Cross Border Digital Payments – Regulatory Regime and the Global Context

The world is moving towards smarter payments with technology trends picking up the pace in 2021. Surge in cross-border transfers and the heightened interest in digital currencies are drastically changing the way consumers perform transactions. This also affects how businesses perform operations and deliver services since Distributed Ledger Technology (DLT) and Central Bank Digital Currencies (CBDCs) are the talk of the town. While financial watchdogs are proposing different regulations to make cross-border transfers secure and convenient, there’s more to what meets the eye.

This blog discusses the cross-border digital payments landscape, the regulatory regime, and recent events related to CBDC use for international transfers.

What are Cross Border Digital Payments?

Financial transactions performed through cross-border online gateways regardless of where the recipient and payee are located are termed as cross border digital payments. These payments include but are not limited to consumers, financial entities like banks, and corporate entities that intend to transfer funds across different regions and territories.

Recommended: Wholesale or Retail CBDCs? Settling the Endless Debate

Barriers in International Transactions

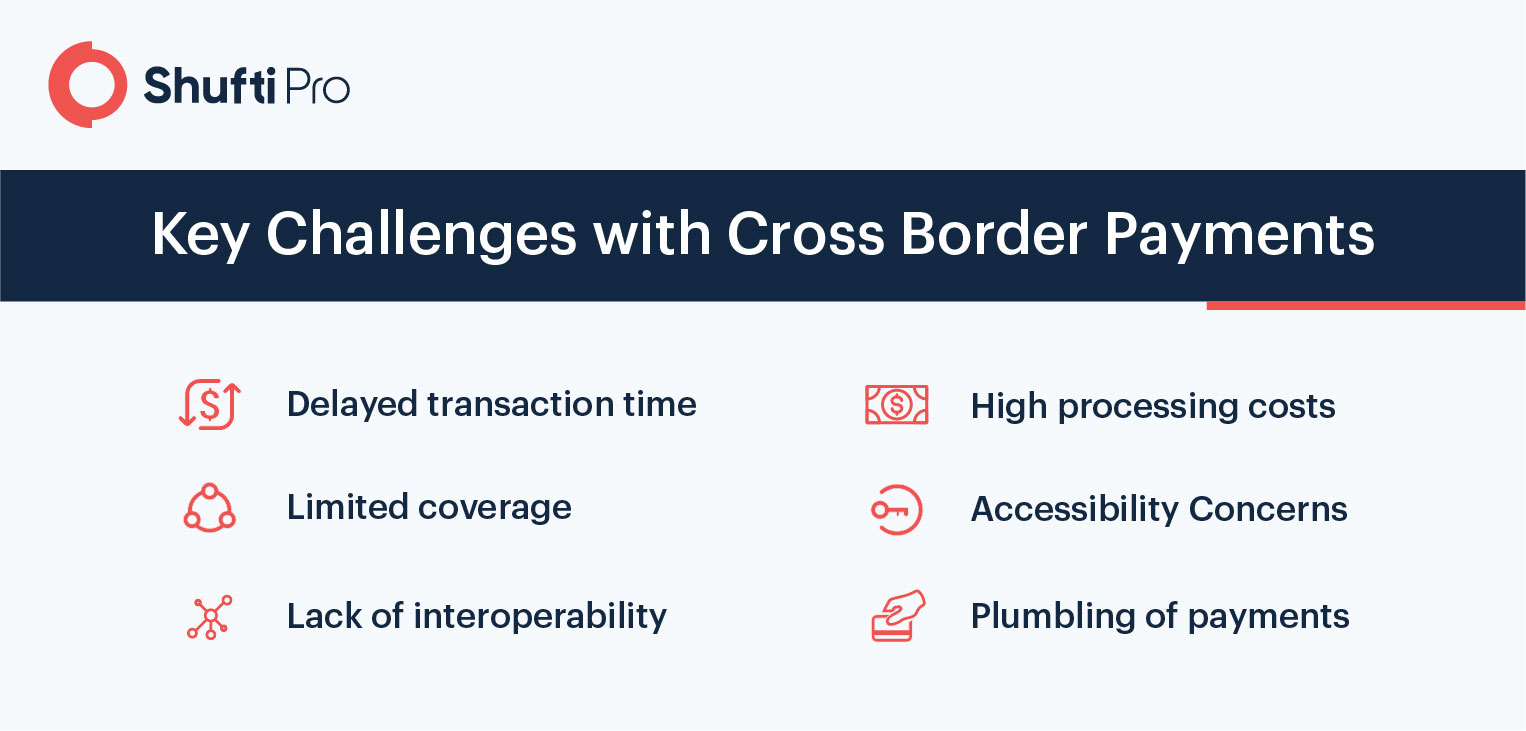

Cross-border payments are complex given the regulatory frameworks and data processing procedures of different jurisdictions. Digital payments can often take 2-3 days on average, adding further time and cost if the sender and receiver are located farther apart. When it comes to businesses, interpreting regulatory obligations carry key significance since the payments industry has quite robust penalties for non-compliance. Following are listed some concerns during cross-border digital payments that financial entities need to address.

Barrier #1 – Speed and Cost

For the time being, cross-border payments sent through online channels are costly and not so convenient for users. This is because there may be multiple intermediaries involved in processing a single international payment. Apart from that, lesser-developed markets and frameworks also add fuel to fire when it comes to cross-border payment procedures.

When we talk about the cost, it usually consists of three major things: the messaging fee, the transfer cost, and the spread on foreign exchange and its related processes. Usually, when all intermediary costs are calculated, they add up to 25 to 35 USD on average per transaction since correspondent banks need to be reimbursed for their service charges depending on separate financial agreements.

Suggested: Top 5 Payment Trends Transforming the Commerce Sector in 2021

Barrier #2 – Challenges in Correspondent Banking

