High-Risk Countries and The Significance of AML/CFT Regulations – How Shufti Can Help

Money laundering and terrorist financing are becoming a global concern. To overcome the risk of crimes, governments across different jurisdictions are adopting Anti-Money Laundering and Counter-Terrorist Financing (AML/CFT) compliance to streamline legal as well as regulatory obligations. These laws and standards mandate businesses to determine, assess and understand the potential risk of financial crimes which they may get prone to. So, it’s pretty noticeable that countries with weak AML/CFT regulations or ineffective security systems have higher levels of corruption, illicit market operation, and financial crimes. However, as the threat of crimes continues to rise with global AML non-compliance penalties, around 17 banks were penalized in the first half of 2021 which accounted for around $2.7 billion.

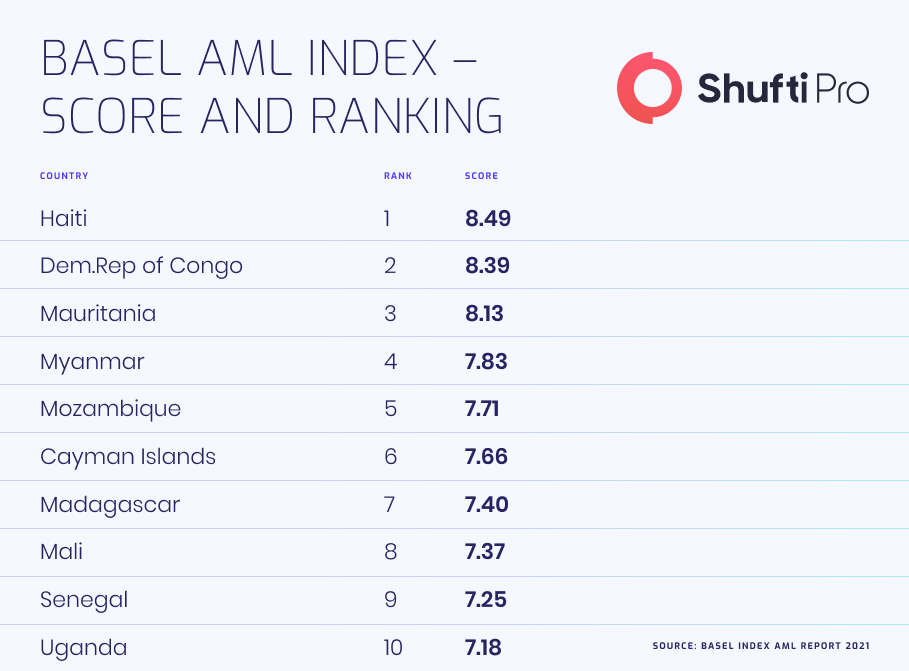

In addition to this, the Basel AML index reports were also published in September 2021 in which more than 200 countries were evaluated. The results were surprising yet concerning as the ratings and scores illustrated significant changes in regulation across countries. Where some jurisdictions made enhancements while many were found prone to financial crimes due to ineffective AML measures.

A Brief Overview of High-Risk Jurisdictions

The jurisdictions and territories failing to meet AML/CFT regulations, having significant levels of deficiencies in countering money laundering and terrorist financing measures, and a greater level of corruption according to the Transparency Index List are considered “High-risk countries. These are subject to increased monitoring and are listed on various global lists including FATF “greylist or blacklist”, the Basel AML Index and the EU’s high-risk country ratings. However, Financial Action Task Force (FATF) is the main regulatory authority that determines the countries with strategic anti-money laundering and countering terrorist financing shortcomings. FATF has developed a series of lists including the High-Risk countries Subject to a Call for Action, and Jurisdictions under Increased Monitoring, which are updated three times a year. Moreover, the regulatory authority also helps out the flagged countries to enhance their AML measures to overcome the risk of money laundering that can have negative impacts on the international financial system.

However, the EU, UK and US have developed their own list in accordance with FATF’s standards and guidelines. These high-risk countries’ lists are quite similar to the FATF’s list because they are created on the same standards;

- Countries or territories having ineffective AML/CFT control systems

- Jurisdictions having a greater level of corruption and criminal activities

- Countries sanctioned or under sanctions

- Jurisdictions financing organised crime groups or having terrorists organisation operational within boundaries

Countries under FATF’s Increased Monitoring

Countries under increased monitoring are required to work with the financial action task force to address shortcomings in their AML/CFT laws and control system to curb terrorist financing, money laundering and proliferation financing. However, when the FATF places a country under an increased monitoring list, it means the state has assured that they will take every necessary step to resolve the determined problems in their in-house control system within agreed timeframes and is subject to FATF’s increased monitoring. Adding to this, this list is often referred to as the “grey list”

Top Five Countries Under FATF’s Increased Monitoring

- Albania

- Barbados

- Burkina Faso

- Cambodia

- Cayman Islands

Financial action task forces specifically make efforts to make the world free from money laundering and terrorist financing. To do so, it assists high-risk countries to address their problems in AML/CFT framework, dividing such countries into two lists, high-risk states are subject to a call for action and are placed on a blacklist while the countries are under increased monitoring are listed on the greylist.

