Digital Safety for Social Media, Gaming & E-Commerce Platforms

As people and businesses are getting more and more connected online, social media continues to play an even bigger role in terms of customer retention and loyalty. Businesses that follow social media and e-commerce best practices are empowered with an incredible source to boost customer engagement and establish brand loyalty. However, the anonymity offered by social media, e-commerce, and gaming platforms opens doors for fraudulent activities.

When it comes to digital safety, these three types of online platforms can be considered equally risky in terms of identity fraud. This is partly due to the increased dependency on technology, but also because of the negligence of service providers.

The Need for Digital Safety in the Modern Era

Although every digital platforms’ services and security measures vary in nature, fraudsters tend to find sophisticated ways to manipulate customers’ accounts. Digital safety is of particular importance when considering financial operations such as transactions in e-commerce and in-game purchases in online gaming. Similarly, the ability to register on social media platforms without any kind of verification enables fraudsters to use others’ identities to carry out their illicit motives.

To put it simply, the protection of personal information is a necessity regardless of the type of service being offered. For this reason, laws like the EU’s General Data Protection Regulation and China’s new Personal Information Protection Law are in imposed.

Social Media

In the beginning of 2021, social media platforms had 4.2 billion active users worldwide, which was more than half of the total global population at the time. On average, a user opened an account on 8.3 different social media applications.

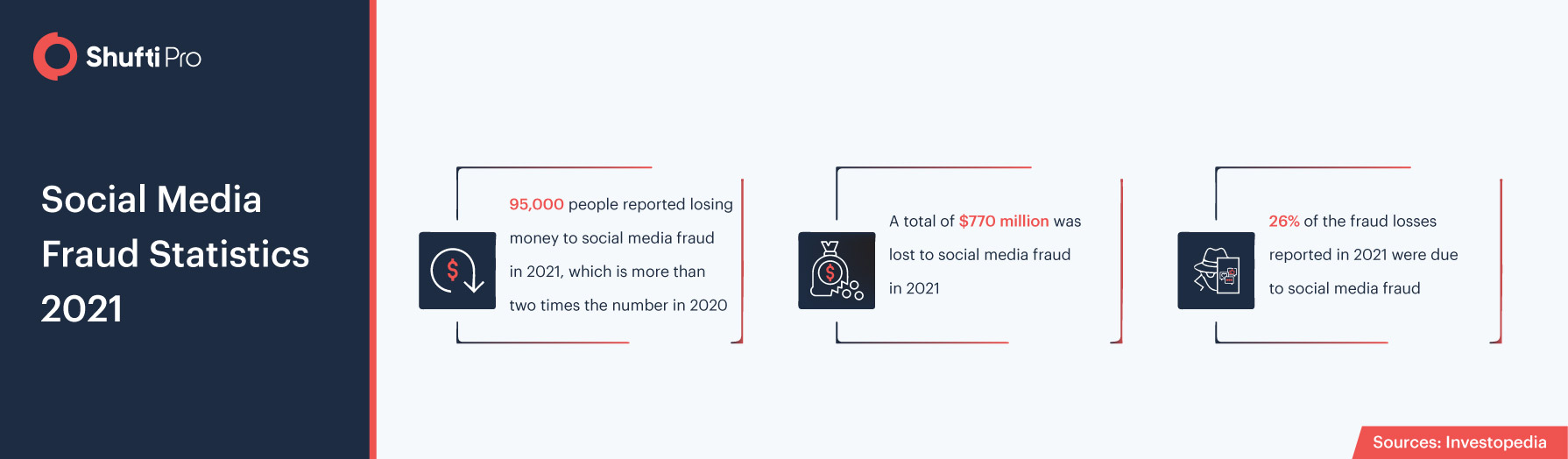

That being said, social media users have reported receiving threats of violence, identity fraud, abuse, and cyber bullying. The Federal Trade Commission labeled 2021 as a banner year for social media scammers in its latest Consumer Protection Data Spotlight.