Correspondent banks during a cross-border payment need to make sure Customer Due Diligence procedures are fully met and that all AML/CFT obligations are intact. Uncertainty in Know Your Customer (KYC) policies leads to heavy non-compliance penalties for correspondent banks. Some of these irregularities include:

- Banks that fail to produce an adequate income to combat compliance costs

- Financial entities that are located in a particularly high-risk jurisdiction

- The business offers services to customers that pose a high risk of money laundering and terrorism financing

These challenges can be addressed by standardising customer information acquired at the time of KYC verification. In this regard, ongoing monitoring procedures recommended by global regulatory watchdogs such as the Financial Action Task Force are also effective.

Recommended: Basel AML Index 2021 – Evaluating the Risk of Money Laundering Worldwide

Barrier #3 – Closed Loop Systems

Generally, closed-loop banking systems connect the payer and recipient to a Payment Service Provider (PSP) that acts as an intermediary between both parties. The major area of concern in these payment systems is that they are subject to compliance obligations depending upon the amount of connected countries. Oftentimes, these closed-loops are not directly linked with each other which means that they may not be supervised by regulatory authorities, ultimately requiring a specific risk management approach each time.

To cater to these risk assessment requirements and to reduce financial losses for merchants and customers, individual KYC/AML initiatives for correspondent banking can prove effective towards supervised payment systems. In this regard technological advancements such as Digital Ledger Technology (DLT) can help meet gaps in customer experience and the overall cost.

The Cross Border Payments Regulation

The European Parliament enforced the cross-border payments regulation (CBPR) in 2009 that enabled service providers to govern international transfers across different countries in the Union. The regulation’s primary focus was to streamline payment costs across all states and to make sure payment businesses have a functioning AML compliance program up and running. Since high processing fees were a primary barrier in digital payments, CBPR allowed customers some relief.

Amendments to the Payments Law

The revised cross-border payment regulation (CBPR) aims to develop cost transparency and further reduce payment intermediaries resulting in costly transactions. This specific regulation was introduced in 2019, extending the scope of the previous cross-border payments regulation, increasing transparency for card-based and digital transfers and enforcing requirements for service providers to send electronic messages of financial activities to customers.

