Fraud Prevention – Challenges, Strategies, Best Practices, and Technologies

- 01 Growing Fraud Cases - Post COVID-19 Situation

- 02 Top 3 Types of Online Fraud

- 03 Impacts of Digital Fraud on Online Marketplaces

- 04 Challenges Faced by Authorities in Fraud Prevention

- 05 An Overview of Top Strategies to Halt Online Fraud

- 06 Fraud Prevention Technologies

- 07 How to Ensure Compliance and Secure Digital Sector?

- 08 How Shufti can Help

The twenty-first century is by far the most revolutionary time in the history of humans in terms of technology. Every other day businesses witness innovations that ease their operations and make way for rapid digitization. Mobile banking, e-commerce, online insurance portals, and blockchain technology are all classic examples of advanced technologies. But this technological growth has come at the expense of online fraud, which often leads to non-compliance concerns for businesses. The financial sector, including banks, crypto firms, insurance companies, and online payment platforms, is more or less vulnerable to the after-effects of fraudulent activities. Hackers steal the data of customers of a bank, join online forums using compromised data and carry out illicit activities.

In the first half of 2022, US consumers alone reported more than 800,000 fraud complaints, of which more than 27% were related to monetary losses. Financial organizations are the prime target of criminals due to the influx of money coming in and out of the sector. Fraudsters are using a myriad of advanced techniques, particularly stealing identity, hacking, and phishing attempts to onboard the system and get involved in criminal activities. Although all the companies are enforcing stringent anti-fraud measures, the crime percentage is increasing every year, urging the authorities to find more robust solutions. The global financial watchdogs, particularly Financial Action Task Force (FATF), European Union (EU), and Interpol, are also working tirelessly to legislate global laws and help the member states comply with them through seminars and guidelines.

Growing Fraud Cases – Post COVID-19 Situation

While global fraud cases were growing at an unprecedented rate due to rapid digitization, COVID-19 further aided the criminals as a large number of on-site businesses started remote services. A survey conducted in August 2020 by fraud examiners showed that 45% of digital service providers reported that there was a significant increase in cyber attacks during the pandemic. Now when the shutdowns are over, and operations are normalizing, the criminals have become quite advanced in their fraudulent techniques while becoming able to conduct high-level hackings and inflict financial damages to consumers.

The whole digital system is in dire need of stringent anti-fraud measures that will prevent financial losses and save organizations from reputational damage. The most prominent solution available to counter the criminals is Know Your Customer (KYC) measures which use several advanced technologies like facial recognition, Optical Character Recognition (OCR), and Near Field Communication (NFC) to detect fraudulent activities by bad actors. Although COVID-19 has provided criminals with attractive opportunities for fraud, it has urged the authorities to find modern solutions to halt the fraudsters.

Top 3 Types of Online Fraud

With innovation in the technological sector, criminals have also become more advanced and are using intelligent techniques to defraud the system while exploiting loopholes. There are a large number of fraudulent activities which have been observed by law enforcement authorities, like identity fraud, credit card scams, account takeovers, and payment fraud. The whole digital sector has been affected by these crimes which have ultimately resulted in users and companies losing billions of dollars.

Let’s study some of the prominent fraud which are prevalent in the online system:

