SEPA Instant Credit Transfer Schemes – Disrupting the Financial Sector in 2023

- 01 Insights Into SEPA Instant Credit Transfer Scheme (SCT Inst)

- 02 How Does SEPA Instant Credit Transfer Scheme Work?

- 03 The Necessity of Instant Payment in the Eurozone

- 04 Impacting the Payments Landscape

- 05 Amendments in SEPA Instant Credit Payment Scheme

- 06 How is European Payment Council (EPC) Dealing with Contemporary Challenges?

- 07 Opportunities Provided to Investors by Instant Credit Payment Scheme

- 08 Instant Credit Payment Scheme and Financial Crimes

- 09 How to Ensure KYC/AML Compliance in European Financial Sector

- 10 How Shufti Can Help

There is no denying the fact that the financial industry has vital importance in the contemporary world. Rapid digitization has altogether changed the whole concept of managing finances which is eradicating the use of cash and promoting digital transactions. Especially during COVID-19, the idea of using online means for fund transfer has intensified, and now when the effects of the pandemic are diminishing, it has become a new norm to opt for digital solutions for all operations. This is the prime reason that regulatory authorities across the globe are working tirelessly to find swift and efficient methods for fund transfer.

In 2021, 38% of businesses reported expanding their digital options, and there are chances that this number will rise to 53% in 2022 as more merchants are expected to adopt online methods for their payments. In the wake of the rising need for digital options for businesses, European Union has taken a landmark step to harmonize all 36 countries by introducing a uniform payment system. The European Payment Council (EPC) has initiated the instant payment solution “SEPA (Single Euro Payments Area) Instant Credit Transfer (SCT Inst),” which ensures local and cross-border euro credit transfer throughout the Single Euro Payments Area (SEPA) zone. Considering the opportunities and challenges businesses face with the advance of SCT Instant transfer, the digitalization of the economy brings the need to make and receive payments 24×7 and have immediate availability, all of which are being supported by the scheme.

Insights Into SEPA Instant Credit Transfer Scheme (SCT Inst)

The SEPA credit transfer is the latest technology that allows the euros transaction to be processed in seconds across the whole region. It was launched in November 2017 by the European Payment Council (EPC) with the aim to remove fermentation in the payment landscape while providing an efficient and swift borderless fund transfer service. Unlike all other payment service providers, the speed is independent of your account-providing company and all other factors. If both companies are registered under the Instant SEPA transfer scheme, the transaction will be smooth and will be completed in a few seconds.

EPC has devised an efficient payment solution in the form of SEPA Instant transfer which is available 24 hours a day on all calendar days of the year, allowing the transfer of amounts up to 100,000 Euros to other affiliated accounts in less than 10 seconds. ECP has yet to make it mandatory for all financial organizations to follow this scheme; instead, it has been made optional, which state institutions recommend. All the monetary transactions through the SEPA Instant Payment scheme will be subject to uniform standards, resulting in fast and easy circulation of money across all 36 countries.

How Does SEPA Instant Credit Transfer Scheme Work?

In the traditional banking system, the credit/money transfer is managed in batches which means all the users will make payments to the banks, and it will be processed in a big single batch at any specific time of the day. The fundamental reason for the banks to get delayed is that they have to get clearance and settlements before processing the transaction. On the contrary, the system offered by SCT Instant Payment works on a different model and processes the payment in real-time. This is why the traditional fund transfer system can never match its speed, and users prefer to opt for the swift method.

The Necessity of Instant Payment in the Eurozone

After the devastation caused by WWII across the European region, the authorities took a landmark step to merge the whole region into a single trading unit while adopting one currency. Single Euro Payments Area (SEPA) was implemented across all countries which has made it a huge trading market in the whole world. This is the most significant reason that the payment system across the whole continent is the same and is administered by European Payment Council (EPC). In 2021, non-cash payments in Eurozone increased by 12.5% to 114.2 billion compared to the previous year. In the wake of rising digital financial transactions, EPC initiated the SEPA Credit Transfer Scheme, which has facilitated users in expediting their transactions.

With emerging technologies and rapid digitization, the online system has advanced to a large extent transforming financial transactions. In order to keep pace with the fast-evolving digital system, EPC introduced the SEPA urgent payments policy, which is now implemented across all 36 countries. The banks and other payment service providers just have to register themselves under the SEPA SCT Inst scheme, which could let them transfer their funds to anywhere across the region in less than ten seconds. The most important feature that has made the plan quite attractive is its availability for businesses and individuals.

Impacting the Payments Landscape

The launch of the European SEPA SCT Instant scheme has set a development towards cross-border real-time payment services between connected banks and other financial organizations. Payment Service Providers (PSPs) can now develop overlay services around B2B invoice payments for corporates. This is particularly useful for businesses that want to implement immediate cash management practices. Firms can also achieve cost savings by efficient use of cash and the streamlining of the reconciliation process.

Moreover, instant credit transfer scheme will also help the whole Eurozone to merge into a single payment circle. Although not mandatory, EPC is encouraging all financial institutions, particularly banks, to get registered under this scheme which will ultimately make a uniform financial system leading to the institutions falling under a single banner.

