5 Features of the Best Transaction Monitoring Solution

Criminals are continuously devising sophisticated strategies to launder illegally-acquired money. Every year 2 – 5% of the Gross Domestic Product (GDP) or $800 billion – $2 trillion cash is laundered globally. As the financial sector deals with a high volume of transactions, it has become fertile ground for impersonators to move illicit money into a legal system. This is where the transaction monitoring solution comes to the rescue, mitigating the risk of financial crime by monitoring high volumes of transactions.

Understanding Transaction Monitoring Solutions

With more transactions being processed daily, tracking suspicious transactions and detecting any issues quickly requires automation. Transaction monitoring solutions enable financial firms to analyse transactions and data in real-time and detect odd behaviour based on advanced models. The bank transaction monitoring solution generates an alert when it detects any dubious activity. Compliance and risk professionals then investigate and send a Suspicious Activity Report (SAR) to Know Your Customer (KYC), Anti-money Laundering (AML), and Countering Terrorism Financing (CTF) regulators.

Having a robust transaction monitoring solution allows organisations to:

- Recognise and respond to high-risk suspicious activity promptly.

- Minimise false positives whilst abiding by regulations and meeting customer experiences.

- Ensure processes and systems are updated to comply with the changing regulatory requirements.

- Avoid heavy fines by adhering to AML regulations.

- Stay flexible and promptly modify strategies to evade criminal threats.

- Tailor workflows to improve the efficacy of examinations without necessitating any engineering resources.

Financial organisations can abide by regulations, maintain client trust, and protect their business reputation by investing in the appropriate transaction monitoring solution.

How to Choose the Best Transaction Monitoring Solution for Your Needs?

Companies need a solution that fulfils their needs as they compete to offer the best customer service. Whilst some technologies automate standard procedures, they do not consider a business’s vision or effectively modify rules to prioritise cases. Transaction tracking is not the only component but the most crucial part of an effective AML programme.

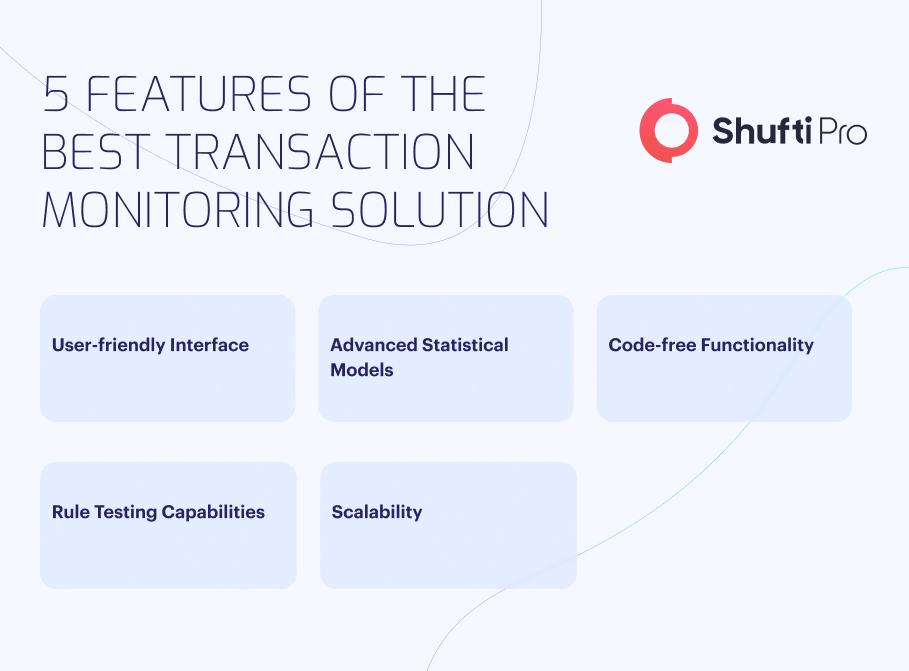

A transaction monitoring solution needs to have a few vital features for the compliance and risk team to operate at its best.

-

User-friendly Interface

One of the best transaction monitoring solutions provides every feature and functionality that compliance and risk teams require. It must present the customer data that can be easy to navigate and handle. When efficiency is crucial, a delay in viewing or acting upon information causes the investigation to hold up.

-

Advanced Statistical Modelling

Many solutions are predicated on concepts learned from past events, legal requirements, and organisational knowledge. Criminals can easily interpret and get past rules that are based on history. More sophisticated statistical algorithms can distinguish between potential money laundering and a series of safe transactions by forecasting aberrant transactions and spotting subtle trends. Advanced analytics help businesses identify and report suspicious activity by analysing a wide range of behaviours, such as click speed, IP address, sites visited, etc., to determine the motive behind a transaction.

-

Code-free Functionality

The risk and compliance team needs more time to focus on investigating high-risk and suspicious behaviours when rules are written, tested, and deployed utilising a graphical user interface. Access to pre-configured policies and the capability to modify guidelines to run against transactions would help non-technical operations teams. It facilitates them in setting and developing new approaches that the business requires without a data scientist or an engineer.

-

Rule Testing Capabilities

Rules must be amended and implemented fast as criminals search for ways to avoid discovery and compliance standards shift. New cases can be recorded and evaluated using accurate data to ensure that rules work as expected before deployment. The development process can be significantly sped up by having a library of pre-made regulations and the freedom to create new ones. To guarantee that their AML system remains reliable and efficient, compliance teams may verify and put the requirements into practice. This can be accomplished quickly by thoroughly auditable testing of new rules through historical data.

-

Scalability

Criminal behaviours and the volume of transactions change with time, necessitating a transaction monitoring process that also can modify along with the changes. Adaptation is a constant in transaction tracking, and a solution that restricts rather than enables it can reduce the team’s productivity and jeopardise the business’s AML efforts.

How Can Shufti Help?

Shufti provides businesses with advanced transaction monitoring solutions that help them identify any suspicious activity. With Shufti’s robust AML transaction monitoring solution, risk and compliance teams can implement rules and use sophisticated statistical models that reduce false-positive rates. Not only this, but it also enhances alert performance whilst freeing up investigators to work on other essential duties.

Here’s what makes Shufti’s transaction monitoring solution stand out:

- Detect any suspicious transaction within seconds and mitigate the risk of money laundering and other financial crime.

- Ensure processes and systems are up to date to abide by the ever-evolving regulatory requirements.

- Customise rules and develop sophisticated statistical models without any engineering resources.

- Adapt to any changes in customer behaviour, transaction volume, and risk profiles.

Still confused about whether a transaction monitoring solution can help businesses detect suspicious activity and streamline monitoring and reporting?

Explore Now

Explore Now