Why is EIN Verification Essential for Business Compliance?

- 01 What is an EIN and Why Does It Matter for Businesses?

- 02 What are the Key Differences for Business Identity: EIN vs. TIN

- 03 What is EIN Verification? Strengthening Business Compliance

- 04 How Does an EIN Verification Checklist Ensure Businesses' Legitimacy?

- 05 What are the Different EIN Verification Lookup Tools?

- 06 How Does Reverse EIN Lookup Help Trace a Business’s True Identity?

- 07 Common EIN Verification Challenges and How to Solve Them

- 08 How Automated EIN Verification Powers Smarter & Faster Compliance?

- 09 Shufti’s Trusted Approach to Verifying Business Identities

Behind every legitimate business in the United States is a small but mighty number, the Employer Identification Number (EIN). As in the current times, there are over 33 million businesses in the United States only (33,185,550, to be exact). Not all of them have an EIN; some are employer businesses, while others are non-employer entities. However, many non-employer businesses also obtain an EIN for tax filing or banking purposes

An incorrect or unverified EIN may result in compliance issues that often lead to failed transactions and potentially create legal problems. Therefore, it is important to understand how EIN verification works.

What is an EIN and Why Does It Matter for Businesses?

An Employer Identification Number is a unique nine-digit number assigned by the Internal Revenue Service (IRS). This number is used to identify a business for tax and reporting purposes, primarily by the IRS. It serves the same purpose as a Social Security Number, but specifically for business entities. EINs are used by companies requiring tracking of business operations, filing taxes, and maintaining records of compliance.

The IRS issues EINs to a wide range of entities, from corporations and partnerships to limited liability companies (LLCs) and nonprofits, and even to sole proprietors who hire workers or operate under a particular tax structure.

Most probably, businesses are expected to receive an EIN when they hire employees or file for business taxes. Other possibilities include if the company opens a corporate bank account or applies for licenses and permits.

In addition to compliance, EIN creates a legal personality for a company and provides transparency of financial transactions.

The employer identification number is an essential part of legitimate business processes and for most of its operations. Without a business identifier, a company cannot file taxes or process payroll, nor can it build credit.

