Enhanced Due Diligence Vs. Customer Due Diligence – The Practical Approach to Counter Cybercriminals

The nature of digital operations is changing, and users are now preferring to use remote services instead of visiting offices. In the highly digitized world, businesses should not only focus on their revenues but also keep an eye on the type of customers they are dealing with. Most businesses classify their customers based on the security risks associated with them. If the companies successfully validate the identities and other sensitive records of their users, there remain fewer chances of fraudulent activities.

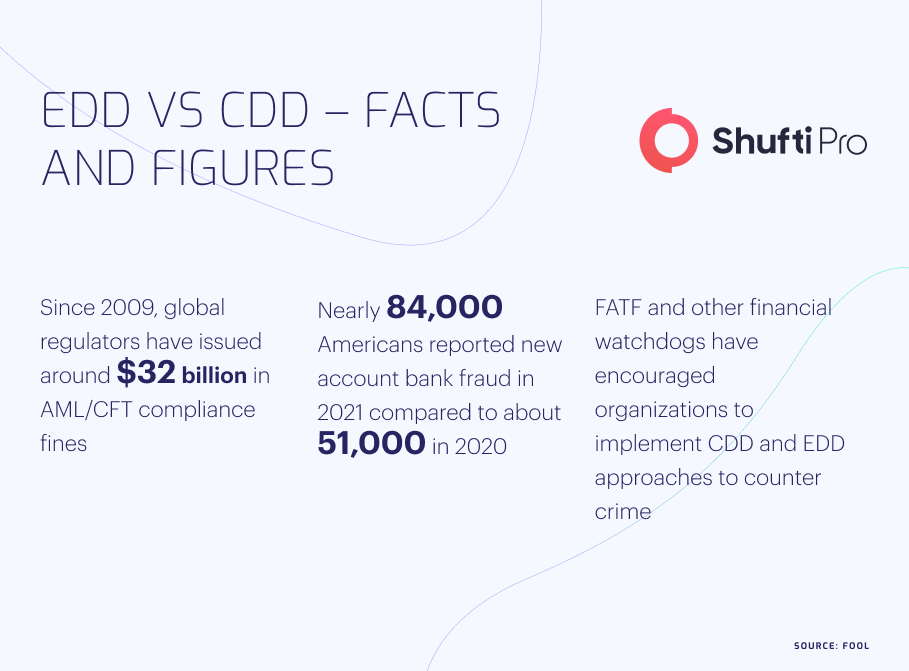

In the US alone, Federal Trade Commission (FTC) received 1.4 million reports of identity theft, raising the alarm for the regulatory authorities. Money laundering, terrorist financing, and identity fraud are significant issues encountered by digital service providers, and law enforcement authorities are working tirelessly to curb all these crimes. Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD) are the most optimal approaches for all digital service providers, which could help them in making a record of all users’ identities and counter the criminals.

An Overview of Enhanced Due Diligence and Customer Due Diligence

In order to understand EDD and CDD, it is important to know about Know Your Customer (KYC), which provides the base for identity verification measures. KYC mainly includes the biometric authentication of users, address verification, and document authentication using advanced technologies. In a time of increased digitization, KYC has become mandatory for all online companies, especially for the financial sector as they are highly prone to risks of identity theft and other monetary scams. CDD and EDD are actually two different approaches used in the KYC and AML processes, which will be discussed in this blog.

Customer Due Diligence (CDD) is an identity verification approach that is used to collect information about customers for authenticating their data. Generally, the CDD includes verifying the name of the customer, address, business information, and other financial details. Due to the increasing crime percentage, it has become mandatory for businesses to keep a record of all the users’ information and further use it in case of any fraudulent activity. Almost all financial institutions, particularly banks, crypto firms, insurance companies, and e-commerce stores, are following this model to lessen the prevailing crimes. CDD in banking is quite crucial as these financial institutions are considered the important pillar of any country’s economy. The KYC CDD has helped these institutions a lot in verifying users’ true identities and countering the bad actors.

On the other hand, Enhanced Due Diligence (EDD) is a step-up KYC process specifically used to verify high-risk individuals, companies, or countries. EDD is a complex process that involves a Risk-Based Approach (RBA) to investigate the users and counter money launderers. It requires more evidence and detailed information about the history of any specific user. In the same way, as CDD is helping businesses to counter criminals, EDD in AML helps financial companies to track the reputation and monetary activities of the users in a more detailed way and distinguish them from the sophisticated users. EDD in banking has proved quite helpful and currently, the major banks of all jurisdictions are ensuring EDD compliance to make their platforms secure from money laundering. Global financial watchdogs like Financial Action Task Force (FATF), Interpol, and European Union (EU) have also recommended the Fintech sector to implement EDD checks to eradicate terrorist financing and money laundering.

