Shufti’s Journey Builder: Designing Identity Verification Made Simple

As financial regulations around the world become more complex and ever changing, businesses like yours need flexible identity verification (IDV) systems that can keep pace. And while keeping up with one country’s regulatory requirements can be difficult on its own, globally expanding businesses must comply with a wide range of regulations and consumer norms. For instance, the quality and security of government issued IDs varies greatly, as well as the availability of national ID schemes, credit data, and so on, all complicate how firms act to establish their customers’ identities in different markets and scenarios. And updating processes and technologies can cause headaches for companies when those regulations change over time.

Many identity solutions are difficult to implement, or limited in design and capability, requiring complex integrations and combinations of providers. It can be hard to make even the simplest changes, such as adding additional use cases or verification methods, and often requires taking the system offline.

Introducing Journey Builder

Shufti’s Journey Builder is a user-friendly, no-code tool with a simple drag-and-drop interface that doesn’t require technical expertise. It simplifies setup, saving time and budget. Unlike standard verification configuration tools, Journey Builder offers businesses flexibility in the KYC (Know Your Customer) process, allowing you to customize verification to fit your specific needs. Companies can create multiple verification paths for various use cases, regions, and customer segments, ensuring a more relevant and accurate process. From end-user languages… to accepted documents… to verification services… Journey Builder is designed to serve 240 countries and markets, a wide range of industries, and new and emerging use cases.

By simplifying the setup process and eliminating the need for coding, Journey Builder can be ready to go live in a matter of minutes instead of weeks. Real-time previews allow businesses like yours to see how a journey will work for their end-users and adjust as needed before going live. Once a journey is live, it can be altered and expanded as needed by updating workflows, adding new verification steps, and scaling it as the business grows or enters new markets — all without downtime. Plus, Journey Builder can generate code snippets in multiple programming languages to smoothly integrate custom journeys into their existing systems.

How Journey Builder Works

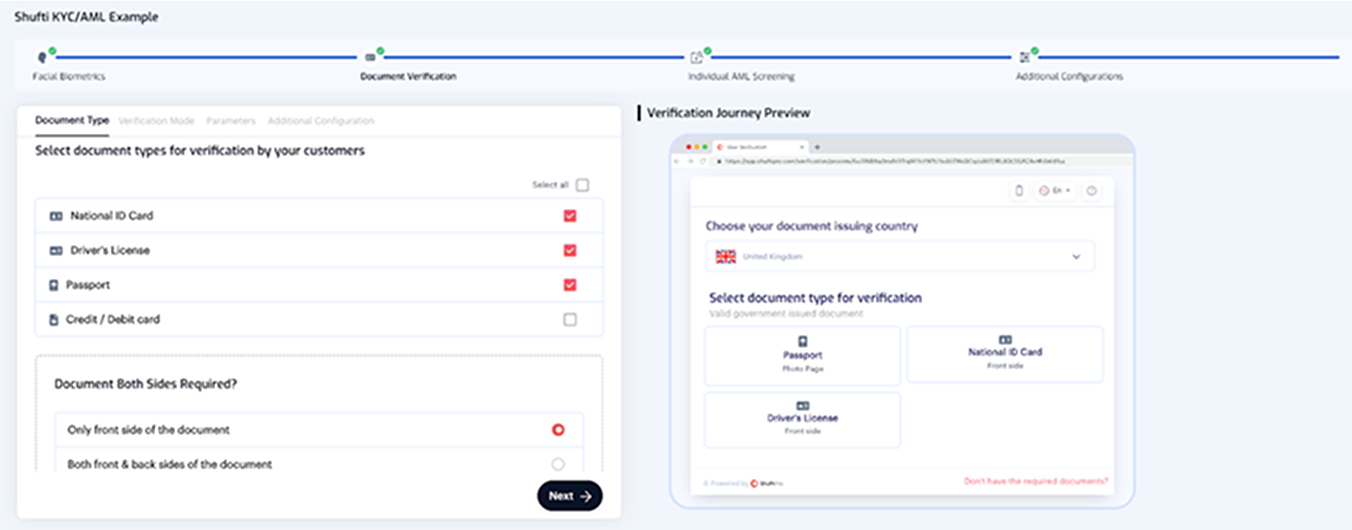

To start, the Journey Builder lets you add in various verification services. In the following journey, we’ve selected Facial Biometrics, Document Verification and AML Screening. Once selected, Journey Builder walks through various configuration options that fit a wide range of use cases, regulations, and business preferences based on fraud and user experience considerations. On the left side of each view are the options and on the right are what end-users would see as their corresponding view to choices made. In this view, we’re seeing that the user selected three document types and then how that appears in the customer’s experience.