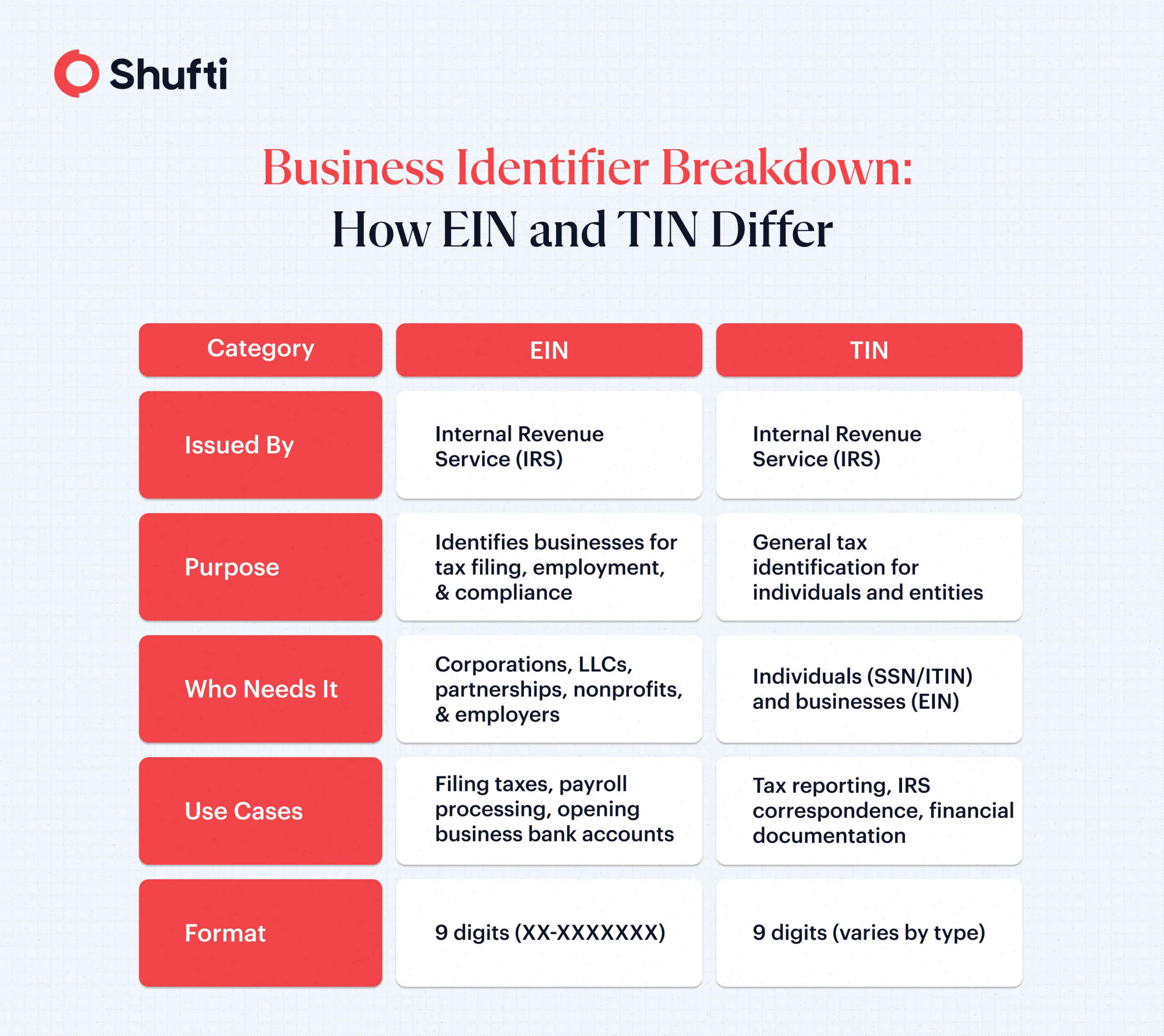

What are the Key Differences for Business Identity: EIN vs. TIN

EIN is just one of several unique business identifiers used for legal and compliance purposes. Recognizing the relevant identifier is key to achieving accurate reporting and enhancing business credibility. Here is a quick snap of the difference between EIN and TIN:

What is EIN Verification? Strengthening Business Compliance

EIN verification is the process of confirming that a business’s Employer Identification Number (EIN) is valid. It is correctly registered and matches official IRS or government records. The verification of EIN helps confirm the legal identity of the company. It also ensures that the company is authorized to operate within the business ecosystem and the geographical boundaries of the United States.

This process is critical for Know Your Business and AML compliance. It allows organizations to identify legitimate entities and prevent fraudulent or shell companies from entering their networks. Financial institutions and payment processors, along with the B2B service providers, routinely verify EINs to assess risk and comply with regulatory requirements.

Therefore, failing to verify an EIN can expose businesses to serious risks, such as regulatory enforcement and even reputational damage. These risks make the EIN verification a foundational step in maintaining trust among businesses.