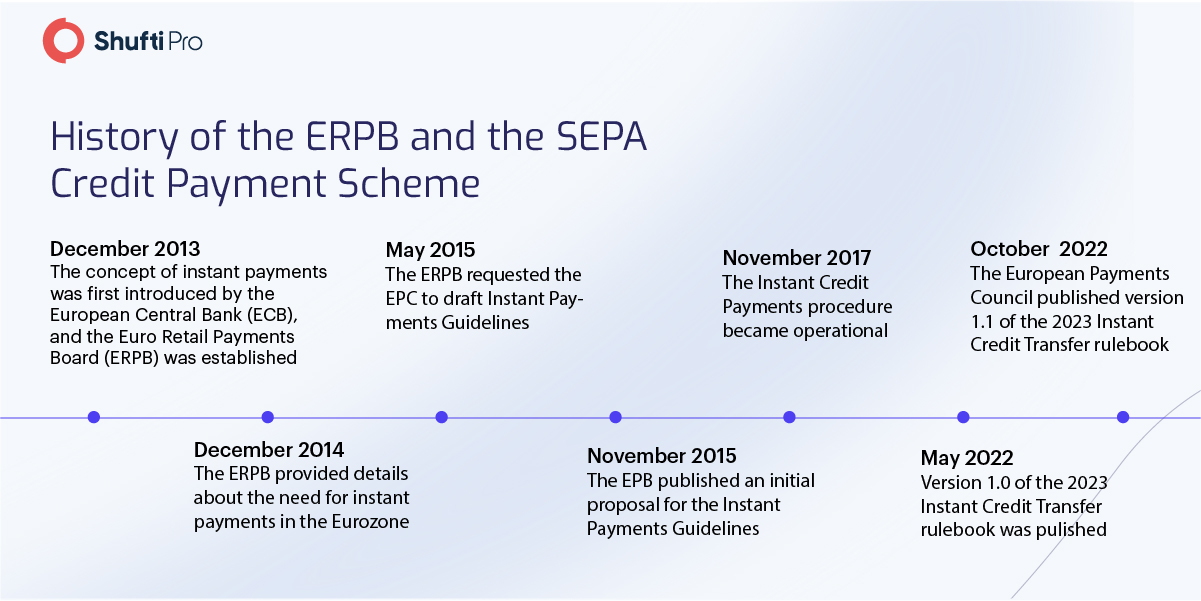

Amendments in SEPA Instant Credit Payment Scheme

The SCT Payments scheme was introduced in 2017 by the EPC, and since that time, the authorities have kept updating it to address the prevailing financial challenges. Up till now, EPC has issued three different versions of the SEPA finance scheme having updates as per the economic circumstances in the region. Moreover, the SEPA credit transfer rulebook is also issued by the EPC having all the detailed guidelines about the whole scheme:

Let’s have a look at all the different versions of the SEPA Credit Transfer Instant scheme:

SCT Inst Rulebook Version 1.0

In November 2020, the European Payments Council (EPC) published updated and enhanced versions of the SEPA Credit Transfer (SCT) and SEPA Direct Debit (SDD) rulebooks. The 2021 SEPA Instant Credit Transfer rulebook version 1.0 entered into force on 21 November 2021 at 08:00 CET and remained in effect up to 11 January 2022 08:00 CET. The Implementation Guidelines of version 1.0 were based on the relevant ISO 20022 XML message standards.

SCT Inst Rulebook Version 1.1

The SCT Instant Credit Payments rulebook currently in effect up to April 25, 2023, at 08:00 CET is the 2021 rulebook version 1.1, which was enforced on January 11, 2022, at 08:00 CET. The guidelines of version 1.1 are also based on the relevant ISO 20022 XML message standards. It reflects the disbandment of the Scheme End-User Forum (SEUF) and makes it optional for banks and other financial institutions to follow this scheme.

SCT Inst Rulebook Version 1.2

SCT Instant Credit Payments Rulebook Version 1.2 will come into effect from 25 April 2023 at 08:00 CET up to 19 November 2023 at 03:00 CET. Version 1.2 has no specific impact on the business and operational rules compared to the previous version. It will also be working on the principles of ISO 20022 XML message standards and proposes a few changes which will be disclosed in the next section.

How is European Payment Council (EPC) Dealing with Contemporary Challenges?

EPC is vigilant towards making the scheme efficient enough to deal with all the contemporary financial challenges. This is the reason that after an appropriate time, they are issuing new versions of the SCT Inst and SEPA rulebook having all the necessary changes in it. The current implemented version is SCT Inst 1.1, which is going to be replaced by version 1.2. Let’s have a look at the changes which are going to be part of this latest version and have all the essential changes as per the new developments:

- In order to cater to both retail and Financial Institution-to-Financial Institution payment use cases, the term ‘Customer’ is replaced by the term ‘Payment Service User’ (PSU).

- The payment service users are allowed to send a structured address of the Originator and/or the Beneficiary in electronic Customer-to-PSP files.

- Inclusion of the Proxy/Alias of the payment account of the Originator and/or of the payment account of the Beneficiary as an optional attribute in certain datasets.

