A Guide to Secure Address Verification for KYC Compliance

- 01 The Growing Importance of Address Verification in AML Compliance

- 02 How Address Verification is Crucial as Part of a Customer Identification Program?

- 03 Global Key AML/CIP Regulations that Call for Address Verification

- 04 Why Verifying Multiple Document Types Improves Address Accuracy?

- 05 Understanding the Address Verification Workflow

- 06 Why Many IDV Vendors Struggle with Reliable Address Verification

- 07 How does Shufti Support Compliance With Robust Address Verification?

Imagine this, fraudsters claiming to live at 10 Downing Street or Buckingham Palace successfully opening digital bank accounts. Sounds absurd? Yet, a few months ago, regulators fined a leading neobank after discovering that its system approved accounts with implausible residential addresses, including well-known UK landmarks.

This case speaks of a very vital loophole in AML compliance, the fact that where address verification is weak or rather skipped, even the best of fintechs would be vulnerable to liabilities. Associated with insufficient verification regarding where money comes from, financial fraud could occur, and, of course, damages to reputation are distinctively high.

The Growing Importance of Address Verification in AML Compliance

For different companies, customer address verification is necessary due to their peculiar operational needs. The accurate address is needed by postal and courier companies for timely deliveries; e-commerce platforms require verification to prevent failed shipments and chargebacks. Utility service providers verify addresses to tie accounts to the right location, and telecom companies use addresses to verify the eligibility of providing the service.

As for today, the most consequential driver of address verification is regulation. Under the AML regulation, financial institutions must confirm the address of every customer before onboarding them as part of the Know Your Customer (KYC) requirements. This transforms address verification from just a business necessity into a line of defense against fraud and other financial crime.

How Address Verification is Crucial as Part of a Customer Identification Program?

Address verification is an important element of the Customer Identification Program (CIP). In the course of establishing a customer relationship, financial institutions are mandated by their KYC demands to request proof of address documents, such as utility bills, bank statements, or government-issued IDs. This confirms that the customer’s home is a legitimate and traceable one, thus helping them comply with anti-money laundering laws.

To this end, identity verification service providers have o go beyond traditional means of identity verification provision. They validate a whole range of document types and verify supplied addresses against external sources, ranging beyond the credit bureau and telecom databases. Such a layered approach enables companies to comply while ensuring a lower risk of fraud.

Global Key AML/CIP Regulations that Call for Address Verification

Address verification of customers is a compliance requirement for banks as well as others, such as crypto, electronic money institutions, and fintech services. There are quite a number of Anti-Money-Laundering laws in different regions worldwide that require Customer Due Diligence.

United States

Banks and covered institutions are required to use risk-based procedures to confirm identity according to the Customer Identification Program rule under 31 CFR 1020.220 and related FinCEN guidance for U.S. customers. To check where someone lives, banks and institutions can use different information. They need to be sure they know who the person is and keep a record of how they checked it.

European Union (EU)

In compliance with the 5th Anti-Money Laundering Directive of the European Union (Directive (EU) 2018/843), it is obligatory on the part of the obliged entities to treat address verification as an important process of customer due diligence whenever a business relationship is established.

Address verification is a part of a crucial procedure towards customer due diligence under the EU law. Keeping a verified proof of address would help businesses comply with applicable laws of the respective jurisdiction and obligations resulting from the directive

United Kingdom

In the United Kingdom, the Money Laundering, Terrorist Financing and Transfer of Funds Regulations 2017 require firms to carry out customer due diligence and keep accurate records when regulations 27 and 28 apply. These regulations specify when due diligence is needed, like during the time of onboarding or when suspicious activity arises, and outline the steps firms must take to verify customers’ identity and address.

Confirming a customer’s address is standard practice under that framework because it supports identity checks, risk assessments, and the record keeping that regulators review during supervision.

Why Verifying Multiple Document Types Improves Address Accuracy?