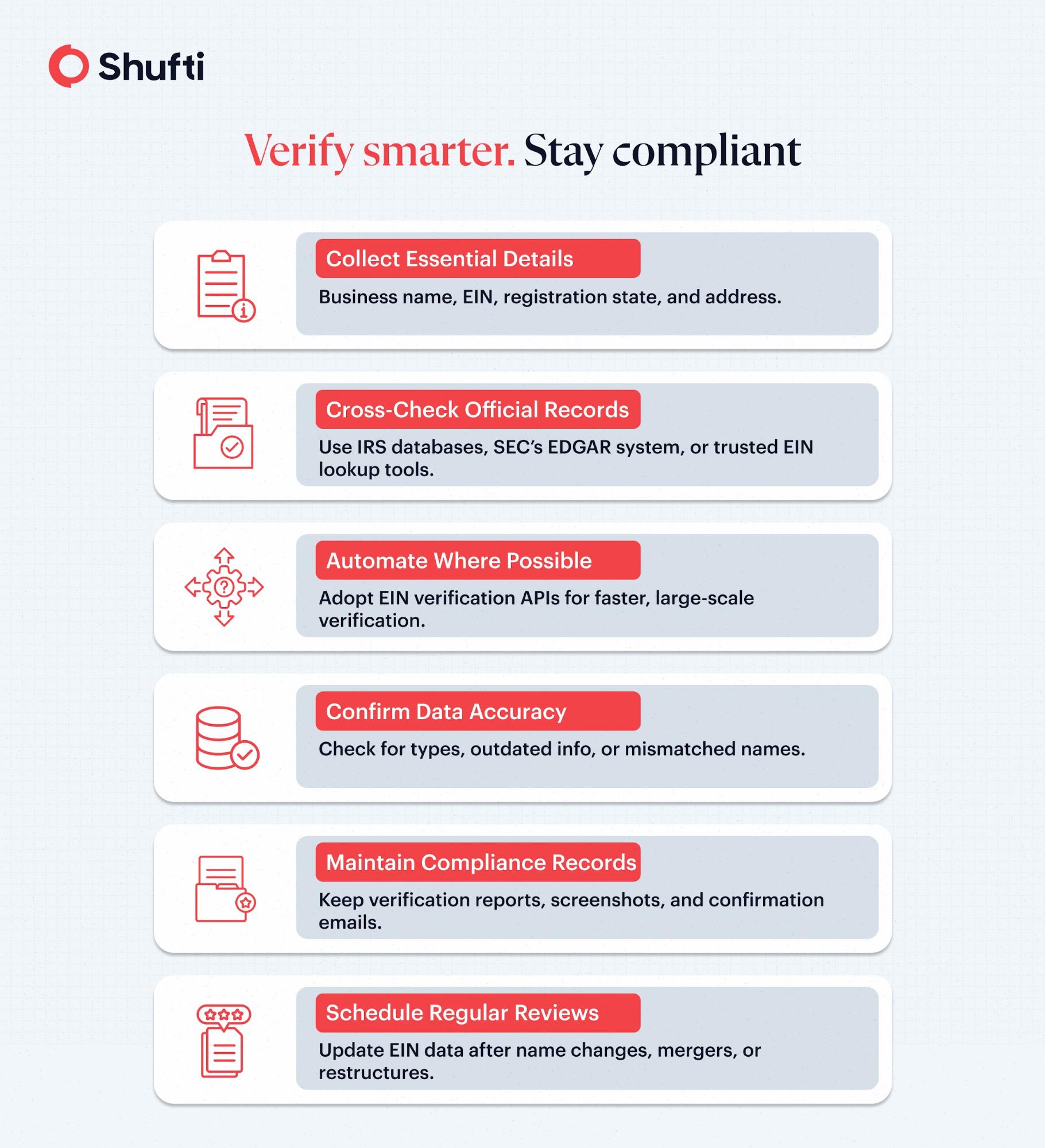

How Does an EIN Verification Checklist Ensure Businesses’ Legitimacy?

An EIN verification checklist helps confirm the legitimacy of the business by following a systematic process to enhance trust among partners and clients.

Businesses can integrate EIN verification APIs to speed up onboarding. These APIs connect to reliable data sources and automate the verification process when onboarding or checking vendors. It is important to follow privacy and data protection laws while using any verification method. Make sure to use EIN data only for genuine and compliant business verification purposes.

What are the Different EIN Verification Lookup Tools?

Businesses more often rely on EIN verification lookup tools to confirm the authenticity of their vendors or clients. The IRS offers limited services for verifying Employer Identification Numbers and lets businesses confirm their own EINs or check nonprofit EINs through the Tax Exempt Organization Search.

Moreover, many companies prefer to use online EIN lookup tools because they provide faster and more accurate results than checking for it in the physical records.

However, EIN verification tools generally fall into two categories: basic database searches and automated systems. Basic searches allow users to review business information through state registries or IRS databases manually. On the other side, automated systems use APIs or verification platforms that cross-reference government and trusted private data sources in real time.

