European Payments Initiative Calling for IDV Solutions

The rise in the popularity of Visa and Mastercard in Europe, both US-headquartered companies, was previously a reflection of the comparative weakness of homegrown European competitors. In an attempt to remove this label, the European Payments Initiative (EPI) was launched by EU banks in July 2020 with the goal of creating a unified payment solution across Europe. The EPI was made with the intention of solving marketplace and regulatory issues that caused complication of transactions for the likes of both, European merchants and consumers. Previously, with the rapid development of payment technology came the higher likelihood of uneven internal adoption rates, making cross-border cohesion difficult. However, this initiative will be able to successfully tackle the underlying issue by creating an integrated European payment market.

Why the Launch of EPI Became Necessary

A similar initiative called the “Euro Alliance of Payment Schemes (EAPS)” was introduced back in 2007, that had aimed to unify the debit card system to rival Visa and Mastercard. However, the European Commission-backed initiative failed and was consequently abandoned by 2013. Despite other similar attempts to unify the EU payment system, fragmentation in this arena still exists. For instance, mobile wallets only function at a national level and national payment card schemes that still work in 10 European countries are not compatible with other EU countries. Evidently, a single, unified payment system in the EU was crucial to give competition to other international and mostly non-European players.

Breaking down the European Payments Initiative

The EPI is a project that is expected to launch by the first quarter of 2022 for the purpose of streamlining the payment process for merchants and consumers across Europe. This initiative is backed by the European Commission along with sixteen EU banks that are spread across five Euro countries, namely France, Germany, Belgium, Spain and the Netherlands.

The Benefits EPI Offers

Regarding the pros of this initiative, the ECB (European Commission Bank) states:

“EPI seeks to replace national schemes for card, online and mobile payments with a unified card and digital wallet that can be used across Europe, thereby doing away with the existing fragmentation. As it is based on the SEPA instant credit transfer scheme, it can immediately capitalize on powerful and sophisticated existing infrastructures.”

Additionally, the Covid-19 crisis has emphasized the need to move towards cashless payments. However, approximately 50% of retail payment transactions in the EU are done by cash even today. Apart from being a more hygienic solution, the benefits of digital payments outweigh those of cash payments, especially in terms of eliminating corruption.

Lastly, by offering a modern digital payment solution that is accepted throughout Europe, the fields of banking, payment and technology will be aligned to contribute towards the formation of a single payment market based on European digital agendas.

Working Within Regulations

To regulate electronic payments and electronic payment service providers in Europe, the revised Payment Services Directive (PSD2) was introduced in 2018 and is administered by the European Commission. To stay in compliance with these regulations, the following conditions must be met:

- Safeguard customers’ financial data

- Mitigate risk of fraud by guaranteeing customer authentication

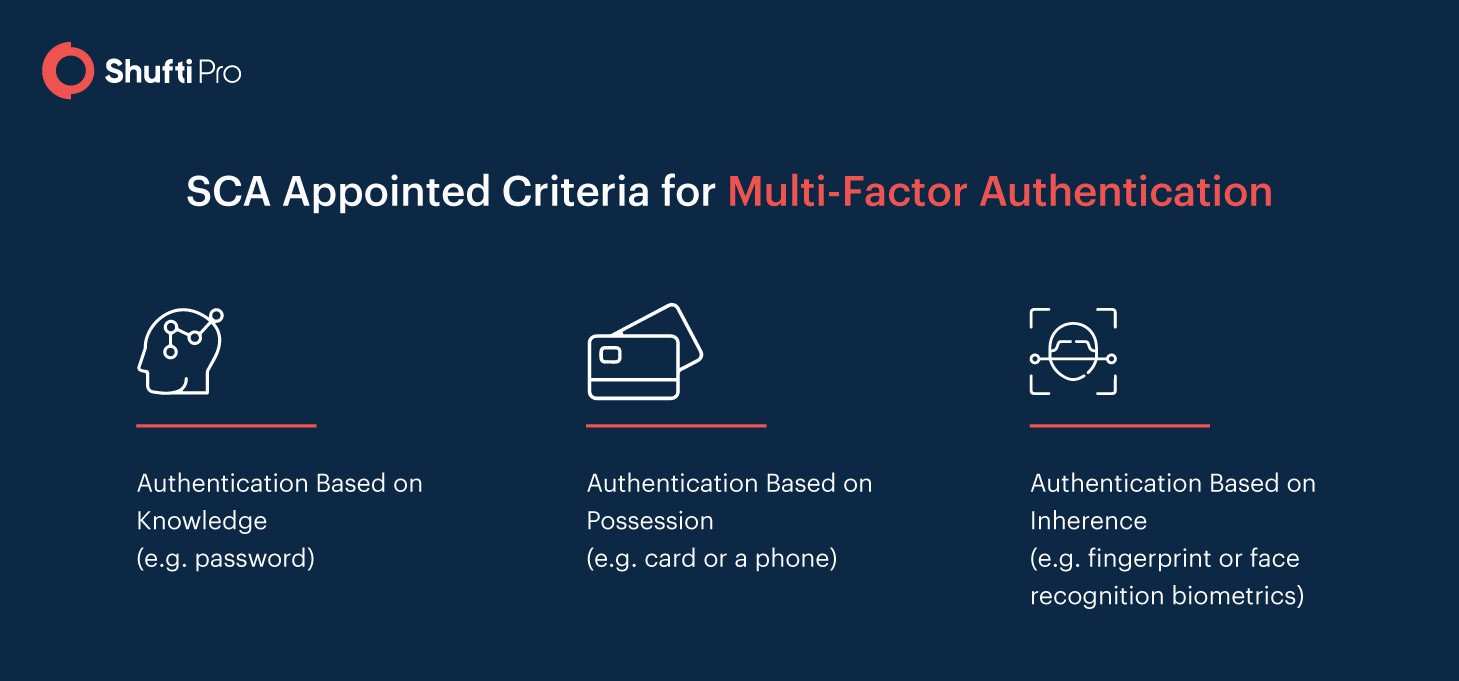

To add an extra layer of protection, a new requirement included in the PSD2 is Strong Customer Authentication (SCA). The SCA requirement came into force in 2019 with the mission of eliminating electronic payment fraud by making multi-factor authentication mandatory.

Non-Compliance to PSD2

With authentication under PSD2 in place, the EPI can successfully pave the way for new innovations in the European payments market. On the other hand, as PSD2 is mandatory for banks, any non-compliant transaction is considered a violation of the law and can lead to hefty fines and penalties. One way financial institutions can avoid this situation is to comply with SCA using AI-powered ID verification solutions for automated customer authentication.

Digital IDV Solutions for PSD2 Compliance

It is mandatory for all the member banks of European Payments Initiative to fulfil PSD2 regulatory requirements. In order to avoid fines, banks offering digital payment services can ensure the identity of their customers while onboarding remotely through the implementation of KYC (Know Your Customer) procedures using IDV solution providers like Shufti. This can be done either through Video-based KYC or Biometric Authentication.

- Shufti’s Biometric Authentication provides a quick and cost-effective approach for compliance and fraud mitigation. The process of biometric authentication employs unique physical characteristics to enable automated online account login and transaction approval. Physical attributes used for authentication include the customers’ face, voice pattern or fingerprints. This way, firms are able to weed out fraudsters by verifying that the customer is actually who they are claiming to be.

- In Shufti’s Video KYC, a KYC expert authenticates the identity of a customer through documents presented during a live video call. During the video call, the customer is asked to display their government-issued ID documents to have their credentials swiftly verified .

Numerous financial institutions and mobile wallet companies are utilizing automated KYC procedures to enhance customer experience and to meet regulatory obligations.

Key Takeaways

- EPI is an ambitious project initiated by banks in Europe and signifies the payment industry’s critical transitional stage

- It aims to replace national schemes for card, online and mobile payments with a unified card and digital wallet that can be used across Europe

- With the support of numerous European institutions, including the European Commission, this initiative is all set to pave the way for the digital payment market

- EPI will be subject to PSD2 compliance, including SCA requirements

- To stay in compliance with regulatory bodies, Shufti’s Video-based KYC and Biometric Authentication can be employed

Explore Now

Explore Now