Balancing UX and Security in the Finance Sector with Biometric Authentication

The global coronavirus outbreak transformed financial operations and forced retailing banks to temporarily close down and suspend physical customer services. However, as of today, banking services are expected to be easy and safe. Financial institutions, especially the banking sector, are required to meet the surging client demands for convenience, accessibility, and trust that their assets as well as privacy are protected.

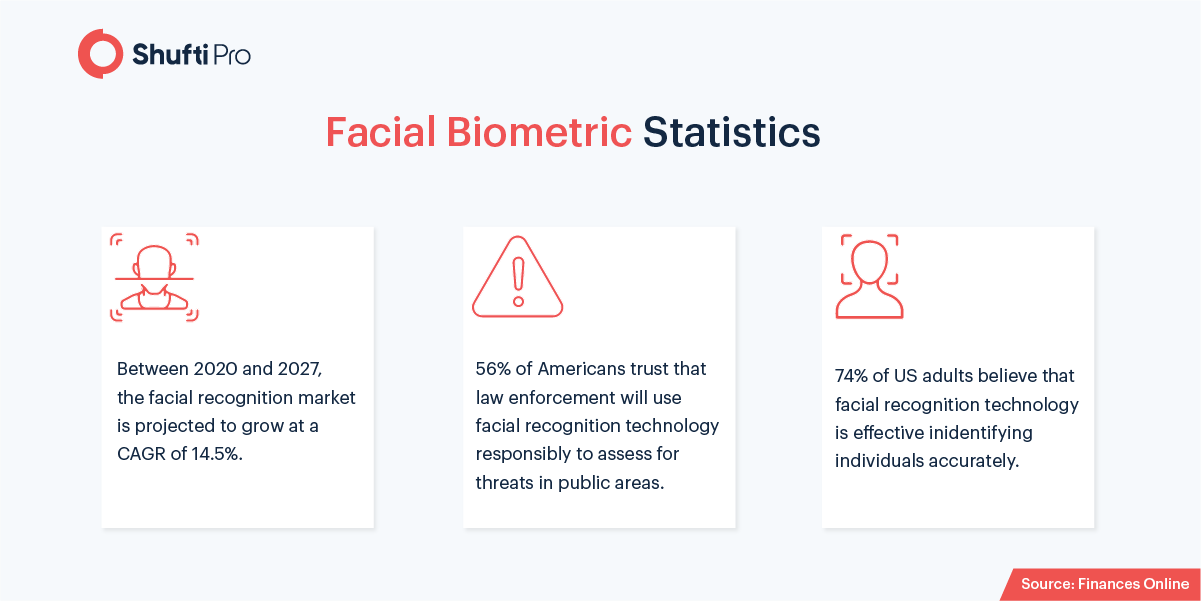

The increasing trend of digitization has accelerated the need for remote work and online banking services. However, the bars for cybersecurity and convenience have also been raised. On the other hand, digital financial fraud is also growing at a fast pace. Providing customers with seamless and secure financial services is becoming hard for financial institutions. Facial biometric technology offers a viable solution for the banking sector, as it can support them to enhance security measures and maximize client onboarding experience.

Strong Authentication and Swift Banking Experience

The rapid increase in digitization is making it crucial for all financial institutions to adopt strong authentication solutions. This is because financial services have routed towards digital channels. Yet fraudsters and money launderers have become more sophisticated, as they can now easily penetrate through the weakest links in the institutes’ cybersecurity systems. Due to this, hackers can access customer credentials, financial databases, and transactional records legitimately. The cost of online financial fraud is quite high for both parties, the victim as well as financial corporations, including the fines, sanctions, and investigation costs.

“In the first half of this year, criminals stole a total of £753.9 million through fraud, an increase of over a quarter (30 percent) compared to H1 2020. The advanced security systems used by banks prevented a further £736 million from being taken.”

Frauds including account takeovers, malicious bots, phishing attacks, and various other scams are the major driving forces that resulted in crime growth in the banking sector. However, coronavirus has also paved the way for fraudsters to earn easy cash. Millions of customers opened digital accounts and moved toward virtual wallets. However, banks need strong and robust authentication measures to curb rising concerns of financial crimes. Thus, biometric technology is considered an extra security layer as it is hard to manipulate. For financial institutions, facial biometric authentication holds significance with respect to cybersecurity and data protection. Facial verification services could be easily utilized through smartphone cameras or web cameras to verify the identities with selfie and ID documents. Other than this, biometric technology could also be integrated into ATMs to provide customers with a touchless experience. This will render an entirely new way of authenticating individuals as well as their transactions.

