13 Reasons Why IDV Fails and How Shufti Delivers Verification You Can Trust

As Benjamin Franklin put it, ‘An ounce of prevention is worth a pound of cure.’

In identity verification, that single idea can be the difference between a smooth approval and an unnecessary rejection.

Imagine you are one step away from something you actually need. Perhaps it is a bank account to receive money, a platform to start work, a wallet for trading, or an app to book a service. The signup process goes smoothly until the app requests a quick identity check. You do what most people do. You take a photo of your ID, upload your selfie, and wait for the process to complete. You are just trying to move forward. And then the result comes back as identity verification failed.

What makes this rejection so frustrating is not only the fact that you have been rejected but also the lack of explanation for your rejection. For most people, these verification rejections have little or nothing to do with any type of fraud or malicious intent. There are many reasons why an everyday thing may make your submission harder for the verification system to evaluate with an adequate level of confidence. For humans, these minor inconveniences are significant obstacles.

This blog focuses on traditional identity document verification and does not cover other methods like eIDV or NFC. It explains the most common reasons users get rejected and shows how Shufti addresses each pain point through distinct capability layers that reduce false declines and help legitimate users get approved faster.

What Do Users Ask After a Failed Identity Verification?

After an identity verification failure, users often don’t know the exact reason, but they tend to worry about the same things. Here are the most common questions we hear:

- “Could lighting or glare be affecting my ID?”

- “Do I look different from my ID photo?”

- “Is my phone camera too blurry?”

- “Can a scratched or faded ID fail verification?”

- “Do shadows or reflections matter?”

- Why isn’t my newer ID design recognised?”

- “Could shaky hands cause a failed scan?”

- “Why does it keep saying ‘face not detected’?”

- “Did I misunderstand the instructions?”

- “Which documents are actually supported?”

- “Why won’t it accept my digital ID?”

- “Did my internet glitch cause the failure?”

- “Is it slower because my ID isn’t in English? ”

The 4 Capability Layers Behind Shufti’s Higher KYC Approval Rates

Most providers reduce risk by tightening rules at the final decision point and accept false declines as collateral. Shufti improves approval rates differently by preventing the common failure triggers earlier in the journey. That prevention is delivered through four capability layers, each targeting a specific rejection cluster.

