Prevailing Crimes in Metaverse – How Shufti’s IDV Solution Can Help

Metaverse is a virtual space where people belonging to the same or different physical regions can interact with each other. Although not yet recognized globally, it is predicted by experts that metaverse will soon find a huge space in the contemporary world. The concept of metaverse is quite old, but it came into mainstream when Mark Zuckerberg changed Facebook’s name to “Meta.” With the metaverse ecosystem expanding, more online opportunities are emerging making it highly profitable for investments.

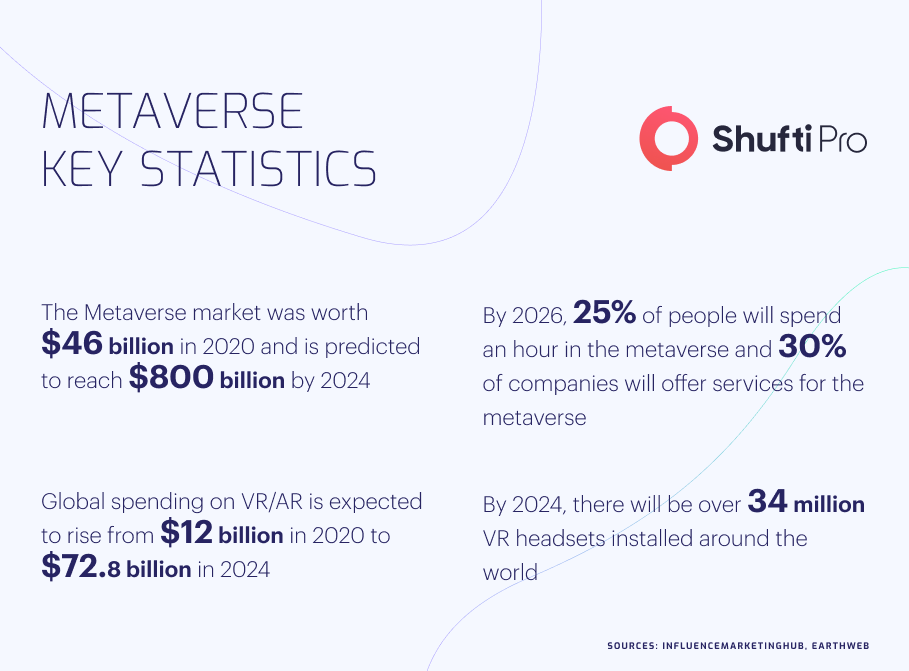

To access the metaverse, Augmented Reality (AR) and Virtual Reality (VR) devices are used, which are in high demand nowadays. The technological giants, particularly Facebook, are investing heavily in AR & VR devices, setting high competition among companies. It has been estimated that VR gear sales are set to hit $10 billion in 2022, with an expectation of rising in coming years. Due to the huge potential of investment in metaverse, meta criminals are also finding several ways to exploit the system resulting in identity theft, money laundering, and other financial crimes.

An Overview of Metaverse – A Highly Vulnerable Sector

Companies and individuals are spending billions of dollars on metaverse and other digital assets. The huge influx of money and lack of stringent regulations have encouraged cyber criminals to exploit loopholes by getting involved in financial crimes. Identity theft is one of the prevalent scams in metaverse, which has become a huge threat to existing systems giving rise to several fraud, particularly account takeovers, multi-accounts, and data breaches. In 2021, metaverse companies faced 60% more cyber attacks as compared to the last year. Cybersecurity experts have also termed the metaverse to be a safe haven for meta-criminals which is in dire need of strict Know Your Customer (KYC) checks.

Metaverse is mainly dependent on cryptocurrency, which relies on blockchain Distributed Ledger Technology (DLT), and the lack of stringent regulations here paves new ways for scammers. With emerging technologies, criminals have also adopted advanced techniques of fraud which must be encountered to secure users. Metaverse is the new reality of world that is here to stay, and it is imperative for all stakeholders to implement strict KYC measures making it a secure platform.

