What You Need to Know About Switzerland’s Crypto AML Rules by FINMA

Switzerland is historically famous for being a global hub for gold. However, the new digital gold, cryptocurrency, has been making waves in recent years. Currently, 960 blockchain and cryptocurrency businesses are located in the country, particularly as Swiss crypto laws are receptive towards the underlying technology.

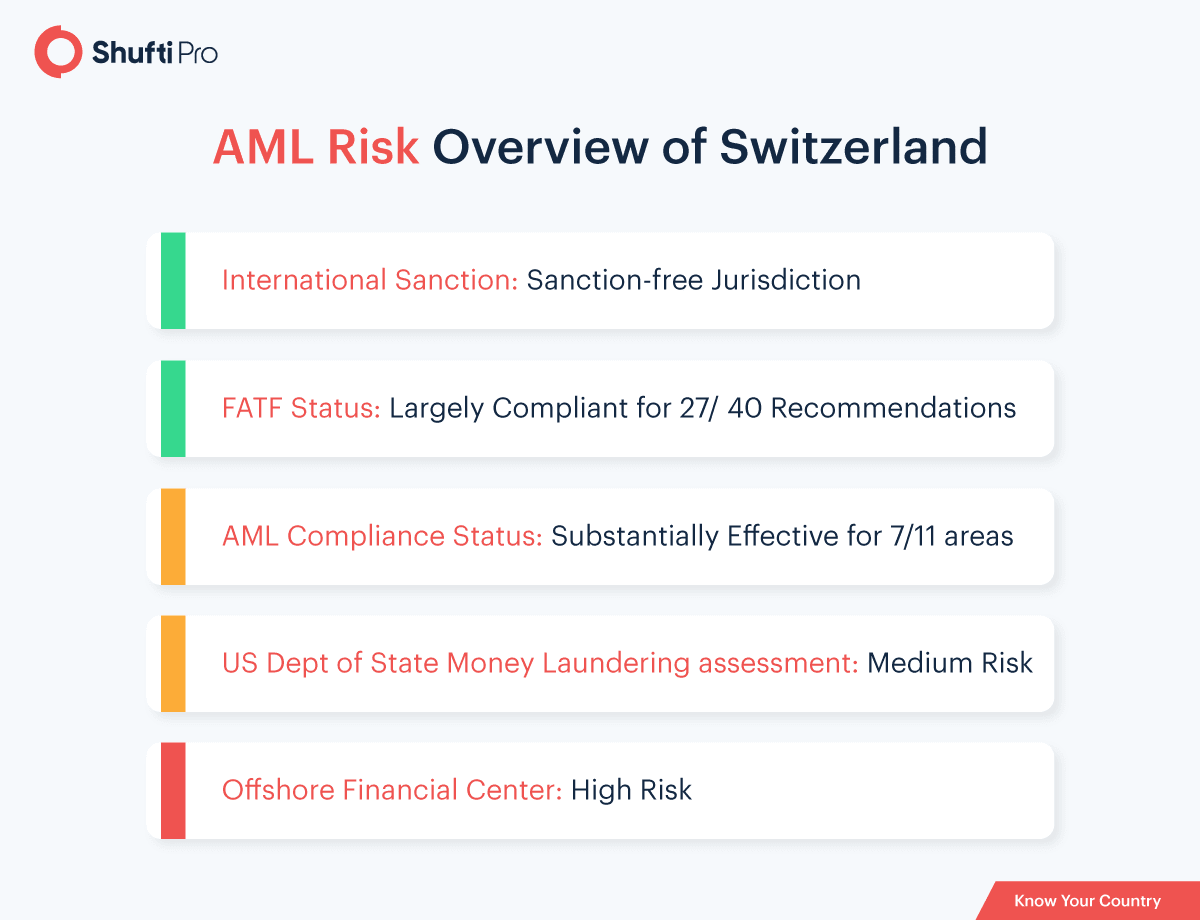

Both the Swiss government and the Financial Market Supervisory Authority (FINMA) recognize the potential of cryptocurrencies and their positive implications on the economy. For regulatory purposes, FINMA has mandated Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements on all VASPs in the country. Additionally, new transaction thresholds have been introduced for KYC verification this month, causing a stir among industry players.

What is FINMA?

FINMA, or the Swiss Financial Market Supervisory Authority, is Switzerland’s independent financial regulator that monitors banks, insurance companies, investment firms, cryptocurrency businesses, and other financial institutions. The regulatory body is also responsible for combating money laundering, and, where necessary, conducts bankruptcy proceedings.

