What’s Inside the report?

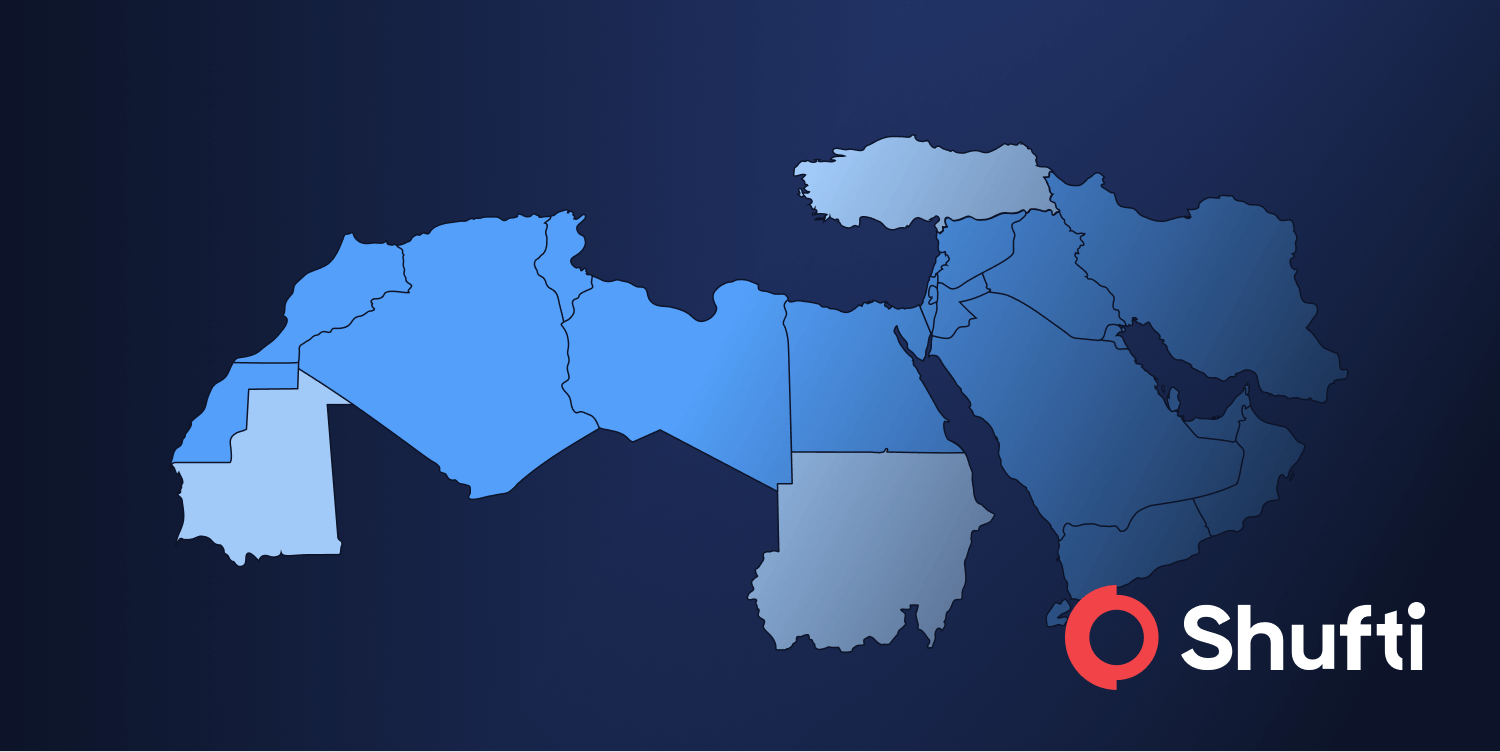

The Global Banking Landscape in 2021

On-premises vs Cloud Services

Most prevalent banking frauds in 2021

The Morgan Stanley Bank case

Technology and its role in fighting FinCrime

Why Shufti’s on-premises solution

Over the past few years, the financial services industry has been on a roll, embracing smart technologies, successfully adapting the COVID-driven trends, and delivering a purposeful experience to consumers. In this regard, top-tier financial institutions (FIs) like banks have pioneered technological disruption, creating more opportunities for FinTech to flourish.

Banks are steadily incorporating digital services in their business models, given the emerging customer needs and the mounting demand for regulatory compliance. To come up with a feasible approach, banks started embracing regulatory technology to fulfill compliance criteria as well as to meet the remote banking needs of customers amid the pandemic. Before the global health crisis, banks maintained a steady capital ratio that helped the global economy survive through trying times.

The global banking sector has timely recognised the need for robust policies and procedures to combat digital fraud, standardising Know Your Customer (KYC) and adopting emerging technology trends. Identity theft, privacy-based concerns, and protecting customers’ personally identifiable information (PII) remain the key challenges alongside delivering a seamless customer experience in 2021.

To cater a viable solution to these problems, this report discusses “on-premises identity verification” which, depending upon the banking needs, offers stronger data residency, authorised access, and a greater sense of security for the customer.

Explore Now

Explore Now