Identity Theft

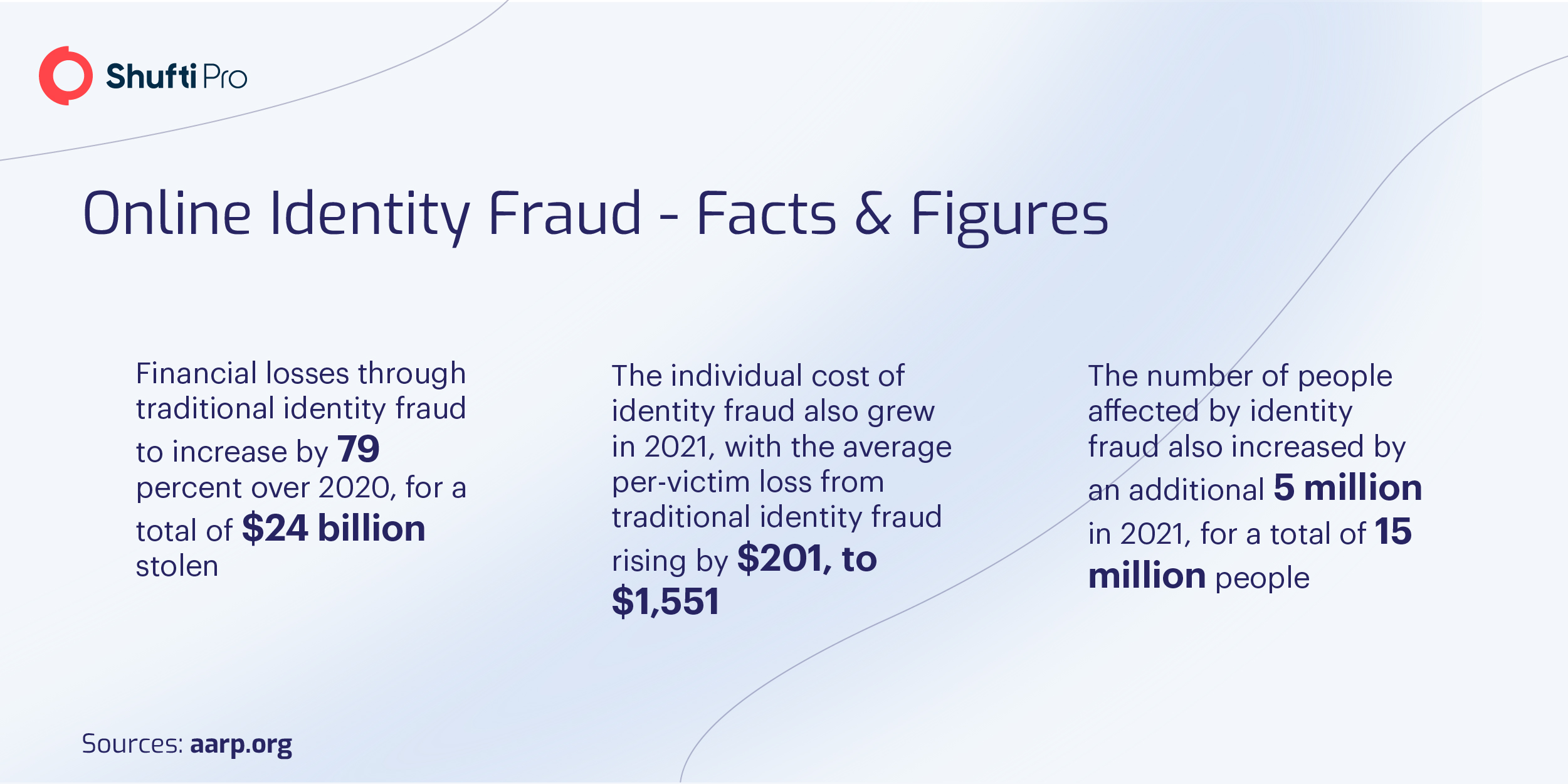

Identity theft is an issue that is quite common nowadays and causing a lot of trouble for companies as well as users. The United States is a country that is under severe threats of identity fraud, as 15 million people had their details stolen alone in 2021. Criminals steal the identities of consumers through various means like phishing and hacking. While using the users’ sensitive data, they manage to make accounts and onboard any online platform to get involved in multiple fraud practices. The major problem linked to identity theft is that it becomes a gruesome task for authorities to identify the fraudsters as they use the right information while joining any platform and get away without leaving any trail after the crime. Money launderers and terrorist financiers frequently use identity theft to carry out heinous crimes, disguising their original identities.

Online Payment Fraud

Online payment fraud is also quite frequent nowadays, through which criminals are inflicting financial losses on users. The fraudsters steal the identities of users, log in to their bank/e-commerce accounts, and transfer money or make online purchases. In this way, the original user does not even get to know, and bad actors get away after carrying out illicit transactions. According to an estimate, online payment fraud cost e-commerce $20 billion globally in 2021, with an expectation to increase in the coming years. This is one of the

Account Takeovers

Account takeover is another prominent fraud that has highly affected digital operations and cost users billions of dollars in losses. According to a 2021 study, 43% of US merchants claimed that account takeover fraud accounted for over 10% of chargebacks. The criminals steal users’ identities, further logging in and changing the credentials leaving the customer losing their accounts. As soon as the fraudsters get access to accounts, they can do whatever they want to, and also this crime lets them disguise their original identities. The problem with account takeover is that it is not only limited to e-commerce stores but also encompasses social media platforms, ride-hailing services and real-estate sector through which the criminals defraud the users in several ways.

