AML Compliance – Sharpening Focus on FinCrime in the Payments Industry

- 01 Overview of the Payment Industry in 2021

- 02 The Aftermath of Being Non-Compliant with AML Regulations

- 03 Credit Transfer Fraud Cases Quadruple in Greece

- 04 Credit Card Fraud Increases by 29% in the Philippines

- 05 TSB to Ban Cryptocurrency Buying Due to E-Wallet Scam

- 06 How Shufti Can Help

- 07 Final Thoughts

Conventional payment services are embracing technological transformation, which is significantly disorganizing business models. The digital payment industry is forecasted to digitize the ways of carrying out payments as new tech-driven innovations are emerging. Now payments can be done through smartphone applications. Mobile payments have become a crucial alternative to using cash or credit cards. New technologies have provided ease to send or receive money from any part of the world using smart gadgets and it includes all the standards of verification.

On another hand, the technological transitions are helping out criminal activists that are always in search of finding new ways to manipulate the payment industry security measure. Various frauds like cards not present are badly affecting the payment industry. Yet, the financial watchdogs are making efforts to legislate standards to secure the digital payment ecosystem.

Overview of the Payment Industry in 2021

The payment industry is depending on new technologies like cloud computing, artificial intelligence, big data, and machine learning algorithms. Due to this, the dynamics of this sector are constantly evolving. Mainly, the key driving force behind payment industry digitization was the coronavirus crisis. The old-fashioned credit cards and paper-based money is now mostly transited into digital payment methods. Mobile payment wallets like Apple Pay are rapidly becoming the new norm as transactions can be carried out without any effort.

Many payment regulations have emerged, aiming to secure businesses and individuals within the payment landscape. Researchers predict that the payment market will surely expand and evolve in coming years, with the increase in digital payments and growing transaction volumes. With this, the year 2021 was full of headlines, reporting payment frauds and thus, the industry has become a prominent target for criminals. Financial corporations in this sector are playing a viable role to curb monetary crimes. On a daily basis, millions and billions of transitions are being carried out that exponentially increase the crime rate. However, in recent years the advent of money laundering and terrorist financing is carried out through online payment gateways.

Therefore, the global AML regulatory bodies have set various laws and standards. However, to remain competitive, the payment industry needs to swiftly adopt technological tools, improve the infrastructures, and pave ways to fulfill regulatory obligations.

