High-Risk Transactions – How Can Enhanced Due Diligence (EDD) Help?

In today’s continuously evolving world, businesses should not only focus on the revenue they generate but also the type of customers they are dealing with. This means that verifying identities of all the stakeholders is mandatory. Businesses classify customers into different categories based on the risk associated with them. To ensure that all the customers are legitimate and do not bring any challenges for enterprises, Customer Due Diligence (CDD) is made compulsory by regulatory authorities. However, CDD cannot help in mitigating the risk of dealing with high-risk customers like blacklisted individuals or nationals of sanctioned states. Since KYC and AML compliance have become more rigid now, Enhanced Due Diligence (EDD) is a great way to help your business. You can read everything about enhanced due diligence in this blog.

What is Enhanced Due Diligence (EDD)?

Enhanced Due Diligence (EDD) is a procedure to verify high-risk transactions and customers in the company. It is a Know Your Customer (KYC) verification method that can authenticate high-risk customers categorised by the KYC risk rating system. EDD provides a higher scrutiny level that is not possible with Customer Due Diligence (CDD).

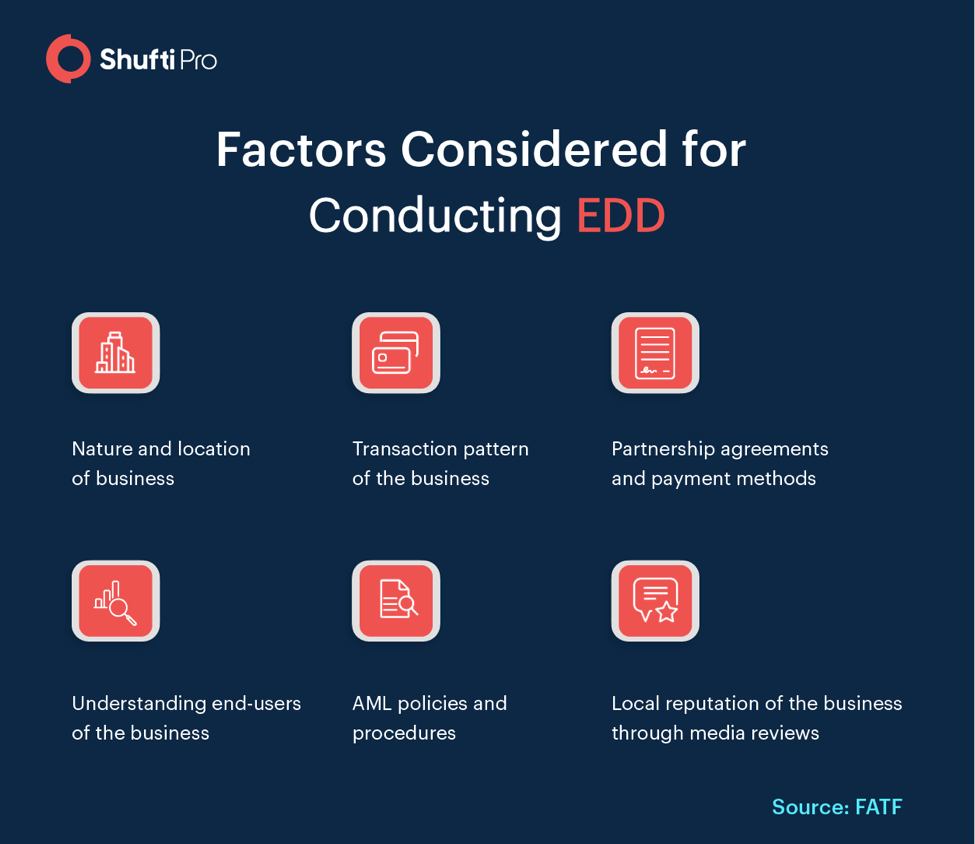

What Does FATF Suggest for High-Risk Transactions?

Financial Actions Task Force (FATF) recommends the risk-based approach for dealing with high-risk transactions or customers. All companies, especially financial institutions, are directed to develop a risk-based approach (RBA) for their company and assess money laundering and terrorist financing activities. They must take AML and CFT measures to mitigate the risk of such transactions effectively. Companies must assess the impact of high-risk transactions on their business in the RBA. As per the FATF’s 40 recommendation, the risk-based approach enables states to adopt flexible measures for targeting their resources effectively.