Recent Crime Cases in Metaverse

With the increasing investment, crime rate in metaverse is also going up, and criminals are finding advanced ways to exploit loopholes. Several fraud cases have been witnessed around the globe, raising the need for uniform legislation for whole sector.

Cybercriminals in US Target Metaverse Investors

Three different cases have been filed against a metaverse company in Florida selling fake metaverse land and convincing people to make investments. All the investors have stated that in first few months, everything was good, but suddenly they lost all their virtual land.

It has been reported by CNBC that hackers use multiple fake links for fraud and asked users to input their details which resulted in the loss of their virtual properties. Investors further said that the hackers made them believe that websites were credible but turned up phishing sites. The affectees of scam have asked law-enforcement authorities to take action against culprits and restrict their illegal activities.

Fraudulent Russian Metaverse Project Halted by Five US States

Law-enforcement agencies of five states in the US have announced plans to take immediate action against a Russian organization. The company was involved in fraudulent deals of NFTs to investors and further funding a metaverse casino “Flamingo Casino Club”. The investigations have found that the company was responsible for selling fake metaverse properties to sophisticated users. After purchasing the assets, users ended up losing their money as whole scheme was a fraud.

Existing Frauds in Metaverse

With transforming technologies, criminals are finding advanced ways to abuse the system. Multiple types of scams are linked with metaverse, and fraudsters are using various techniques to carry out scams, particularly identity theft and money laundering.

Account Takeovers

Metaverse companies are encountering major scams in the form of account takeovers. Hackers use advanced phishing which may include; sending fake links to users and convincing them to invest in NFTs. As soon as the users log in using their credentials, the account gets hacked and all the data is lost.

Scam Projects

Hackers use this trick to convince the users to invest in various projects which are usually fake or have no value. The criminals promise a myriad of lucrative profits to investors and soon after investment, the project vanishes away while users end up losing money and time.

Data Breaches

Due to a lack of strict regulations, metaverse platforms are highly vulnerable to data breaches. Users have to input their details while logging into their account and hackers use advanced techniques to get users’ details. All this information is further used to steal metaverse assets of investors.

Who Will Govern the Metaverse?

Increasing identity theft, money laundering, and other monetary crimes have led stakeholders to devise a monitoring structure for metaverse. Investors are countering a large number of financial threats and it has become imperative to eliminate meta criminals for smooth flow of system. To be viable as a place to do business, the metaverse will need real controls to protect users from abuse, fraud, and loss.

Global authorities, particularly the Financial Action Task Force (FATF) and Interpol are working tirelessly to develop a system to monitor suspicious activities in metaverse. It has been instructed by FATF to implement Risk Based Approach (RBA) in virtual assets and virtual asset service providers. It has further been termed that metaverse is associated with high risks of money laundering and is in dire need of strict Anti Money Laundering (AML) regulations. FATF has also stated that they will continue working with member countries to formulate stringent laws against meta criminals.

The Role of KYC in Eliminating Meta Criminals

Metaverse, with a huge potential for investments and business, is exposed to identity theft and other financial crimes, which can be curbed through strict KYC checks. Criminals on board the system using fake information and exploit the platform by stealing details of other investors. The metaverse market is growing by 13.1% every year, making it highly vulnerable to monetary scams.

KYC measures mainly include facial recognition, document and address verification which can help in verifying true identities of investors and keeping bad actors away. By the end of 2024, metaverse market will be worth $800 billion, so it is the right time to implement strict KYC checks protecting investors from scams.

What Shufti Offers?

Metaverse is digital future, and it is quite critical to secure these platforms using stringent measures. Shufti’s identity verification services are the most feasible solution for metaverse market. It will help virtual service providers verify the true identities of their users before getting them onboard and reporting any suspicious activity. Shufti’s KYC solution is powered by thousands of AI algorithms, verifying the identities of users through facial recognition and document verification. Generating results in less than a second with 98.67% accuracy makes Shufti pro an ideal solution for business.

Want to know more about KYC solutions for the metaverse?

Explore Now

Explore Now