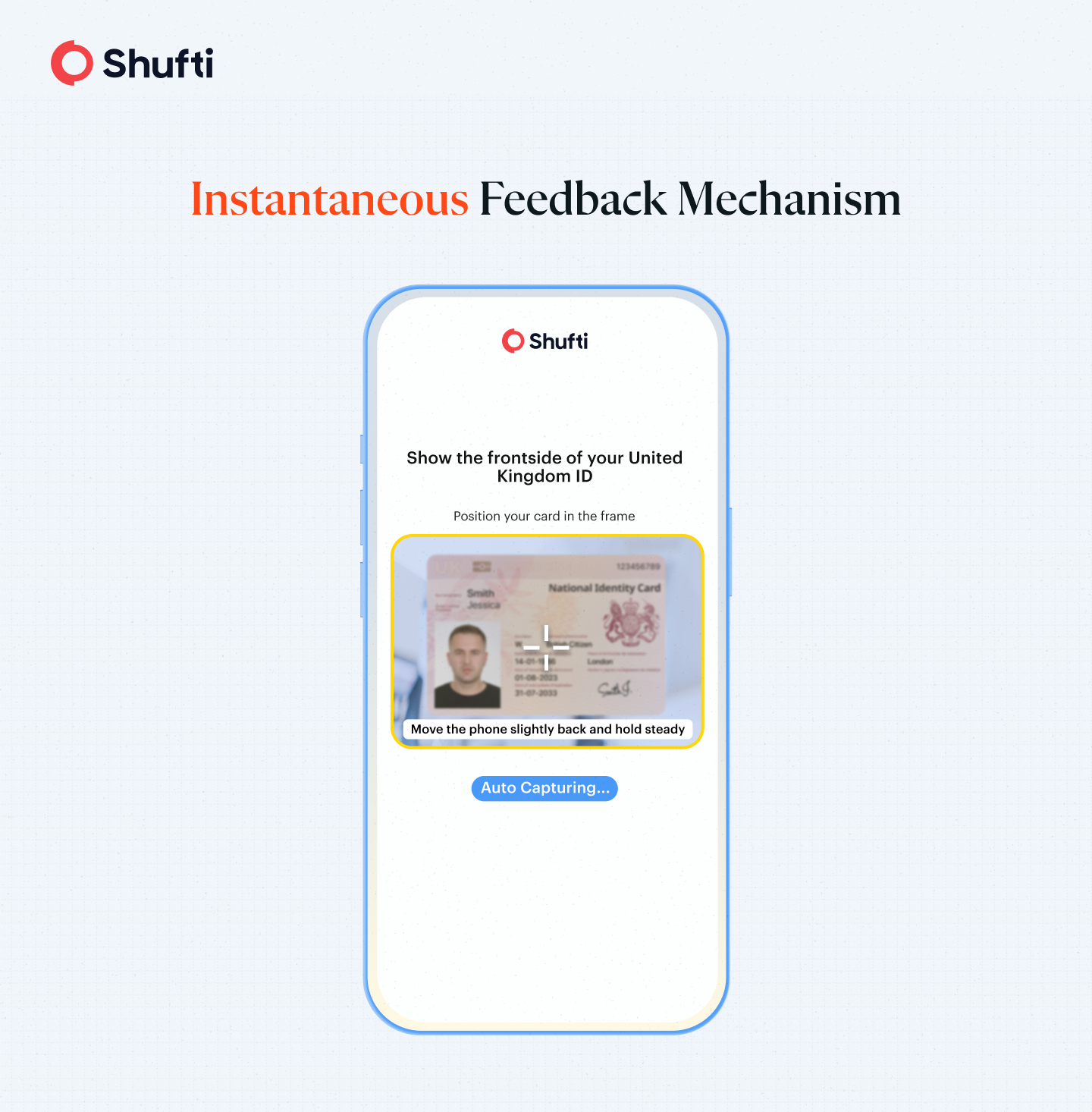

1. Real-Time Capture Guidance Prevents Image-Based Rejections

Image-capture issues like blur, glare, and movement are the biggest drivers of first-attempt failure. These include reflections from the card, shadowing, shaky hands, and poor camera angles, all of which can reduce image quality enough to trigger an automated decline.

Shufti prevents these failures before submission. Its Mobile and All-In-One SDK allows users to upload their image and follow simple instructions on the screen. If the user’s photo is too blurry, the SDK will provide them with immediate feedback to make necessary corrections.

Shufti clients in high-volume sectors like forex, gaming, and crypto have seen up to a 60% improvement in first-attempt pass rates, helping genuine users complete verification faster with fewer unnecessary declines.

