EDD: Safeguarding Business Interests with Comprehensive Risk Mitigation

Traditional due diligence practices may not provide sufficient insights into higher-risk business relationships in today’s dynamic and complex business landscape. Enhanced Due Diligence (EDD) goes beyond standard due diligence measures, employing a more comprehensive and rigorous approach to gather in-depth information about clients, partners, or transactions. It involves gathering and analysing additional data, such as beneficial ownership, reputation checks, and Politically Exposed Persons (PEP) screening, to assess potential risks more effectively. By implementing EDD, businesses can strengthen their risk mitigation strategies, enhance regulatory compliance, and make informed decisions when engaging in higher-risk activities.

Understanding EDD

Customer Due diligence (CDD) and EDD are different forms of Know Your Customer (KYC) processes that firms implement to verify their clients. EDD was established as a set of regulations and protocols to manage clients with a high-risk profile and significant financial transactions. High-risk customers and transactions that raise suspicions pose an increased threat to the financial sector, and a conventional customer due diligence process may not be sufficient to identify them. By detecting and investigating high-risk clients and suspicious transactions, EDD procedures minimise the likelihood of money laundering, terrorist financing and other financial crimes.

What is Enhanced Due Diligence Required for?

Companies must adhere to EDD procedures when they start doing business with certain entities or individuals. This requirement applies to the following:

- Businesses located in high-risk third countries

- PEPs and their immediate associates, including family members

- Companies operating in sectors known for a higher risk of money laundering, such as the gambling industry

- Shell corporations

- Ultimate Beneficial Owners (UBOs)

- Companies that have been involved in terrorist financing and are blacklisted

Difference Between EDD and CDD

Customer due diligence checks verify the customer’s identity by matching provided information with databases using document and biometric checks. This is typically required during account opening and for facilitating high-risk transactions.

In cases where a customer is considered low risk, simplified customer due diligence may be applied, which involves solely identifying the customer without needing identity verification.

EDD serves as an additional step in the KYC process for high-risk customers. Factors such as location, occupation, or political exposure may contribute to a customer being categorised as high-risk. Consequently, the specific requirements for conducting EDD vary depending on the jurisdiction.

Why is EDD Important?

Deploying enhanced customer due diligence solutions are crucial to prevent high-risk situations that can result in significant penalties. A notable example is 2019, when the US Securities and Exchange Commission accused Credit Suisse Group AG of fraud and violating internal accounting controls. The bank had raised substantial funds for Mozambican government projects, which government officials subsequently misused. To resolve these charges, Credit Suisse agreed to pay a combined settlement of $475 million to the SEC, the US Department of Justice, and the UK Financial Conduct Authority. This highlights why banks and financial firms must apply additional EDD measures when dealing with high-risk clients, including politically exposed persons.