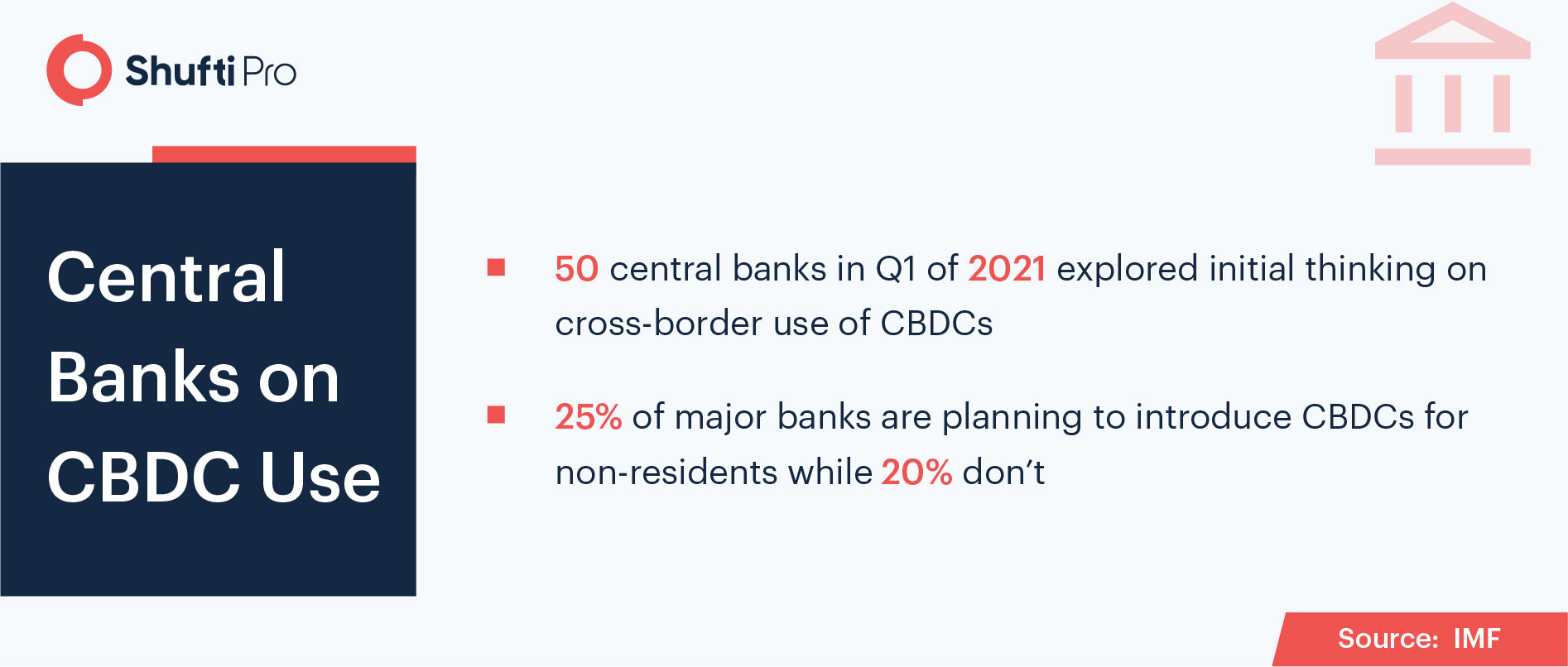

Central Banking Entities Team Up for CBDC Trials

Recently, major banks of Singapore, Australia, Malaysia and South Africa signed a mutual agreement regarding the initial performance review of Central Bank Digital Currencies (CBDCs). The main incentive is to evaluate consumer experience on the use of state-approved digital currency for international transactions. Many countries are also assessing CBDC in their national financial institutions and are planning to enter the international landscape in this regard. Likewise, South Africa, Malaysia, Australia and Singapore central banks have concluded to carry out trials for global payments using digital currencies. The joint aims to propose and implement shared platforms for cross-border payments through CBDCs.

The model will allow financial entities to perform cross-border transactions using centrally-backed digital currencies, which will allow customers to perform transactions without any third party. Thus, the cost and time per transaction will reduce.

How can Shufti Assist?

Shufti is a PCI DSS (Payment Card Industry Data Security Standard) compliant identity verification service provider based in the UK. While offering seamless KYC and AML solutions powered by artificial intelligence, we make sure that our services meet all relevant security guidelines for the payment industry. Offering ID verification products and services in more than 230 countries and territories, data security and KYC/AML compliance remains a top priority. Shufti maintains data integrity to make sure businesses offering cross-border digital payments remain compliant with industry-centric regulations and their customers enjoy an effortless onboarding experience.

Want to know more about our KYC and AML solutions? Talk to experts right away!

Explore Now

Explore Now