AML Compliance – Addressing Financial Crime Challenges in the UAE’s Banking Sector

The United Arab Emirates (UAE) is fast becoming the world’s most reputable financial hub, but the astounding rise has not come without multiple regulatory challenges. The 5th largest economy in the Middle East has a Gross Domestic Product (GDP) of $501 billion in 2022.

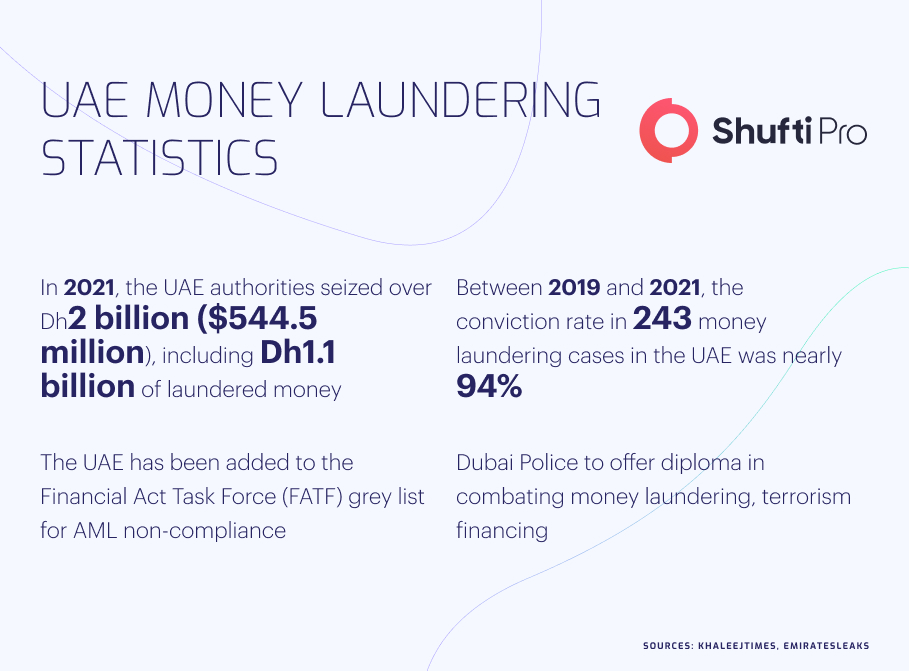

The ongoing economic boom has put the country in a tough spot, with threats of financial crimes like money laundering and terrorist financing. Although the conviction rate remained at 94% between 2019 and 2021, the overall crime percentage in UAE is increasing, raising concerns for law enforcement authorities.

UAE’s Banking Sector and Money Laundering

In 2000, UAE’s banking sector had assets valued at a total of $75 billion. The number has grown to $900 billion in 2022, making it a hotspot for criminals from all over the world. This influx of money in the sector has encouraged criminals to exploit loopholes in the system and launder the proceeds of crime.

Due to the increasing crime percentage, AML compliance has become quite crucial for the banking sector to avoid criminal acts by money launderers. The UAE government has shown quite a vigilance by implementing strict laws, but it has yet to manage to halt crimes altogether, and overall, money laundering is increasing every year.

As per the report by the Central Bank of UAE, instances of cybercrime and money laundering in the whole country have increased to a large extent after the pandemic. Digitization during the COVID-19 lockdowns has opened a myriad of doors for criminals, and they are exploiting online platforms like e-commerce, crypto firms, and banks.

UAE’s Inclusion in FATF’s Grey List for AML Non-Compliance

Financial Action Task Force (FATF), the global regulatory authority monitoring money laundering, has placed the UAE on its grey list for not ensuring AML compliance. FATF has clearly stated that UAE has failed to confront money launderers and terrorist financiers, which has caused the flow of illicit money in a large number of countries.

