Anti-Money Laundering Compliance for Crypto Exchanges [2021 Update]

Anti-Money Laundering compliance solutions are gaining popularity in all corners of the world. Unfortunately, the money laundering activities on a global scale have significantly increased; therefore, there is a need for a solution that can help different sectors of the world in combating the crime. According to reports from UNODC, two to five percent of the global GDP is consumed in money laundering and terrorist financing activities. The figure is increasing every day. Without any preventive measures, businesses have to suffer from losses like they are incurring right now.

Many countries are emphasizing on cryptos to digitize transactions in the future. France has recently implemented regulations for dismantling the anonymity of crypto transactions. This will help in enforcing digital currency transactions in the future. However, criminals target cryptocurrencies for the majority of the money laundering and terrorist financing activities. According to MIT Technology Review, criminals laundered USD 2.8 billion through crypto in 2019. Due to the same reason, the FATF has also implemented stringent laws to combat money laundering. AML compliance program is, therefore, mandatory for all the crypto exchanges. Read this blog to find out what 2021 holds for crypto exchanges and what would be the role of AML compliance?

What is AML Compliance?

The process of background screening and ongoing monitoring of customers is AML compliance. It’s purpose is to identify and eliminate financial crimes such as terrorist financing and money laundering. The screening is performed against global watchlists, PEPs, and sanctions.Stringent AML regulations are implemented by global regulatory bodies.

Read more about AML compliance: A Comprehensive Guide to AML Compliance [2020]

The 2021 Update for AML Compliance in Cryptocurrencies

The year 2020 brought many changes and digital transformation was the biggest change and challenge for many sectors. Due to digitisation, virtual currencies have become a viable option for transactions. Cryptocurrencies are not restricted to exchanges only. Different regions of the world are considering them for day-to-day transactions as well. According to a research paper from University of Technology Sydney, the crypto market accounts for $76 billion of illegal activities every year.

