Know Your Donor – Securing NPOs and Charities Through KYD/AML Solution

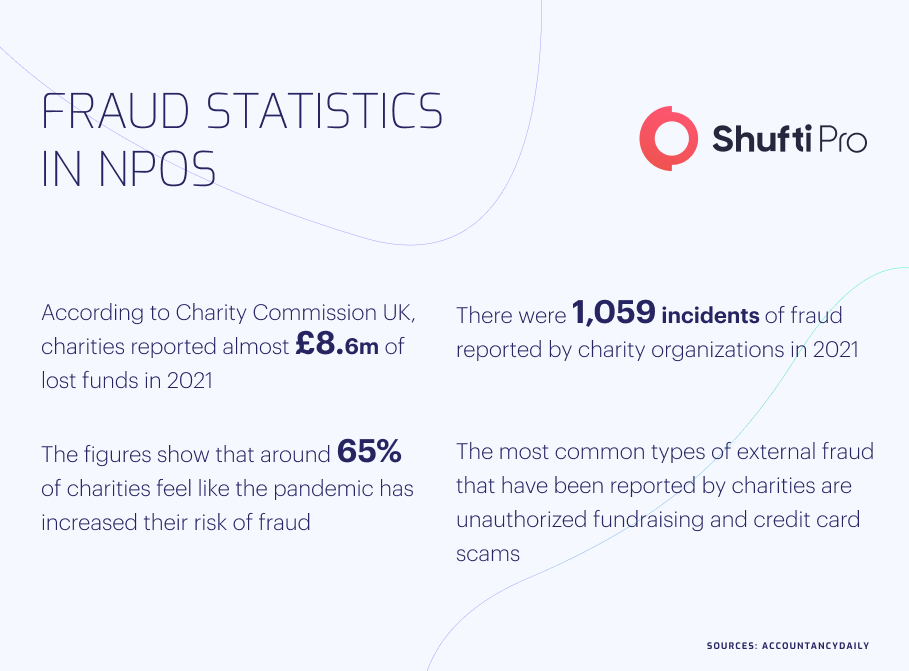

Emerging technologies and growing digitization have increased financial crime risks in Non-Profit Organizations (NPOs) and charities. All the NPOs operating on a global scale face significant threats in the form of financial fraud. Criminals are exploiting these noble platforms to carry out money laundering and terror financing, harming the overall reputation. Although a sacred sector with the aim of helping poor people, it is still home to a myriad of illicit activities.

In 2021, US citizens donated $484 billion to charity which was used to help deserving people by investing in different sectors, particularly education and health. Unlike banks, NPOs and charities have not implemented stringent checks to curb criminal activities resulting in financial losses and a bad reputation for the whole sector. Therefore, preventing criminals from exploiting the system through Know Your Donor (KYD) and Anti-Money Laundering (AML) screening checks has become imperative for whole sector.

Risks of Financial Crimes in NPOs and Charity Organizations

Money laundering and terror financing are significant crimes linked to charity organizations, raising global watchdogs’ concerns. Criminals donate large sums of dirty money to charities/NPOs, which are further layered in with legitimate funds of the organization. After that, a fake beneficiary is a setup that receives laundered money, making it legal. Multiple other ways are also used to exploit NPOs, including illegal fundraising, credit card scams, and fake invoicing.

In the US alone, more than 1.5 million NPOs have been registered, raising potential risks of identity fraud and money laundering. The Financial Action Task Force (FATF) has termed charity organizations as safe havens for money laundering and terror financing. FATF has also issued detailed guidelines for all member countries to monitor charities by implementing strict AML/CFT checks and report to regulatory authorities in case of any suspicious activity. Money laundering accounts for 3% to 5% of global GDP every year, and it is mandatory to monitor all industries, including charities and NPOs.

Fraud Cases in Charities and NPOs

NPOs and charities are also involved in facilitating bad actors by providing them opportunities to launder money. Several cases have surfaced in the past where charities have been found involved in multiple financial crimes. Fraudsters register charities using fake identities and further abuse these platforms to carry out multiple financial scams.

