IDV: Foundation for global expansion

A fintech in Malaysia planning global reach must verify identities across all jurisdictions, each with unique identity document formats, KYC, AML rules, and data residency requirements.

Similarly, a fintech in Europe expanding into Asia must verify non-Latin documents, multilingual data capture, and country-specific onboarding standards that demand precise transliteration and validation.

The right IDV partner removes this friction. It standardizes identity flows across markets, applies jurisdiction-specific risk logic, enforces local compliance, and integrates multilingual document intelligence. The result is faster user onboarding, lower fraud, and confident expansion at a global scale.

From coverage to conversion

Choosing an IDV vendor that enables expansion is only the first step. The real test is whether verification converts more legitimate customers while staying compliant. Your verification layer should raise approval accuracy, adapt to evolving fraud, and keep journeys fast and low friction so acquisition, activation, and revenue scale together. Hers’s what to demand from your Identity Verification vendor

High pass rate with precision

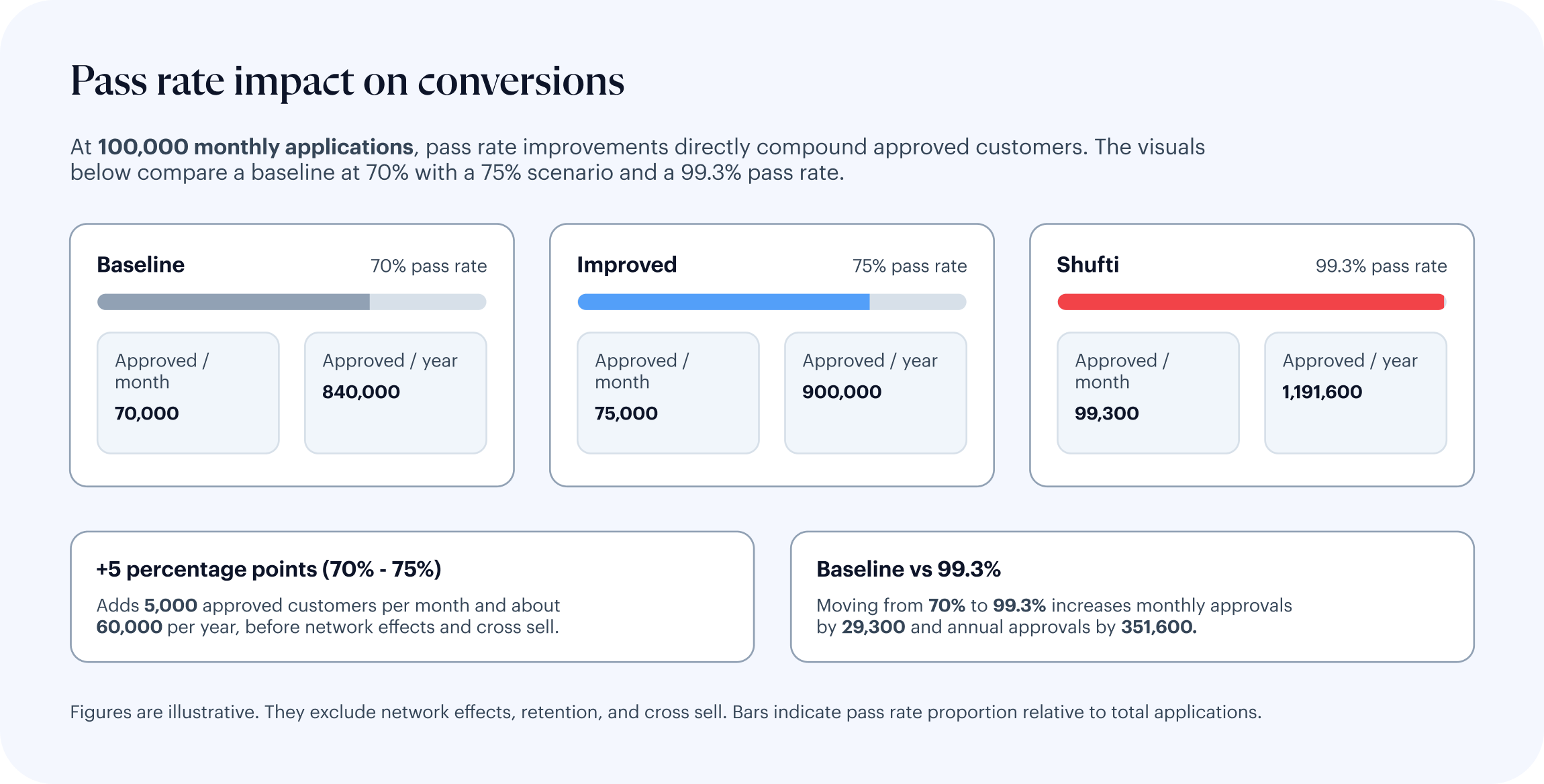

Optimize approval of genuine users while holding fraud low. Even a five percent uplift in legitimate pass rate can compound conversion and lifetime value across markets.

Deepfake and typology resilience

Detect sophisticated spoofs with biometric liveness and model updates that track emerging fraud patterns, not just yesterday’s attacks.

Speed and low friction

Deliver decisions in seconds with minimal retries and step-ups. Lower latency and fewer interruptions reduce abandonment and lift completed onboardings.

Take the next steps to better security.

Contact us

Get in touch with our experts. We'll help you find the perfect solution for your compliance and security needs.

Contact us

Explore Now

Explore Now