The FATF “BlackList”

Businesses intended to make ties with the companies or some sort of dealings in jurisdictions flagged as high-risk are required to practice enhanced due diligence procedures as per FATF’s obligations. In sensitive cases, the member countries are also mandated to implement countering regulations such as AML/CFT to safeguard the international financial system from emerging money laundering and terrorist financing threats. Since 2020, the blacklist includes only two countries, Iran and North Korea

The FATF “GreyList”

When FATF identifies a jurisdiction to be placed on the list of countries under increased monitoring, the respective state needs to provide assurity to the financial watchdog that they will take all necessary steps to enhance their countering crime systems within the provided timeline. In addition to this, the regulatory authority also applauds the progress made by the countries in countering money laundering and does not impose strict sanctions or hefty fines. However, jurisdictions placed on the grey lists may experience economic sanctions from the International Monetary Fund (IMF) and World Bank which can result in a financial crisis. Moreover, at any cost, the banking sector operational in such countries need to be closely monitored in order to stay put with regulatory obligations.

EU New Delegated Act on High-Risk Third Countries

One of the core components of EU legislation to counter money laundering and terrorist financing is Directive (EU) 2015/849. In light of this Directive, financial firms, particularly banks, are obliged to implement enhanced vigilance before making business relationships and transactions carried out to or from high-risk countries. These requirements are extra verification checks and control measures that have been defined in Article 18a of the EU Directive.

However, on 7 January 2022, the European Commission adopted new Delegated law associated with third countries which have significant shortcomings in their AML/CFT framework that may pose negative impacts on the financial system of the Union. Determining such countries is a legal obligation which is an essential part of Article 9 of the EU’s Fourth Anti-Money Laundering Directive, aiming to secure the Union’s financial system.

In addition to this, the Commission has also come up with a revised methodology for the identification of high-risk third countries. This ensures that a transparent and robust process is applied. The primary goal of this revision is to determine the countries which vulnerable to money laundering and terrorist financing crimes.

The objective is to identify jurisdictions which have strategic deficiencies in their national AML/CFT regimes which pose significant threats to the financial system of the Union and hence the proper functioning of the internal market. Once identified, the Commission adopts delegated acts listing these jurisdictions. However, the methodology states that the Commission will consider FATF lists as a starting point and complement this by automated assessment of other countries using the following approach;

- Determine the risk profiles by evaluating the threat level to which the jurisdiction is exposed

- Assess the country’s AML/CFT legal framework and its effectiveness in 8 critical areas,

- Criminalization of money laundering

- Customer due diligence requirements, a suspicious transaction reporting and record-keeping in banks

- Customer due diligence requirements, a suspicious transaction reporting and record-keeping in the non-financial sector

- Effective sanctions in case AML/CFT failing

- The powers and procedures of competent authorities

- Their practice in international cooperation

- The availability and exchange of UBO’s information on legal persons and arrangements

- Implementation of targeted financial sanctions

How Businesses can Safeguard Their Interests

Both the financial and non-financial businesses need to take essential steps to determine and assess money laundering risk factors associated with jurisdictions and clients. However, businesses when making relationships with clients from high-risk countries, businesses need to pay attention to things;

- High-risk jurisdictions are subject to strict financial sanctions, so taking extra precautionary measures is suggested

- As per global regulatory obligations, companies need to practice enhanced due diligence measures while making any transactions with a customer in a high-risked jurisdiction

- Develop a risk-based approach to identify is there is a need to apply EDD measures or not

- Background screening against global financial crime lists, watch lists, PEPs lists and adverse media sources

How Shufti Can Help

As the money laundering and terrorist financing cases are rising, the FATF and other financial regulatory authorities call for rigid measures to counter such activities. Shufti’s robust AML screening services can help financial businesses to perform accurate background checks on their customers to screen them against 1700+ sanction lists in less than a second with 98.67% accuracy, preventing companies from getting involved in money laundering or terrorist financing.

Want to learn more about our AML screening solution for your business?

Explore Now

Explore Now