Impacts of Digital Fraud on Online Marketplaces

The increasing number of fraud in the digital financial sector is putting significant effects on the overall marketplace. Not only are users bearing the monetary losses, but it is also damaging the repute of the industry by discouraging users from avoiding remote services, which further creates problems.

Here are some of the top impacts which the digital sector has observed in the recent past due to increasing fraud:

Financial Losses

Identity fraud, credit card scams, online payments, and account takeovers are all fraudulent activities that are performed to get illicit financial gains. In the US alone, consumers lost $5.8 billion to different online scams in 2021, which is 70% more than the numbers in the previous year.

Reputational Damage

Reputation always remains quite important for any on-site or remote business which is highly damaged by any fraudulent act. After rapid digitization, it has almost become mandatory for all people to use digital services, without which it is hard to cope with daily tasks. The increasing risk of fraud is giving quite a bad name to banks, crypto firms, insurance companies, and other departments, further deteriorating user experience and causing trouble for businesses as well.

Money Laundering and Terrorist Financing

Money laundering is a global issue that has raised concerns for financial watchdogs, and they are working actively to eradicate this menace from the economic system. Fraud in the digital sector is also promoting money laundering as criminals adopt the identities of other users and carry out the crime while staying disguised behind different details. It is costing 2% to 5% of the global GDP every year, and there is strong evidence that terrorists are also using laundered money to commit heinous crimes. The Financial Action Task Force (FATF) is the primary authoritative body that is working to curb money laundering and terrorist financing bounding the member-states to comply with global regulations.

Increased Budgets of Companies

The anti-fraud market was estimated at $19.5 billion in 2020, which is expected to grow to $46.4 billion by 2026, ultimately increasing the budgets of online businesses. With the increasing crime, particularly identity theft and money laundering, the digital sector is incorporating Know Your Customer (KYC) and Anti-Money Laundering (AML) measures to cope with the situation, which is the prime reason for companies’ expenditures ballooning globally.

Challenges Faced by Authorities in Fraud Prevention

Although global law enforcement authorities, along with the companies’ stakeholders, are taking drastic steps to counter crime, there are multiple challenges that digital sectors are facing right now. Besides the active role of responsible financial agencies, the crime percentage is increasing at an unprecedented level.

Let’s have a look at some of the prevailing challenges in the way of fraud prevention:

Accelerated Digitization

Since the pandemic, digitization has skyrocketed, encouraging businesses to offer their services on the internet. Nowadays, consumers have no option other than to interact digitally with the service providers. Due to this trend, a large number of businesses have started offering their services without implementing any stringent KYC and AML measures, encouraging the bad actors to exploit the loopholes and get involved in fraudulent activities.

Digital Identities

E-commerce stores, mobile banking apps, crypto firms, and the insurance sector all rely on users’ digital identities to approve their services and financial transactions. The problem with the whole system is that it all requires users to input their personal details to onboard which makes them highly vulnerable to financial crimes. In the UK alone, roughly 28 million data breaches are recorded every year, and the number is increasing with high-paced digitization.

Lack of Global Laws

The major problem with digitization is that it has its presence across the world, and users can interact with the person anywhere on the planet, raising the need for global laws. Although a lot of financial watchdogs, particularly the Financial Action Task Force (FATF), European Union (EU), Global Financial Integrity (GFI), and Interpol, are working tirelessly, there is still room for improvement. Several countries are considered safe havens for digital crimes, and agencies do not have their authority there. All such regions are actively contributing towards increased crime percentage globally and are in dire need of effective legislation.

Complex Anti-Fraud Measures

The majority of the screening solutions which are generally used to identify and report criminals are quite complex and time taking. When companies implement these measures like KYC and AML, the overall scrutiny process becomes quite complicated, which is usually disliked by the users. Although there are multiple Artificial Intelligence (AI) powered solutions available in the market, the majority of the companies are following traditional methods causing users’ dissatisfaction.

An Overview of Top Strategies to Halt Online Fraud

Financial crimes, particularly money laundering, terrorist financing, and identity theft, have raised serious concerns for global law enforcement authorities. This is the reason that financial watchdogs are encouraging all member-states to find solutions to these issues and implement them to counter criminals. Almost all online businesses have now started following the guidelines and incorporating best practices to eradicate the chances of financial irregularities.