FINMA has divided cryptocurrency tokens into three categories. These include:

- Payment Tokens: This token functions as a means of payment that can be used for money or value transfer

- Utility Tokens: This token is designed to provide digital access to an application or service

- Asset Tokens: This token functions similar to stocks and bonds, and therefore is subject to securities rules

Are Cryptocurrencies Legal in Switzerland?

While virtual assets are not considered legal tenders in Switzerland, cryptocurrency exchanges and Virtual Asset Service Providers (VASPs) are legal, as long as they are licenced and regulated by FINMA. The regulatory body strictly advises all exchanges to perform Enhanced Due Diligence in accordance with the country’s AML/CFT framework. Additionally, KYC checks need to be implemented on all customers to prevent financial crimes, such as identity theft.

The Canton of Zug in Switzerland has been dubbed as the “Crypto Valley”, while other important technological hubs include Zurich, Geneva, Ticino, Vaud, Lucerne and Berne.

Suggested Read: The Case Against Cryptocurrencies: Where is it Banned & What’s Causing the Crackdown?

Regulatory Overview

In November 2019, the Swiss Federal Council proposed new regulations for digital assets and submitted a draft for the Distributed Ledger Technology (DLT) Bill. The regulation proposed various amendments, including updates to the Anti-Money Laundering Act (AMLA). The DLT Bill was partially enacted as an Act in February 2021, while the remaining provisions concerning the amendments to the Swiss banking regulation and financial market infrastructure regulation came into effect on 1 August 2021.

In further attempts to clamp down money laundering activities in the country, FINMA updated its AML regulation in September 2021 which lowered the threshold for which businesses are mandated to verify the identity of their clients during Bitcoin trades and other cryptocurrency transactions. The new threshold has been set to 1,000 Swiss francs ($1,082) per month, as revealed in a letter by Christoph Kluser who supervises the para banking system. The new FINMA regulation also seeks to lower burgeoning crypto frauds that are surfacing through ATMs, which FINMA has revealed are being used by drug dealers as their primary payment system. Currently, 130 Bitcoin ATMs exist in the country, with Zurich and Lausanne at the forefront with 38 and 20, respectively.

Suggested Read: Money Laundering Through Cryptocurrency: Red Flags and AML Risks

How Did Crypto Businesses React to the New KYC Threshold?

The 1,000 Swiss francs threshold was introduced by FINMA at the beginning of 2021, after a thorough consultation with the industry. However, the latest criterion of applying this as a monthly metric has been introduced without external consulting.

Where the regulator considers the latest measure as a clarification, crypto providers view the move as a threat to their existing business models. Cryptocurrency providers can automate KYC compliance by investing in RegTech solutions, keeping intact the new regulations.

How Can Businesses Comply with the FATF Crypto Travel Rule?

FATF’s crypto Travel Rule came into force in Switzerland on January 1, 2020. Under this rule, the following compliance targets must be met to avoid incurring hefty fines and penalties.

Minimum Threshold

All VASPs have been obligated to perform KYC verification on transaction amounts that go beyond 1,000 Swiss francs and prove ownership of non-custodial wallets. This includes accurate identity verification of all clients and beneficiaries for the purpose of fraud prevention.

PII requirements

To prevent the threat of financial frauds such as identity theft, account takeovers, and money laundering, all VASPs are required to collect Personally Identifiable Information (PII) of customers involved in crypto transactions. This move was introduced following a good deal of money laundering cases that emerged in recent years. The following information needs to be collected for KYC verification:

- Client’s name

- Client’s account number, or a reference number for the transaction

- Client’s address, date and place of birth, their client number, or national ID number

- Beneficiary’s name

- Beneficiary’s address

Why Choose Shufti For Complying with Swiss Crypto Regulations

In the first half of 2021, penalties worth USD 937.7M were issued for non-compliance with anti-money laundering, know your customer and data privacy regulations. Closely followed by North America, Switzerland imposed the second-largest number of fines, distributing USD 85M in penalties. To comply with the stringent KYC and AML regulations, automated solutions provide the perfect alternative.

Shufti’s automated identity verification solution, for example, is powered by thousands of in-house AI models, making it easy for crypto platforms to verify client identities and meet KYC compliance targets in a single go. This solution collects the end-user’s PII and confirms their identity in real-time. Once the data is collected, it is mapped against 1700+ AML watchlists to flag high-risk identities. The automated AML screening solution also conducts comprehensive background screening of ultimate beneficial owners within 30 seconds to reduce financial risks to zero. Once risk profiles have been created this way, crypto providers can successfully counter prevalent financial crimes by strengthening internal security mechanisms.

Need to screen your customers to comply with global crypto regulations? Try our 7-day free trial right away or talk to our experts!

Explore Now

Explore Now