Brexit to Change Sanction and Money Laundering Regulations in 2021

In 2016, the United Kingdom decided to part ways with the European Union (EU). After its preparation for a future without being a part of the EU, companies operating in the United Kingdom are concerned about sanctions. December 31, 2020 is the last day for the United Kingdom to decide if it’s a deal or no-deal brexit. The UK was in a transition period which is also about to end with 2021 just a few days away. The decision is not yet clear, raising millions of concerns every day.

The particular concern of all organisations is sanctions and KYC/AML regulations that will greatly impact them. Parting ways with the EU will not only change the UK’s identity but it will also reshape the future of regulations. December 3, 2020 was the last date to enforce the sixth anti-money laundering directive (6AMLD) by the European Union, but what will the UK do after deciding an independent future? Being no longer a part of the EU means the country needs its own rules and regulations. For the same reason, the Sanctions and Money Laundering Act 2018 will be enforced in the country.

Sounds great, but how will companies manage cross-border trade with the EU states? There are numerous questions that lack answers. However, we have managed to gather information that might suffice for your needs. Read this blog to know the impact of Brexit on KYC/AML regulations in 2021.

What is Brexit?

The United Kingdom decided to part ways from the European Union. There are two scenarios; deal Brexit and no-deal Brexit. In a deal Brexit, the UK and EU come to a joint agreement, whereas no-deal Brexit is a scenario where both parties are not on the same page for agreement.

Brexit Impact on KYC/AML Compliance

The EU announced 6AMLD to be imposed latest by June 2021. Given the rise in criminal activities due to the pandemic, the directive was imposed in December 2020. Currently, the UK has to follow the directive, but this will end as soon as the transition period ends. What next? In 2021, the Sanctions and Money Laundering Act of 2018 will be enforced. The Act also states the majority of the points that EU’s 5AMLD mentions.

Following the end of the UK’s transition period, it will be referred to as a third country. Due to the fifth and sixth AML directive, there are high standards for mitigating potential risk involved in transactions and other business relationships. Enhanced customer due diligence checks are mandatory for dealing with third countries. So, businesses in the UK have to undergo EDD checks to deal with the EU members. However, the procedures are likely to become more cumbersome in the future.

No Deal Brexit and Money Laundering Laws

No-deal Brexit means the United Kingdom and European Union are not on the same page for the agreement. This is not good news because stepping out of the EU makes the UK a third country and there is no going back. 6AMLD is not a major concern for the country because the 2018 Act already complies with the majority of laws mentioned in the sixth AML directive. For certain money laundering offences, regulatory authorities in the UK have announced 14 years of imprisonment, which is more than what 6AMLD imposes.

Highlights of the Sanctions Act 2018

Since the Sanctions and Money Laundering Act of 2018 will be enforced in the United Kingdom, here are some of the main points of the Act that might interest you.

- The UK will continue to implement UN sanctions to meet foreign policy objectives and national security.

- Ensure updated anti-money laundering and counter-terrorist financing measures.

- Assist enhancements in the UK’s domestic security and comply with the international standards.

Role of Companies in Complying with New Laws

Brexit is not only a way of choosing separate ways for the UK, but it will have a serious impact on businesses too. The corporate sector is bound to suffer from the consequences. The plethora of changing regulations is the worst change of all. Businesses have to reconsider their KYC/AML compliances. Adopting the 6AMLD is an easier choice for businesses in the UK.

Since businesses are confused about which regulations to follow and which one to pass, fraudsters are working day and night to find a loophole in this situation and execute their malicious plans. To reduce the uncertainty, new Sanctions List and OSFI Consolidated Lists should be used for screening from January 1, 2021. Companies can figure out better ways to comply with these regulations and ensure robustness of the KYC/AML solutions.

