A Comprehensive Guide to Understanding Ultimate Beneficial Owners (UBOs)

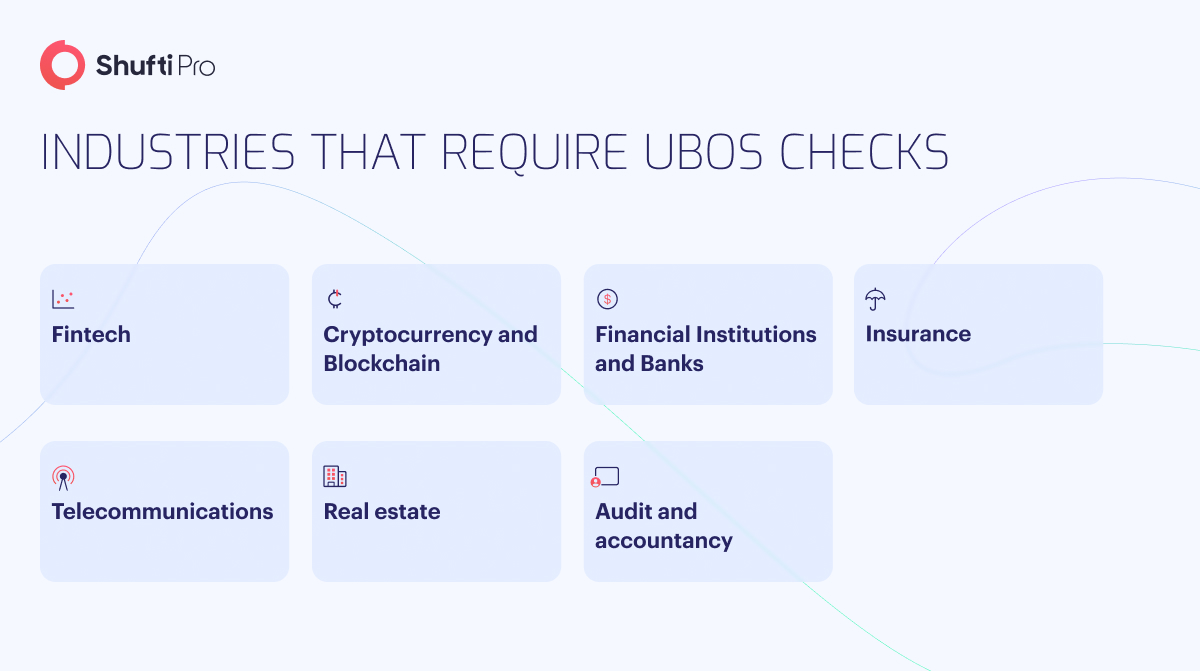

Identifying UBOs and their control over a business is crucial for financial firms to meet regulatory standards and enhance security measures. Despite variations in the definitions and requirements of UBOs across jurisdictions, understanding the structure of corporations and identifying Ultimate Beneficial Owners (UBOs) is a critical component of Anti-Money Laundering (AML) and Know Your Customer (KYC) compliance.

Understanding UBOs in Detail

A UBO is an individual who ultimately owns or controls a business, partnership, or other legal entity. Whilst an individual client can be easily identified as the beneficiary of the transaction, UBOs are not immediately recognised as they conceal their identities or are hidden by corporate infrastructure.

The Financial Action Task Force (FATF) defines UBOs as “the natural person(s) who ultimately owns or controls a customer and/or the natural person on whose behalf a transaction is being conducted. It also includes those who exercise ultimate effective control over a legal person or arrangement.”

As per FATF, the following individuals fall under the definition of UBOs:

- Persons who own a minimum of 25% of the company’s share capital

- Beneficiaries who have a minimum of 25% of the entity’s capital

- Individuals who have a minimum of 25% of voting rights

- Guardians of minors

- Persons who have the power of attorney

- Corporate directors or nominee directors who are designated with concealing the valid owner of a company

- Shareholders, including those who possess bearer shares, transferred without revealing their identity

Beneficial Ownership and EU Anti-Money Laundering Directives

Ultimate beneficial ownership rules are part of the EU’s latest Anti-money Laundering Directives (AMLD).