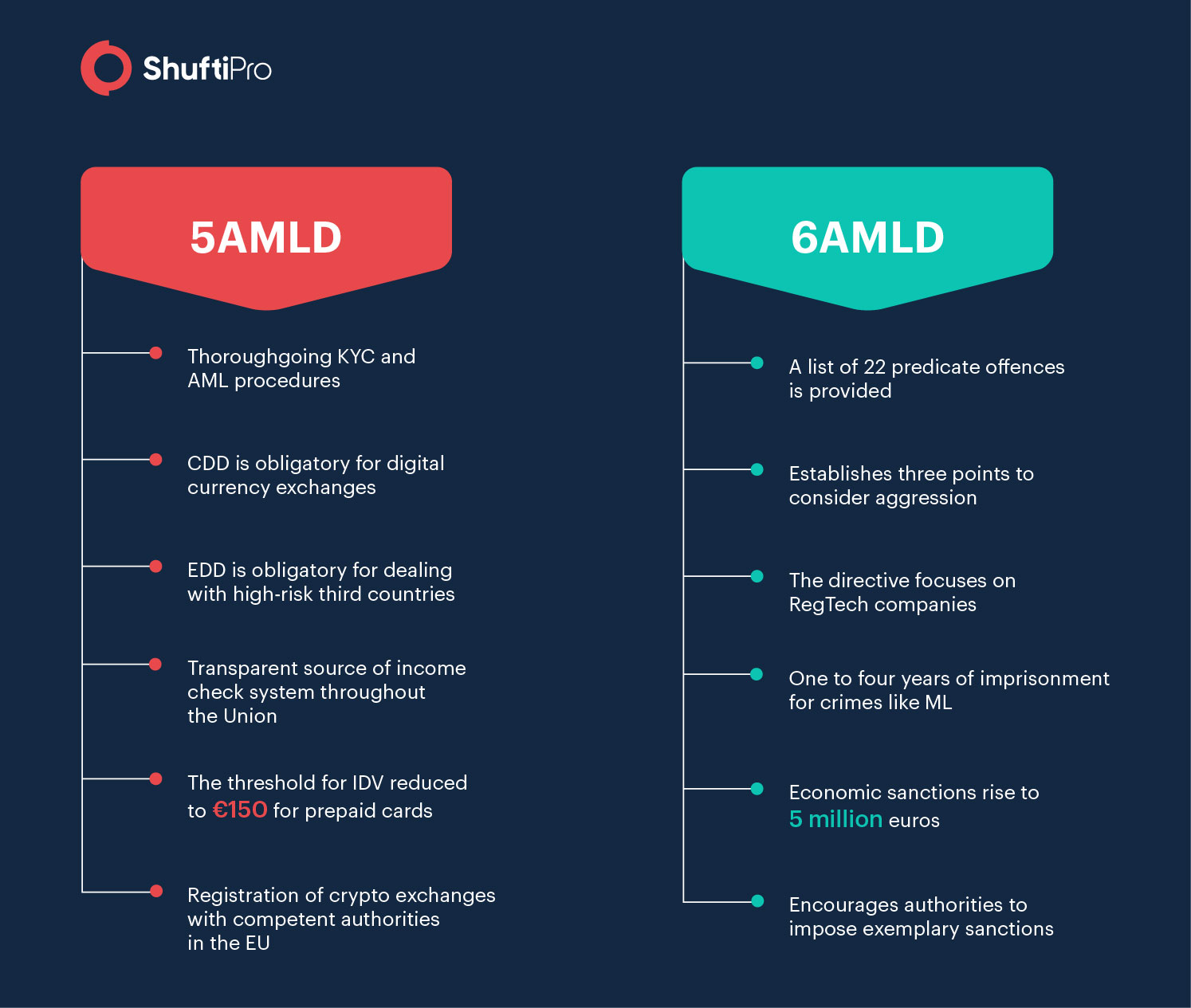

The fifth anti-money laundering directive was implemented in the beginning of 2020 and by the end of the year, the sixth anti-money laundering directive is all set to increase challenges for crypto exchanges. Next year, all digital currency exchanges will be following 6AMLD for sure. Take a look at both the directives and how the sixth directive is more challenging for cryptocurrency exchanges.

AMLD for Crypto Market

The fifth anti-money laundering directive was enforced in January 2020. According to this directive, all crypto exchanges are obliged to follow KYC and AML checks and customer due diligence (CDD) is mandatory. Enhanced Due Diligence (EDD) must be performed for customers from high-risk third-world countries. Moreover, the threshold for the identity verification checks on prepaid cards and online transactions was reduced to €150 from €250 and €50 for domestic transfers.

Recommended: Customer Due Diligence Checklist – Is Your Business Compliant?

Unfortunately, criminal activities significantly increased during the pandemic and now, all states in European Union have to comply with the sixth anti-money laundering directive. According to 6AMLD, there are 22 offences related to tax crimes, cybercrime, environmental crime, and self-laundering. Non-compliance with any of the regulations will result in hefty fines. As compared to the 5AMLD, the penalties have increased which means crypto exchanges are now at more risk than they were before. The minimum fine for money laundering and terrorist financing crimes is one to four years of imprisonment. Similarly, sanctions have increased to five million euros. As per the sixth directive, regulatory authorities can also impose exemplary sanctions.

The article 7 of the new directive also focuses on RegTech companies working on corporate responsibility and identification. The article has specified and set rules that legal persons should be responsible for lack of supervision and control for any criminal acts by a leader. Due to the same reason, high-security digital identity verification processes are so essential.

For more details on 6AMLD: 6AMLD of EU – A detailed insight

FATF Recommendations for the Crypto Sector

The Financial Actions Task Force (FATF) has set certain rules and regulations for secure and effective operations in the sector. Cryptocurrencies are prone to financial crimes due to their anonymous nature, so the FATF has certain laws for the crypto exchanges. Inability to comply with these regulations results in hefty fines. Here are some of the laws for cryptocurrencies that might interest you:

- All virtual asset service providers must develop a customer due diligence process to assist them in assessing AML/CFT risks.

- CDD must be performed for building strong relationships in the businesses and occasional checks for people with transactions above USD 1000 to EUR 1000.

- Ongoing due diligence for assessing risks is important for scrutinising transactions.

- AML screening for businesses is mandatory if you are in the B2B market.

- Hold records of all the customers especially their names and wallet addresses.

It All Narrows Down To…

Cryptocurrency is likely to be the extensively used means of transactions in the future. However, the rising number of fraudulent activities, such as money laundering and terrorist financing are becoming a barrier. To combat these crimes, FATF has implemented laws on all digital currency exchanges. In December 2020, the sixth anti-money laundering directive replaced 5AMLD. The new directive is more stringent when it comes to financial crimes in cryptocurrencies. The penalties have increased and KYC/AML checks should be more robust. Hence, AML screening is important for crypto businesses.

Shufti’s Anti-Money Laundering screening deploys thousands of AI algorithms to ensure that you only onboard trustworthy customers. Our ongoing AML service makes sure that all the stakeholders are monitored, so that you can maintain updated risk profile of your global clientele.

Explore Now

Explore Now