Address verification depends heavily on identity verification vendors’ ability to process various document types that can provide proof of address. Businesses in a regulated industry cannot depend on one source of information. Instead, they require systems that will validate customer specifics across different types of documents to increase the precision of information and to ensure compliance.

Some examples of important identity documents employed in address verification include, but are not limited to:

- Identity cards are widely used to confirm personal information and residential details.

- Utility bills provide recent proof of address and are trusted because they come from independent service providers.

- Driver’s licenses verify both identity and current residence, making them a dual-purpose document.

- Passports are internationally recognized and, when paired with other records, strengthen address verification.

- Bank statements help validate financial activity and provide an additional layer of proof of residence.

- Government-issued residence permits are essential for verifying legal residency status and current address.

A vendor that maintains compatibility with all these document types offers a sense of confidence to businesses in ensuring robust compliance. Authentication based on various sources enhances the reliability of its verification process and helps to reduce the risks of fraud and identity misuse.

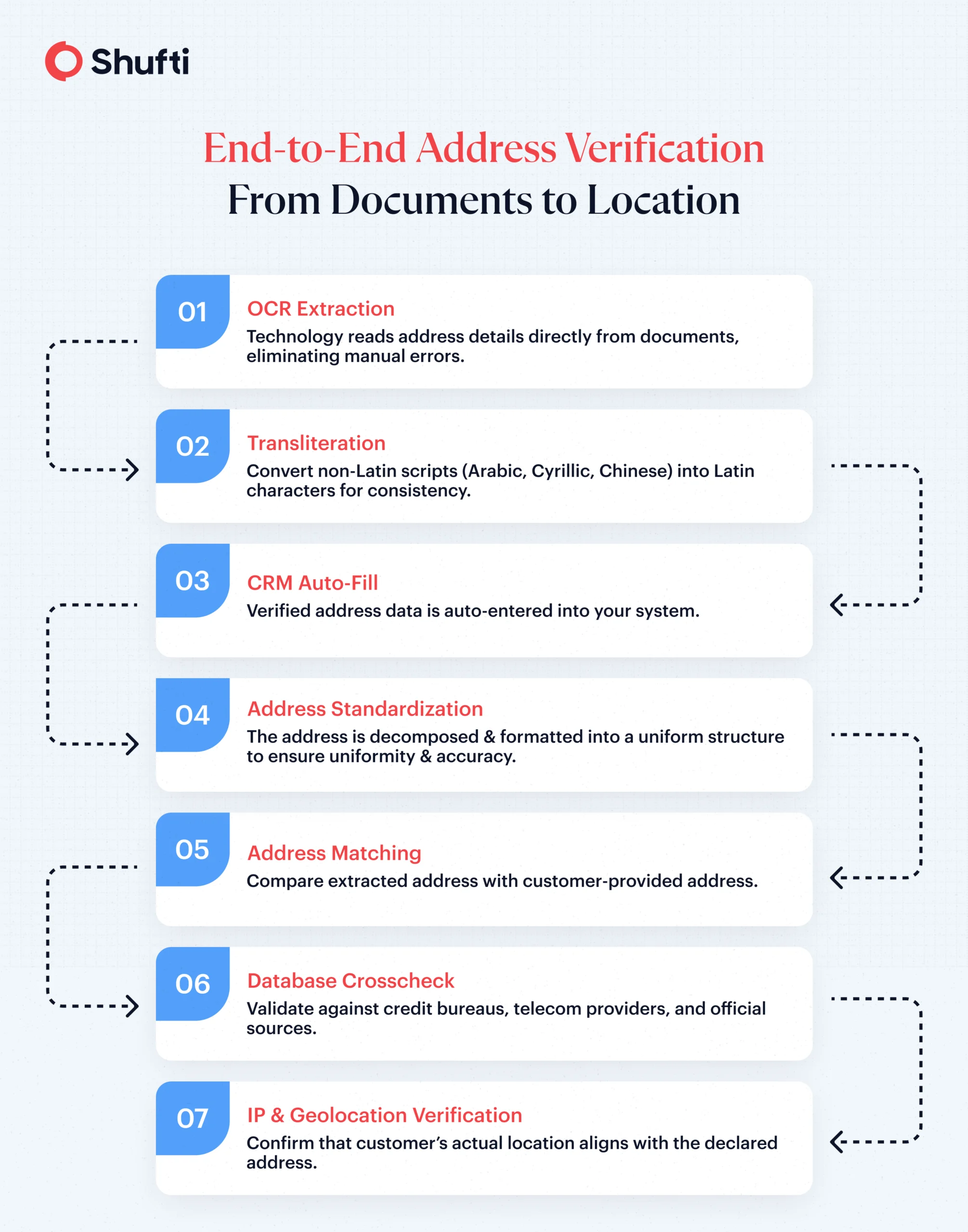

Understanding the Address Verification Workflow

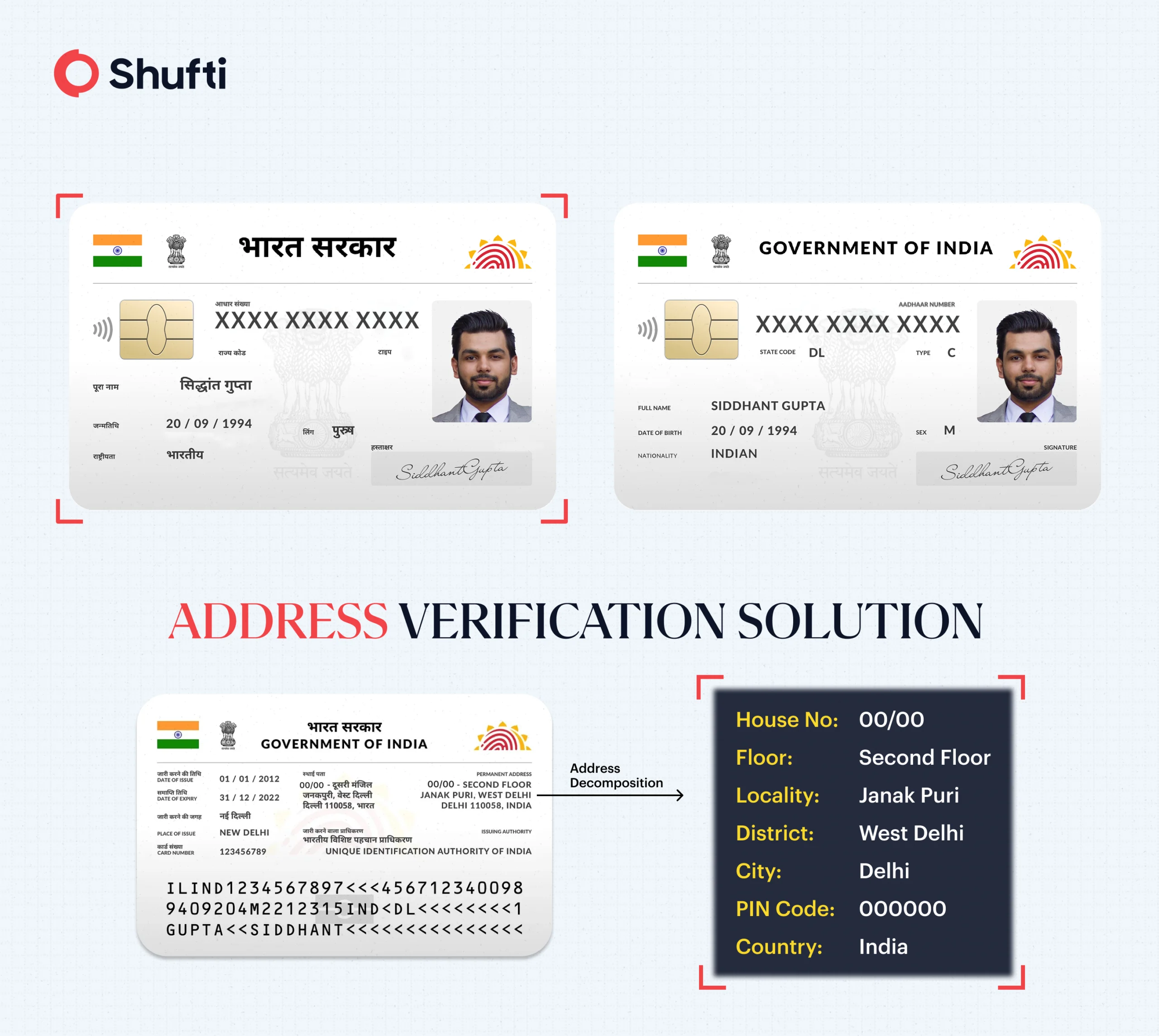

Verifying documents such as identity cards and utility bills, driving licenses, and passports is the first step toward validating the customer’s address. After verifying the authenticity of documents, the next step is OCR extraction.

- OCR Extraction: Technology reads the address details directly from documents, which may eliminate manual errors.