Placement in the grey list has not only caused reputational damage for UAE but will also have other serious economic repercussions for the country. In response to the listing, the UAE government has committed to working closely with the FATF’s officials while removing all the flaws in their economic system.

Here is the official statement by UAE authorities “Robust actions and ongoing measures taken by the UAE government and private sector are in place to secure the stability and integrity of the country’s financial system.”

High-Profile Money Laundering Cases in UAE

In the recent past, a large number of money laundering cases have surfaced in the UAE, which has ultimately urged authorities to take strict action against perpetrators of crime. Let’s study some high-profile cases showing the UAE government’s vigilance toward curbing crime and ensuring AML compliance.

Nine-Member Gang Guilty of Money Laundering Referred to Court

Law enforcement authorities in UAE have rounded up nine money laundering suspects who were involved in several illegal activities, particularly drug trafficking. It was found during the investigation that criminals were using fake phone numbers, bank accounts, and ATM cards to take money illegally out of the country.

It is suspected that during a time of one year, they managed to launder millions of dollars, and Police are working to find more suspicious transactions related to the case. Currently, all the criminals are behind bars, and authorities have sent the case to court, which is yet to decide their penalties.

Gang Convicted in Abu Dhabi for Money Laundering

A 40-members gang of money launderers has been convicted in UAE’s court for their involvement in multiple financial crimes. The criminals were found to be involved in defrauding sophisticated users through the stock market and cryptocurrencies.

All the primary suspects have been sentenced to ten years in jail, and others are serving five years. The gang members have been collectively fined Dh860 million, and the court has further ordered the law enforcement authorities to have a strict crackdown on other gangs involved in financial crimes.

UAE’s New Anti-Money Laundering Guidelines for the Banking Sector

In order to ensure AML compliance in the country and get aligned with the FATF’s new guidelines, the Central Bank of UAE has issued new regulatory instructions for all financial organizations, particularly banks and crypto firms. Here are the primary initiatives which the Central Bank has recommended:

- All Large Financial Institutions (LFIs) are obliged to develop internal policies and procedures to manage risks linked to terrorist financing and money laundering.

- Not only banks, crypto firms, and insurance companies have also been asked to ensure AML compliance by screening their users against sanctions lists by the global financial watchdogs.

- Financial institutions are also responsible for conducting due diligence on their customers while monitoring all their transactions.

- The banks should also have sanctions compliance programs with an efficient system that can screen customers’ financial transactions.

- The Central bank has devised a strong system of imposing hefty fines, and up till now, a fine of $525,000 has been imposed on several financial institutions.

How UAE’s Banks can Ensure AML Compliance

To ensure AML compliance and stay put with the evolving global regulatory regime, the UAE government must implement an effective system of Enhanced Due Diligence (EDD) and Customer Due Diligence (CDD), which can counter all types of criminal activities.

Customer Due Diligence (CDD)

The UAE banks should have a system based on CDD through which they can screen the customers against global financial lists. The global financial watchdogs, particularly FATF, Interpol, and European Union (EU), have accumulated data on money launderers in the form of sanctions lists which must be consulted to counter money laundering and report suspicious persons to law enforcement authorities.

Enhanced Due Diligence (EDD)

Financial firms, particularly banks, should practice EDD procedures involving more rigorous and stringent customer due diligence checks applied toward high-risk customers. It includes ongoing transaction monitoring and more frequent review and updating of clients due to diligence information.

What Shufti Offers

Countering financial crimes, particularly money laundering and terrorist financing, has become imperative for UAE to ensure global AML compliance and avoid their name being placed on FATF’s blacklist. UAE is a huge financial market that is expected to rise more in the coming years, ultimately increasing the need for stringent AML checks.

Shufti’s AML screening solution is an ideal option for the UAE banking sector as it has access to 1700+ sanctions lists by financial watchdogs. Screening users’ data against these sanctions lists, it generates results within seconds with a ~99% accuracy.

Want to know more about AML screening solutions for the UAE banking sector?