Process of EDD for High-Risk Transactions

The process of Enhanced Due Diligence is very simple and takes only a few minutes for completion. As per the guidelines from different regulatory authorities, here’s the process of EDD:

Step 1: Risk-Based Approach

First, a risk-based approach is developed for classifying all the customers into different categories. Classification helps in better understanding of the customers and acquiring appropriate information becomes convenient for the company.

Step 2: Create an Enhanced Due Diligence Checklist

Now, a checklist is created for Anti-Money Laundering policies and KYC checks for high risk clients. It is also known as the enhanced due diligence checklist and provides all the essential information collectively.

Step 3: Analyse Source of Funds and UBO

Knowing the customers’ source of income is crucial since illegally earned money should not be allowed to enter your business. For more effective verification, the value of all financial and non-financial assets of the client must be known. Lawfulness of the source of funds is essential for enhanced due diligence. If we find any discrepancies in the records or statements, the verification is immediately stopped. In case of B2B transactions, subsidiaries and beneficial owners of the entity must be verified during the screening of Ultimate Beneficial Ownership (UBO) of the company.

Step 4: Ongoing Transaction Monitoring

In this step, the transaction history of the customers is checked. Duration of the transactions, receivers of the payments, and similar details are considered while monitoring transactions. Apart from these details, transaction monitoring in enhanced due diligence also considers the threshold of every transaction made by the customer.

Step 5: Analyse Local Reputation of the Business

Sometimes, all the information available may not be able to give an idea of the position of brand among the local customers. To tackle high-risk transactions, enhanced due diligence checks also review the local reputation of the business. This is done by reviewing local media such as social media platforms, news, etc.

Step 6: Physical Address Verification

Since it is enhanced due diligence for high-risk transactions, the address is verified by physical visits as well. This is done to verify proof of address i.e. the address in the identity document exists in reality as well and the client is associated with it too. In case physical address verification is not possible, online address verification through latest documents such as bank statements, utility bills must be performed to control risk.

EDD Entails More than Identity Verification

Apart from enhanced due diligence’s role as an identity verification measure and fraud prevention, it has numerous other benefits too. Here are some of the perks that your business can enjoy after employing enhanced due diligence.

EDD Enhancing Your Customers Experience

As the aforementioned enhanced due diligence process has made it clear, there is plenty of information required for conducting the identity verification. All the available information will not only help you in verifying the identity of customers with high-risk transaction records, but it will also assist you in providing better services to the customers according to their preferences.

Keep Your Company’s Files Clean

While performing enhanced due diligence checks, you can prevent dirty money or illegally earned money from entering your business’s ecosystem. Maintaining clean files with all white transactions is what companies dream of and EDD verification can help you achieve that goal. You are not only verifying an individual, but all the entities associated with the business like its shareholders. Enhanced security layers will keep your business protected from money laundering and other criminal activities.

Build Credibility in the Industry

Building a positive brand image can not only be achieved through corporate social responsibility (CSR) but it is also achieved through enhanced due diligence. All the other businesses in the industry will trust you since all the transactions are strictly monitored and everyone is well aware of the fact that you do not have any high-risk clients onboarded.

Keep Fraud Schemes at Bay

Not just money laundering, but other fraud schemes like terrorist financing and account takeover can be prevented too. You can focus more on business growth and higher profits since financial crimes are at bay with enhanced due diligence. KYC/AML compliance have become more rigid and adding enhanced due diligence has become the need of the hour to prevent crimes. You can read our KYC guide to know more about the evolving laws.

Summing It Up

It all narrows down to one point – enhanced due diligence is the key to tackling high risk transactions and customers in no time. The process requires all major and minor details of the transaction to ensure accurate verification. Moreover, it has numerous other benefits apart from the robust identity verification checks. It makes your business credible for other business entities and customers. You can keep all financial crimes at bay with enhanced due diligence.

Shufti’s KYC and AML screening ensures that all the high-risk customers are identified on time so that you can keep your business secure. Furthermore, our KYC services are especially designed to streamline the customer onboarding process.

For more information about enhanced due diligence and know your customer, talk to our experts now.

Explore Now

Explore Now