A Guide To DAC7 Reporting Requirements for Platform Operators

- 01 What is DAC7?

- 02 What are the Reporting Requirements of DAC7?

- 03 The Reporting Cycle

- 04 Who is Mandated to Comply with DAC7?

- 05 What Happens When Businesses Fail to Comply with DAC7 Obligations?

- 06 Common Challenges Faced by Platform Operators When Complying with DAC7 Reporting Requirements

- 07 How Shufti Helps Platform Operators Comply with DAC7 Reporting Obligations?

The digital economy is reshaping the world at a rapid pace. Whether it’s e-commerce or fintech, the rules of business are being rewritten altogether.

While the success of the digital platforms has contributed to economic growth and consumer convenience, digital footprints of these platforms offer many other opportunities, like assessing consumer behavior or consumption tracking for taxation visibility. One such measure is that of DAC7, introduced to ensure smooth and fair taxation in this advanced digital world.

What is DAC7?

In order to fill out any transparency gaps, the Directive on Administrative Cooperation was introduced. The DAC7, also known as EU Directive 2021/514, was implemented as the seventh amendment to EU Directive 2011/16. It was formally enforced on January 1st, 2023; however, the reporting due date for the first calendar year was January 31st, 2024.

To ensure proper functioning of the internal market, reporting rules have been designed in such a way as to be effective, plain, and comprehensible. The primary purpose of introducing the seventh amendment was to place reporting duties on digital platform operators. Platform operators are seen to be in a better place to collect and verify the necessary information of sellers who are using their platform.

At the core of it, DAC7 is expected to ensure that any income earned through digital channels should not remain outside of the routine tax visibility. The tax authorities are always in need of verifiable, trustworthy data with regard to the income generated through online platforms. DAC7 obliges the platform operators to supply that data.

What are the Reporting Requirements of DAC7?

In order to meet all necessary DAC7 reporting requirements, operators are obligated to give thorough data on any “reportable sellers”. For DAC7 purposes, reportable sellers are those that do not fall within the excluded seller categories defined under the directive.

Reporting Platform Operators are mandated to collect the following information for each seller who is not an excluded seller but an individual:

- First name and last name

- Primary Address

- Any TIN issued to the seller, and in the absence of a TIN, the place of birth of that seller.

- VAT identification number of that seller, where available

- Date of birth

The Reporting Platform Operator is mandated to take up the following information for each seller that is an Entity and not an Excluded Seller

- Legal Name

- Primary Address

- TIN issued to that seller, including each member State Issuance

- VAT identification number of that seller, where available

- Business registration number

- Existence of any entity registered in Union (for foreign platform operators only)

For sellers that deal with property rentals, additional document requirements like property address, registry numbers and the amount of days the property was rented out must also be given.

The Reporting Cycle

- Data Gathering: The reporting is made on an annual basis, and the reporting cycle consists of each calendar year. However, the data needs to be collected throughout the year.