The Aftermath of Being Non-Compliant with AML Regulations

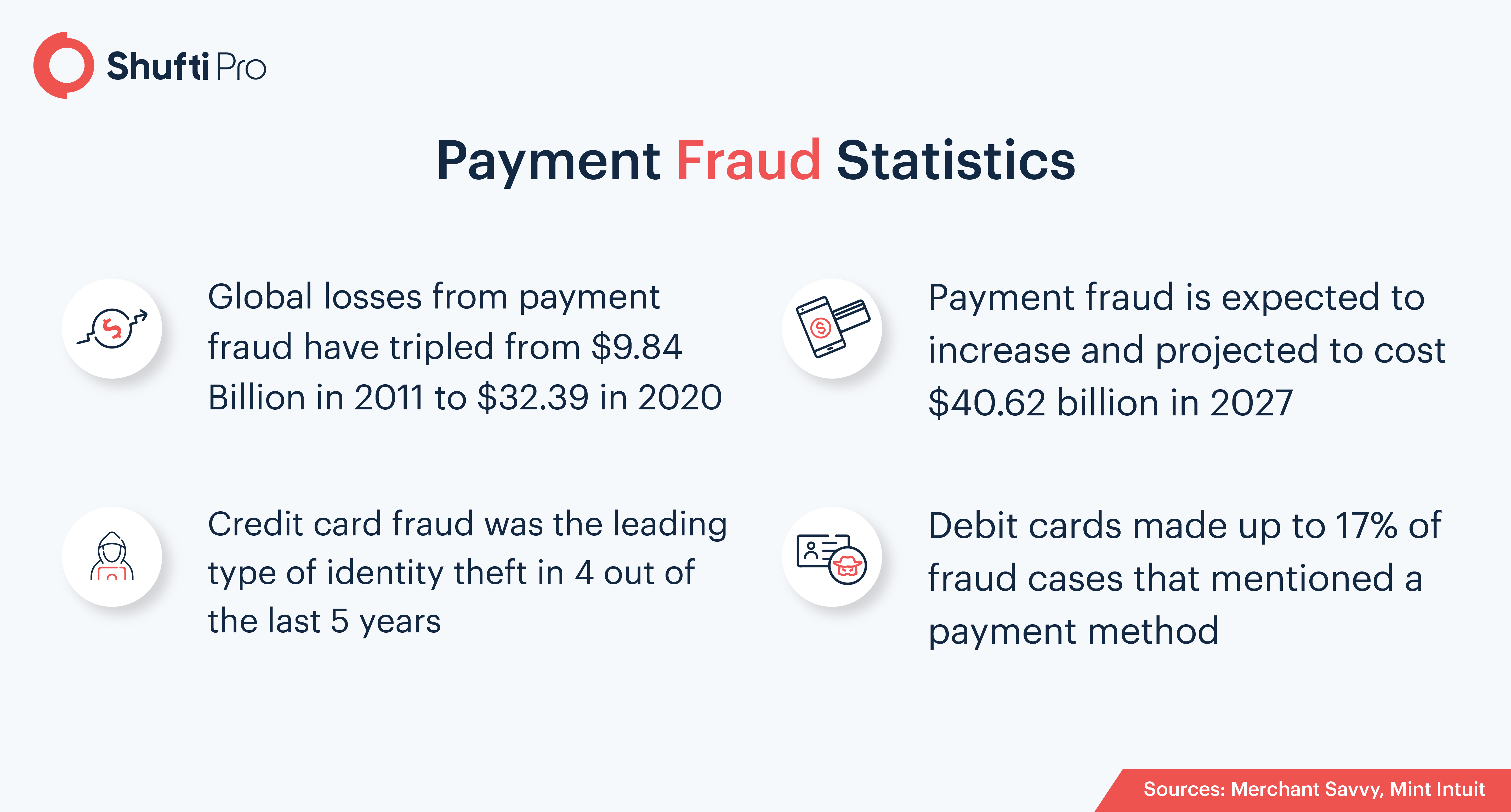

Digital payments are highly under the stress of criminals as making online transactions does not even require having a credit card in physical form, the card credentials are stored. Due to the lack of verification checks implemented by the businesses, it’s quite easier to get along without getting suspected. Due to this reason, payment fraud has become a multi-billion dollar business and is still growing. Following are some of the incidents that happened due to lack of ID verification solutions as well as non-compliant with regulations that cost businesses and individuals huge financial losses or penalties.

Credit Transfer Fraud Cases Quadruple in Greece

Bank account takeover and card not present cases have spiked in Greece. According to the Central Bank of Greece, illicit transfer of funds from one account to another has increased four times since last year. The CBG financial stability uncovered that there were a total of 1,179 cases of illegitimate credit transfer amounting to EUR 6.2 million. However, the cost of payment fraud is quite high, as access by fraudsters to victims’ financial details could lead to theft of money. According to the law enforcement authorities’ investigations, the fraudster uses phishing and vishing techniques to gain access to the victim’s personally identifiable information.

Credit Card Fraud Increases by 29% in the Philippines

Digital payments through credit cards or other channels have spiked by 29% in the Philippines since the Covid-19 outbreak, including the lockdowns and work-from-home norms. According to the reports of Credit Card Association Philippines (CCAP), coronavirus drove the adoption of conventional payment to digital means that accounts for the proliferation of criminal activities including cards not present.

“Fraud happens more often in cyberspace, given that it is easier to facilitate there. It does away with the need to secure a physical card and more importantly, it is a safer option for the fraudsters because of the anonymity that the internet provides,” CCAP executive director Alex Ilagan said in an advisory.

TSB to Ban Cryptocurrency Buying Due to E-Wallet Scam

According to a report in The Times, UK bank TSB will ban more than 5 million clients from buying or making transactions for digital currency as concerns regarding scams on crypto platforms are rising. In addition to this, the bank is planning to block more than half a million customers from transferring or withdrawing money from digital assets platforms like Binance and Kraken, as such websites don’t have to strengthen identity verification as well as AML checks. Almost two-thirds of the cryptocurrency scams are linked with Binance. In 20 days, 849 TSB clients reported losing money placed in Finance accounts. The report also stated that the platform hardly responds to the fraud allegation, and denies it at the end of the day.

How Shufti Can Help

Having in mind, FATF, FINCEN, and other financial watchdog’s standards payment industry needs to incorporate the anti-money laundering framework into their services for customer identification and screening before getting them on board. The defined obligations aim to determine the UBOs and high-risk entities that are enlisted in PEPs or global financial watchlists. Other than AML screening, FATF suggested verifying government-issued documents against regulatory checks. Thus, a risk-based approach must be implemented to stay put with the regulatory obligations.

Shufti’s anti-money laundering screening is a state-of-the-art solution for the payment industry as it can help them to identify criminals and curb money laundering activities. Shufti’s identity verification system is based on PCI DSS standards that assist payment service providers to remain compliant with the regulations. Offering services in 230+ countries and territories, AI-powered AML solution protects data security and makes cross-border transactions secure.

Final Thoughts

Financial regulations have become crucial for the payment industry. It’s significantly important for the companies to understand the risk and consequences of being non-compliant with AML compliance. The payment industry needs to adopt technology-driven solutions that will surely assist them to fight financial crimes and make them AML compliant.Hence, the digital payment ecosystem will become fraud-free.

Ready to effectively comply with the KYC and AML regulations? Try our solutions for free.

Explore Now

Explore Now