KYC Verification: Eliminating Fraud from Crypto Exchanges

Despite persistent volatility, the crypto market continues to yield profits. Whilst the market will probably fluctuate, the rising number of crypto investments and firms suggests that they are here to stay. Their presence is further supported by the 2019 joint statement from the Securities and Exchange Commission (SEC), Financial Crimes Enforcement Network (FinCEN), and Commodity Futures Trading Commission (CFTC) that classified crypto firms as Money Service Businesses (MSBs), obligated to abide by Know Your Customer (KYC) and Anti Money Laundering (AML) regulations under the Bank Secrecy Act of 1970.

SEC Crypto-related Penalties Hit $2.6 Billion in 2022

Just like any other sector, crypto exchanges have also been hit hard by scammers. The SEC has charged 79 digital asset market players with 30 enforcement actions in 2022 and of those participants, 23 were firms and 56 were individuals. This shows a 50% increase from 2021 and the highest number of enforcement actions that the SEC has taken since 2013. A total of $2.6B was charged since 2013, out of which compensations amounted to $242M as of December 2022. Among the enforcement actions, the most recurrent violations were related to scams and unregistered securities services.

BlockFi topped the list of heavy financial penalties imposed by the SEC in 2022, having to pay $100 million over failure to register a crypto lending product. Moreover, FTX Co-Founder Sam Bankman-Fried was charged with a late monetary penalty for his alleged part in running a scheme to cheat investors in once a top cryptocurrency exchange FTX.

What Does KYC Mean for Crypto Exchanges?

The latest study by Coinfirm reveals that 69% of the 216 studied crypto firms don’t have “complete and transparent” KYC solutions in place —a vital part of the AML program. A report by CipherTrace indicates that one-third of the leading 120 crypto exchanges have poor KYC processes and two-thirds “lack strong KYC policies.” These stats are horrifying as poor or non-transparent KYC procedures in crypto exchanges make them a hub for fraudulent activities.

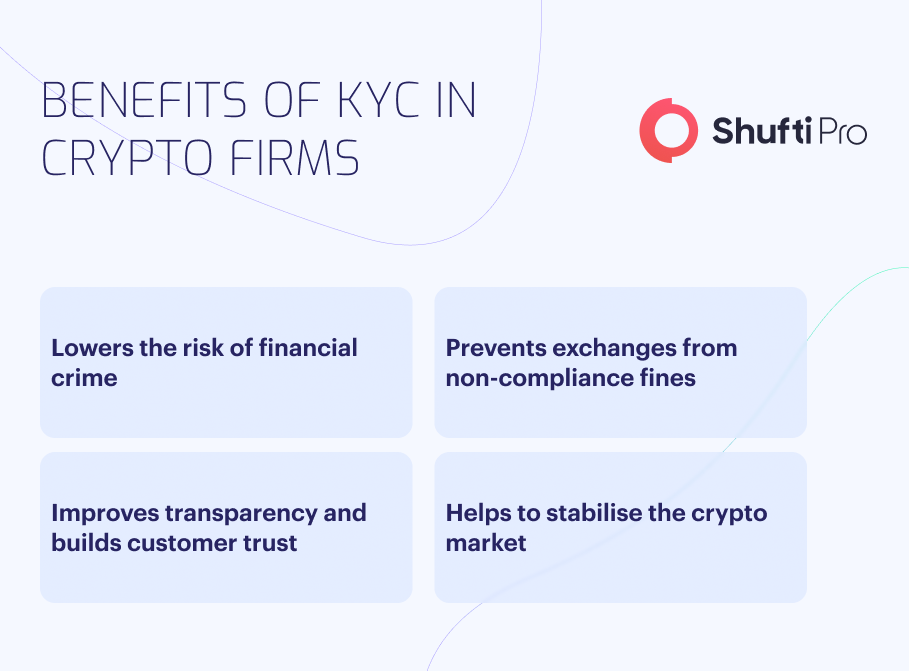

But why is KYC essential for crypto exchanges? Here are some of the benefits that robust KYC verification offers to crypto firms in the digital age:

KYC Challenges Faced By Crypto Exchanges

Crypto exchanges are required to have strong KYC and AML procedures. However conventional KYC comes with a number of challenges in terms of onboarding friction, data security, cost, and changing regulations.

Let’s deep dive into the KYC challenges that are faced by crypto firms:

Conventional KYC is Costly

Stringent regulations mean more expenses to fulfil compliance. Not only do crypto exchanges have to pay a handsome amount for registering with regulatory bodies, but they need some budget for verification purposes and to pay larger compliance teams.

Conventional KYC processes are costly as KYC involves mailing client documentation to a third party verifier and exchanges have to cover the expenses of these verification organisations. Moreover, crypto entities have to hire more compliance staff for ongoing monitoring which means a steep rise in salaries, adding another price tag to the heavy costs.

Manual KYC Procedure Causes Friction in Customer Onboarding

As the KYC verification process can not be transferred to organisations, customers need to go through the KYC procedure for every crypto exchange they use. Besides this, the manual KYC process is lengthy and time-consuming, causing customers’ drop-off rates to rise.

Traditional KYC Has Data Security Concerns

Conventional KYC procedures involve gathering, storing, and sharing customers’ sensitive details. Without having a robust data security solution in place, there is a high risk of exploitation at the hands of hackers.

The greater the number of KYC applications being processed, the greater the chances of sensitive information being passed to outsourced KYC companies, making customers vulnerable to identity fraud.

Moreover, with stringent data protection laws emerging regarding personal data collection and storage, there will probably be a conflict of interest between know your customer processes and data regulations.

Current KYC Practices Do not Satisfy Changing Regulations

With many countries ready to build their Central Bank Digital Currencies (CBDCs), it has become apparent that regulations will only increase. Furthermore, a spike in money laundering cases has also led to tighter regulations to curb white-collar crime in this modern age.

Increased regulation means in-depth and more frequent KYC procedures in crypto exchanges. Financial firms already need time, money, and the workforce to cover the latest KYC demands and KYC processes like this cannot be maintained, nor do they have the capacity to upscale KYC operations.

How Does Shufti Help Tackle These Challenges?

Shufti addresses all the concerns that manual KYC comes with. Shufti’s KYC verification solution eliminates the need for manual verification conducted by third parties and expensive compliance teams, making the onboarding process frictionless and economical. KYC and AML solution checks customers against 1700+ global watchlists to prevent hacks, money laundering, and other kinds of fraud.

What’s more is that an AI-powered KYC onboarding solution benefits your business and customers, saving time and money. Rather than manually authenticating each user, Shufti makes it easier for your customers to get themselves verified and offers verification in as little as 30 seconds.

With Shufti’s robust KYC procedures, customers can trust that the crypto exchange and its verified clients are legitimate, boosting positive user experience. Not only that, but Shufti’s KYC solution ensures compliance with changing regulations and prevents crypto exchanges from hefty penalties.

Still confused about how KYC verification solutions keep crypto exchange fraud-free?

Explore Now

Explore Now