Let’s have a look at the top strategies which are frequent among digital companies nowadays:

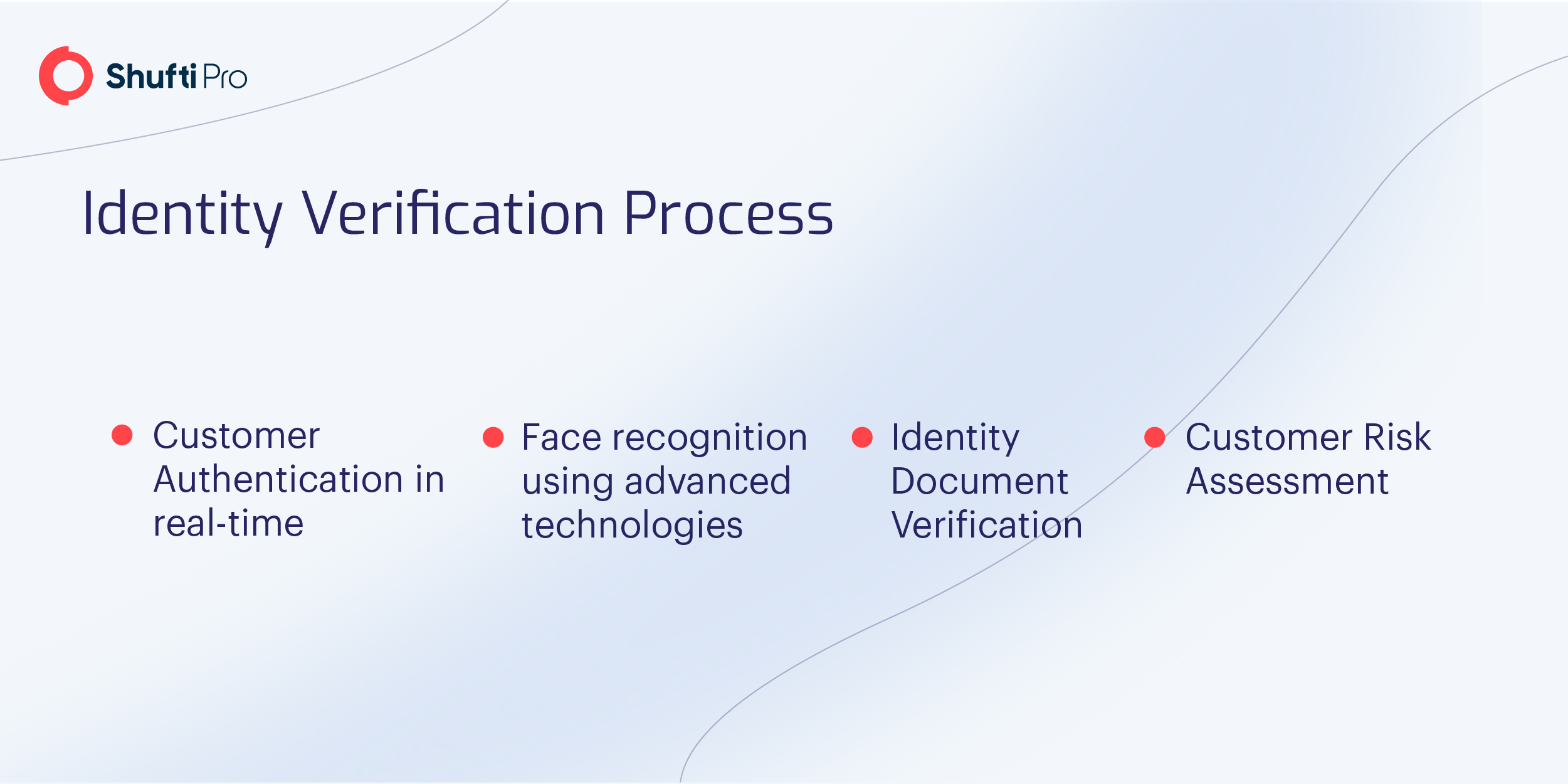

Adopting Agile Know Your Customer (KYC) Processes

Know Your Customer (KYC) solution is not only a compatible solution but also highly recommended by the global financial authorities. KYC includes a variety of modern techniques like face recognition, document authentication, address verification, and many others, which help companies to identify criminals and report them to agencies. In 2021, global KYC spending touched $1.4 billion, with an expectation to rise in the coming years. So the top strategy for a majority of online businesses is curbing digital scams through effective KYC measures powered by AI, which can generate results in a few seconds.

