The Truth Around DeFi Compliance – Bridging the Transparency Gap

Financial markets around the world have seen increased popularity with the advent of decentralised finance (DeFi). As a result, the crypto sector has also seen a rapid boom in investments and transition towards the digital space, opening new doors of innovation for peer-to-peer exchanges. The fact that these distributive systems are still emerging makes them less prone to global rules and regulations set forth by regulators as in the current financial industry. But in order to build transparency and trust, the industry tends to develop frameworks to better govern its procedures for wider user acceptance.

This blog highlights the emerging decentralised financial systems, their staggering growth in the market, and the essential compliance measures to prevent monetary crime through these channels.

What is Decentralised Finance?

DeFi (decentralised finance) is a collection of blockchain-based applications that provide real-time digital financial services. Unlike traditional centralised systems that have space and time challenges, systems running on DeFi offer greater user control without the complex transaction process. Although financial intermediaries are absent, online payments are secure despite being on-the-go.

Financial Services – Then vs Now

As a rule of thumb, financial service providers act as a third party communication channel between the customer and the business. These intermediaries or man-in-the-middle parties charged heavy fees to cover up service charges and meet their clients’ financial needs. They also need to perform Know Your Customer (KYC) procedures that take a significant amount of time – ultimately affecting the customer experience.

Assume the example of PayPal which connects people anywhere around the world so that they can make digital transactions in no time regardless of where they are currently present. In return, it charges them a small sum of money as a service fee.

How is DeFi Different?

With DeFi, consumers are not reliant on a central authority like a bank, can significantly reduce third-party tariffs, and perform effortless end-to-end transactions stored on a digital public ledger. The various financial products and services that incorporate DeFi create a unique user experience that in the traditional financial system seems impossible given the stringent KYC/AML regulations.

When we talk about decentralised models, one important thing to note are the smart contracts which replace traditional bank transfers. These smart contracts – digital documents of transactional records and consent – over online platforms are now replacing operations that were once performed by financial entities ending the long-retained monopoly. However, ensuring the legitimacy of these digital transactions remains a concern for global and domestic watchdogs such as FinCEN, EU and FATF.

DeFi Over the Years – A Force to Reckon With

With cryptocurrency and Non-fungible Tokens (NFTs) soaring sky high in the past few years, DeFi has been the centre of attention not only for investors but also for businesses operating in the online space. A quick way to determine this growth is through keeping an eye on the Total Locked Value or TLV which is the combined sum of values of all the tokens stored on the public ledger. This number, acting as a security interest, is often used to protect transactions by utilising various DeFi protocols.

The future of decentralised finance is promising since it is rapidly growing. Despite the fact that offering a service or being a mere consumer in this sector requires the user to be technically sound about crypto industry norms, it is an apple of the eye for financial tech giants and end-users alike. Moreover, Decentralised Exchanges (DEXs) are now enabling people to exchange various kinds of virtual currencies, and conversion of asset-backed currencies like the USD.

