Address Verification: Challenges and Solutions For KYC in Vietnam

- 01 How Vietnam’s 2025 Administrative Reforms Impact Address Verification

- 02 How Vietnam’s KYC struggles with Western Parsing:

- 03 The issue of Diacritics in Vietnamese Identity Data

- 04 Why Legacy KYC Vendors Fail at Address Verification in Vietnam:

- 05 How Shufti Bridges the Address Verification Gap in Vietnam

Vietnam is among the most complex identity verification environments in Southeast Asia. Financial institutions operating across crypto, forex, iGaming, and social platforms frequently report sharp drops when onboarding Vietnamese users. These failures are rarely driven by fraud or user intent, but by structural complexities that many global KYC vendors are not built to handle.

Traditional IDV vendors rely on Western Conventions, rigid address hierarchies, and limited support for Latin character sets with diacritics. Vietnam challenges all three simultaneously, which is why generic KYC solutions repeatedly struggle with Address Verification in Vietnam

How Vietnam’s 2025 Administrative Reforms Impact Address Verification

Address verification in Vietnam became significantly more complex following a nationwide administrative reform in 2025. Many vendors remain unaware of this change, leading to widespread address mismatches and incorrect compliance outcomes.

In April 2025, Resolution 60-NQ/TW approved a shift to a simplified two-tier administrative structure. The district level was abolished entirely, leaving Province/City to Commune/Ward as the official hierarchy. Shortly after, Resolution 125/NQ-CP reduced the number of provincial-level units from 63 to 34. Regions were merged, renamed, and reorganised, and new administrative codes were issued.

These changes became effective nationwide on 1 July 2025. However, Vietnamese identity documents still frequently display the old three-tier structure. Government databases now follow the new system. KYC vendors that have not updated their address logic continue to check customer data against obsolete hierarchies.

The result is systematic address mismatching. Legitimate addresses fail validation checks because the KYC system treats them as inconsistent. While the administrative system was overhauled, many individuals would still have registered addresses in the previous three-tier format. Hence, without a modern KYC solution and logic that is able to incorporate the new two-tier system and reconcile it with old registered addresses, compliance teams are left reconciling data that appears contradictory but is technically correct within Vietnam’s evolving framework.

How Vietnam’s KYC struggles with Western Parsing:

Vietnamese names follow a fundamentally different structure from Western formats. The Vietnamese order is Family Name → Middle Name → Given Name, which is the opposite of how most global KYC systems expect to process identity data. A Vietnamese name such as Nguyễn Văn Min is locally understood as Nguyễn (the family name), Văn (middle name), and Minh (individual’s given name).

Further, Vietnamese names frequently contain three, four, or even five separate words. However, ID documents include names as a single word, without differentiating between family, middle, and first names. Consequently, traditional KYC systems attempt to force Vietnamese names into rigid first-name and last-name fields.

This becomes especially problematic during AML screening. When the name registered at onboarding is noted differently from the OCR-extracted name in the document, the KYC system registers false matches. Generic KYC systems may incorrectly flag legitimate clients as high-risk individuals, burdening compliance teams with unnecessary manual reviews, a waste of resources, and lower customer retention due to a slow onboarding experience.

The issue of Diacritics in Vietnamese Identity Data

Vietnamese is a diacritic-rich language, and these characters are not optional stylistic elements. A diacritic is a sign (such as lines written above or underneath letters) that indicates a different pronunciation of the same letter when unmarked.

