The Vital Role of AML Compliance for P2P Lending

Archiac banking traditions saw loan applicants held in suspense, waiting for lengthy periods of time before the financial institution gave approval; even then, this process proved to be unsuccessful as many applicants were rejected. Now, we’ve seen Peer-to-peer (P2P) lending gain traction as it seems to have solved this dilemma.

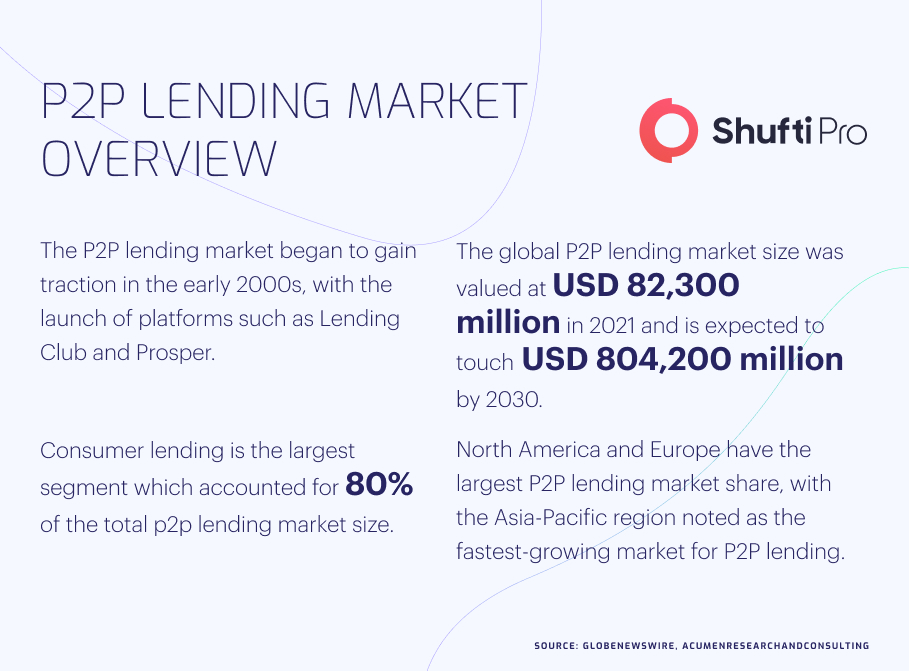

P2P lending cuts out the intermediaries and helps borrowers receive loans directly from individuals. This type of social lending seeks to make investing and financing more accessible and has worked well for millions of borrowers and investors. The global P2P lending market was valued at $82,300 million in 2021 and is projected to reach $804,200 million by 2030.

Understanding the Difference Between P2P and Traditional Lending

The P2P industry is a type of lending whereby businesses or individuals exchange money using online services through which they connect. Traditional lending was costly, as individuals would borrow money from a corporation or financial firm. However, P2P lending is cheaper because services are offered online, reducing the overhead costs. In P2P lending, interest rates are higher for investors/lenders but lower for borrowers as compared to conventional banks.

The Dark Side of P2P Lending

Whilst P2P lending is beneficial to borrowers who can secure loans with greater ease, it is accompanied by some financial and regulatory risks.

Here are the major risks associated with P2P lending:

- Anonymity: It is possible to hide an identity whilst transferring funds or applying for loans through P2P platforms.

- Money Laundering: Peer-to-peer lending companies open the door for laundering illicit funds through loans and being paid off with legitimate money.

- Structured Transactions: Utilising P2P lending, scammers can engage in “structured” transactions. It means moving money through several transactions across numerous platforms to scew the origin of illegally obtained funds and is a key component in cleaning ‘dirty money’.

- Cross-border Transfers: P2P lending involves cross-border transfers. Criminals take advantage of different regulatory standards, making it tough for authorities to track transactions.

The Key Red Flags to Watch Out for

Here are some key red flags that will indicate criminal use of P2P lending:

- Loans or transfers that involve high-risk customers, such as Politically Exposed Persons (PEPs), clients on sanctions lists or customers who’re the subject of adverse media coverage

- Loans or transfers crossing jurisdictional reporting thresholds

- Unusual patterns of transactions, loans or crowdfunding investments involving clients in high-risk jurisdictions

- Inadequate verification or false representation of loan recipients

- Using correspondent banking services whose ownership, as money transfer structures, is ambiguous

FCA Regulations for the P2P Lending Platforms

The Financial Conduct Authority (FCA) has published new regulations for P2P investment-based and loan-based platforms following requests to protect consumers/lenders in the industry. Lendy, a company that was set up to crowdsource funds to lend to property developers, crumpled due to a sharp spike in defaults. Before the collapse of Lendy, article 36H of the Financial Services and Markets Act 2000 (Regulated Activities Order) 2001 regulated the digital lending system. This was the main regulation as it caught many P2P platforms.

The FCA started reviewing how the industry was regulated in 2016 and consulted on revisions in 2018. However, the proposed amendments came into effect on December 9, 2019.

Here are the policies that P2P lending companies are required to comply with:

- Clients can not invest more than 10% of their portfolio in peer-to-peer investments without consulting an official.

- P2P lending firms will perform assessments on the customer’s knowledge of investment.

- P2P firms must be able to figure out the level of risk associated with lending money to borrowers via their platform so that they can mitigate the risk properly.

- The P2P lending firms must have in place a permanent and independent function to satisfy compliance, unless they can ascertain that this requirement is disproportionate.

How to Comply with AML Regulations?

Financial service providers have a legal binding to satisfy Anti-money laundering and Countering Terrorist Financing (AML/CTF) regulations. They are required to detect any suspicious activity happening in P2P lending platforms and report it to the authorities. As per Financial Action Task Force (FATF) recommendations, P2P platforms must implement a risk-based approach to mitigate the risk of money laundering and other financial crimes.

Therefore, P2P lending service providers must ensure that their compliance programs include:

- Customer Due Diligence (CDD) to accurately validate identities or beneficial ownership of investors on loan customers.

- Transaction monitoring to detect any suspicious activity such as unusual transactions or those occurring in high-risk jurisdictions.

- Screening and monitoring clients on PEPs lists, international sanctions lists, watchlists, and those appearing in adverse media stories.

Under FATF recommendations, peer-to-peer lending and crowdfunding services must appoint a compliance officer who has the expertise to oversee the AML program. Moreover, firms should formulate a training plan for the compliance team for an ongoing AML.

What Does Shufti Bring to the Table?

Shufti offers an AI-based AML screening solution that lets you know who you are dealing with, what they’re doing in your company, and whether you should be concerned about compliance risk.

Here are the key features of Shufti that help your digital P2P lending platform meet AML requirements:

- Perform AML Checks: Screen your borrowers against 1700+ AML watchlists

- Monitor Transactions in Real-time: Identify suspicious repayments deviating from the norm and those crossing the AML thresholds in a particular jurisdiction

- Flag Users and Generate a Red Alert: Flag users whose online presence raises suspicions, like an absence of a digital footprint and generate a red alert

Want to know more about how an AML screening solution works?