5 Reasons to Invest in Intelligent Character Recognition Services

Businesses deal with a plethora of documents, ranging from accounting and finance to sales and marketing. Enterprises are spending millions of dollars processing the information manually which is susceptible to human errors, is time-taking, and isn’t scalable.

Touchless handling of documents is the need of the hour. It is estimated that 50% of corporate-to-corporate invoices worldwide will be processed and paid without human intervention by 2025.

Optical Character Recognition (OCR) has been used for many years but is insufficient as it only retrieves data from printed files. This is where Intelligent Character Recognition (ICR) comes to the rescue, extracting information from handwritten files of different fonts and styles — automating business workflows.

What is ICR?

ICR is the advanced form of OCR that uses artificial intelligence algorithms to enhance text recognition. But how does ICR extract information from documents?

The technology recognises handwritten digits and letters by analysing features such as lines, closed loops, and line intersections.

For example, “C” is an open loop while “O” is a closed loop. ICR compares these features with vector-like representations rather than pixel-based is what makes it best to work on different handwritten fonts.

What is OCR?

OCR uses “matrix matching” algorithms to identify characters. But how does OCR do this? The software determines any character by matching a matrix of pixels between the character in the picture and the stored example. This sounds like a good approach but has some pitfalls.

Even when there are thousands of examples stored for just one character, issues happen when there are uncommon fonts used or matching text on bad-quality images.

OCR vs ICR – What is the Difference?

Besides just understanding both technologies from a technical perspective, it is crucial to understand why businesses use ICR vs OCR or vice versa.

- OCR is a vast character recognition technology and ICR is its subset

- OCR focuses on printed documents while ICR recognises text in handwritten forms and images

- OCR is not adaptive and can not be trained according to document layout as compared to the ICR

- OCR is best for those firms that have structured as well as the unchanging format for documents while ICR can recognise even unstructured documents

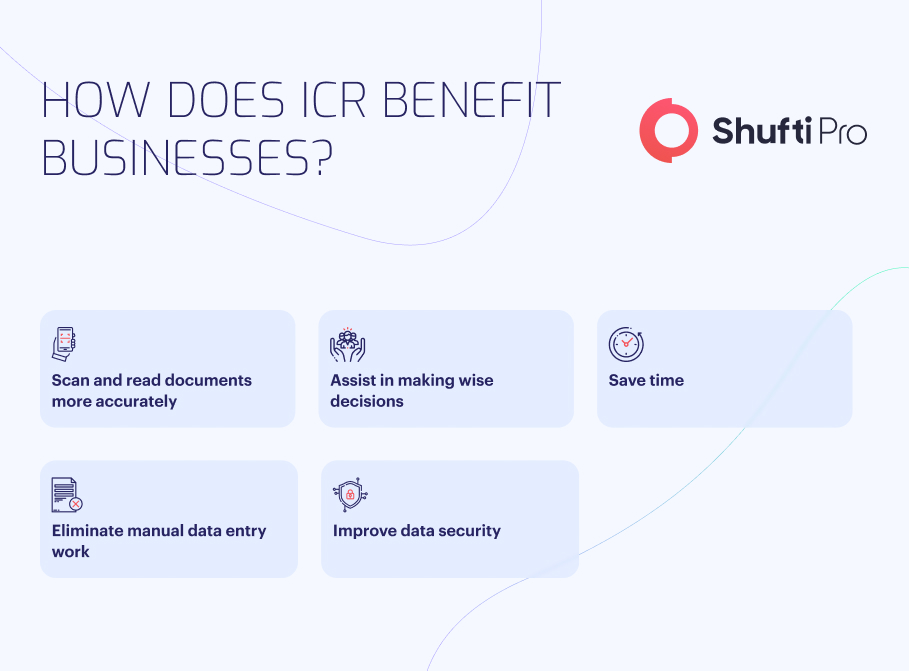

Perks of Using ICR Software

Firms need ICR not only to save time on managing data manually but also to enhance data security. This is where ICR proves to be a great bet.

Let’s dive deep into the many benefits that ICR software has for any business.

1. Scan and Read Documents More Accurately

ICR uses neural networks that help the software learn from its own experience. AI algorithms help software enhance its capability of scanning and reading documents more accurately.

2. Assist in Making Wise Decisions

ICR helps businesses in retrieving documents from handwritten documents. As far as the accounting department is concerned, the software helps in accessing information and making decisions about whether they should partner with another firm or not.

3. Save Time

Businesses have piles of documents to handle and are struggling to get the job done while saving time. Hiring a workforce to do the data entry tasks is not effective as they spend hours scanning data. Not only this, manually retrieving data leads to increased errors in the authentication process. ICR automates workflows and saves time for urgent tasks that need more attention, enhancing customer experience.

4. Eliminate Manual Data Entry Work

ICR software makes a big difference in terms of recognising text and that too with higher accuracy. As it does not require any labour to enter data or manage files, proves to be a great investment to automate businesses and go away with laborious data entry tasks.

5. Improve Data Security

Identity theft and data breaches are increasing day by day, causing reputational damage to any firm. Almost 15 million records of customers were exposed through data theft globally during the third quarter of the year 2022. The figure has risen 37% when compared to the last quarter.

Businesses are dealing with bundles of files containing personal details, including their name, driving licence number, social security number, etc. If the software doesn’t have ICR, they may face the risk of privacy concerns. Privacy incidents lead to loss of employment and cost the firm heavy penalties.

When Do Businesses Consider ICR Technology?

ICR software is getting popular due to the many perks that it offers. Here is when a business must consider using ICR technology.

- Dealing with Handwritten Documents: ICR handles all the data entry and processing tasks automatically with minimum to no errors.

- Working with Different vendors: Companies are dealing with a number of vendors on a daily basis and managing their documents manually is a frustrating job. However, ICR makes data management simple and easy.

- Requiring Scanner Regularly: Businesses have to scan volumes of documents which is a time-consuming task when done manually. ICR helps companies scan data quickly and accurately.

- Striving for Digitisation: All firms want to do away with paper documents; this is where ICR is a promising software. It is assisting businesses in examining, organising, and transferring documents more efficiently.

- Encouraging Remote Work: ICR converts all paper-based files into digital format. This encourages employees to do their tasks in a remote setting.

How Shufti Fits in the Puzzle

If your firm is dealing with volumes of paper documents, ICR is the perfect option to boost business efficacy. And this is where Shufti’s ICR software steps in, covering 150+ languages and extracting information from documents in less than a second. Shufti is trusted globally with effortless integration and unbeatable accuracy of 99+%.

Still, confused about how ICR can meet your data extraction needs?

Explore Now

Explore Now