Why Shufti’s NFC check sets the standard for frictionless identity verification

Gone are the days when user identity verification was only done through document verification. Shufti offers multiple ways to verify and authenticate global users with the least amount of friction and highest accuracy.

Accuracy without compromise

Unlike OCR or surface scans, Shufti validates identity directly from the secure chip.

- Detects forged or tampered documents instantly.

- Ensures biometric data matches with live user input.

- Achieves near-zero false acceptance rates (FAR).

Frictionless user experience

Verification that’s both seamless for users and rigorous for businesses.

- Single-tap document authentication within seconds.

- Works across passports, ID cards, and ePassports worldwide.

- Reduces drop-offs with mobile-first design.

Compliance built in

Stay ahead of global regulations without slowing down business.

- Aligns with ICAO 9303 standards for eMRTDs.

- Fully supports GDPR, KYC, and AML frameworks.

- Provides auditable logs for regulators and partners.

NFC Verification for every industry

Five steps to secure identity with Shufti’s NFC chip verification

Our NFC verification process is designed to be straightforward for users and airtight for businesses. Each step removes uncertainty and ensures that every identity is validated against the most secure data source available.

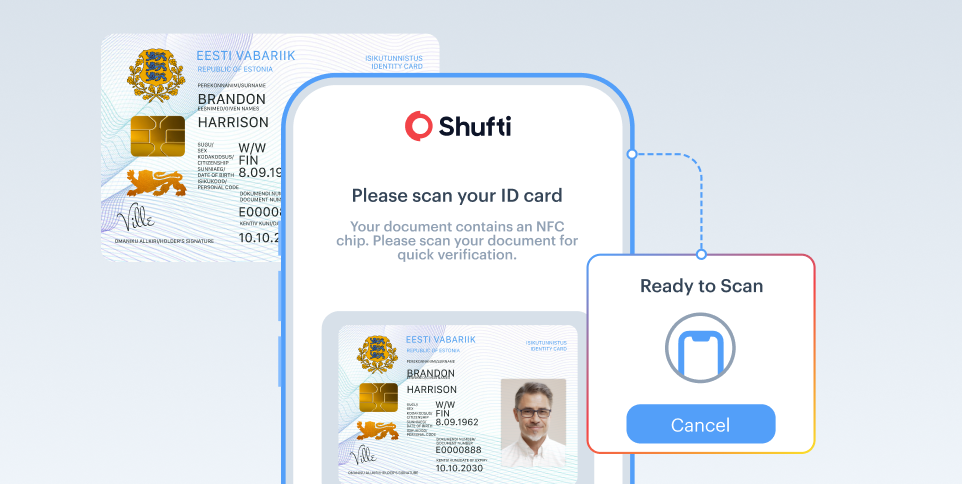

Step 1Document Detection

Step 2Secure Chip Access

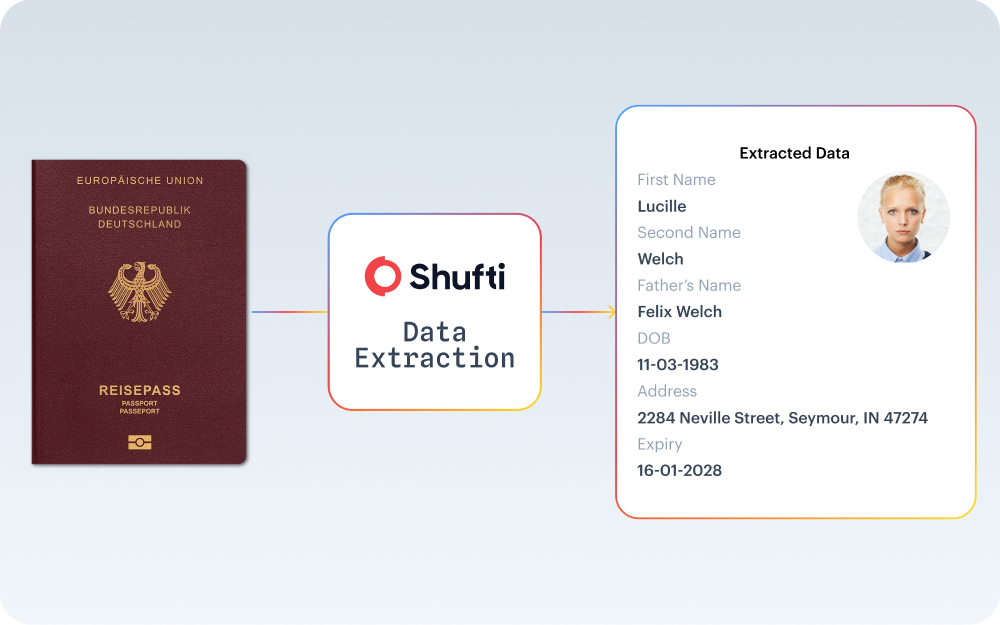

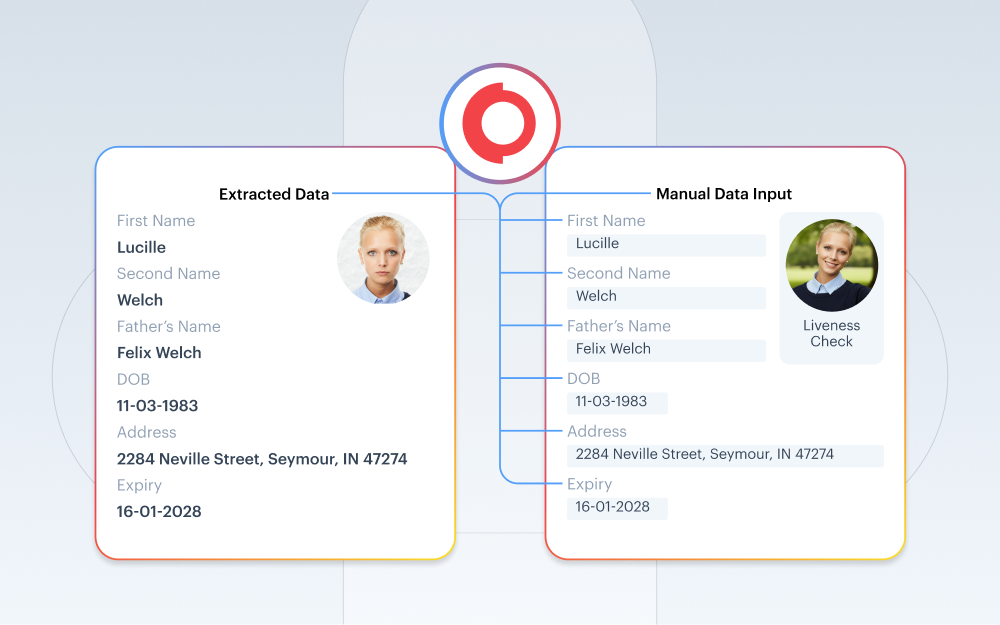

Step 3Data Extraction & Matching

Step 4Liveness & Biometric Comparison

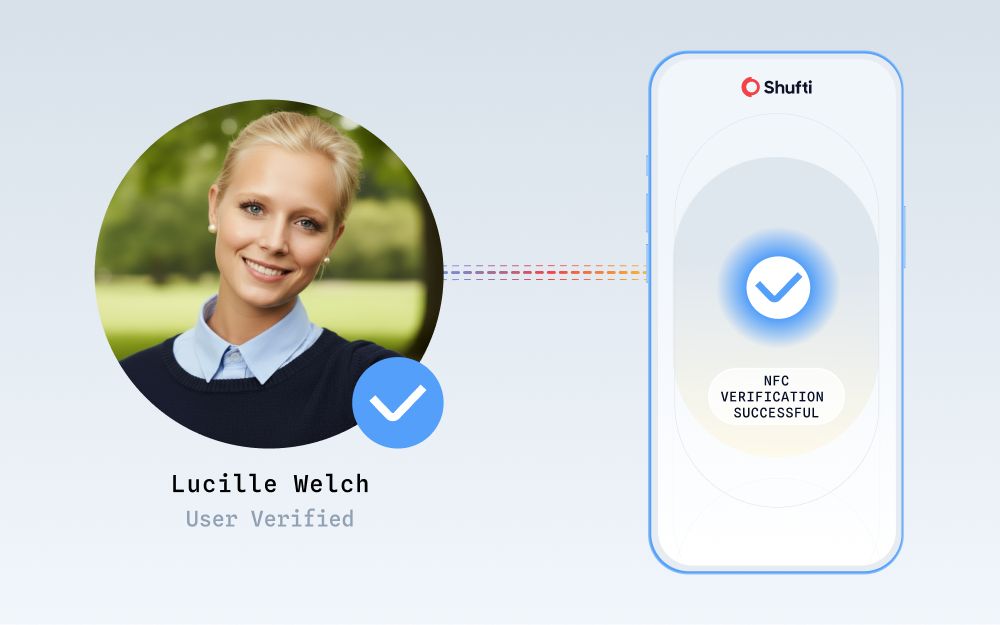

Step 5Verification Decision & Report

Shufti connects directly with the document’s chip for data retrieval.

- Uses Basic Access Control (BAC) or Password Authenticated Connection (PACE).

- Prompts user to place the document against their smartphone.

- Guarantees encrypted, authenticated communication.

