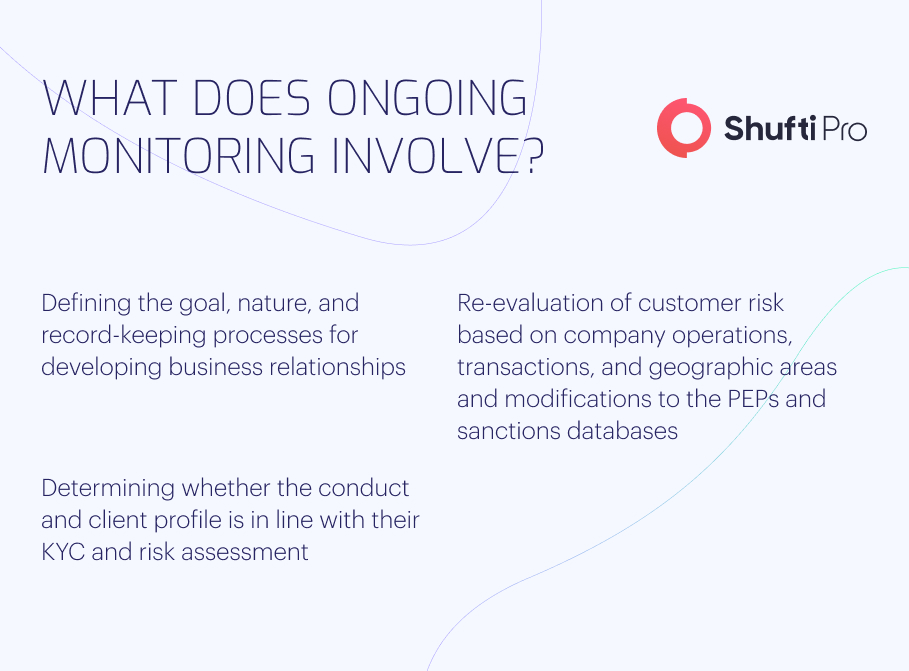

The Crucial Role of Ongoing Monitoring in Risk Mitigation

The nature of a business-to-clientele relationship subjects organisations to significant risks. For example, financial firms and precious metals traders engage in high-value transactions with parties who may be Politically Exposed Persons (PEPs) or sanctioned individuals. The risk exposure is significant since invoicing and payment transfers are frequently used to fund criminal operations, hide the sources of money, and launder illegally-acquired funds. Thus, businesses must do a one-time assessment as part of the due diligence process and implement an ongoing monitoring system since client profiles and business actions may change periodically. This is done to ensure that risk profiles haven’t changed in a manner that could expose the company to non-compliance and reputational risk.

COVID-19 and the Demand for Ongoing Monitoring

The entire globe’s financial landscape has significantly changed due to the COVID-19 outbreak. Growing unemployment has encouraged criminals to commit financial fraud via charitable organisations and other commercial ventures. Cryptocurrency prices have risen due to market instability, which has caused some to keep illegal funds in virtual wallets. On the other hand, money transfer companies have witnessed a more significant number of transactions, particularly in high-risk countries.

The popularity of contactless home delivery and online payments has caused digital wallets and eCommerce businesses to flourish significantly. These regulated industries are very susceptible to money laundering and terrorism financing. Thus the demand for an efficient KYC solution and ongoing monitoring has increased.

Why Do Businesses Need Ongoing Monitoring?

Whether you run a small casino, a real estate agency, or a money service company, you deal with customers who might be headquartered abroad. How do you stay abreast of the rising risks? How can you stay on top of compliance mandates while protecting your business from financial crime exposures and penalties? A continuous monitoring strategy will help any company protect their reputation in the market.

Here are some circumstances in which ongoing monitoring might assist your company in reviewing its risk mitigation strategies.