2. Global Document Intelligence Verifies Real-World IDs

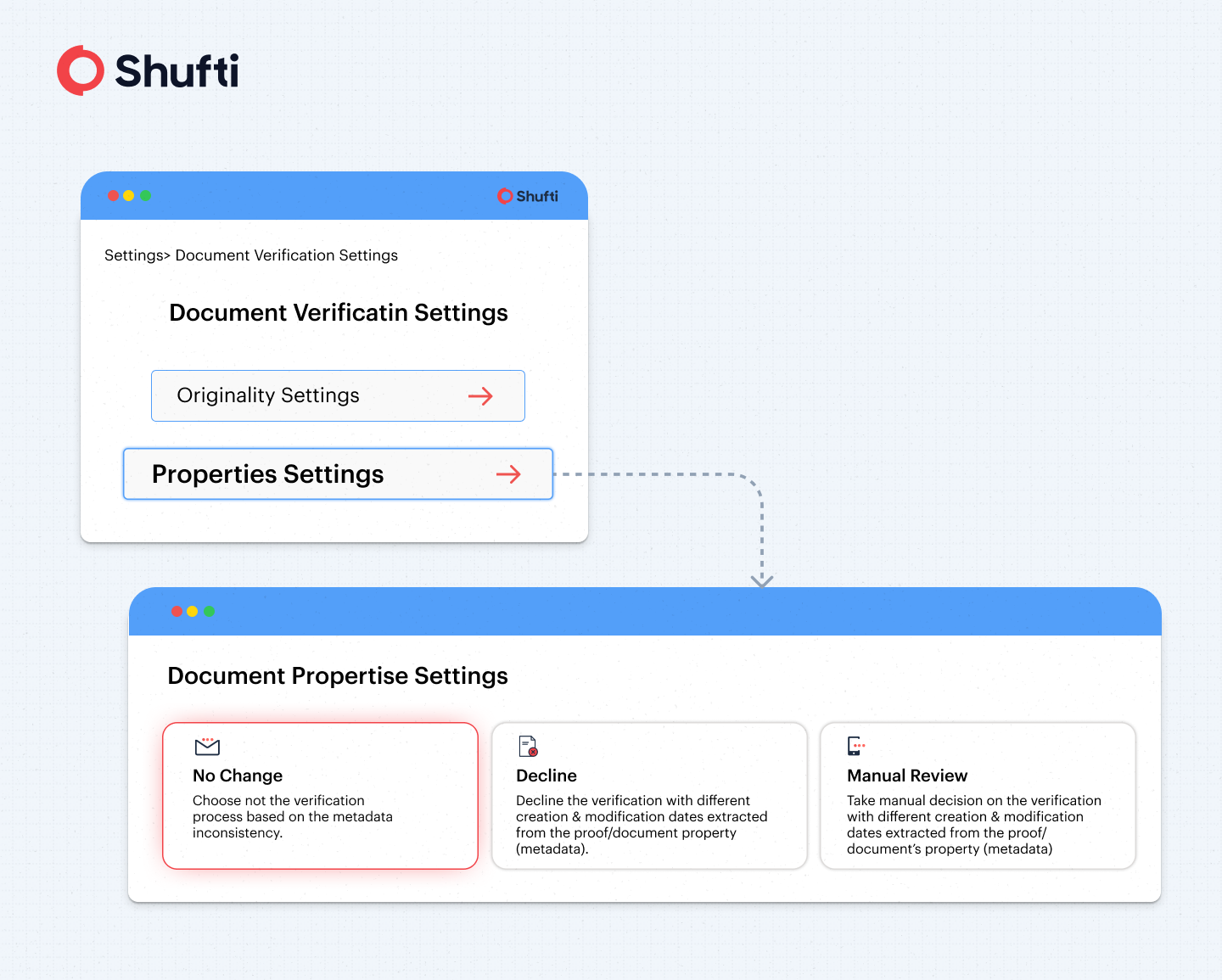

Even with a perfect photo, verification can fail if the system expects a perfect document. In reality, IDs get scratched, creased, faded, or issued in slightly different layouts over time. Government templates evolve, and users cannot control those changes.

Shufti is built for document reality, allowing for the acceptance of more than 10,000+ different types of documents in 240 countries and jurisdictions around the world.

Shufti’s ID document verification is designed to handle real-world wear and template variation. Its Document Properties Settings help businesses define how they treat minor metadata mismatches and customise what to accept or decline and tune authenticity rules.

infographic

3. Time-Aware Face Matching Reduces Selfie Mismatches

Face mismatch is one of the most sensitive failure points in biometric verification. Standard systems compare a live selfie to an ID photo as if people never change, but what systems forget about is that people naturally change and look different over time.

Shufti uses facial biometrics with advanced liveness detection to ensure a real person is present during verification. It then applies confidence-based, time-aware face matching that accounts for natural appearance change over time and normal selfie variation.

In practice, the system may accommodate appearance shifts consistent with roughly +5–10 years of age progression from the ID photo and −5–10 years of variation from the live selfie, depending on confidence and risk context, and treats genuine users fairly while staying resilient against spoofing and impersonation.

4. Context-Flexible Verification for Every User Condition

Some failures aren’t caused by capture or document quality at all; they’re contextual. Users may live in regions where passports aren’t common, rely on digital IDs, use low-bandwidth connections, or submit IDs in non-Latin scripts that weaker systems struggle to read.

Shufti has designed its services to account for these contextual conditions so that businesses can configure journeys with multiple document types based on the country, as well as provide lighter onsite and offsite modes of operation for slow internet connections and support multiple languages for OCR data extraction around the world.

