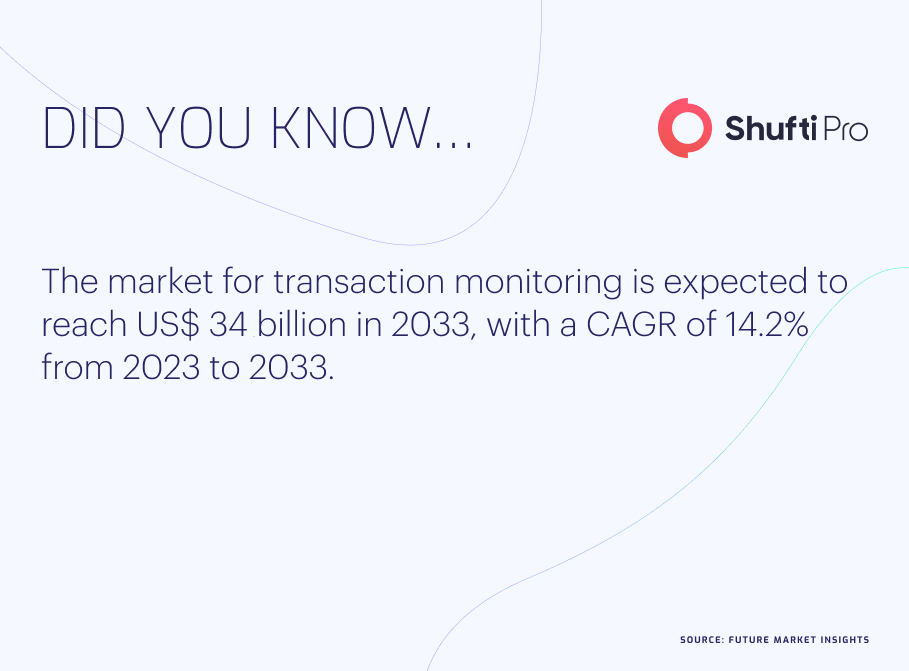

Financial institutions utilize transaction monitoring, a component of AML compliance, to continuously examine financial transactions for possibly suspect activity connected to money laundering, financing of terrorism, or other financial crimes. Any transaction that fits specific criteria triggers an alert from the system, and AML analysts look into it further. To scan and prevent financial crimes, transaction monitoring is essential for regulatory compliance. Sufficient mechanisms, competent staff, and continuous monitoring are necessary.

What is a False Positive?

A “false positive” occurs when a routine transaction is inadvertently reported as suspect during monitoring and screening. This indicates that the deal was incorrectly classified as risky and suspicious.

Certain typical consumer behaviors that aren’t suspicious could appear suspicious because of the limitations of transaction monitoring and screening procedures. For example, a customer’s repeated bank transfers to various destinations from multiple banks on the same day may result in an AML alert even though their transactional behavior is acceptable for business purposes. Similar to this, certain global naming trends may lead to extremely similar names for distinct clients, which sanctions screening systems may mistakenly link to names on sanction lists.

Transaction monitoring is not the only detection system that suffers from false positives. A number of reasons can lead to false positives in transaction monitoring. One explanation is when a transaction follows a pattern that is typical of legal transactions, such as paying a vendor on a regular basis or paying a wage on a regular basis. Even though these transactions are legitimate, the system may flag them as suspicious. False positives can have a big effect, raising expenses and decreasing productivity. Financial organizations can use a number of tactics to reduce the chance of false positives.

False Transaction Monitoring: A Compliance Challenge

Globally, financial organizations face compliance difficulties due to false positives. Despite the fact that false positive alerts significantly reduce costs and efficiency, organizations typically cannot afford to lessen the sensitivity of their monitoring and screening procedures because of the potential financial, reputational, and even criminal consequences of not adhering to regulatory requirements. In the global fight against financial crime, false positives can potentially negatively impact consumer satisfaction and make it more difficult for organizations to manage legitimate cases of money laundering.

Reducing false positives while maintaining the highest level of accuracy and efficacy in AML transaction monitoring and screening should be a top focus for every compliance team. Financial institutions should, therefore, comprehend the causes of false positives and potential remedies to reduce false positive rates.

Causes of False Positive Alarms in AML Transaction Monitoring

AML transaction monitoring false positive alarms can be caused by a number of things. These are a few of the primary reasons:

Incomplete or Outdated Data

For AML transaction monitoring systems to detect suspicious activity, precise and current data is essential. The system may issue false positive alerts if the data is out-of-date or incomplete. peculiar but lawful transactions: The AML transaction monitoring system may find certain lawful transactions to be peculiar. A consumer might, for instance, deposit a sizable sum of money as part of a legal commercial transaction. But the AML system can raise a false positive alert if it isn’t set up to detect this kind of behavior.

Lack of Context

Systems for monitoring AML transactions use context to spot questionable conduct. A false positive alert could be generated by the system if there is insufficient context available for a particular transaction. For instance, the system might flag a customer’s abrupt, substantial transfer to a foreign account as suspicious. Nevertheless, the system might not be able to detect this if the consumer has a valid purpose for the transfer, such as paying for a vacation.

Configuration of the System

False positive alerts may also result from configuration errors in AML transaction monitoring systems. The system may produce more false positive alarms if it is set up too sensitively. However, if it is not sophisticated enough, it can overlook questionable activity.

Differentiating False Positives and False Negatives

It’s critical for AML compliance to distinguish between false positives and false negatives. False negatives indicate risks that were overlooked or missed, whereas false positives cause genuine activity to be identified.

A valid transaction that is mistakenly marked as suspicious is known as a false positive. This needless investigation could cause inconvenience to customers, squander resources, and heighten compliance risks.

A suspicious transaction that isn’t recognized as such is called a false negative. Typically, what goes unnoticed is possible money laundering, sponsorship of terrorism, or financial crime. This raises the possibility of regulatory penalties, harm to one’s reputation, and a permanent exit from the corporate world.

Achieving an optimal between the two is crucial for efficiently reducing the likelihood of financial crime and avoiding penalties.

Balancing False Positive and False Negative

The reduction of false positives and false negatives must be balanced to maintain AML compliance. Setting a goal of having no false positives could result in more false negatives, which would mask possible dangers. It is imperative that financial institutions fine-tune their AML systems and processes in accordance with their risk appetite and legal requirements.

Detect False Transaction Monitoring With Shufti

Financial institutions must take proactive steps to reduce false positives, as they pose a serious barrier to AML compliance. Financial organizations may balance detecting real risks and reducing false positives by utilizing cutting-edge technologies, optimizing systems and parameters, and funding employee training. Maintaining customer satisfaction, cutting operational expenses, and improving compliance effectiveness all depend on striking this balance.

With support for more than 150 languages, Shufti offers an AI-powered solution for transaction screening and monitoring in over 240 countries and territories. The AML and KYC solution we offer reduces terrorism financing, money laundering, and other financial crimes with real-time sanctions and watchlist analysis. With the help of this robust software, companies may design unique criteria and scenarios to find possible matches and minimize false positives. It also offers more search choices, such as birth date, Identity number, SSN or passport numbers, to lower the possibility of false alarms. Financial crime is not only discouraged, but it also helps institutions adhere to international regulatory norms.

Still confused about how you can detect false transactions and maintain compliance?