While some online sources suggest using the SEC’s EDGAR database for EIN searches, it’s not a reliable method; the SEC does not publish EINs. Instead, businesses should rely on IRS TIN Matching systems or trusted Know Your Business data sources.

Some advanced systems even offer reverse EIN lookup that enables users to track down a company’s details using its EIN.

How Does Reverse EIN Lookup Help Trace a Business’s True Identity?

A reverse EIN lookup helps in finding detailed information about a business by using its Employer Identification Number (EIN). Instead of looking for an EIN by the company’s name, this method shows the business’s official name, registration status, address, and sometimes information about its owners.

Businesses, banks, and investigators often use reverse EIN lookups to check if a company is legitimate and to find connections between different entities.

When used responsibly, this process complies with data privacy laws and ensures that information is accessed only for valid verification and risk assessment purposes.

The benefits of reverse EIN lookup go beyond just convenience. It helps prevent identity theft, and along with this, it builds trust in business relationships and secures partnerships. For industries that focus on compliance, it is an important step for ensuring transparency and keeping operations secure.

Common EIN Verification Challenges and How to Solve Them

EIN verification is essential to ensure that companies partner only with verified and trustworthy businesses. However, even minor errors can lead to delays and hinder successful onboarding, and even raise regulatory concerns. Some of the most frequent challenges that businesses encounter when verifying their EINs are listed below:

- EIN mismatches: This happens when the name of a business does not match the IRS records because of typing errors, old filings, or naming changes of the business.

- Obsolete or unfinished data: Databases may not capture the latest company developments, mergers, or liquidations.

- Newly registered or inactive companies: EINs for such companies typically aren’t found in public or private databases, which makes them challenging to verify independently or manually.

- Incorrect format of EIN: EINs are not in the proper format of nine digits, as XX-XXXXXXX. They have missing or additional numbers that lead to verification errors.

- EIN misuse or identity theft: Criminals can pretend to be real businesses by using fake or stolen Employer Identification Numbers (EINs).

- Privacy Restrictions: The EIN information for certain states or corporations cannot be shared without demonstrating a valid business need.

Addressing these issues requires thoroughly reviewing records and reaching out to official sources, rather than depending on just one report.

How Automated EIN Verification Powers Smarter & Faster Compliance?

Automation has revolutionized the process of businesses confirming the Employer Identification Numbers (EINs). Now it is possible to verify EIN with AI-based systems, APIs, and data automation tools with minimal error, making compliance verification quicker. Automated EIN Verification helps businesses in verifying the legal identities in real time and meet regulatory requirements.

Automated EIN checks speed up the onboarding process, enable ongoing monitoring, and reduce compliance costs. These solutions are particularly valuable for financial service providers, corporate insurance firms, and B2B FinTechs that must verify the legitimacy of U.S. businesses through EIN validation.

EIN verification becomes more accurate when solutions incorporate information from multiple trusted data sources, including official government registries and verified private databases.

Shufti’s Trusted Approach to Verifying Business Identities

Businesses expanding to the US market must verify Employer Identification Numbers (EINs) to confirm the legitimacy of partner companies and ensure compliance.

Shufti takes it a step further by offering a comprehensive business verification solution that not only validates EINs but also verifies essential company details, including legal name, registration status, address, and regulatory standing.

The platform cross-references information from both government and private sources to deliver accurate, up-to-date results.

Discover how Shufti simplifies EIN verification and strengthens compliance. Request a demo.

Frequently Asked Questions

What is an EIN verification?

EIN verification confirms a business’s tax ID accuracy with official records to ensure legitimacy and prevent financial fraud.

How can I verify an employer identification number quickly?

Use automated EIN verification APIs or trusted databases for instant, accurate validation of a business’s tax ID details.

What’s the difference between EIN verification and business registration check?

EIN verification confirms tax identity, while business registration checks validate legal existence and licensing with state or local authorities.

Can an EIN be used or transferred to another business?

No, each EIN is unique to one business and cannot be transferred. Structural or ownership changes may require a new EIN.

Explore Now

Explore Now