- Transliteration: If the document is in a non-Latin script (Arabic, Cyrillic, Chinese, etc.), the address is converted into Latin characters for consistency across systems.

- CRM Auto-Fill: Verified address data is automatically entered into the company’s CRM, speeding up onboarding and reducing human error.

- Address Standardization: The address is decomposed and formatted into a uniform structure, ensuring uniformity across systems and improving accuracy for verification against external databases.

- Address Matching: The extracted address is compared with the one entered by the customer at registration, flagging mismatches or suspicious submissions.

- Database Crosscheck: Address details are validated against diverse databases such as credit bureaus, telecom providers, and other official sources to confirm authenticity and accuracy.

- IP & Geolocation Verification: IP data and geolocation confirm that the customer’s actual location aligns with their declared address.

Why Many IDV Vendors Struggle with Reliable Address Verification

IDV vendors play a crucial role in meeting compliance standards, though not all conventional identity verification workflows can manage proper address verification. This has been due to inadequate technical capabilities to process diverse identity documents. Once they fall short of fulfilling the plethora of documents and formats required in global onboarding, it makes the verification process unreliable in its entirety.

1. Limited support for non-Latin documents

IDV providers encounter major challenges when attempting to provide correct processing for documents that fall into script systems like Arabic, Cyrillic, or Chinese. Misreading or misrecognition of addresses sourced from such documents due to a lack of proper transliteration and parsing means opening an avenue for compliance lapses and client frustration.

2. Restricted document coverage

Vendors that guarantee only a few documents-passports or ID cards- normally miss ten other pivotal sources, such as household bills, permits for residence, and bank statements. This is not flexible enough for someone’s checks on addresses, affecting the verification.