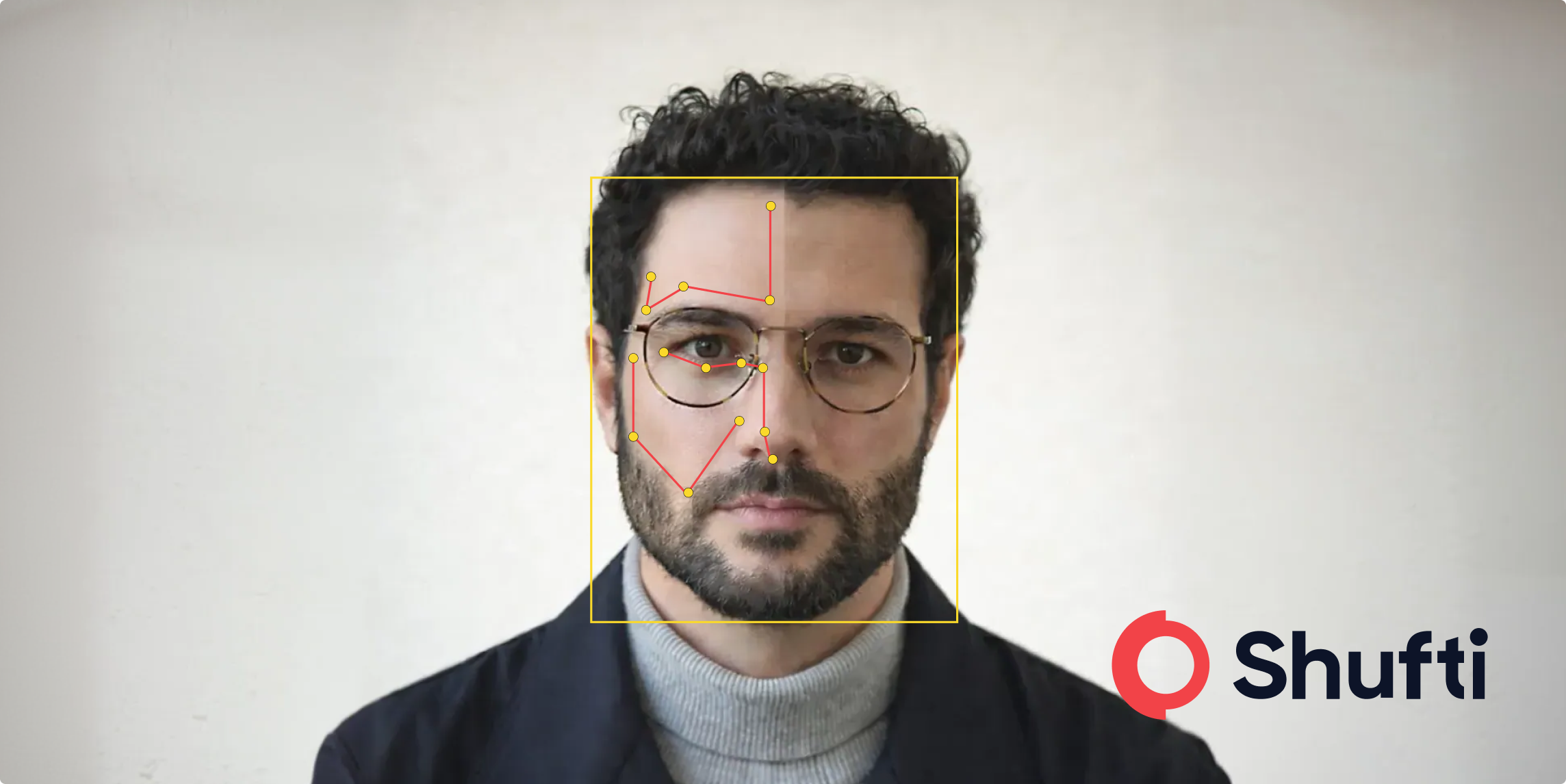

How Can Digital KYC/AML Solutions Help?

Businesses operating in the EU and UK have to face a lot of problems in their Know Your Customer (KYC) and Anti-Money Laundering (AML) systems. Due to differences in rules and regulations after Brexit, the UK has to follow the Sanction Act 2018 while EU states will continue to follow the 6AMLD. Both the laws have different sets of rules and regulations that might make it challenging for businesses to perform seamless customer onboarding checks. Fortunately, digital AML/KYC solutions have been satisfying business needs for a while now. No matter which laws a state has enforced, digital AML screening and e-KYC ensure that your business complies with the regulations.

Brexit will be a game-changer for the EU states and the UK. Before things go out of hand, it is better that digital KYC and AML screening solutions are utilised.

Read more about KYC: A Comprehensive Guide to KYC and AML Compliance in the UK

It All Narrows Down To…

The United Kingdom’s decision to part ways with the EU has greatly impacted different sectors of the country. All the companies are concerned about the uncertainty brought by changing regulations in the country. Financial criminals are figuring more sophisticated ways for their malicious intentions and loopholes in the regulatory system will bring ease for criminals. However, the corporate world can employ robust KYC and AML systems backed by AI models. No matter what sanctions list or regulations the country follows in 2021, digital KYC/AML checks can assist businesses in complying with laws.

Talk to our experts and know more about digital KYC/AML solutions.

Explore Now

Explore Now