The New Face of Authentication (*hint: you’ve seen it before!)

Companies face the daunting tasks of securing their data against the evolving threat of fraud while providing a frictionless experience for their customers. With application abandonment rates as high as 97% and fraudsters targeting identity verification frameworks, these challenges are top of mind for many business leaders. Fraud prevention companies have a variety of methods to address these challenges, but only Shufti is actively innovating to create a lightning-fast user authentication solution that doesn’t sacrifice security. We discussed the challenges of KYC, customer onboarding, and the ongoing threat posed by fraudsters using advanced AI-enhanced techniques in a previous blog post, if you’d like to read more.

Shufti recently unveiled Fast ID, the world’s first truly global persistent identity across the full customer journey. Fast ID provides a low-friction, fast, and secure experience for user onboarding and session, step-up, and risk-based authentication.

Read on to learn more about why Fast ID is a game-changer for identity across the customer journey and why we feel it’s the new face of authentication.

What is Shufti Fast ID?

Fast ID takes a KYC-compliant identity verification and can authenticate based on that strong verification anywhere else in a customer’s experience, including session authentications, as well as step-up or risk-based authentications.

After a user registers on a site with a government ID and a selfie, Fast ID lets users authenticate their identities with a selfie and a quick multiple-choice click for their date of birth; no further ID documentation is required. Once a user authenticates with their identity document, their next visit to our customers’ platform won’t require the document again. That’s Fast ID.

By going beyond basic KYC identity verification when opening an account, Fast ID gives users a superior digital experience while lowering risk.

Where Fast ID Adds More Value

Fast ID adds value through the types of transactions users can make, including secured high risk actions like transferring a large payment. Fast ID helps merchants ensure the person about to make that transfer was indeed their customer and not a fraudster using a step-up authentication. Fast ID is also ideal when a merchant wants to make sure their high-balance customers were authenticated for each user session.

Fast ID also offers ultimate adaptability as an organization evolves. For example, an identity verified in one subsidiary or the parent company can be used as a simple and secure authentication elsewhere in another part of the organization.

How Does Fast ID Work?

Let’s walk through Fast ID in action.

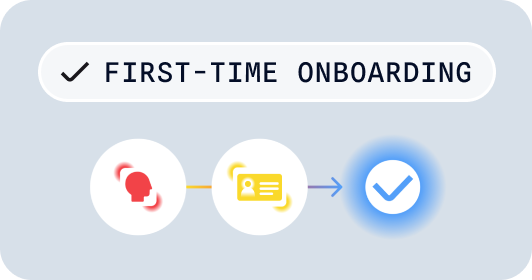

STEP 01

User Selfie

User takes a selfie with Shufti Fast ID for a quick authentication check

STEP 02

Check for Match

The user’s face is cross-checked against information held in our database

STEP 03

Authenticate, If Known

Once the user’s face has been successfully matched with the right profile from Shufti’s database, authentication is complete. There is also an option for multiple choice KBA using ID number and DOB

Or Verify, If New

The first time a user is onboarded via Shufti Identity Verification, their face and document data will be automatically stored for future Fast ID checks

It’s worth noting that Fast ID works all over the world. The fraud controls that ensure security work to verify more than 1,000 government documents in 240+ countries to detect deepfakes and other forms of fraudulent activity. Shufti forged its business in some of the most challenging identity markets in the world, making us a great identity partner supporting your global expansion.

How is Shufti Fast ID Different From Other Identity Solutions?

Initially, users only need to register with a government ID and a selfie to secure KYC-compliant verification. To pull that strong, verified identity into authentications, all they need to do is take a selfie. The user’s face is cross-checked against information in Shufti databases, so no further checks will need to be performed. There are no separate sign-up, registration, or additional set-up costs for log-in or step-up authentication processes.

Furthermore, Fast ID does the following:

- Combines Shufti’s global experience in identity markets with user-friendly design and robust fraud prevention.

- Extends a KYC-compliant and robust identity into the rest of the customer journey, all while providing a great user experience.

- Supports highly diverse use cases, ensuring the solution adapts to your needs while maintaining security and compliance.

The Future of Fast ID

Shufti Fast ID is designed to be “future-ready.” This means that customers will be able to use Shufti Fast ID as a portable and permissioned identity as the industry continues to move in the direction of shareable identities.

Fast ID incorporates Shufti’s philosophy – customer delight through low-friction identity trust creation, unlocking more ways for businesses to thrive, and staying ahead of fraudsters. Another approach that sets Fast ID apart is that people are the core of the product. As we note on our website, “our people make it happen.” Companies depend on the authenticity of its users, and those customers rely on a secure and seamless identity solution throughout their journeys. So when you think about the new face of authentication, it should look familiar. After all, it’s you!

If you’d like to learn more about how Fast ID can help your company to thrive, learn more on Shufti’s Fast ID page.

Explore Now

Explore Now