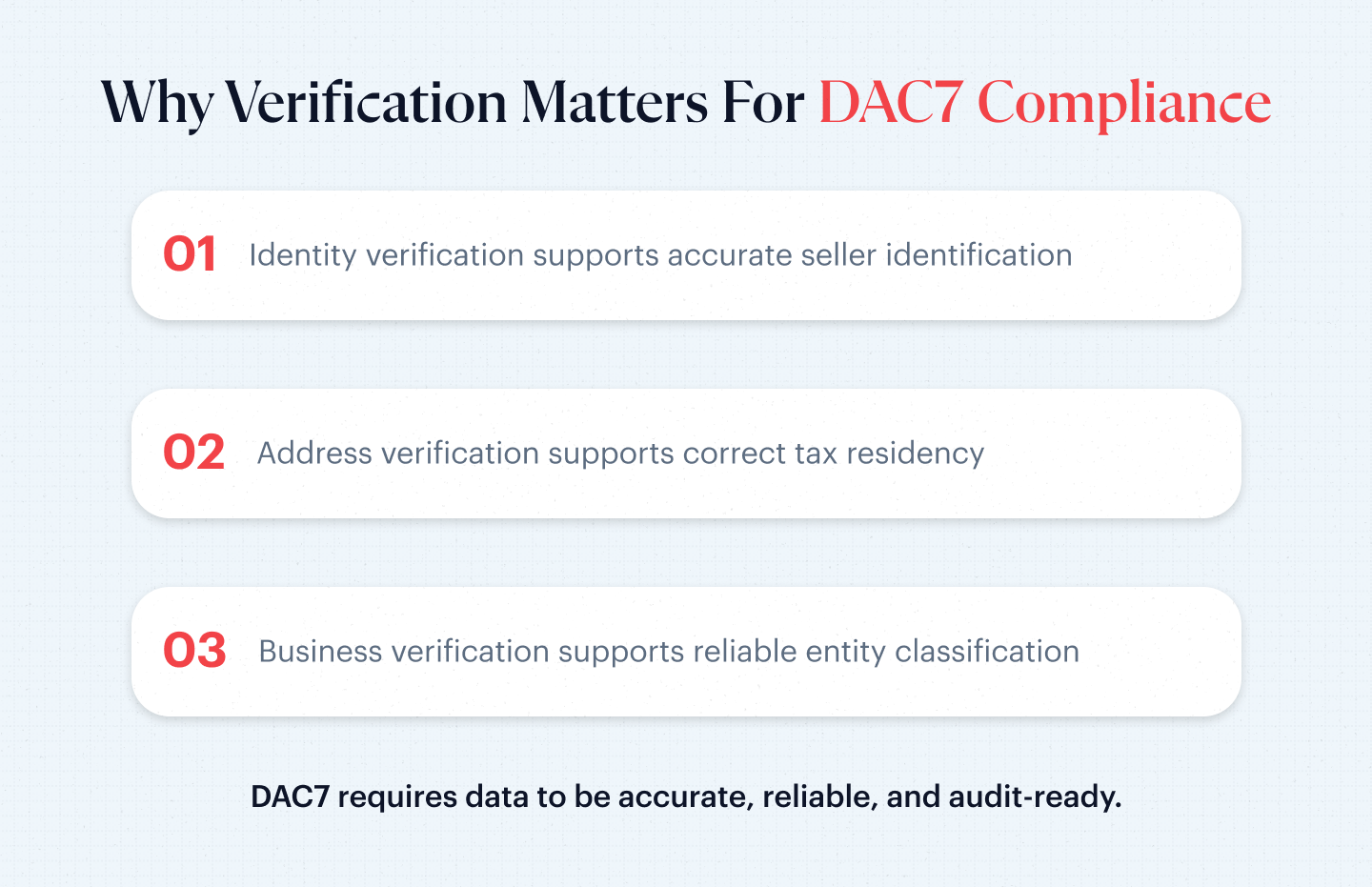

- Verification of the data: The operators are obliged to provide verified and reliable information when reporting. For this purpose, they need to verify business details, the identities of individuals, and demand relevant proof of address in order to determine accurate tax residency.

- Data Logging: XML schema is used for providing data to one EU member state. That state then further shares this information with other EU tax authorities under the Automatic Exchange of Information system (AEOI).

The annual submission of a reportable period must be filed by 31st January of the following year. Platforms are obligated to give sellers their report in order for them to review and see the data for any corrections or changes that are to be made. The data is to be stored for a minimum time period of five years that is readily available for audit upon a formal request.

Who is Mandated to Comply with DAC7?

At a broad base, DAC7 is applied to platform operators, where their headquarters do not truly matter. The directive explicitly mandates platforms registered within the European Union, along with any foreign platform operators, to comply, given that they, in any capacity, handle transactions or deals that involve EU sellers or customers within the member states.

The relevant activities covered are:

- Markets for goods like eBay.

- Platforms for sorts of personal services like food delivery or rides services, an example includes DoorDash.

- Rentals and immovable properties within the EU, like AirBnBs.

- Platforms exclusively for vehicle rentals.

It is also important to know that some entities are exempt from the reportable seller categories under the DAC7. Digital platforms are not liable to report on the following sellers:

- Government entities.

- Those are publicly listed companies with their own reporting obligations

- With less than 30 transactions and sales below EUR 2,000.

What Happens When Businesses Fail to Comply with DAC7 Obligations?

The lack of compliance with DAC7’s reporting obligation can result in significant penalties for relevant platforms. The right to set penalty thresholds lies with the respective authority of each member state; however, as provided by DAC,7 these should be “effective, dissuasive and proportionate”.

As an example, France has set a penalty of €50,000 per violation, whereas the Netherlands has allowed administrative penalties up to €900,000 in certain circumstances.

Financial sanctions aside, platforms that consistently fail to comply with legal requirements increase the chance of suspension and losing their operations in the EU markets.

Common Challenges Faced by Platform Operators When Complying with DAC7 Reporting Requirements

DAC7, along with being a tax reporting obligation, is an operational challenge too since it requires digital platforms to not only maintain the data, but to provide authorities with accurate, verifiable, auditable seller data collected throughout the calendar year. Quality reporting of DAC7 is directly linked with the way seller information is collected, screened, and maintained at the onset of the onboarding process.

Platform operators are obligated to report seller identity details, tax identifiers, addresses, and all transaction-related information. If this data turns out to be outdated, inaccurate, or incomplete, it puts platforms at the exposure of enforcement actions. Manually collected data poses the most risk, especially if the platform is operating across different jurisdictions and seller types.

Operational compliance under DAC7 can be attained through robust onboarding and verification controls. Proof of address checks, identity verification and business verification play a crucial role in creating reliable datasets that enable accurate reporting. Verification processes ensure everything is done smoothly and that the seller’s information is authentic, current, and compliant with regulatory requirements. This minimizes the likelihood of disparities at the reporting stage.

In addition, DAC7 requires the platforms to retain that data for a minimum of 5 years (member states may have extended retention periods but not more than 10 years), so that the information is available when requested by the tax authorities.

Platforms that integrate verification and compliance checks in their onboarding processes are in a better position to meet these obligations efficiently while also reducing operational pressure linked to manual processes.

How Shufti Helps Platform Operators Comply with DAC7 Reporting Obligations?

Platform operators are directly required to collect, verify, and retain accurate seller details to meet DAC7 reporting requirements. Compliance with these obligations becomes even more difficult if platforms scale across borders and seller types. Manual onboarding and scattered verification processes lead to data gaps, increasing the risk of false reporting and adding operational burden.

Shufti empowers platform operators by enabling identity verification, address verification, and business verification workflows that help create reliable seller data from onboarding through ongoing compliance. It’s a no-code journey builder that helps compliance teams manage and adapt workflows as requirements change or the platform enters new markets.

Platforms that can maintain structured and verified information are better positioned to meet DAC7 reporting expectations with confidence.

Request a demo to explore how Shufti can support DAC7-ready onboarding and verification processes.

Explore Now

Explore Now