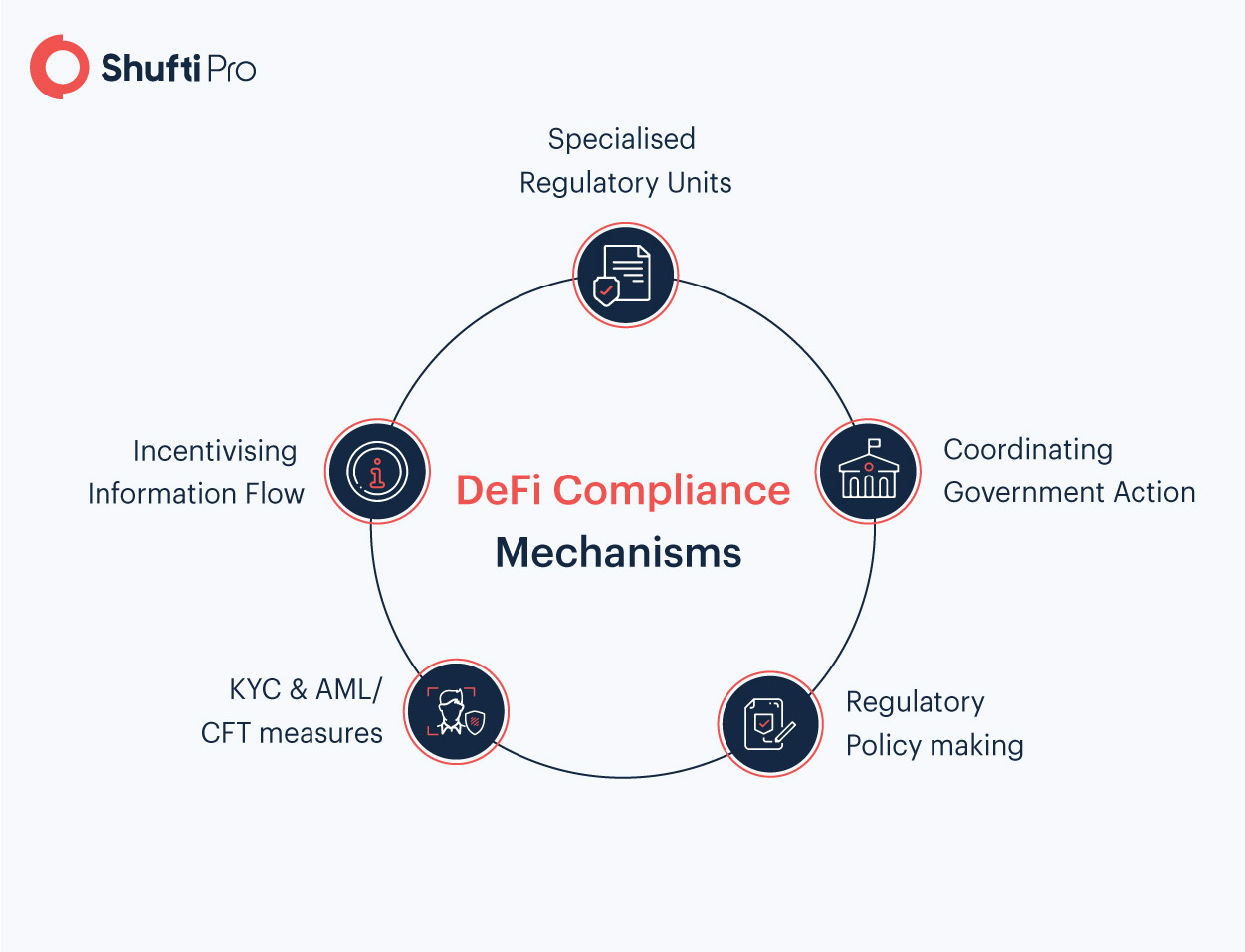

Compliance Measures of DeFi Systems

Regulating the DeFi sector is no simple task since technologies are highly complex and emerging. But to ensure the crypto industry does not serve as a haven for money laundering and other financial crime, it must be modulated given the same rules and regulations as the traditional financial system. One such regulation is the 6AMLD which entails 22 predicated offences and a regulatory framework to streamline the virtual asset landscape.

It comes with increased non-compliance penalties highlighting that crypto exchanges and DeFi service providers should develop viable measures to safeguard crypto wallet users, and to prevent financial crimes leading to money laundering and terrorist financing, thereby emphasising AML/CFT compliance.

FATF’s Take on VASPs

The Financial Action Task Force, the global supervisory watchdog, provides insight into how decentralised finance can play its role against global money laundering. Its Travel Rule for VASPs (Virtual Asset Service Providers), which is also Recommendation 16, directs financial institutions and digital asset providers to report suspicious transactional information to regulatory authorities. The 2021 update by FATF mentions that:

“The FATF should further review its draft guidance to ensure it is providing a clear message on how to apply the standards to decentralised structures, including the definition of a VASP, taking into account the risks, limitations and size of this sector.”

The guidelines laid out by FATF directly address concerns related to anonymity and its role in increasing financial crime. DeFi exchanges can reduce such illicit activities through their channels by ensuring thorough KYC verification of their users.

How can Shufti Help?

Decentralised financial systems, despite providing convenience and effortless user experience need regulatory procedures to safeguard consumers. Service providers offering digital assets should verify if their customers are transparent and honest in what personal information they give out. To cater to the needs of such blockchain-based businesses, Shufti’s AI-powered identity verification solution can offer great value, both in terms of legitimate customers as well as mitigating impersonation fraud and identity theft instances.

Our solution incorporates global KYC and AML compliance standards which enable businesses to stay compliant and ensure trust and loyalty among customers. With an accuracy of 98.67%, users can now breeze through the IDV process.

Are you a DeFi-based service provider looking for IDV services? Talk to our team for expert insight.

Explore Now

Explore Now