KYC/AML Compliance – Eliminating Financial Crime in Challenger Banks

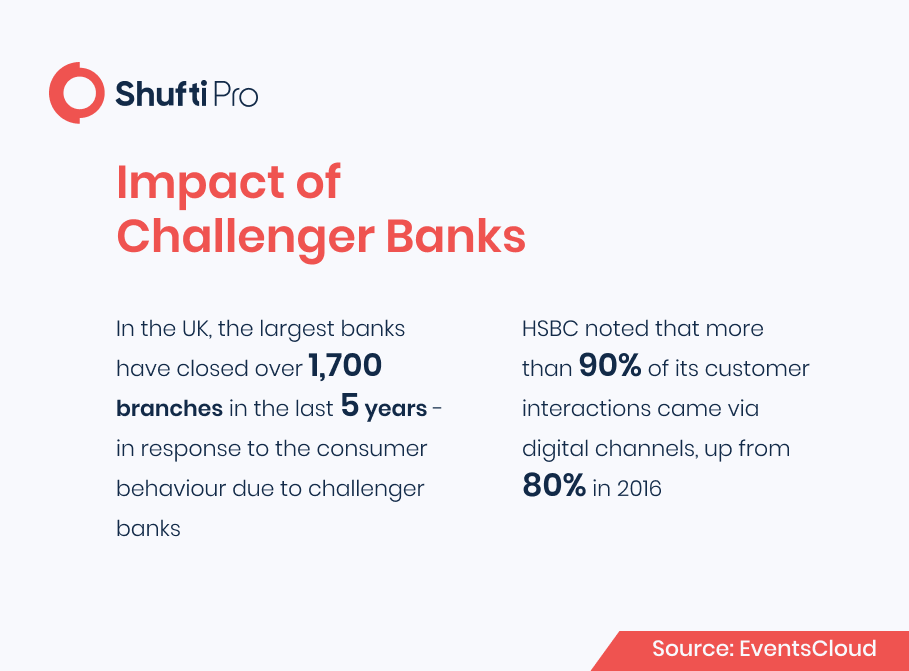

Challenger banks have emerged in the financial services paradigm by bringing digital innovations and offering seamless customer onboarding. While the Covid-19 pandemic had adverse effects on numerous industries and businesses, it also contributed to the global adoption of online financial services.

Challenger banks have benefited the most from this uptake of online services and adopted a more customer-centric approach. As customers’ convenience is the top priority in any kind of financial service, today’s banks and FinTech companies have come up with new solutions. However, online financial services and challenger banks are not free of threats.

Innovation in Financial Services and Challenger Banks

The fast-paced adoption of online financial services has brought not only legitimate customers but also criminals who aim to manipulate challenger banks and FinTech companies to get away with their illicit activities. In order to secure customers’ interests when they make online transactions, challenger banks must incorporate AML Screening solutions within their systems. AML Screening not only allows these market disruptors to analyse risks but also allows them to avoid compliance penalties.

It’s no surprise that the banking sector offers a certain level of security to its customers as it has a closed and centralised system. However, the industry doesn’t allow start-ups to establish themselves very easily as previously established banks have a stronghold. The digital shift throughout the world has opened up doors for startups and challenger banks. In the UK, the emergence of challenger banks like Atom Bank, Monzo, Revolut, and Starling has given way to innovations in the financial sector.

Atom Bank is one of the pioneers in the financial sector’s digital revolution. It was founded in 2014 and officially became part of the market in 2016. The UK-based challenger bank introduced a system where customers got to carry out their financial operations through mobile applications without having to go to physical branches. By mid-2018, the startup had made £149 million in a single funding round, showing that investors are confident and trust Atom bank’s services. The bank has now collected a total of £1 billion in deposits, establishing itself as one of the fastest-growing startups in the country.

Simultaneously, the ‘mobile-first’ bank Monzo introduced for its customers a transparent debit service that offers intelligent notifications and instant balance updates to give more financial management control in the hands of the customers. Starling Bank is another such startup that capitalised on its smartphone-friendly customers to create financial services that bring together the personal and business accounts of the customer. It also provides access to services from third-party providers for the purpose of insurance, pensions, and investments.

The Vulnerabilities of Challenger Banks

Challenger banks face financial crime risks just like the traditional banks and financial institutions, but in this case, the risks arise due to the anonymity and speed of digital transactions. Financial criminals looking to launder the proceeds of crime capitalise on anonymous systems through the online financial system to hide their identity as well as bypass AML measures. The rise in the adoption of online services and challenger banks further augments the threats of money laundering and terrorist financing.

The administration of these banks is left with no choice but to implement a robust AML/CFT mechanism to ensure regulatory compliance. However, they must also find ways to maintain the convenience provided to their customers to reach new business milestones. Considering these conditions, challenger banks and FinTech firms definitely need to develop systems and incorporate solutions to verify the identities of their customers and analyse the risks associated with them.

This implies that challenger banks must follow the steps taken by traditional financial institutions and incorporate systems for customer due diligence (CDD) and in high-risk cases, enhanced due diligence (EDD).

The FCA’s Take On Challenger Banks

The UK’s Financial Conduct Authority (FCA) has identified that challenger banks lack the necessary measures required to combat financial crimes like money laundering and terrorist financing. The FCA has issued a warning to challenger banks saying that they should stop bypassing the necessary measures to avoid financial crime to cut down on costs. The regulatory authority states that the currently implemented processes leave the door open for customers to create accounts easily without having to go through verification checks.

Lack of Risk Analysis Measures

After a study, the FCA identified major challenger banks that lack proper measures for risk analysis of their customers’ transactions and other account activity. Risk analysis measures are the basic tool to ensure that the bank knows its customers’ background and to prevent financial crimes like money laudnering. Besides, customer due diligence is a legal requirement for banks and businesses that are under the UK’s AML regulations. The FCA state that

“without a customer risk assessment, a firm can’t ensure that due diligence measures and ongoing monitoring are effective and proportionate to the risks posed by its individual customers.”

Lack of Enhanced Due Diligence

The FCA further mentioned that even though challenger banks are an essential and growing part of the UK’s financial system, they cannot compromise the protection of customers’ personal data by avoiding robust verification measures. For this purpose, challenger banks must improve their financial crime systems to prevent reputational damage and compliance penalties.

It was also mentioned in the FCA’s study that challenger banks lack the measures to accurately identify high-risk customers that are onboarded and use their system to launder the proceeds of crime. The FCA believes that there should be robust due diligence measures to analyse the risks associated with the customers at the onboarding stage to eliminate the chances of financial crime. Furthermore, the FCA pointed out that even though challenger banks are reporting an increasing number of suspicious activities to regulators, the details and quality of these reports are often compromised. For instance, some of the reports just provide the record of a number of transactions but do not explain why they are suspicious.

What Shufti Offers

The FinTech industry and challenger banks are growing at a fast pace and are proving to be a safe haven for financial criminals. To combat money laundering and terror financing, challenger banks have to follow certain laws from FinCEN, FCA and other regulatory authorities.

With Shufti’s KYC verification solution, banks and financial institutions can deploy a robust identity verification platform along with an AML Screening solution that checks PEP and sanctions lists to analyse the risks associated with potential customers. Shufti AML compliance solution deploys thousands of AI models that can verify the identities and check backgrounds in seconds with 98.67% accuracy. You can onboard legitimate customers, comply with regulations and keep your challenger bank secure from fines.

To know more about AML Compliance, talk to our experts right away!

Explore Now

Explore Now