Change in Client Profiles

Client profiles change as time passes. A reputable client you regularly do business with could be appointed to an international banking organisation position or elected to a political office to become a PEP. Due to high-profile embezzlement, a foreign client may be listed on the most recent FINTRAC watchlist or appear in negative media searches. Another strong client could move to an EU nation subject to 5AMLD (5th Anti-money Laundering Directive) or 6AMLD and General Data Protection Regulation (GDPR). All of these represent modifications to the client risk profile and necessitate an evaluation of risk assessments and compliance strategies.

Exposure to High Risk or Sanctioned Countries

Most nations have lists of businesses or people sanctioned, so customers are encouraged to avoid doing business with them or adhere to specific reporting standards. For example, the Office of Foreign Assets Control (OFAC) list prohibits Americans from transacting business with sanctioned organisations on the SDN list. Some nations might not be included on any sanctions or watchlists but still pose a significant threat to money laundering and terrorism financing. These are often less developed nations prone to internal disputes and frequent changes in political leadership. Political favouritism has fostered a dishonest approach to financial fraud, leading to widespread corruption and a lack of oversight. You need a tailored ongoing compliance programme to prevent your company from being utilised for illicit activities in such countries.

Risk Assessments of Business Relationships

Connections with PEPs or close affiliates, customers on a watchlist, members of high-risk industries, or citizens of sanctioned nations are all considered high-risk. When assessing your clients’ risk exposure, having current data is crucial, and this is where ongoing monitoring comes to the rescue.

The Benefits of Automated Ongoing Monitoring

- Determine potential dangers that impact the viability and standing of your business.

- Be aware of any negative news or updates to a daily, monthly, or quarterly watchlist to make an informed decision about your risk.

- Check against countless national and international databases for the most recent information about your client and operating countries.

- Avoid potential financial loss and stop business risks from expanding, particularly in high-risk markets.

- Prioritise high-risk clients and adjust risk levels in response to issues discovered through automated monitoring.

- Knowing the risk areas in detail can help you make data-driven decisions.

- The company’s compliance plan will become more flexible as it adds the names of clients who will be followed up with regularly.

- Eliminate manual and out-of-date processes to ensure rapid and affordable compliance.

What to Consider Before Investing in an Ongoing Monitoring Solution?

A carefully planned ongoing monitoring system will help you proactively manage third-party risks for long-term development in any sector.

Here are some questions to consider before investing in an ongoing monitoring solution:

- KPIs: Have you chosen a set of KPI measures that fits your company’s objectives? You must do it to understand how a threat presents itself in your management procedures. This procedure will assist your leadership team in creating a framework of checks and balances for sound decision-making.

- IT Ecosystem: Does the vendor monitoring system you selected to integrate with the larger IT infrastructure ecosystem support your company’s objectives?

- Regulatory Compliance Needs: Does your monitoring procedure consider the laws and professional standards that apply to your company?

- Vendor Relationship Management: Do you find it easy to connect with your vendors daily in an open setting? It will be easier for you to comprehend the specific elements influencing your vendors’ performance if you establish solid ties and open lines of communication with them.

- Performance Monitoring: Do you have the necessary setup to gather and evaluate vendor data? Monitoring performance problems over time can assist you in optimising your programme and making sure your company regularly achieves its objectives. Along the way, it also helps you figure out where you might improve.

- Consider Automation: Many businesses attempt to perform due diligence manually, but automation can constantly alert high-risk areas with an automatic flag. As a result, human error is decreased, and you can detect additional shifts in risk level.

How Can Shufti Help?

Shufti offers an ongoing AML solution to 230+ countries and territories. Our ongoing monitoring solution helps financial service providers, crypto exchanges, retailers, credit institutions, high-value goods and real estate firms identify high-risk profiles.

Here’s what makes our ongoing AML monitoring solution stand out:

- Additional identity assurance

- Faster customer onboarding

- Accurate risk profiling

- Enhanced compliance screening

- High-security standards

- Reduced compliance costs

Want to know more about how an ongoing monitoring solution helps businesses mitigate the risk of fraud?

![Insights Into Austria’s Biometric KYC Onboarding [2022 Updates] Insights Into Austria’s Biometric KYC Onboarding [2022 Updates]](https://shuftipro.com/wp-content/uploads/b-img-austria.png)