The Need for EDD and CDD

EDD and CDD in KYC/AML has adopted the form of the most crucial steps without which the concept of secure transactions has not remained possible. A large number of online service providers are following these approaches, and they have remained successful in lowering crime percentages while reporting criminals to law enforcement authorities.

Let’s have a look at the CDD and EDD process and due diligence examples in some of the prominent financial sectors:

What is CDD and EDD in Banking

Banks have always remained an important part of the global economic system, and all countries are managing their finances through the banking system. The huge influx of money in this sector has encouraged criminals to get involved in a variety of financial scams like money laundering and identity theft. Customer due diligence for banks has first remained a crucial step towards countering criminals and now enhanced due diligence in banking is revolutionizing it with more advanced and modern approaches. The EDD and CDD process in banking is quite prevalent nowadays which is ultimately helping the authorities to counter financial crimes.

Crypto Exchanges

Cryptocurrency has become the new economic norm which has all the capacity to replace fiat currencies. Investors are now preferring to invest their capital in crypto exchanges, and it has proved to be highly profitable. The overall crypto market size was $1.6 billion in 2021, which is expected to touch $2.2 billion by 2026 at a CAGR of 7.6%. Due to a high potential for investment, criminals have also started exploiting the loopholes and carrying out money laundering using these platforms. The enhanced and customer due diligence in KYC has helped the crypto exchanges a lot in implementing a system of checks and balances, which does not leave any space for fraudsters to onboard using stolen or fake identities. The customer due diligence process involves the tracking whole record of the users through biometric identification and document verification. Once the users pass these checks, only then are they allowed to invest and use the crypto firm’s services.

How to Implement CDD and EDD

In order to implement the CDD and EDD, it is important to collect all the important information of the users like name, address, ID number, social security, and other business records. Once the data is collected, the digital services provider should compare the provided details with the ones on the users’ documents. Optical Character Recognition (OCR) is the most advanced technology which can help companies to verify the authenticity of documents in real-time and compare it with users’ biometrics leaving no space for criminals.

Moreover, global financial watchdogs like FATF and Interpol have accumulated the data of money launderers and terrorists in the form of sanctions lists which must be consulted by online businesses as a part of EDD. So, to implement enhanced due diligence, it is important for the system to have access to all this global data.

The Benefits of Implementing CDD and EDD

The incorporation of CDD and EDD has generated a lot of benefits for financial companies. In the present scenario, it has almost become mandatory for digital service providers to find ideal solutions like KYC having CDD and EDD approaches. Just like customer due diligence in banking has made investments safe for users and business owners, it also has the potential to counter all types of financial crimes.

Here are some of the major benefits the financial companies are having through due diligence approaches:

Counter Identity Theft

In the US alone, identity theft cost $52 billion in 2021 to the users and further resulted in multiple crimes like account takeovers, money laundering, and terrorist financing. The banks remained the prime target of criminals and this is the reason that the concept of due diligence in banking picked up the pace. It has proved highly productive in countering identity theft and criminals now face the threat of being caught due to efficient record-keeping and verification measures by the institutions.

Identify Money Launderers

It is estimated that roughly $800 million to $2 trillion money is laundered every year globally. Money laundering through banks, insurance companies, and crypto firms is carried out using fake identities, and criminals get away without leaving any trail. In such a situation, CDD and EDD approaches have proved quite helpful, assisting digital firms in verifying the true identities of their customers via biometric verification and making a record of it for any future use.

Prevent Financial Losses

Criminals steal the identities of sophisticated users, take over their accounts and further make illicit transactions to inflict financial losses on users. It is estimated that in 2021, the financial losses from fraud rose by 77% compared to the previous year. Banks are the prime target of cybercriminals; this is why CDD EDD banking has become quite famous, and it has benefited not only the users but the owners as well.

Final Thoughts

Combating financial crimes, particularly money laundering, terrorist financing, and identity theft, is quite crucial for all financial institutions. EDD and CDD are the most feasible approaches which cannot only help the authorities to counter the criminals but also ensure compliance with global regulations.

Shufti’s KYC and AML screening services are the most optimum solutions for ensuring customer and enhanced due diligence approach. Identity verification services can verify the true identities of users by comparing them with the ones on their documents. Moreover, Shufti’s AML solution has access to 1700+ sanctions lists, and it provides results in a matter of seconds by screening users’ data against them with a ~99% accuracy. In this way, the companies can implement CDD and EDD approaches while securing their platforms for consumers.

Want to know more about CDD/EDD compliance for financial organizations?

Explore Now

Explore Now