UBOs and 4th Anti-money Laundering Directive

The 4AMLD, which went into effect on June 26, 2017, significantly addressed UBOs by enacting the following regulatory measures:

- In any legal entity, beneficial ownership is established when a party owns or controls more than 25% of the capital and voting rights.

- When the aforementioned requirements cannot be met, 4AMLD permits senior management representatives to be considered beneficial owners.

- According to 4AMLD, EU nations must mandate entities maintain UBO lists under this rule, containing the most recent ownership data in a centralised database available to authorities, eligible entities, and public members with legitimate interests, like journalists or NGOs.

In accordance with 4AMLD, businesses should use the following information, procedures, and resources to identify UBOs:

- Direct or indirect ownership

- Shareholdings and subsidiaries

- All businesses in a corporate group that share the same ultimate owners as the chosen company

- The actual and perceived ultimate owners who operate independently from the business

- Comparing real and perceived ownership

- corporate family trees

- Ownership evaluations carried out using a bottom-up or top-down methodology

- Different interpretations of ownership

UBOs and 5th Anti-money Laundering Directive

The Fifth Anti-Money Laundering Directive (5AMLD), which went into effect on January 10, 2020, added the following UBO provisions:

- UBO lists (created under 4 AMLD) must be available to the general public.

- Trusts or any similar arrangement must adhere to beneficial ownership laws and, like corporations, must make such data available to authorities or anybody with a legitimate interest.

- UBO national registries must be interconnected at the EU level to encourage collaboration and information sharing between member-state agencies.

- To guarantee that the data they contain is accurate and trustworthy, member states must upgrade their UBO verification processes.

- Member states are required to establish distinct UBO registrations for bank accounts. Unlike firm UBOs registries, these listings are exclusively accessible to authorities and aren’t accessible to the general public.

Why Do Businesses Need to Identify UBOs?

Criminals who attempt to launder unlawful funds may try to bypass AML controls by hiding their identity. They occasionally carry out transactions utilising corporate structures, like shell firms or proxies. Even though shell corporations can be established for lawful purposes, criminals frequently use them to conceal illicit funds and make it easier for them to access legitimate financial systems. Businesses can mitigate the risks associated with fake companies and other money laundering techniques by investigating ultimate beneficial ownership. This will help them to make sure that they aren’t working with criminals who are exploiting corporate infrastructure to hide their identity.

How to Identify UBOs?

Businesses should identify the ultimate beneficial owners by implementing appropriate KYC processes as part of their AML measures. However, this should entail the following:

- Customer Due Diligence: Businesses should try to gather personally identifiable data about their clients, such as the directors’ names, residences, and the details of the company’s incorporation.

- AML Transaction Monitoring: Businesses may be able to spot shell businesses by keeping track of their transactions, looking out for odd transaction patterns, and being cautious whilst conducting business in high-risk nations.

- Sanctions Screening: Internationally sanctioned customers could access banking services through a shell company. As a result, businesses should check high-risk clients against the pertinent sanctions lists.

- Politically exposed Persons (PEPs) Screening: PEPs, such as politicians or government officials, pose a high AML risk and can use shell firms to hide their identity. Businesses should do PEP status checks on their clients.

- Adverse Media: News reports may indicate clients involved in UBOs-related money laundering charges before official authorities publicise the information. Businesses should perform ongoing adverse media checks whenever a negative news story involving one of their clients is reported.

How Can Shufti Help Identify Your Client’s UBOs?

Shufti’s Know Your Business (KYB) solution screens clients against 1700+ global watchlists to eliminate the risk of money laundering and enables you to meet compliance easily. Our KYB solution checks UBOs, PEPs, and those with negative media coverage within seconds, protecting your firms from financial crime.

Still confused about how a KYB solution helps verify customers’ UBOs?

Explore Now

Explore Now