Social media fraud losses have increased 18 times as compared to the number recorded in 2017. Although an overall increase was seen in fraud cases, the age group 18 to 29 were 2.4 time more likely to lose money due to social media scams. Looking on the bright side, social media proves to be an efficient and effective platform for businesses, entrepreneurs, non-profit organizations, and even government organizations. However, the major concern of information security has led social media platforms to receive criticism due to lack of measures for identity verification.

Cyberbullying & Trolling

Business pages and service providers operating through social media platforms have repeatedly reported instances of monetary losses originating from identity theft. As the social media marketing strategies of many businesses depend on influencers promoting their products, it’s crucial to understand the risks that originate from fraudsters targeting those particular accounts. Young influencers often face cyberbullying and trolling on social media as they provide a certain level of anonymity and such crimes do have little-to-no consequence.

Hate crimes and abuse that result in serious criminal punishment in the real world have no consequences when it comes to social media apart from harming the real owners of the accounts.

E-Commerce

Although e-commerce platforms operate differently as compared to social media, the nature of online transactions provides opportunities to fraudsters. As a result, these platforms experience several types of fraud:

Card Testing Fraud

In card testing fraud, one or more credit card numbers are accessed by the criminal. These numbers are usually stolen or purchased from particular sites on the internet. The fraudsters then make smaller purchases using different card numbers to check which ones are valid, followed by larger purchases. By the time e-commerce platforms identify card testing fraud, a lot of expensive purchases are already made.

Account Takeover Fraud

Compared to brick-and-mortar stores, e-commerce platforms offer several opportunities for fraud. One of these loopholes is used by fraudsters to take over customers’ accounts. There are a variety of ways through which fraudsters gain these accounts, such as stolen passwords, security codes, stolen customer information from the internet, and the infamous phishing attacks. Once an account is taken over, the fraudsters can cause damage to the owner by any means, such as changing the account details, making purchases, withdrawing money, or accessing other accounts owned by them.

Interception Fraud

In this type of e-commerce fraud, fraudsters use e-commerce websites to purchase items using stolen credit cards and leave out address verification checks. The billing and shipping addresses often do not match with each other, as the goal is to intercept the order before it is actually delivered to the address.

Chargeback Fraud

Chargeback fraud is a common type of fraud where the scammer contacts the credit card company or bank to void the purchase after purchasing a product or service from the e-commerce platform. This results in a chargeback, meaning that the fraudsters get back the money. This kind of fraud is particularly different as compared to others as it can even happen when a real purchase isn’t recognized by a real user. This “friendly fraud” is still damaging to e-commerce platforms, as it negatively impacts both the business and its relationship with the customer.

Chargeback fraud is purposely committed by fraudsters who exploit company policies to get free items while the purchase is being refunded to their credit card. Companies that become the victims of chargeback fraud are hit in multiple ways due to chargeback fees, lost merchandise, shipping costs, administrative costs and penalties, and banking fines.

Online Gaming

Online gaming is another sector that is commonly targeted by scammers and surged to shocking numbers in recent years. In terms of viewership and growth, the online gaming sector has become one of the largest industries throughout the world. It is now estimated that the revenue produced by online gamers will exceed $200 billion by 2023. While this sector prospers with success and creates opportunities for businesses, it also brings trouble when fraudsters exploit the anonymity-factor.

Along with the amazing growth of the gaming industry, there is also a rise in fraud cases as criminals are taking advantage of the relatively less regulated sector. Weak payment barriers and easy access to sensitive information for in-game purchases often results in gamers losing a lot of money.

Moreover, cloud access and the lack of Know Your Customer (KYC) measures further increase the susceptibility of fraudulent activities in gaming platforms.

Many of the well-established gaming platforms even provide the option to trade in-game coins for real-world money, creating opportunities for fraudsters who take over gamers’ accounts to steal their money.

What Shufti Offers

Establishing businesses through social media platforms and standing out as a prominent e-commerce or gaming service provider requires the satisfaction and safety of customers. None of these can be achieved unless the digital platforms are secured against fraudulent entities. To secure digital identities of customers in these platforms, Shufti offers an identity verification solution that enables businesses to carry out their operations seamlessly.

Want to learn more about identity verification for your online business?

Explore Now

Explore Now