3. Weak OCR performance

If a vendor’s OCR cannot extract information descriptively enough from documents of varying quality or differing formats, any important address information may be missed or extracted incorrectly due to its additional input of information, thereby increasing the chances of errors.

4. Lack of integration with external databases

Usually, a strong verification process would entail verifying the data against relevant government, telecom, or financial databases. Vendors not having these integrations may not have multiple channels to verify addresses or may fail to check whether an address is genuine or current.

How does Shufti Support Compliance With Robust Address Verification?

For robust address verification, Shufti goes beyond the conventional approach. With intelligent OCR, multi-format support, and advanced authenticity checks, the solution verifies real addresses, regardless of the format they are submitted in. With software that integrates various types of verification, the solution safeguards businesses against fraud, chargebacks, and compliance risks. Additionally, in sectors like crypto ,where regulations keep evolving Shufti helps crypto cliensts with customized solutions tha enable high level of assurance with on demand address verification.

The IDV solution links the address directly to the customer through databases, documents, and other signals, if any. With a solution that supports multiple identity documents, including address extraction from residential permits and utility bills, businesses can ensure accurate verification, standardized addresses, and enhanced compliance against fraud and financial crime.

Experience seamless onboarding with Shufti’s multilayered address verification approach. See how real-time checks enhance compliance and protect your business. Request a demo today.

Explore Now

Explore Now