California Charity Scam – Operators Sent to Prison for Fraud

Law enforcement authorities of the US conducted a raid in California arresting a gang running a fake charity to commit mail fraud and tax evasion. The organization was set up to provide financial assistance to low-income families and individuals. They received $1.35 million in the fund, and only a small percentage was used for charitable purposes.

The criminals used charity money to disguise their black money by spending it on luxury items while avoiding taxes. The court found all gang members guilty and penalized culprits with imprisonment. California Police has vowed to take action against all the bad actors involved in abusing charity organizations and bring them to trial.

American Cancer Society of Michigan – A Fake Charity

Michigan Police have captured a gang who was running an illegal charity organization in the name of supporting cancer patients. In 2020, a few criminals registered “American Cancer Society of Michigan” as an NPO and received funds from the whole country, which was further used to serve purpose of money laundering.

The organization received $152,000 in funds and used this money to convert its illegal assets to legal ones. The investigations are still going on, and court has ordered to trace all other transactions involved in money laundering scheme.

Global Regulatory Authorities Monitoring NPOs and Charity Fraud

Since 9/11, global regulatory authorities and major jurisdictions have taken strict action against money laundering and terror financing. Financial watchdogs like FATF and Interpol are working tirelessly to legislate laws curbing financial crimes. Due to high influx of money, charities have also become a major source of money laundering, which has urged the legislators to monitor non-profit organizations and eliminate the chances of financial crimes.

Canada

With more than 86,000 charities in the country, Canada is highly vulnerable to money laundering through NPOs. Canadian government has termed charities as a huge source of monetary crimes and issued detailed guidelines for common people to avoid charity scams.

Office of Consumer Affairs is the primary regulatory authority monitoring non-profit organizations and has proposed several legislations to lawmakers to counter charity crimes. The law-enforcement agencies have instructed all people to contact Canadian Anti-Fraud Call Center to report any suspicious activities by NPOs.

Australia

Australian Charities and Not-for-profit Commission (ACNC) is the national regulator of NPOs. It has expressed its concerns against charity fraud and warned common people to beware while raising funds for any non-profit organization. ACNC has termed money laundering and terror financing to be potential threats to NPOs.

On its website, ACNC has mentioned a list of checks which everyone must follow while donating to noble causes through charities. It has also warned proprietors of non-profit organizations to incorporate KYD and AML measures to restrict criminals from abusing the system.

Germany

Germany has remained quite vigilant towards prevailing crimes in charities and non-profit organizations. As per German laws, all NPOs must submit tax details, information about donors, and detailed reports about the spending of funds to law enforcement authorities. In order to halt money laundering by political personalities, German authorities have put a ban on people running charity organizations from participating in politics.

Implementing KYD/AML Compliance in NPOs and Charity Organizations

In the wake of rising crimes in charities, implementing a robust system to counter criminals has become mandatory. Money laundering and terror financing are menaces to the whole financial system giving rise to several heinous crimes, particularly terrorism. Prevailing fraud in charities is not only affecting financial operations but also giving a bad name to the whole sector. Like banks and insurance companies, non-profit organizations are in dire need of strict KYD and AML measures restricting bad actors from exploiting loopholes of NPOs.

Customer Due Diligence (CDD) is critical for reducing crime ratio and verifying true identities of donors. KYD measures, including facial recognition and document verification, can help in keeping bad actors away while onboarding. Moreover, global regulators like FATF and Interpol have accumulated the data of money launderers in the form of sanctions and Politically Exposed Persons (PEP) lists which must be taken into account to identify scammers.

How Shufti can Help?

Shufti’s identity verification measures can help in identifying true identities of donors through facial recognition and document verification. Powered by thousands of AI algorithms, KYD solution is the most viable option for charities and NPOs.

Shufti’s Anti-Money Laundering (AML) screening solution has access to 1700+ sanctions lists by global watchdogs and screens data against them to identify criminals. The system is efficient enough to generate output in less than a second with 98.67% accuracy.

Want to get more information about KYD/AML solutions for charities and non-profit organizations?

Explore Now

Explore Now