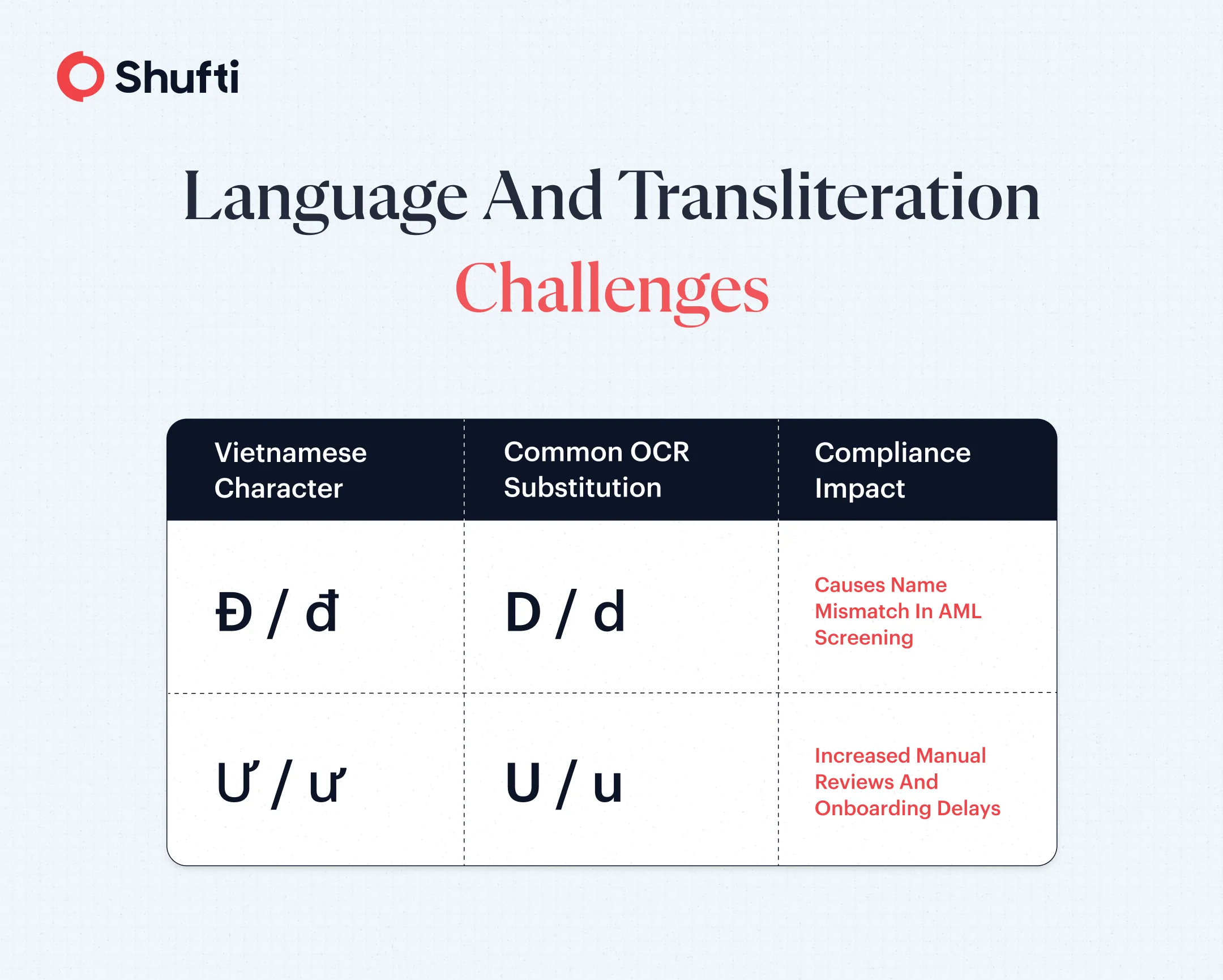

Characters such as Ă, Â, Ê, Ô, Ơ, Ư, and Đ are common in Vietnamese names. Generic OCR engines frequently strip or substitute these characters during extraction. Rigid KYC solutions include Ô or Ơ being reduced to O, and Ư being reduced to U. When this occurs, the name no longer matches government databases, watchlists, or customer records.

Without robust diacritic-aware OCR and intelligent normalization, IDV systems create artificial discrepancies between user-entered details, data from ID documents, and database checks. As a result, the rate of rejection for genuine customers increases, and compliance agents lose confidence in the accuracy of their KYC stack.

Why Legacy KYC Vendors Fail at Address Verification in Vietnam:

The challenges in Vietnam are not individual issues. The combination of Western-dominated parsing, limited diacritic flexibility, and administrative reforms collectively amplifies failure rates across KYC processes.

Poor name parsing causes mismatches between document data and OCR output. Weak diacritic handling corrupts identity fields at the extraction stage. Outdated address logic invalidates otherwise correct location data. When these errors feed into AML screening systems, the output becomes incorrect and unreliable.

Many global KYC providers rely on set strategies, hard-coded assumptions, and outdated databases that reflect foreign naming and address conventions. Such KYC solutions fail to capture the contextual intelligence needed to adapt to the linguistic realities of Vietnam.

As customer onboarding volumes rise, failure rates scale, noticeably increasing operational expense, and customer drop-off ratios.

How Shufti Bridges the Address Verification Gap in Vietnam

Shufti’s Identity Verification feature adapts to country-specific requirements, rather than a generic application of KYC rules.

For Vietnam, Shufti applies intelligent name parsing models that recognise multi-part name structures and reverse sequencing logic. Instead of forcing names into Western formats, Shufti preserves semantic accuracy across extraction, matching, and screening workflows.

Shufti’s Optical Character Recognition (OCR) technology is trained to identify Vietnamese diacritics, so extracted names retain their true identity meaning. Consequently, when names are registered with their correct diacritical marks, the likelihood of false matches in AML and sanctions screening is low.

On the address side, Shufti’s systems support Vietnam’s post-2025 administrative structure and can process documents in both pre- and post-administrative-reform formats. This dual-awareness approach allows accurate validation even when IDs reflect older hierarchies.

For businesses in Vietnam, the result is an efficient workflow with low manual reviews, leading to a stronger compliance alignment. A tailored demo can demonstrate how Vietnam-specific optimisation transforms onboarding outcomes.

Explore Now

Explore Now