Money Laundering in the Metaverse – NFTs, DeFi, and the Role of Shufti’s AML Solutions

For more than a decade, the metaverse concept has been picking up pace, and the world is preparing itself for substantial technological change. Although there is much work to be done in this field, experts predict that the metaverse could soon play an important role in global affairs. Due to the increasing trend, and technological giants like Facebook advocating for metaverse, a large number of companies have started investing in blockchain, crypto, and NFT technologies. As a result of the increased investments in the sector, many opportunities for profits have been created, which has also encouraged criminals to exploit loopholes and carry out several financial crimes.

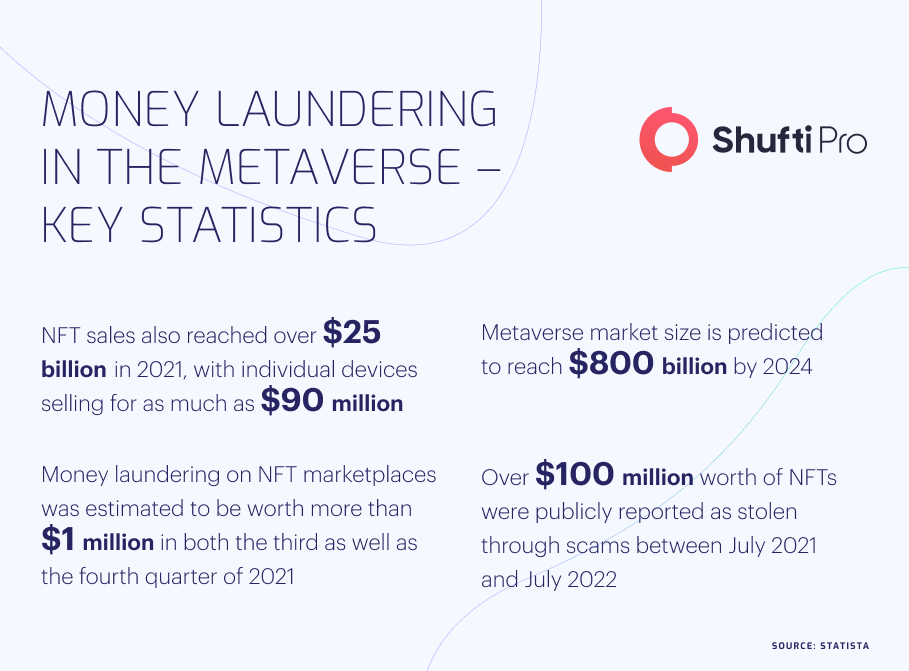

In 2021, metaverse companies faced 60% more attacks than the previous year, raising concerns for regulatory authorities globally. Money laundering is the most prominent issue faced by these companies, and due to the inherently decentralized nature of blockchain and metaverse, identifying the criminals has become a gruesome task. Criminals are just investing their black money into the system and taking it out in some other country without revealing their personal identities. In order to curb all these scams, it is crucial to enforce Anti-Money Laundering (AML) measures through which the system can automatically identify the bad actors.

Money Laundering in the Metaverse

Understanding Web3 is essential to identifying the root cause of prevailing money laundering in the metaverse. In essence, Web3 is a decentralized token economy that uses permissionless blockchain technology to perform transactions in a distributed ledger. So on such a decentralized platform, it becomes nearly impossible to track the money launderers, creating a tempting loophole that’s easy for criminals to exploit. With every coming year, NFT sales are booming which is ultimately giving rise to high participation from scammers in the system inflicting financial damages on users and companies.

The most optimum option for countering criminals is through strict security checks at the time of customer onboarding. Companies in the metaverse would greatly benefit from investing in Know Your Customer (KYC) and AML screening measures which can verify the true identities of legitimate users while countering bad actors and reporting them to relevant authorities. It is estimated that the Ethereum blockchain alone contributed to $6 billion in money laundering in a span of a few short years. This clearly shows how vulnerable blockchain and its related technologies are to financial crimes. Hence, it’s in the highest interest of Web3 companies to implement screening measures to stop criminals in their tracks.