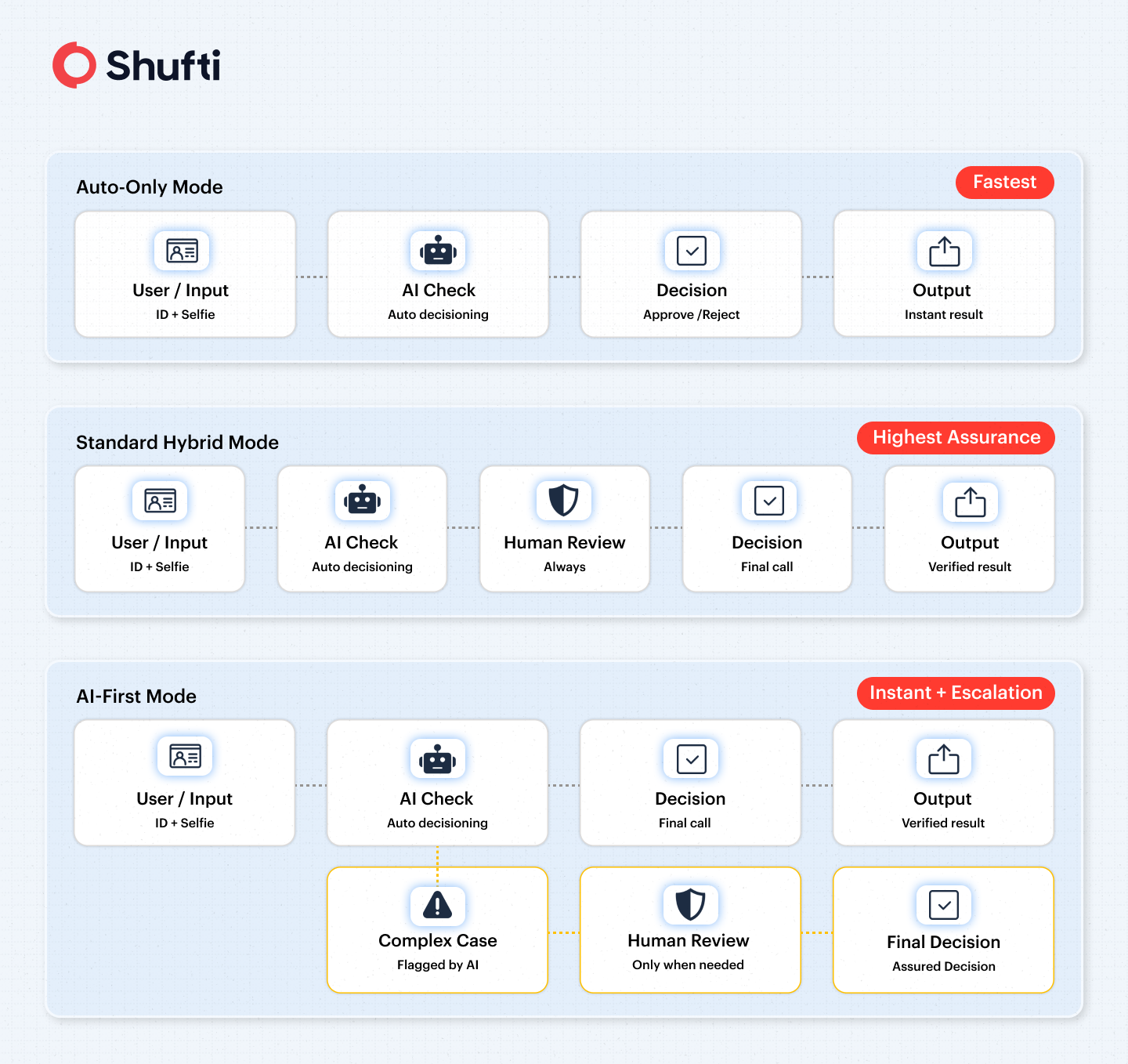

When an automated verification cannot reach sufficient confidence to approve users, Shufti doesn’t leave them stuck. Instead, businesses can route cases through one of three configurable modes:

- Auto-Only Mode for fast and fully AI-led decisions.

- Standard Hybrid Mode, where AI automation is reinforced by human review for higher assurance.

- AI-First Mode delivers instant AI results while seamlessly escalating complex cases for manual checks.

This flexible, business-centric setup ensures genuine users always have a clear path to completion, even when their case falls outside a purely automated decision.

How Does Shufti Reduce ID Verification Failures?

When identity verification fails, users are left with three basic needs:

- Clarity: They want to know what went wrong early.

- Confidence: They want an ID verification system that understands real documents and real people.

- Continuity: They want a safe alternative route if the standard process doesn’t work for them the first time.

Shufti meets these needs through real-time capture guidance, global document intelligence, advanced biometric face verification, and flexible fallback options. Instead of rejecting genuine users for avoidable IDV issues, Shufti helps fix the cause in the moment, reducing false declines, increasing KYC approval rates, and keeping onboarding fast, compliant, and user-friendly.

If you’re tired of losing real customers to identity verification failures, it’s time to switch from rule-tightening to prevention. Shufti helps you approve more legitimate users, faster, without increasing fraud risk.

Talk to our team to see how Shufti can reduce ID verification rejections and improve your KYC conversion today.

Explore Now

Explore Now