Addressing the Challenge of Money Laundering Risks for Payment Service Providers (PSPs)

- 01 Payment Service Providers (PSPs) - An Overview

- 02 The Role of Law Enforcement Agencies in Countering Crimes

- 03 Money Laundering Risks for Payment Service Providers (PSPs)

- 04 Global Regulatory Authorities Monitoring the Payment Sector

- 05 Ensuring AML/CFT Compliance for Payment Service Providers (PSPs)

- 06 What Shufti Offers?

During the last few decades, the financial industry has altogether revolutionized, and digital transactions are replacing cash. It is expected that electronic payments will be the only viable option left in the banking system with rapid digitization. Especially the pandemic boosted the opportunities for Payment Service Providers (PSPs) and accelerated the adoption of digital payments, ultimately creating long-lasting benefits for the users.

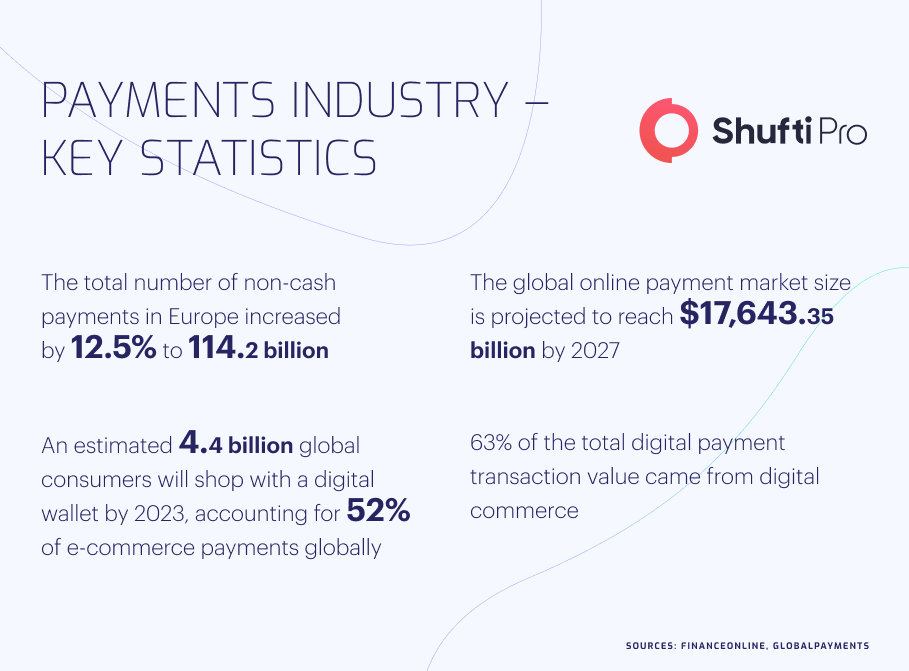

The payment industry is increasing at a rate of 13.7% annually and is expected to reach $146.5 billion by 2030. Due to the high stakes of money in the payment sector, criminals have started exploiting the loopholes in the financial system and carrying out money laundering and terrorist financing. The majority of the PSPs have not implemented stringent Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) measures which have encouraged the bad actors to get involved in multiple crimes and get away without leaving the trail. It is in the high interest of PSPs to enforce efficient AML solutions to counter financial criminals.

Payment Service Providers (PSPs) – An Overview

Money has existed in the world in different forms for thousands of years, and humans have always found innovative ways to carry out trade. Paper currency was first of all used in China in 700 CE, and since then, notes have remained the most popular means to conduct financial transactions. Currently, the trend of currency notes and coins is getting outdated, and the money is flowing through digital means, which has also become a favorite option of users and businesses. In this new setup, Payment Service Providers (PSPs) act as partners helping businesses accept online payments and manage all other financial transactions.

The PSPs have provided a lot of ease to digital businesses as they do not have to visit bank branches for their routine transactions. This is the primary reason that business owners are accepting this advanced financial model, which has increased the need for PSPs worldwide. They make transactions easier for companies, manage all the issues related to transactions, and offer a variety of tools that ease operations. It is estimated that in 2021, the use of PSPs by FinTech companies and other businesses increased by 68% as compared to the previous year.