Money Laundering and Banking Sector: Why is Face Biometric Recognition Needed?

As financial firms, particularly the banking sector, are becoming the top target of money launderers, the Financial Conduct Authority (FCA), Financial Action Task Force (FATF), and countless other global monetary watchdogs continually come up with warnings and standards to secure financial institutions as well as the individuals. Many shortcomings in the banking sector are highlighted by the financial regulators with the aim of preventing money laundering.

Usually, due to insufficient internal controls and lack of in-house verification measures criminals use the banks to clean their illegal cash through financial systems. Following are among some of them;

Scenario # 1: Account Takeover

Money laundering intently gets access to a legit bank account. The accounts could be taken over through several techniques including stealing, hacking, phishing or even buying the credential in return for a bonus. Once criminals get access, they have complete control. Afterward, they can use it to layer illegitimate cash into legal financial systems. Due to this, the victim doesn’t get under the eye of banks or regulatory bodies, as money routes out instantly. In the worst case, its activities get noticed, it gets too late.

Suggested Read: Account Takeover Frauds – Impact, Causes, and Prevention

Scenario # 2: Synthetic Identity Fraud

Instead of taking over victims’ accounts, fraudsters create an entirely new bank account. They go through all the verification steps for registration by using synthetic identities. Such identities are created by mixing legit stolen information with false data in order to create a person that doesn’t really exist in records. Therefore, money launderers can easily route their illegitimate earnings from these accounts, which appear to be legit bank accounts with legal transactions.

Scenario # 3: Money Mules

In this instance, teenagers, particularly students, get tricked by the money launderers. As studying abroad is quite hard and loads of wealth are required, students are always in search of ways to earn easy as well as quick money. Such victims are connected by the fraudster through emails or social media platforms, attracting offers to purchase their accounts for high value. Then, criminals use the money mule accounts to route money from one source to another. In return, students get the commission. However, money muling is considered a serious offense, people become pawns of money launderers to flow money on behalf of them, in both cases knowingly or unknowingly.

Suggested Read: Age Verification Solution – Restricting Minors from Becoming Mules

Above mentioned attempts to launder money are hard to determine and curb by the ordinary identity verification approaches as criminals always have a backup for every kind of situation. Hence, facial biometric recognition systems can be quite fruitful in this regard as they hold the power of detecting spoofing attacks and other sophisticated tricks.

Streamlining Customer Convenience and Security Through Biometric Technology

Facial biometric recognition technology comes up with enough potential to assist financial institutions, and the banking sector to balance customer experience and security.

Mobile Onboarding

The client journey starts with account opening. Users can either use the banks’ website or application. By taking selfies and uploading the scanned copies of the government-issued document for ID verification. In addition to this, they also need to set up facial recognition by scanning their face. This adds an extra layer of security.

At the Bank Branch

Once the customers get themself onboard through digital platforms, clients can be instantly identified and can enter into the bank seamlessly with a facial scan. The facial recognition system matches the client’s face with the facial imprints placed in the bank’s database. If the match is positive, the customer is authorized to use the services or to carry out transactions.

At the ATM

Facial biometric technology provides multi-factor authentication and enables customers to use passwordless and cardless transactions via ATM. Biometric authentication makes ATM services faster by eliminating the time required to enter a pin or card. Eventually, the customer experience exponentially increases while retaining the security measures.

Mobile Banking

Biometric technology can also allow the clients to take benefits of mobile banking through facial recognition by getting verified virtually. Clients can securely open an account and make transactions with just one facial scan.

How Shufti Can Help

Shufti’s facial biometric recognition is an ideal solution to deep fakes and other numerous fraudulent attempts to manipulate the financial institutions’ identity verification systems. This also has the liveness detection feature that can easily differentiate between real customers and spoof attacks. Shufti’s biometric verification also has micro expression, 3d depth perception, and human facial trait analysis that fill all the shortcomings in the banking sector’s identity verification systems.

Want to know more about facial biometric verification for the banking sector?

Explore Now

Explore Now