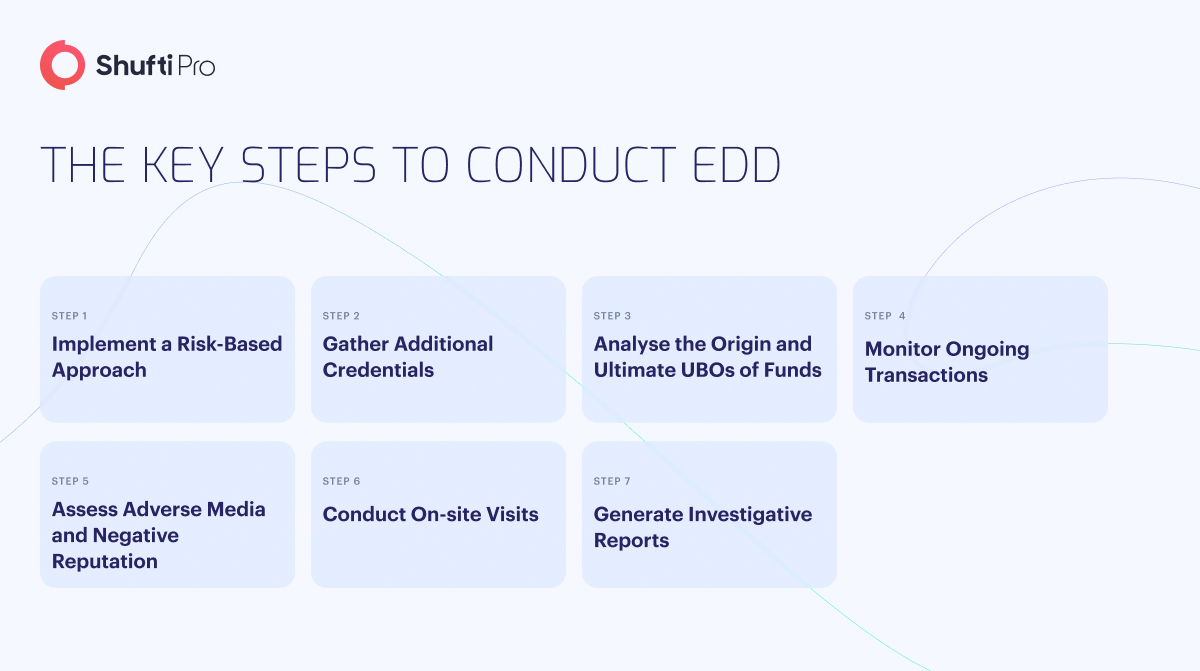

How to Execute Enhanced Due Diligence

Enhanced due diligence is a complex process that can be simplified by breaking it down into manageable tasks. Here is how to conduct EDD:

1. Implementing a Risk-Based Approach

Use a Risk-based Approach (RBA) to identify and investigate high-risk customers. Accurately assessing the customer’s risk level is crucial for achieving Anti-Money Laundering (AML) compliance, as it helps mitigate money laundering risks and financial crimes within your business. Non-compliant companies may face penalties imposed by regulatory authorities.

2. Gathering Additional Credentials

Create a checklist aligned with your AML policies to collect necessary information for high-risk customers. This comprehensive due diligence checklist should encompass all relevant customer details.

3. Analysing the Origin and Ultimate UBOs of Funds

Thoroughly analyse the source and legitimacy of the client’s wealth. Verify that the value of both their financial and non-financial assets aligns with their reported income and net worth. Detect and investigate any inconsistencies between earnings, sources of wealth, and net worth. Examine subsidiaries and shareholders in determining the ultimate beneficial ownership of an organisation or company.

4. Monitoring Ongoing Transactions

Review the transaction history of customers, if available. Investigate transaction details such as purpose, nature, processing times, and involved parties. Ensure the accuracy of this step meets the expected threshold.

5. Assessing Adverse Media and Negative Reputation

Analyse relevant press articles to form a comprehensive profile of your customers’ reputations. Consider negative findings when determining whether an individual or organisation is risky to engage in business.

6. Conducting On-site Visits

Physical visits to registered addresses are crucial for all legal entities. Verify documents that cannot be obtained digitally through on-site visits. Mismatches between the physical and official addresses on documents may indicate potential risks associated with the individual or business.

7. Generating Investigative Reports

Familiarise yourself with the fundamental parameters required to implement a risk-based approach. Based on your industry, develop risk factors that allow for regular scanning of customers and the creation of comprehensive investigative reports using AML compliance solutions.

8. Establishing an Ongoing Risk-Based Monitoring Strategy

Continuous monitoring of high-risk customers requires a systematic approach. Implement a risk-based monitoring strategy using a robust solution that provides alerts based on customer profiles or suspicious activities.

How Can Shufti Help?

Shufti offers a globally trusted AML solution that screens your clients against 1700+ watchlists within seconds and helps firms comply with global regulations. Our robust AML solution protects firms from money laundering and other financial crimes and helps them build their reputation in the market.

Still confused about how an AML solution help firms keep scammers away?

Explore Now

Explore Now