Financial Crime and the Role of Law Enforcement Agencies

In the wake of rising crime in the metaverse, global regulatory authorities, particularly FATF, Interpol, and European Union (EU) have advised all member states to implement stringent regulations curbing money laundering and other financial scams. Law enforcement authorities from all major jurisdictions are working tirelessly to monitor sales/purchases of NFTs and identify bad actors and bring them under the law. Here are two specific examples of Metaverse fraud.

Two Criminals Charged in NFT Fraud Case

Law enforcement authorities of the United States have arrested two criminals who were involved in a multi-million dollar scheme involving illicit transactions related to NFTs. The scammers were marketing fake NFT to users, encouraging them to make the purchase in return for high profits. During the investigation, it was found that they collected $1.5 million and tried to launder this amount to other countries through cryptocurrency. Both criminals have been charged in court, and investigations are still going on to decide their penalties.

Cybercriminals Targeting Metaverse Investors with Phishing Scams

A large number of cases have been registered across different states in the US where users have complained that hackers have taken over their virtual land in the metaverse using phishing techniques. It has been found during the probe that hackers stole a victim’s land by tricking them into clicking on fake links, which ultimately resulted in losing their properties. Law enforcement authorities have labeled it a serious concern and launched an investigation to track criminals and bring them to justice.

Metaverse – The Prime Targets of Criminals

Blockchain is a vast and complex technology that demands a deep dive to understand it properly. The same is true for understanding the scope of money laundering in the metaverse, where criminals are using sophisticated techniques to abuse the system and carry out financial crimes. The scammers usually exploit Decentralized Finance (DeFi) and Non-Fungible Tokens (NFTs) to carry out their illicit activities. Let’s have a look at both of them to understand the overall concept:

Decentralized Finance (DeFi)

Decentralized Finance (DeFi) is an emerging financial technology that has challenged the prevailing centralized banking system. Through these services, users can bypass traditional banking channels, instead utilizing Peer to Peer (P2P) transactions. Although DeFi shows a lot of promise and has a lot of pros for its users, it is also prone to a higher amount of financial crimes, particularly money laundering and terrorist financing due to its decentralized nature. In DeFi, criminals often onboard systems using stolen identities and perform their illegal transactions while hiding behind a fake identity and staying anonymous.

Non-Fungible Tokens (NFTs)

A Non-Fungible Token (NFT) is a unique digital identifier that is recorded on the blockchain, which can never be copied, duplicated, or subdivided. Given their inherent nature, NFTs have provided an attractive option for money launderers to commit monetary scams and get away without leaving any trail. Like art, the value of an NFT is largely determined by how much a given buyer is willing to pay for it. Criminals use their black money to purchase NFTs and sell them to other users while converting their illicit amount into legal assets.

Ensuring Compliance in the Metaverse with AML Solutions

Metaverse is an emerging technology that has the potential to play an everyday role in our social and economic lives. A large number of individuals and businesses are aggressively investing heavily in this sector, and it is highly important to secure their assets and confidential details while keeping bad actors away. Money laundering is a global issue which is costing 3% to 5% of the overall world’s GDP, thus eradicating this menace from the economic system is essential for reducing Web3 crime. The most optimum option for a metaverse company is to implement stringent AML measures through which they can screen their new users’ details with global sanctions lists and counter criminal activity. Once bad actors are identified during onboarding, the chances of monetary scams are greatly reduced. The ideal AML screening solution should have access to all the sanctions lists by top financial watchdogs and report the suspected persons to relevant authorities.

How Shufti Can Empower Web3 Enterprises

Metaverse is a new digital reality for our world which is here to stay. Combating financial crimes, particularly money laundering and terrorist financing, is crucial for the smooth flow of the system. By investing in KYC and AML solutions, metaverse companies can counter financial crimes while making the whole sector a safe zone for sophisticated users.

Shufti’s AML screening solutions are the ideal option for a Web3 company that will ensure compliance with global regulatory standards. Powered by an AI algorithm that’s continuously getting smarter, Shufti’s AML screening solution has access to 1700+ global sanctions lists and screens data against them while providing results in just seconds with a ~99% accuracy.

Ready to find AML solutions for the metaverse?

Explore Now

Explore Now