Top Cryptocurrency Trends to Look Out for in 2022

- 01 Banks To Issue Their Own Digital Currencies

- 02 Aligned Regulations Across Jurisdictions

- 03 Increased Importance to Reduce Bitcoin’s Carbon Footprint

- 04 Cryptocurrency to be Accepted as a Payment Source

- 05 Boost in Cryptocurrency Education

- 06 Reduction in Crypto Frauds

- 07 Digital Currency Savings Accounts will Become the Norm

- 08 The Year of Bitcoin ATMs and Successful Crypto Brokers

- 09 AI-Backed Identity Verification Systems

- 10 Video KYC for Crypto Exchanges

- 11 Final Thoughts

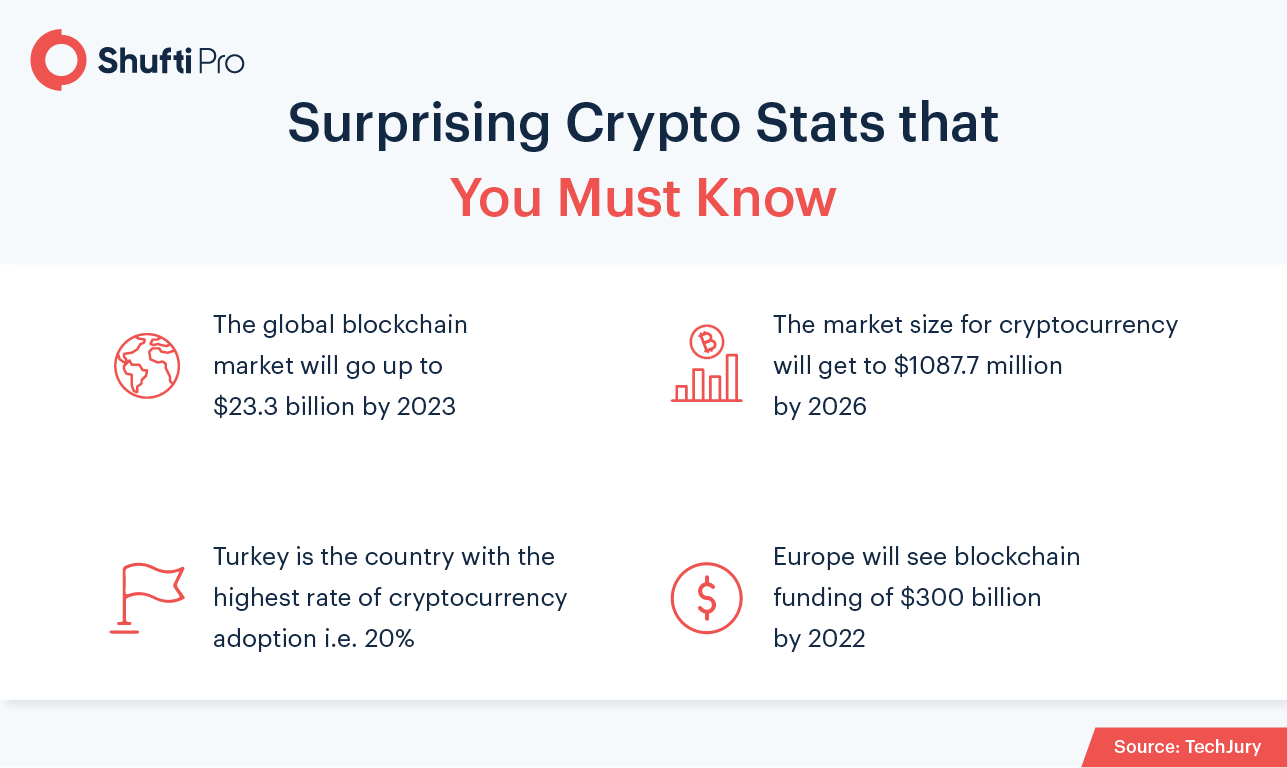

2021 has been a remarkable year for cryptocurrency as because of COVID-19 outbreak crypto industry managed to attract mass audience. Having blockchain as the backbone of cryptocurrency is considered the most secure alternative to conventional money. Regulations are being established that are making crypto businesses trustworthy. The crypto sector has made its way through and holds a market share of over $2.79 trillion, making it the world’s 8th largest economy in terms of GDP.

The crypto industry and its major players are curious to see how the value of digital currencies will change in 2022. So, let’s take a deep dive into 10 upcoming trends that will redefine cryptocurrency sector and transform the financial sector.

Banks To Issue Their Own Digital Currencies

Many governments around the world are working on their own Central Bank Digital Currencies (CBDCs) to lower the rate of bitcoin adoption. CBDC is a country’s own digital currency that can be utilized as a legal payment option. If CBDCs are recognized as legal tender, they can serve as a legitimate and reliable alternative to present cash transactions.

According to a bitcoin market study, the popularity of CBDCs will grow in 2022, as they are regulated by central banks and reduce transparency between domestic and cross-border intermediaries. However, the year 2022 will be remembered as the year when countries around the world finally experimented with their own digital currencies. China will be among the first adopters as it’s all set to launch digital Yuan during the 2022 Olympics.

Aligned Regulations Across Jurisdictions

Her Majesty’s Revenue & Customs (HMRC) has published a crypto guideline that provides guidance for transactions and taxation. Similarly, US regulatory bodies have also legislated a bipartisan bill that provides insights on digital currency transactions.

The Spanish government passed a new law last year that contains provisions to combat tax fraud with cryptocurrency. Along with the countries that already require crypto-asset holders to publish both the value of their holdings and the interest received on those assets, new legislators and governments may begin to look into further regulating the sector to improve how they oversee cryptocurrency transactions.