- Extra clarifications about the charging principles.

Opportunities Provided to Investors by Instant Credit Payment Scheme

The Instant credit transfer scheme by the European Payment Council has provided individual users and digital businesses with a myriad of fund transfer opportunities, which has eased multiple operations for users. Here are some of the prominent benefits that financial organizations can avail by enrolling in the SCT Inst scheme:

- Enter into the scheme; instant sepa credit transfer allows you to make payments to suppliers and receive payments from customers in Euros from anywhere in the SEPA zone, 24×7, with full settlement certainty.

- Join SEPA credit transfer instant policy and benefit from standardization and error reduction: a single format for the entire SEPA zone based on the ISO 20022 XML simplifies multi-country payments.

- Simplify reconciliation processes with up to 140 characters of narrative information through SEPA online banking.

- Consolidate redundant low-volume Euro accounts from several countries into fewer locations with SEPA instant transfer banks structure.

- EPC website contains the SEPA Instant credit transfer bank list, which can help users in getting information about banks registered under the policy.

- Centralize your internal operations and transactions into one point (e.g., to a Payment Factory or Shared Service Centre).

- Maximize your liquidity with round-the-clock transactions, with immediate credit to your account 24×7 with the SCT SEPA credit transfer method.

- Maximize your cash flow efficiency with just-in-time payments that can take place during non-traditional business hours, including weekends.

- By studying the sepa sct rulebook, all the information related to funding transfer can be acquired.

Instant Credit Payment Scheme and Financial Crimes

Although the EPC has worked a lot to ensure safety and security in money transfer credit card, there are still strong chances of a myriad of financial crimes. European Union is a vast trading market and due to the high influx of money on the net, criminals try to exploit all such platforms through a large number of illicit activities, particularly money laundering, terrorist financing, and identity theft. Balance transfer credit cards and other transactions through this scheme are prone to all these risks, which must be addressed by the authorities.

Money Laundering

Money laundering is one of the top crimes associated with all financial organizations. It is costing 2% to 5% of the global GDP every year which made it a highly potent crime for all the trading markets. It is estimated that EUR715 billion to EUR1.87 trillion is laundered only in the European market, which ultimately raises risks for SCT Inst. As it is providing a lot of ease to the users to transfer their funds across all the member-states within seconds, there are strong chances that criminals will try to exploit all these platforms to transfer their illicit money to other countries. It is in the higher interest of online service providers to implement stringent Anti-Money Laundering (AML) measures which should have access to global financial sanctions lists and counter criminals while screening data against them.

Identity Theft

Identity theft is one of the most prominent crimes linked to digital businesses which is inflicting financial losses on users. It is estimated that 25% of Europeans have experienced fraud in the form of stolen identity at some point while doing online transactions. Criminals stole the identities of sophisticated users and various onboard platforms using that information while inflicting financial damages on them. The SEPA instant credit transfer banks are also exposed to the threats of identity fraud which bad actors could exploit. In order to minimize the risks of this particular crime, the platforms should implement an efficient system of Know Your Customer (KYC) and Know Your Transaction (KYT), which will ensure safe and secure fund transfers through all platforms.

How to Ensure KYC/AML Compliance in European Financial Sector

With emerging technologies, criminals are also finding advanced and modern means of committing fraud with digital platforms. Although European Payments Council has introduced quite a revolutionary scheme for the financial industry, it has also become necessary to accompany it with modern solutions efficient enough to counter fraudulent activities. Besides assisting sophisticated users, the scheme is also quite favorable for criminals and contains a lot of loopholes.

Money laundering threats are largely associated with it, and ensuring AML compliance for all digital platforms is quite crucial. The Financial Action Task Force (FATF), the primary body working to counter money launderers, has accumulated huge data in the form of sanctions lists that must be consulted while onboarding new users. It will not only help the authorities to counter criminals but will also ensure a seamless onboarding system.

To add to it, identity theft is another major issue associated with online financial transactions, which can be curbed using efficient KYC measures. Biometric authentication and document verification are the most important parts of the KYC solution, which can counter criminals with stolen identity while onboarding and ensure global compliance. By implementing KYC checks, all the platforms can verify the true identities of their users while maintaining a thorough record of them for any future use.

How Shufti Can Help

Combating money laundering and identity theft is crucial for all digital platforms registered under the EPC credit transfer scheme. It is a vital chance for all payment service providers, and it is here to stay. It is in the higher interest of the businesses to invest in the AML/KYC solution to ensure the secure use of their services.

Shufti’s reliable Know Your Customer (KYC) solution is the ideal option for all digital platforms opting for the Instant Credit Payment scheme. By incorporating advanced security checks, particularly biometric authentication of users and document verification using Optical Character Recognition (OCR) technology, companies can securely onboard customers and keep a record of financial transactions.

AML screening solution by Shufti has access to 1700+ sanctions lists by global financial watchdogs and screens users’ data against them while generating results in a matter of seconds with a ~99% accuracy.

Want to know more about our AML solutions to comply with the Instant Credit Payment scheme?

Explore Now

Explore Now