The Role of Law Enforcement Agencies in Countering Crimes

All the major jurisdictions have acknowledged this burning issue and are working actively to counter all the bad actors involved in the heinous crimes. The law enforcement agencies of all these countries have arrested several criminals and presented them before the court to make them an example.

Here are some of the high-profile cases associated with the payment industry:

Criminal Gang Sentenced for Involvement in £1.1M Scam

London law enforcement authorities have arrested two members of an organized criminal gang that was involved in a £1.1 million payment scam. The investigations have found that scammers used several payment fraud techniques to defraud banks and other financial organizations. The law enforcement authorities have further revealed that they were sending fake messages to business owners convincing them to use their payment services, which ended up in losses. Both criminals have been awarded imprisonment of two years by the court.

Gang of Fraudsters Jailed for 43 years for Payment Fraud

UK Metropolitan Police arrested a gang of fraudsters that was running a payment scheme, “Diversion Fraud,” using multiple hacking software. The criminals were collecting money from the investors and further laundering it to other countries using decentralized platforms. The court took two years to investigate the whole matter and announced a collective sentence of 43 years to all the culprits.

Money Laundering Risks for Payment Service Providers (PSPs)

All the major jurisdictions along with financial watchdogs are ready to address this mighty challenge. The majority of organizations, like banks and insurance companies, have implemented stringent measures to curb this scam which has led criminals to find new ways to carry out their illicit motives.

The payment industry is one of the sectors which is highly vulnerable to money laundering and terrorist financing. The criminals usually set up fake business that accepts digital payments, and in this way, they attract new customers while defrauding them with their assets. Online businesses and e-commerce stores generally do not have geographical limitations, making them a soft target for criminals. Money launderers invest their illicit money into the payment industry and further get it out while converting it into legal assets. The Financial Action Task Force (FATF) has also raised its grave concerns regarding increasing monetary scams in the payment sector and instructed the member states to address this prevailing challenge.

Global Regulatory Authorities Monitoring the Payment Sector

Under the light of FATF’s guidelines, all the major jurisdictions are working to counter the criminals. This is the prime reason that several cases of criminal activities have surfaced in the recent past, and fraudsters have presented before the court to penalize them under the law. Let’s have a look at some of the prominent laws in a few countries:

United States

United States has implemented quite strict regulations to monitor PSPs while making it mandatory for the service providers to get a license before starting their operations. The “Payment Service Regulations” is the primary law covering the country’s digital payment sector, and several criminals have been penalized under this law.

United Kingdom

The Financial Conduct Authority (FCA) is working under “Electronic Money Regulations” which has made it imperative for the whole financial sector to implement a Customer Due Diligence (CDD) approach to maintain a record of users’ identities and present the data to agencies in case of any illegal activity.

Ensuring AML/CFT Compliance for Payment Service Providers (PSPs)

Since 9/11, money laundering has adopted the form of a global issue and several shreds of evidence have been collected where terrorists have been found using the laundered money to carry out their heinous motives. This is the prime reason that global financial watchdogs, particularly FATF, Interpol, and European Union (EU) are working tirelessly to implement a comprehensive framework countering money launderers and terrorist financiers. They have gathered huge data on criminals in the form of sanctions lists which must be looked into them by the payment industry to identify the criminals and eliminate them from the system.

What Shufti Offers?

Combating money laundering and terrorist financing from the payment sector is quite crucial to ensure transparency in the financial system. It is in the higher interest of payment service providers to invest in AML/CFT solutions to make it a secure platform for their customers.

Shufti’s AML/CFT screening solutions are ideal options for Payment Service Providers (PSPs), ensuring compliance with the global regulatory authorities. Having access to 1700+ sanctions lists by global watchdogs, Shufti’s AML solution screens the users against them and provides results in seconds with a ~99% accuracy.

Would you like to get more information about AML/CFT solutions for PSPs?

Explore Now

Explore Now