However, the UK and Eurozone are becoming leaders in establishing long-lasting crypto regulations. London, Miami, Singapore, and San Salvador may become international cryptocurrency hubs in 2022 as they will roll out effective and clear crypto regulatory regimes.

Increased Importance to Reduce Bitcoin’s Carbon Footprint

It’s a proven fact that bitcoin mining results in negative impacts as it consumes high energy resources, resulting in disrupting the environment, which is a major concern for the entire crypto market.

Keeping in mind the environmental factors and the efforts being made to secure it, 2022 will be the year of change as tech companies are set to develop effective solutions to make the whole mining process carbon-free.

Cryptocurrency to be Accepted as a Payment Source

Bitcoin was created by Satoshi Nakamoto as P2P digital currency. This allowed people to make transactions without involving financial institutions or banks. Due to its success, numerous businesses around the world are now accepting digital currency as a payment gateway. For instance, El Salvador became the first country to embrace digital currencies as legal tender, and banks that have the required technology available are also accepting bitcoins.

Apart from this, Spain’s second-largest bank, Banco Bilbao Vizcaya Argentaria (BBVA), has also allowed its customers to trade and carry out transactions using cryptocurrencies. Such scenarios are overwhelming and indicate the possibility of cryptocurrency being adopted as national currencies in 2022.

Boost in Cryptocurrency Education

2021 is considered a golden time for cryptocurrencies as the industry experienced significant rise in value as well as adoption. Governments and individuals are starting to realize the potential of blockchain technology, the driving force behind cryptocurrency.

It’s expected that in the first quarter of 2022, learning cryptocurrency trading and mining education will become the norm, as colleges and universities are all set to come up with blockchain courses. Moreover, virtual asset trading has become a piece of cake as tech companies have developed heaps of trading platforms and applications. Crypto enthusiasts can expect simpler approaches of trading and investing in fiat currency and converting it back into the local currency.

Reduction in Crypto Frauds

Due to its anonymity and decentralized nature, cryptocurrency is considered a haven for criminal activists. 2022 will be the year in which countries will adopt effective and stringent regulations to monitor crypto trading and transactional activities. These efforts are expected to reduce cryptocurrency scams and make transactions more transparent.

However, the recent multi-million dollar Squid Game token scam has also opened the eyes of regulatory bodies to make regulations more rigid and strict, to assure that investors don’t fall prey to the fraudsters. By building a compliance regime, suspicious transactions could also be traced and heaps of bogus schemes can be effectively exposed.

Therefore, global financial regulators, crypto market representatives, judiciary, and financial organizations need to get on the same page, collaborating with each other to ensure that the criminals don’t go unpunished. If this happens, the crypto scam statistics will be quite less in 2022.

Digital Currency Savings Accounts will Become the Norm

Bitcoin, Ethereum, and other Stablecoins can easily be staked on crypto saving accounts to yield passive income. Crypto analyst has said that staking will gain importance in terms of revenue for the investors as well as the exchanges. Currently, $9 billion in revenue is being generated annually from cryptocurrency staking.

However, once Ethereum 2.0 is launched, it will increase the staking adoption. This will eventually grow the staking revenue to 20 billion and by 2025 this could touch $40 billion. Staking is the new asset class that will trend in 2022 to use idle cryptocurrency to earn money.

The Year of Bitcoin ATMs and Successful Crypto Brokers

From senior financial analysts’ predictions, it’s clear that cryptocurrency trading will be quite easier in 2022. This is the fruitful result of Bitcoin ATMs installation around the globe. By utilizing digital currencies in the real world, governments and individuals can understand the power of cryptocurrencies. As cryptocurrency adoption and usability will increase in 2022, it will be a new dawn for crypto brokers. They will introduce interactive features and services to capture customers’ attraction.

AI-Backed Identity Verification Systems

Like financial institutions, cryptocurrency exchanges are becoming the primary target of fraudsters. Crypto dealers are finding it hard to differentiate between a fraudster and a legal entity. To secure their interest and develop a fraud-free crypto space, digital identity verification solutions are becoming a necessity. As per regulatory obligation, crypto exchanges must implement ongoing monitoring mechanisms to determine suspicious activities. Apart from that, transactions also need to be verified. This can be made possible by incorporating an AI-backed ID verification system. Anti-money laundering screening is also mandated for crypto businesses. With the help of IDV crypto exchanges can simply screen the customers against the global watchlists, sanction lists, and PEPs lists.

Video KYC for Crypto Exchanges

As digital payments are in demand, criminal activities like bogus schemes, money laundering, and terror financing are skyrocketing. Having decentralized nature is becoming an avenue for fraudsters. Digital crypto exchanges and wallet services provide the need to assure that the people utilizing the services are not criminals.

However, to determine the real identities, video KYC verification is an ideal solution. The virtual asset service providers can authenticate customers over a live video call including, identifying the legitimacy of government-issued ID documents, submitting a facial image, and providing personally identifiable information. By doing so, an authenticated profile can be developed against the customer that can be allowed to carry out transactions seamlessly.

Final Thoughts

Sooner or later, governments and individuals will realize the significance of cryptocurrencies as they are here to stay. 2021 holds importance for cryptocurrency exchanges, individuals, and financial watchdogs alike. Regulatory bodies have to collaborate with the cryptocurrency analysts to straighten the regulation and must adopt identity verification solutions to secure cryptocurrencies’ future.

Want to know more about AI-backed ID verification solution for crypto exchanges?

Explore Now

Explore Now