What To Consider When Implementing Forensic Document Verification Services

As the demand for digital products and services has skyrocketed, so does the need for verification services. It is expected that the market value of ID Verification (IDV) will grow by more than 13 billion by 2027.

The truth is that several companies are still using conventional methods to verify their clients. Those outdated identity verification practices are not only time-taking but also susceptible to human errors making it easy for fraudulent documents to slip through the safety net.

Any sector that deals with financial transactions must follow stringent regulations or be prepared to face the after-shocks of non-compliance.

Automated Forensic Document Verification – A Need of the Hour

Today, only those businesses can win the race that are integrating Machine learning (ML) and Artificial intelligence (AI) powered IDV services. With automated verification services, companies no longer have to depend on manual methods of Forensic Document Verification (FDV). They can instead automate the procedures to verify documents accurately and cost-efficiently. Not all IDV services are the same, but leveraging sophisticated FDV can be a key to a fraud-proof future.

Forensic Document Verification – A Brief Overview

FDV incorporates scientific rules to check the authenticity of any records. Popular forensic document authentication techniques use microscopes, ultraviolet light sources, photography and infrared imaging to identify handwriting. Experts in this field use specialised methods, particularly in courts where no individual’s records are accepted without verification.

OCR Technology – Improving Forensic Document Verification

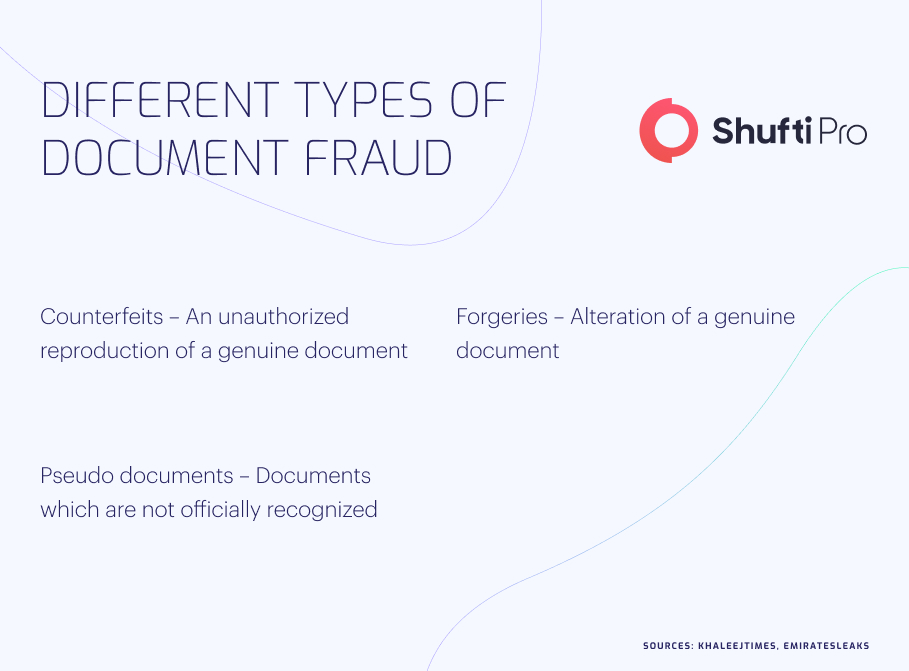

Forensic document verification is as old as the hills, dating back to 539 AD when document fraud was only falsifying someone’s handwriting or changing seals. Today document forgery includes anything and everything from terrorism financing and money laundering to identity theft. Moreover, what is adding fuel to the fire is that scammers are coming up with sophisticated strategies to falsify documents, making it difficult for the human eye to identify them.

Emerging technologies like Optical Character Recognition (OCR), AI, and ML play a major role in identifying cleverly conducted forgeries. OCR can detect documents more accurately and efficiently than manual verification procedures. It assists financial firms in verifying identity documents from foreign countries, retrieving information and then authenticating it with the in-built matching templates.

OCR, when combined with ML and AI-powered algorithms, detect any document for irregularities by matching it with the template in the database. Businesses should know that not all firms that provide IDV services offer forensic document verification. They must be aware that not all OCRs function the same and choosing the best service provider for verifying documents is crucial.

Looking for one of the best OCR service providers that are trusted globally? Contact Shufti!

Steps to Implement Forensic Document Verification

Forensic document verification plays a crucial role in Governance, Risk, and Compliance (GRC) reporting and complaint, boosting efficiencies by removing the need for manual procedures. FDV can facilitate firms to stay compliant with evolving regulations like the National Institute of Standards and Technology (NIST), Service Organization Control 2 (SOC2), and the International Organization for Standardization (ISO).

When firms shift towards FDV technology, they have to consider the organisation’s hunger for change, current infrastructure, and the staff training required.

Gathering Buy-in

Collecting buy-in from leading company leaders and stakeholders is essential for all those firms who want to move towards FDV successfully. Such internal conversations can assist in guiding resource allocation and best use cases. A good tip is to involve C-suite leaders who have expertise in developing, managing, and training the required workforce like Chief Information Security Officers (CISO) as well as risk and compliance officers.

The primary purpose of implementing FDV is to get maximum efficiency while also abiding by regulations. However, not getting cross-organizational support can make the process a cumbersome thing rather than yielding a positive net. Thus, both bottom-up and top-down buy-in is crucial to support positive culture change.

Implementing New Technology

Implementing the latest technology in the existing infrastructure and framework, such as identity verification services, has a natural risk. Thus, it is essential to allocate sufficient resources so teams can be aware of emerging identity fraud and keep their systems up-to-date.

The remaining complaint heavily depends on having a skilled team to implement risk motion strategies. Another risk that firms must consider is compliance’s burden on labour. As updating FDV systems are stressful and complicated, companies should prioritise the well-being of employees in order to avoid turnover.

Properly Training Staff

The rise of FDV requires accurate information, training, intelligence, and supervision just like implementing any latest technology. As the FDV technologies are highly complicated, more than a single training session to educate staff is required.

Only through proper training — whether that be seminars, workshops, or toolbox sessions— will the workforce be able to truly recognise their part in the FDV process and how best to curb financial crimes.

Implementing this approach is not as simple as ABC. It requires a basic culture shift on a corporate level to build a sustainable and risk-free future.

How Shufti Can Help?

Identity theft and other emerging fraudulent activities impact customer experience and destroy the business’s reputation in the market. Companies are looking for robust IDV services to make their platforms safe and sound. This is precisely where Shufti steps in.

Shufti offers the latest IDV services, authenticating clients’ documents and helping businesses onboard legitimate customers using OCR and forensic techniques. Shufti’s identity verification services are trusted globally and help companies mitigate financial crime while staying compliant with KYC/AML regulations. Powered by artificial intelligence algorithms, Shufti’s Know Your Customer (KYC) solution authenticates clients’ true identities and gives output in less than a second.

Are you curious to know how a KYC solution gets the job done?

Explore Now

Explore Now