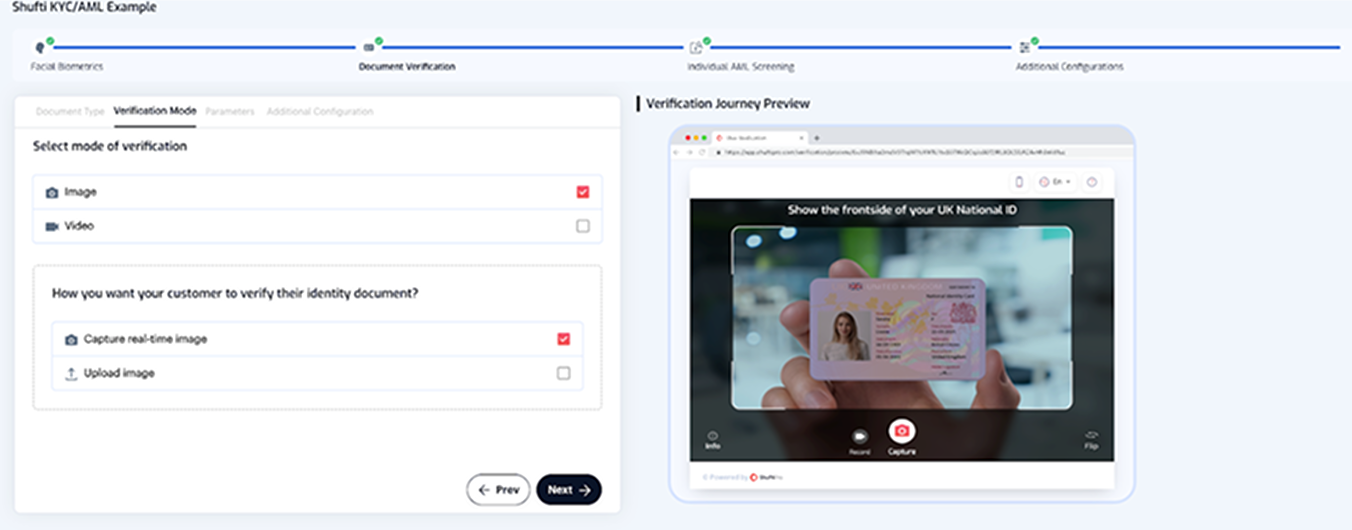

With Journey Builder, businesses can choose what kind of documents customers can use for their verification, as well as how they are able to upload them. And here is how these choices look to your customers.

Real time previews allow businesses to see how the verification process will look for end-users, allowing for immediate adjustments to eliminate potential friction points before going live.

Flexible Solution for Complicated Journeys

An on-line sports betting company needs customizable verification journeys to protect its customers and itself from fraud, and to stay compliant with regulations. Journey Builder helps the firm create personalized flows across the customer journey, including sign-up, account maintenance, and for re-verification when processing high-value payments (“step-up authentication”). Using a simple drag-and-drop interface, the company configures the services and links them to each event:

– When a new user signs up on the gaming company’s platform, the onboarding journey is triggered to verify their identity through a facial biometric and document check, an independent eIDV check, and finally an AML PEPs & Sanctions screening.

– After onboarding, high-risk actions like account maintenance and high-value transactions can be defended by triggering a biometric check to re-verify the user’s identity, reducing the incidence of account takeover or fraudulent first-party fraud claims.

Seamless Workflows with Fast Integration

A payments fintech provider needs an easy way to add identity verification to their client onboarding and transaction processes without coding. With Journey Builder, they can create and set up KYC workflows through the easy to use no-code interface. The customer experience lead can preview the journey and generate code snippets in the multiple programming languages required for their platform. This allows for fast deployment while maintaining system compatibility, helping companies enhance their customer experience and minimizing costs.

Journey Builder is designed to make setting up identity verification systems as simple and cost effective as possible while working in highly regulated sectors all across the world. By combining no-code set up with flexible design and real-time previews, Journey Builder makes the verification process smooth and user-friendly, all while ensuring a precise and relevant experience.

If you’d like to read more about Shufti’s technology resources, read more on our website.

Explore Now

Explore Now