Empowering Businesses Through Artificial Intelligence and Machine Learning

As the traditional methods of identity verification and anti-money laundering screening are quite complex and take a lot of time to verify the users, the trend of using AI-backed solutions is picking up the pace. Online companies are investing in AI-powered KYC and AML solutions that can screen users through advanced checks while providing results in a matter of seconds. Artificial intelligence and machine learning are producing effective results, and the system is getting smarter with time, leaving less need for programming.

Enforcing Laws at a Global Level

Legislation is considered the most important tool against any type of crime and this is why law enforcement agencies and key stakeholders are working actively to regulate the whole digital sector through strict laws. United States, United Kingdom, Australia, Canada, and other major jurisdictions have quite strict laws towards identity theft and money laundering which is ultimately helping them to counter criminals while bringing them under the law. Moreover, financial watchdogs like Interpol, EU, and FATF also overlook the whole legislative process in the member states to ensure that online businesses remain secure.

Implementing Customer Due Diligence (CDD) Approach

Customer Due Diligence (CDD) is another important strategy that online businesses use to track and record the financial activities of their customers. CDD has adopted the form of a global solution where all the financial watchdogs have recommended financial institutions implement this approach. Through this advanced method, digital companies can maintain a whole record of all their customers and report them to authorities in case of any suspicious activity.