The process begins when a user presents their NFC ID or NFC chip enabled passport.

- System automatically detects the chip presence.

- Prompts user to place the document against their smartphone.

- Ensures NFC-ready hardware is available before proceeding.

Shufti connects directly with the document’s chip for data retrieval.

- Uses Basic Access Control (BAC) or Password Authenticated Connection (PACE).

- Protects against unauthorized skimming.

- Guarantees encrypted, authenticated communication.

The chip’s biometric and identity data are read in seconds.

- Facial image, DOB, and document number retrieved.

- Data cross-checked with MRZ (Machine Readable Zone).

- Prevents tampering by verifying cryptographic signatures.

Shufti compares chip biometrics with live user input.

- AI-powered facial recognition with liveness detection.

- Blocks spoofing via photos, videos, or masks.

- Confirms the person presenting the document is its rightful owner.

A real-time decision is returned to the business.

- Pass/fail status with reasoning.

- Full compliance report generated automatically.

- Audit trail stored securely for regulators and partners.

Shufti offers multiple ways to verify your users identity. Learn more about fastID, eIDV, document and facial verification with Shufti

Verify global users identity with ShuftiUse advanced NFC verification to onboard users quickly and enjoy data privacy

With its entire technology built in house, you do not have to worry about the data of your users being used or accesses by third-party vendors.

Tamper-proof, chip-level security

Unlike surface scans that can be forged or manipulated, NFC reads data directly from the encrypted chip inside passports and IDs. Cryptographic signatures ensure authenticity, making it nearly impossible for counterfeit documents to pass undetected. This delivers verification that is as close to fraud-proof as technology allows.

Flow orchestration

Configure NFC to be optional, recommended, or required. Trigger it for high-risk scenarios, fail back to optical where necessary, and capture audit trails for decisions and downstream compliance.

Global standards, built-in compliance

Shufti’s NFC verification aligns with ICAO 9303 standards for ePassports, while meeting GDPR, KYC, and AML requirements worldwide. This ensures businesses can scale across borders without compliance risks. Every check comes with a verifiable audit trail for regulators and partners.

learn more

The 1% that matters in fraud prevention

Most vendors boast “99% fraud prevention”, but the real danger hides in the 1% they overlook. In this whitepaper, follow the story of Jack, a seasoned fraudster who thrives in those blind spots. Discover why it’s time for companies to move beyond surface-level checks and adopt solutions that truly understand the nuance in every case.

Download the solution brief

Frequently Asked Questions

What is NFC verification?

NFC (Near-Field Communication) verification allows a smartphone to securely read the encrypted data from the microchip embedded in a modern e-passport. This process cryptographically proves the passport is genuine and has not been tampered with.

Why is NFC more secure than just taking a photo of a passport?

A photo only verifies the visual layer, which can be faked with forgeries or digital images. NFC reads the chip's digital signature, which is nearly impossible to forge, providing cryptographic proof of authenticity from the issuing government.

How does the "tap-to-verify" process work for the user?

After a quick scan of the passport's Machine Readable Zone (MRZ), the user is prompted to simply hold their e-passport to the back of their smartphone. The chip is read contactlessly in a few seconds, completing the check.

How does Shufti’s NFC chip verification work?

Shufti reads the encrypted data stored in an ID’s NFC chip and cross-checks it with the physical document and user’s face. This ensures the document is authentic, tamper-proof, and tied to the right person. The process is seamless and highly secure.

What types of documents support NFC verification?

Passports, national ID cards, residence permits, and biometric driver’s licenses often contain NFC chips. Shufti’s system can read and validate these documents in real time. However, support varies by country, but coverage spans most major global IDs.

Can NFC verification be integrated with my platform?

Yes. Shufti offers API and SDK options for easy integration into web, mobile, or enterprise systems. This means NFC verification can be added without disrupting your existing workflows.

Does NFC verification comply with regulations?

Absolutely. NFC verification aligns with ICAO, GDPR, AMLD, and other global standards for secure identity verification. It provides an auditable, regulator-approved method of confirming identities.

How fast is NFC verification?

The process takes just a few seconds, as the chip data is read instantly and validated automatically. Shufti’s technology ensures speed without sacrificing accuracy or compliance.

Related Solutions

AML Screening

Check applicants against 1700+ global watchlists using both search- and document-based methods.

Explore

Explore

Know your Customer (KYC)

Simplify customer onboarding with efficient identity verification, reducing compliance burdens and boosting security across your operations.

Explore

Explore

Social Networks

Protect user accounts with strong and fast biometric authentication for high-risk or high-cost services.

Explore

Explore

Take the next steps to better security.

Contact us

Get in touch with our experts. We'll help you find the perfect solution for your compliance and security needs.

Contact us

Explore Now

Explore Now