Fraud Prevention Technologies

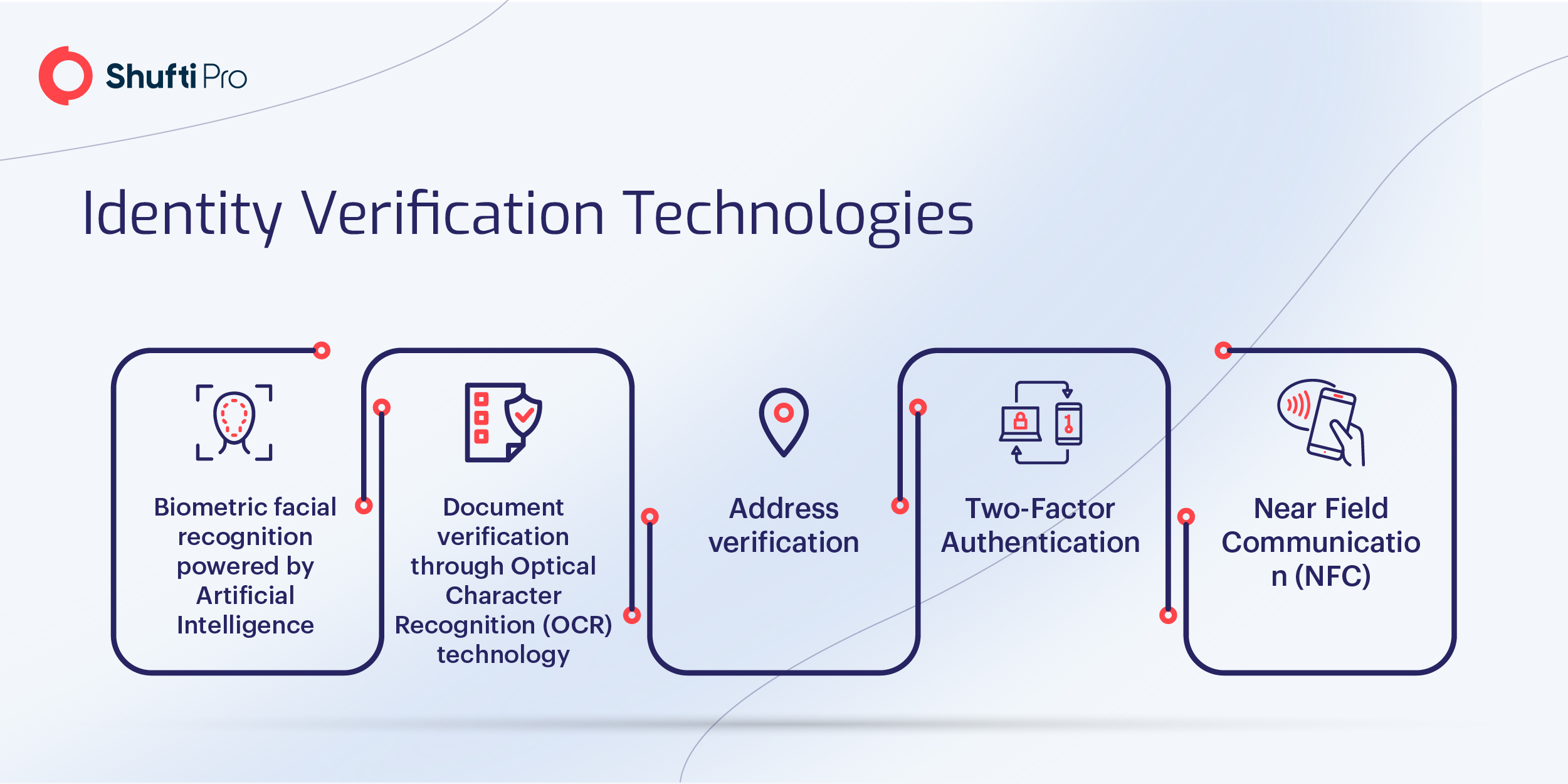

With emerging technologies and rapid digitization, anti-fraud solutions are getting smarter and digital companies are using advanced technologies to counter criminals. KYC/AML solutions powered by AI algorithms have revolutionized the whole concept of identity verification measures, and here are some of the top technologies which the companies commonly use:

Biometric Facial Recognition

Biometric facial recognition is the most innovative technology which has contributed a lot in countering criminals while onboarding. During this verification, the users have to switch on their cameras to let the system detect their face in three-dimension in real-time. The technology is efficient enough to undergo liveness detection, anti-spoofing, and fake image checks. Through these stringent screening measures, the system never lets the criminals bypass it and onboard the digital platform.

Optical Character Recognition

Optical Character Recognition (OCR) is another landmark technology that has eased the task of document verification. Document fraud has become quite prevalent nowadays due to the increased number of online operations. Criminals use fake or forged documents to get admission to universities, apply for immigration, or present illicit records before the courts. OCR is the latest innovation that can extract text from images and check their authenticity. Moreover, OCR also compares the details on the documents with the ones in real-time. In this way, there remain fewer chances for criminals to bypass all these security checks and onboard the system.

Near Field Communication (NFC)

Near Field Communication (NFC) is a technology which has encompasses 81% of smartphones and provides security services to the technology sector. A large number of financial institutions like banks and crypto firms are using NFC-based security systems where users have to log in after passing NFC verification through their smartphones. It stores the users’ biometric information and can even detect forged documents which has eventually resulted in high security against fraudsters.

How to Ensure Compliance and Secure Digital Sector?

Ensuring compliance and securing the digital sector has become quite crucial for online businesses. Almost the whole financial system is dependent on digitization, meaning that users’ assets and finances are at high risk of theft. It is critical for key stakeholders and law enforcement authorities to implement relevant solutions in different sectors. Not only the screening measures, but global law enforcement authorities should also make sure to convince all member states to legislate anti-fraud laws, which will surely discourage criminals from exploiting the loopholes. There are a few sectors, like banks and insurance companies, that have incorporated screening measures and are successfully eliminating criminals. So all other departments can also do the same by enforcing strict solutions.

Moreover, money laundering is another major issue that has become a daunting challenge for financial watchdogs. FATF and Interpol have accumulated data on money launderers and terrorist financiers in the form of sanctions lists which must be consulted in order to identify the criminals. So the right AML solution is the one that has access to this data and screens the users against them. Following KYC and AML guidelines, the whole digital sector can be made secure from cyber criminals.

How Shufti can Help

Combating money laundering, identity theft, and terrorist financing has become quite crucial for online businesses. Every coming year, cybercriminals are costing billions of dollars in financial losses to sophisticated users, damaging institutions’ reputations. Digitization is the new future of the world which is here to stay and it is the most appropriate time for online companies to invest in anti-fraud measures which not only counter bad actors but also report them to authorities in case of any violation.

Shufti’s state-of-the-art identity verification services present online businesses with the most optimal solution through effective KYC screening measures. KYC practices include facial recognition, document authentication, address verification, etc., which can verify the true identities of users and prevent them from onboarding. Moreover, Shufti’s AML screening solution is powered by AI algorithms that become smarter over time and screen against data from 1700+ sanctions lists to generate results in a matter of seconds with a ~99% accuracy.

Would you like to know more about the anti-fraud measures for the digital sector?

Explore Now

Explore Now